How Do I Fix An Error On My Credit Report

If you do find an error in your credit report, its important to dispute credit report discrepancies quickly:

-

Your first port of call should be the provider or creditor the error was associated with. So if your credit card company recorded that you missed a payment and you want to dispute that, call up the credit card company.

-

You should obviously have some evidence of the error being in fact an error, so any receipts or statements will be useful.

-

If the credit card company agrees that it was an error, they have to update their records within a one-month period, and this update goes out to the credit reference agency.

-

However, if the credit card company says that they have no record of the error and everything is correct on their side, then speak to the credit reference agency.

-

They will review the error and make the relevant changes after an investigation into the dispute.

-

You should then also check your credit report with the other credit reference agencies to ensure that they too do not have the same error.

Unfortunately, as the process above suggests, most of the leg work falls onto the consumer. It can seem unfair if an error thats not your fault is recorded, especially if you then you have to chase up the issue. But, if you notice a mistake, dispute it so it can be corrected if possible.

Unfortunately, the pressure to fix credit report errors falls on the consumer, not the agency or creditor

Make Sure Your Disputes Are Legitimate

Be sure you dont do anything to make the credit bureaus think your credit report disputes are frivolous. Dont dispute everything on your credit report and do not send all your disputes at once. If you dispute the same item more than once, you should give a different reason for each dispute so the credit bureau doesnt think youre sending duplicates. The credit bureau has the right to reject your dispute if you don’t have solid evidence.

Dispute Credit Report Errors

All three bureaus have an online dispute process, which is often the fastest way to fix a problem, or you can write a letter. You can also call, but you may not be able to complete your dispute over the phone. Here’s information for each bureau:

How to dispute Equifax credit report errors

-

Write to Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

-

See our guide on how to dispute your TransUnion credit report for details.

Recommended Reading: How To Check My Itin Credit Score

Does Removing Dispute Hurt My Credit

How Will the Results of My Dispute Impact My Credit Scores? Filing a dispute has no impact on your score, however, if information on your credit report changes after your dispute is processed, your credit scores could change. If you corrected this type of information, it will not affect your credit scores.

Common Mistakes That Cause Credit Report Errors

To begin, it’s important to know if the person responsible for the error is you. Often, a person may have applied for credit under different names . Make sure you’re consistent and always use the same first name and middle initial, otherwise your report may actually contain information about another person with a similar name. Likewise, apply the same consistency and care with things like your Social Security number and address.

Or it could be a case of what you didn’t put in your report. If you were denied credit because of an “insufficient credit file” or “no credit file,” it may be because your credit file doesn’t reflect all your credit accounts. Though most national department store and all-purpose bank credit card accounts will be included in your file, not all creditors voluntarily supply information to the credit bureaus, nor are they required to report consumer credit information to credit bureaus.

If you find missing accounts, ask your creditors to begin reporting your credit information to credit bureaus, or consider moving your account to a different creditor who does report regularly to credit bureaus.

Other common errors to look for:

Recommended Reading: How Long Do Repos Stay On Your Credit

Can A Debt Collector Contact You If You Dispute Debt

When you dispute a debt in writing, debt collectors cant call or contact you until they provide verification of the debt in writing to you.

This essentially puts everything on hold until you receive verification, but you only have 30 days from when you first receive required information from a debt collector to dispute that debt. You can lose valuable rights if you dont dispute it, in writing, within that 30 days.

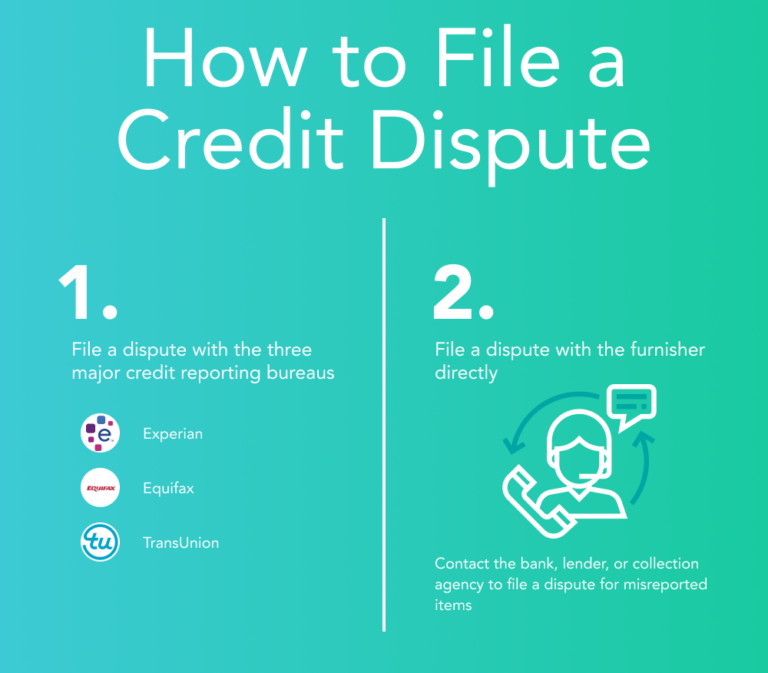

Three Steps For Disputing Information On Your Credit Report

Under the Fair Credit Reporting Act, you have the right to a fair and accurate credit report. If you submit a dispute, the three credit bureaus are legally obligated to investigate the item in question. They must also forward any data you provide about the error to the data furnisher .

Here are the steps, in order, that you should take if you find an error on your credit report.

Read Also: Is 641 A Good Credit Score

If Youve Spotted An Error On One Of Your Credit Reports You Should Take Immediate Steps To Correct The Inaccuracy

Around 25% of U.S. consumers found errors that could affect their credit scores in one of their credit reports, according to a 2012 study by the Federal Trade Commission. The same study reported that one in five consumers had an error that a credit bureau corrected after the consumer disputed the mistake on at least one report.

An error on your credit reports could lead to lower credit scores and impact your ability to open a new credit account or get a loan. Here are steps you can take to ask the credit bureaus to remove incorrect derogatory marks from your credit.

Check All Three Credit Reports For Errors

Through April 2022, youre entitled to free weekly credit reports from the three major credit reporting bureaus: Experian, Equifax and TransUnion. Request them by using AnnualCreditReport.com.

There may be small differences among your reports, because some creditors dont report your account activity to all three bureaus. But if negative information has popped up on one report, its wise to see whether its also on the other two.

There is no cost to dispute credit report errors, and you can dispute as many items as you like. Filing a dispute does not hurt your credit score, but the result of the dispute may have an effect on your score.

Recommended Reading: Raise Credit Score 50 Points In 30 Days

Review Your Investigation Results

When our investigation is complete, well send you an email to let you know. You can then log in to review your results and updated credit report. Most dispute investigations at TransUnion are complete within two weeks, but some may take up to 30 days.

If you dont agree with the results, it may be a good idea to contact the lender directly and provide any documentation you have to support your claim. If the lender denies your claim, it must still report to the credit agency that the information is disputed. If the lender confirms your claim, it has to tell the credit reporting agency to update or delete the item.

We dont want an inaccuracy on your credit report to negatively impact your score and keep you from the credit opportunities you deserve. By consistently monitoring your data identity, you can help ensure your credit report shows an accurate and up-to-date picture of your credit health.

Will A Collection Dispute Reset The Clock On The Statute Of Limitations On Your Debt

No, disputing collections doesnt reset the clock on your debt unless you admit that its yours. Debt collectors can restart the clock if you also make a partial payment or agree to a settlement. Old debts will be removed from your report when they reach the statute of limitations even when you didnt pay them.

Read Also: 626 Credit Score

Also Check: Comenity Bank Late Payment Forgiveness

Know Your Rights Under Fdcpa

Problems between consumers and debt collection agencies have been around a long time. In 1978, Congress passed the Fair Debt Collection Practices Act in an attempt to give consumers protection from abusive practices. The Federal Trade Commission , which oversees enforcement of the law along with CFPB, says debt collection tops the list of consumer complaints.

The FDCPA outlines debt collection guidelines:

- Collection agencies must restrict phone calls to between 8 a.m. and 9 p.m. local time.

- Debt collectors may not call you at work if you tell them that you are not allowed to receive calls.

- You can stop calls from collection agencies by sending a certified letter asking them to stop calling.

- Debt collectors must send you a written validation notice that states how much money you owe, the name of the creditor and how to proceed if you want to dispute the debt.

- Debt collectors may not make threats of violence, use obscene language, make false claims to be attorneys or government representatives, misrepresent the amount of money owed, or claim that you are going to be arrested.

- Debt collection agencies are only allowed to talk about your debt with you and your attorney. They can reach out to your friends and family in search of your contact information, but they cant speak about your debt .

Fixing Credit Report Errors

To ensure mistakes are corrected as quickly as possible, contact both the credit bureau and organization that provided the information to the bureau. Both these parties are responsible for correcting inaccurate or incomplete information in your report under the Fair Credit Reporting Act.

Keep in mind that all three of the credit bureaus now accept the filing of disputes online, with Experian now only accepting online submissions.

Find out how to initiate a dispute online.

Begin by telling the credit bureau what information you believe is inaccurate. Credit bureaus must investigate the item in question-usually within 30 days-unless they consider your dispute frivolous. Include copies of documents that support your position. In addition to providing your complete name and address, your communication should:

- Clearly identify each disputed item in your report.

- State the facts and explain why you dispute the information.

- Request deletion or correction.

You may also want to enclose a copy of your report with the items in question circled. Your communication may look something like this sample.

If mailing a letter, send it by certified mail, return receipt requested, so you can document that the credit bureau did, in fact, receive your correspondence. Also, keep copies of your dispute letter and enclosures. If you want help disputing mistakes on your credit report, myFICO can help you write a free letter in minutes.

Also Check: Syncb/ppc On Credit Report

Send A Letter To The Bureau

The three major credit bureaus Experian, TransUnion, and Equifax each have a process in place to dispute inaccurate information on their individual credit report. You can do so online or by sending a letter to their mailing address.

Although its more convenient to submit your dispute online, we highly recommending sending your dispute through the mail. If your dispute is dismissed, its important to maintain a paper trail of your dispute process if you decide to take the matter up in court.

If youre wondering what to say in your letter, the Federal Trade Commission has a sample letter you can use and adjust to your own situation. Specifically, its important that you:

- Clearly identify each item that you challenge

- Explain why you challenge the information and go into detail

- Request that the negative item is removed or corrected

| Equifax |

|---|

| PO Box 4500Allen, TX 75013 |

When the bureaus receive your dispute, they may be able to adjust the information directly, or they may reach out to the lender, creditor or collection agency that reported the item to them and request that they validate the dispute.

What You Will Learn:

- You’re entitled to a free copy of your credit report every 12 months from each nationwide credit bureau by visiting www.annualcreditreport.com

- Check your personal information carefully on your credit reports

- The information you are disputing should be incomplete, inaccurate or the result of fraud

- Once you file a dispute, you should receive a response within 30 days

To file a dispute with Equifax, you can create a myEquifax account. Visit our dispute page to learn other ways you can file a dispute. By creating an account, you will get six free Equifax credit reports each year.

Don’t Miss: Shopify Capital Eligibility Review Changed

Get A Copy Of Your Credit Report

Once you have your credit report write down the accounts that you need to remove disputes from. You will now need to call each Credit Bureau that lists dispute comments on your report. Tell them you need to remove dispute comments from all of the accounts on your report.

Below are working phone numbers to connect you to a live person with all three Credit Bureaus.

Ways To Dispute Information On Your Credit Report

TransUnion and Equifax have their own processes for disputing credit reports, but Experian provides three methods for submitting disputes:

- Online: Get access to your Experian credit report and initiate a dispute at the Experian Dispute Center . There is no cost to you for using this service.

- : To initiate a dispute by phone, you’ll call the number displayed on your Experian credit report. If you’d like to have a copy of your credit report delivered to you by mail, call 866-200-6020.

- : You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. .

Also Check: Old Address On Credit Report

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently annually, if not more often so you can catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major credit bureaus once a year. However, because of the pandemic, all three bureaus are offering free weekly reports until April 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to request and check your reports from all three bureaus since its not uncommon for each one to get different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance, or employment based on your credit in the past 60 days

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- You’re a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

Other ways to get your credit report

Each of the major bureaus offers credit monitoring services that include access to your report and your score, among other benefits.

Experian

TransUnion

Is The Credit Reference Agency To Blame If There Is An Error

The three credit reference agencies, Experian, Callcredit and Equifax provide lenders with your credit report if you apply for a product with them.

This gives them plenty of power of your ability to get a mobile phone contract, credit card, mortgage and much more.

As a result, having an error free credit report is absolutely important, as any mistakes could damage your credit score.

Also Check: Coaf On Credit Report

Can Submitting A Credit Dispute Hurt Your Credit

It is important to challenge questionable negative information on your credit reports as this information can negatively impact your credit score. It is best to have your credit reports as accurate as possible before applying for a mortgage, car loan, insurance or even a job.

Filing a dispute has no impact on your score however, your credit scores could change if information on your credit report changes after your dispute is processed. For example, removing a mistakenly reported late payment could improve your credit score. Updates to personal information have no impact on your score.

A lower credit score resulting from questionable negative information on your credit report can unfairly prevent you from qualifying for a loan, keep you from getting approved for a low-interest rate, cause your car insurance premiums to increase, or come between you and a new job.

You have the will, we have the way. Let us help you fix your credit. Call today to get started

How To Correct Mistakes In Your Credit Report

Both the credit bureau and the business that supplied the information to a credit bureau have to correct information thats wrong or incomplete in your report. And they have to do it for free. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that information on your report. Heres how.

Don’t Miss: Remove Serious Delinquency Credit Report

Best To Check Credit Reports Regularly

As Ira Rheingold pointed out above, most of the disputes you will have with debt collection agencies are the result of debts you dont even know. Collection agencies are often relying on second-hand or even third-hand information that is unreliable and unverified.

If you check your credit report regularly, you may see a problem early and get it corrected before that debt even reaches a collection agency.

If a judgment goes against you, find a lawyer, Rheingold added. If you do so within 30 days and your lawyer files a motion to reconsider, you have a chance to get it overturned. The crucial thing is to make sure the debt collector has the information necessary to bring the case to court. A lot of times, he is working off a line of data that says the amount owed, but with no real proof that you are the one who owes the debt.

If you cant find a way to stop the phone from ringing, consider call a nonprofit credit counseling agency like InCharge Debt Solutions. Their certified counselors are trained in dealing with credit problems and can steer you toward solutions.

12 MINUTE READ