Do Late Rent Payments Affect Your Credit

On the downside, renting can hurt your credit score in some instances. For example, if you’re late on your rent payments or break your lease, get evicted, or fail to pay any move-out fees, and the landlord reports an unpaid balance to any of the three credit bureaus, that will hurt your credit score. Past-due rental balances can also be sent to a collection agency that could report the account on your credit report.

Your credit report might show an unpaid balance that resulted from an eviction, but the actual eviction would not appear on your credit report. Evictions become a public record in your credit report if your previous landlord sues you, and a judgment is filed against you.

What Kind Of Information Is On My Credit Report

All three bureaus receive information from creditors, collections agencies, courts, and others who deal with you.

Good history, like paying bills on time, gets reported, as does bad history.

Your credit report also shows how long youve been paying your own bills and how many different accounts you have.

A good way to think of it is like a snapshot of your money life.

Inquiries, the types of loans you have, and the balances on your credit cards are also mentioned.

Information Landlords Need To Get A Tenant’s Credit Report

To run a credit check, you’ll need a prospective tenant’s name, address, and Social Security number or ITIN , which will typically be on the rental application or consent to background check forms you ask prospects to complete. The application is also the place for applicants to authorize you to run a credit report. Be sure to tell prospective tenants the amount of any credit fee you are charging .

Also Check: Affirm.com Walmart Apply On Your Phone

How Can I Tell If I Was Rejected Because Of Something On My Credit Report

As part of the Fair Credit Reporting Act, landlords are required to tell you if theyve rejected your rental application because of something in your credit report. This is formally known as an adverse action notice. This notice doesnt have to explain what exact information made them reject youoften, they include vague language like you were denied due to something discovered through a consumer report agencybut the notice does have to mention which agency supplied the report the landlord used.

What Is A Tenant Score And Will It Affect Me

Tenant scores are a model similar to credit scores, but for tenancy.

Landlords can report good and bad behavior to rental platforms, which in turn can help landlords pick tenants.

Some will use the mathematical models in credit score to compare your potential tenancy with others.

That said, there are only a couple of companies that compile tenant scores and they are not nearly as common as traditional credit reports.

Recommended Reading: How To Fix Delinquency On Credit Report

Why Is A Credit Check Necessary

Landlords use credit checks as a way to screen potential renters. Just like you need to make sure youre getting a good place, they need to make sure theyre getting a good tenant. They dont want to find out too late that their new renter has a long history of paying their bills 30 days late. Pulling a credit report is a safety net for the landlord.

What Do Landlords Typically Look For In A Credit Check

As you review an applicants credit report, its important that you know what to look for in order to spot tenant warning signs immediately. As you assess the results of a credit check, landlords should watch for:

1. Low credit score

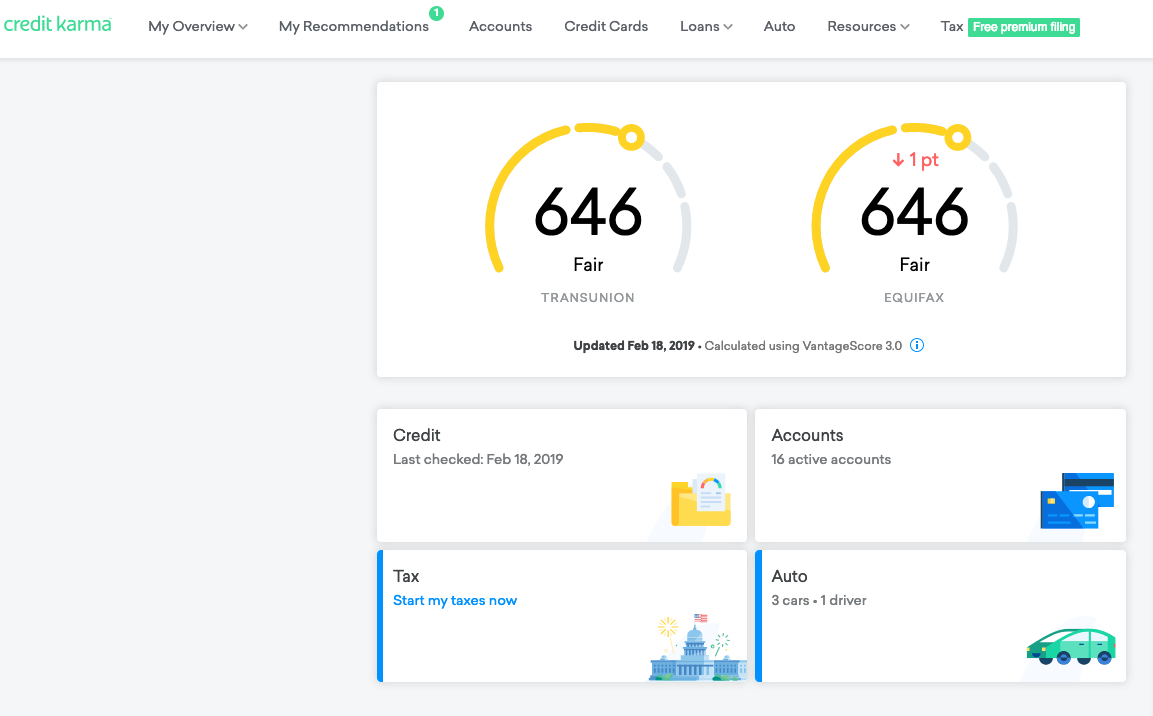

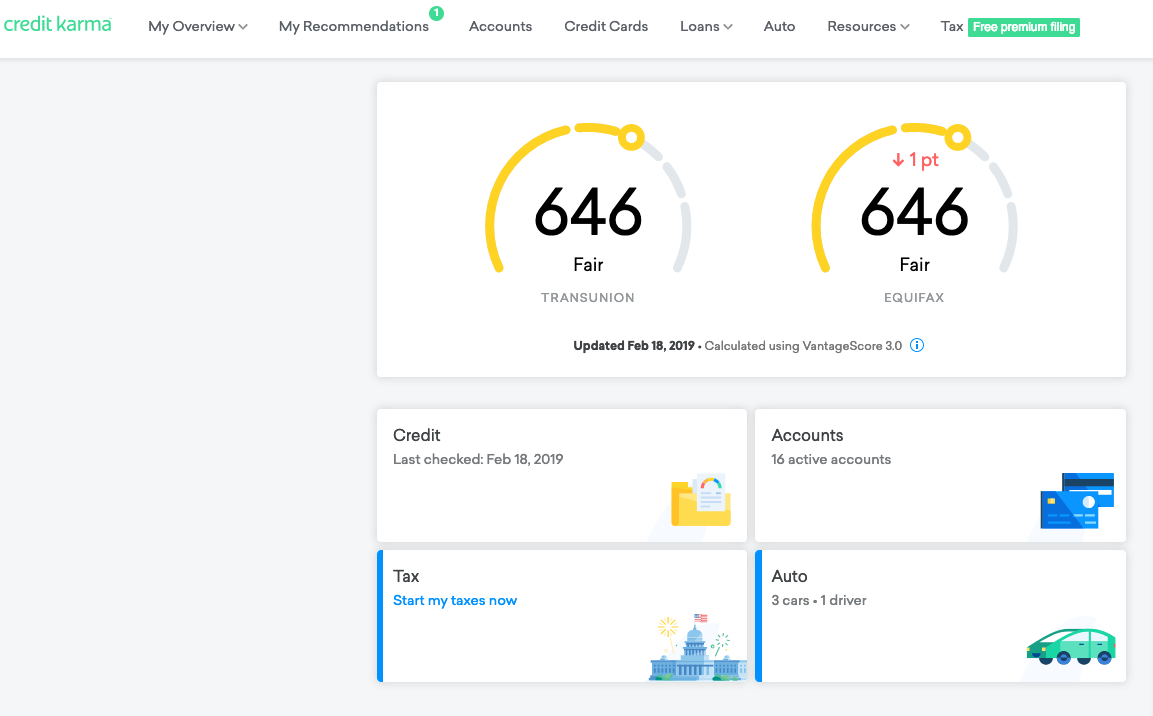

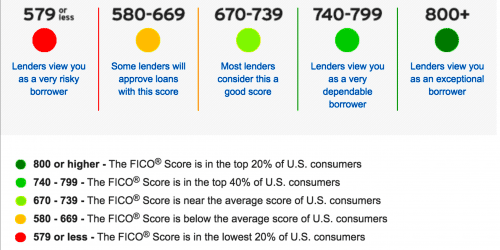

Landlords may initially believe that a low credit score immediately rules out an applicant, but thats not necessarily the case. What credit score does the average landlord look for? According to TransUnion, there is not a definitive good credit score and many factors determine creditworthiness.

A credit score doesnt necessarily provide a holistic view of the applicants financial state or behavior. In a SmartMove survey, 4 out of 5 landlords responded that reviewing a full credit report is important to understanding the applicants credit history and to getting the story behind the score.

Thats why SmartMoves ResidentScore® feature is a valuable tool you can leverage during the screening process. A generic credit score is usually used to evaluate loan performance ResidentScore is tailored to the unique needs of landlords, taking into account almost 1,000 different credit variables that may point to certain rental outcomes, which has been found to help predict evictions 15% more often than the typical credit score.

Unlike a typical credit score, ResidentScore was built specifically to identify the likelihood of a potential tenant being evicted, which means:

2. Late payments

Recommended Reading: What Is Cbna Bby

Why You Want To Maintain A Good Credit Score

Breaking your lease may be the best solution for your current situation right now, but it’s important you make sure to protect your credit score no matter what choice you make.

It may not seem necessary now, but a good or excellent credit score can help you go far in the long run. Healthy credit scores can qualify you for lower interest rates on loans and some of the best credit cards.

For example, the Blue Cash Preferred® Card from American Express ranked as our best grocery rewards credit card but requires good or excellent credit to qualify. Cardholders receive 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases , 6% back on select U.S. streaming subscriptions, 3% back at U.S. gas stations, 3% back on transit and 1% back on other purchases. Terms apply.

The Citi® Double Cash Card ranked as our best no-annual-fee credit card and requires applicants to have good to excellent credit. Those who qualify will be rewarded with 2% cash back .

Make decisions today with your long-term finances in mind, and your credit and wallet will thank you later.

Editorial Note:

What’s The Difference Between Hard And Soft Pulls

Hard pulls are typically done when applying for credit cards, loans, andwhat were most interested in hererenting an apartment.

Another key difference between the two types of credit inquiries is that soft pulls wont affect your credit score, but hard pulls potentially can.

Worst-case scenario, each hard pull can dent your score by up to 10 points apiece.

So multiple pings can really add up and have a tangible impact on your overall credit score.

You May Like: Notifying Credit Bureau Of Death

What Is A Consumer Report

A consumer report may contain information about a persons credit characteristics, rental history, or criminal history. Consumer reports are prepared by a CRA a business that assembles such reports for other businessesand are covered by the FCRA. Examples of these reports include:

- A credit report from a credit bureau, such as Trans Union, Experian, and Equifax or an affiliate company

- A report from a tenant screening service that describes the applicants rental history based on reports from previous landlords or housing court records

- A report from a tenant screening service that describes the applicants rental history, and also includes a credit report the service got from a credit bureau

- A report from a reference checking service that contacts previous landlords or other parties listed on the rental application on behalf of the rental property owner and

- A report from a background check company about an applicant or tenants criminal history.

What Is In A Background Check

Background checks run the gamut from the simple to the deeply complex.

Some services, like TruthFinder, will reveal whether or not you committed crimes, assets tied to your name, as well as information associated with you.

These are often used in job applications, but can still be used for renting purposes.

Many landlords will go a little more in-depth with their searches and use renting-specific software to run your name.

Rent-specific background checks will often bring up more information, including evictions and even noise complaints that wont show up on a credit report.

Don’t Miss: What Credit Bureau Does Paypal Credit Use

Options For Renting An Apartment When You Have Bad Credit

If your credit score isn’t in good shape or you don’t have a credit history at all, it can be challenging to find a landlord willing to lease an apartment to you. Here are some things you can do to offset your bad credit and hopefully alleviate a landlord’s concerns:

- Pay more upfront, such as a larger security deposit or one or two months’ worth of rent.

- Have a creditworthy cosigner apply with you.

- Find a roommate who has good credit.

- Show documents that prove a responsible rental history, on-time utility payments and consistent income.

- Provide letters of recommendation or references from previous landlords.

- Search for apartments that don’t require a credit check.

Also, consider asking the landlord if they have specific requirements for tenants with bad credit. Depending on your financial situation and rental history, it may take more time to find the right fit, but it is possible.

Will Cosigning On An Apartment Lease Hurt Your Credit

- Publish date: Jul 9, 2014 8:19 AM EDT

Financial experts have longed warned against cosigning on auto loans, credit cards and student loans, given the plethora of financial risks. But things are different with an apartment.

NEW YORK Financial experts have longed warned against cosigning on auto loans, credit cards and student loans, given the plethora of financial risks.

Though for apartment leases, acting as a cosigner presents different risks.

Newly minted college graduates making the move to a major city will likely need a cosigner on an apartment lease. Landlords typically require tenants to earn at least 40 times the monthly rent, a hefty threshold for young people, in order to be exempt from the guarantor requirement.

Cosigning on an apartment lease can have indirect impacts on your credit history.

As a cosigner, you are liable for rent payments should the primary tenant fail to pay.

“If the cosigner can’t pick up the slack and make rent payments, the management company can hire a collection agency to collect the unpaid balance and this will show up on the primary tenant’s credit report and the cosigner’s,” says John Ulzheimer, president of consumer education at CreditSesame. “This is where the problem begins.”

Plus, a payment default will remain on your credit report for seven years, which will impact your credit score, a gauge of how well you manage money.

Don’t Miss: Credit Score Needed For Affirm

Collecting Credit Check Fees From Tenants

It’s legal in most states to charge prospective tenants a fee for the cost of the credit report itself and your time and trouble. Any credit check fee should be reasonably related to the cost of the credit check $30 to $50 is common. California sets a maximum screening fee and requires landlords to provide an itemized receipt when accepting a credit check fee.

Be sure prospective tenants know the amount and purpose of a credit check fee and understand that this fee is not a holding deposit and does not guarantee the rental unit.

Also, if you expect a large number of applicants, you’d be wise not to accept fees from everyone. Instead, read over the applications first and do a credit check only on those who are genuine contenders . That way, you won’t waste your time collecting fees from unqualified applicants.

Keep in mind that it is illegal to charge a credit check fee if you do not use it for the stated purpose and pocket it instead. Return any credit check fees you don’t use for that purpose.

Whats An Apartment Credit Check

Before we dive in, lets figure out what a credit check is. An apartment credit check reveals your credit history by looking into your bank and credit card account balances. The credit check also shows any outstanding loans or payments. The reason for running the credit check is simple: the better your credit, the more evidence you have that you will pay your monthly rent on time.

Heres what your landlord will ask you for:

- Full legal name

- Current and former addresses from the last two years

- Current and past employment

Recommended Reading: Can A Closed Account Be Reopened

Why Do I Need To Run A Credit Check On Prospective Tenants

A credit check is just one part of an applicants background, but this basic screening may give you a foundational understanding of their financial health. Note: It is strongly recommended that you consider reaching out to legal counsel that is familiar with both credit reports and tenancy laws.

According to a SmartMove® survey, 84% of landlords cited payment problems as their top concern. A credit check is a prudent method of inquiry that may reveal what to reasonably expect from your renter in terms of their financial behavior.

What Can A Landlord See On A Credit Report

Renting an apartment is a ritual a lot of young adults go through. You fill out an application and hand over a fee. The leaser, or landlord, checks you out or passes your information on to a tenant screening service. One thing you can count on: the landlord will pull your credit. Its a smart move to know what shes going to see on your credit report.

Recommended Reading: How To Get Rid Of A Repo On Your Credit

Whats A Soft Credit Pull

Soft credit checks, also known as soft inquiries or soft pulls, are background checks rather than checks that occur when you apply for a loan. These inquiries dont affect your credit score in any way and may sometimes happen without your knowledge.

A list of common reasons for soft inquiries include:

- Checking your own credit report

- If and when a potential employer checks your credit history to determine your financial reliability

- A financial institute you are already a customer with, checks your credit score

- When credit card issuers check your credit to send you a pre-approved offer

Want to check your credit score? Hop on over to our guide to checking your credit score for free!

Are Rental Payments Included In My Credit Report

Esusu August 31, 2021

Pressed for time? Heres what you need to know.

Historically, credit reports dont include rent payments. Why? Because rent isnt considered debt. As we all know, landlords and property managers dont lend us rent money each month to be repaid later with interest.

Until 2010, the only time rent payments would show up on your credit report is if you have late or missing payments. If your landlord sells the rent you owe to a collections agency, then it becomes debt. This information will definitely appear on your credit report and can negatively affect your credit score. Since 2010, on-time payments can be included in your credit report.

If you have a stellar track record of on-time rent payments, that can be a great way to show lenders that youre a responsible consumer. A history of on-time rent payments can also help you build credit without taking on additional debt. It can even boost your credit score.

In this article:

Read Also: Does Carmax Report To Credit Bureaus

Are There Any Credit Report Red Flags That Make Landlords Turn Others Away

Yes, there are plenty. Late payments, loans that are late to the point of getting charged off, collections accounts, repossessions, and foreclosures can all cause a landlord to turn you away.

Once again, the nuances of your credit report marks are what can make or break your chances at an apartment.

Late payments might not be so bad, but other items that suggest pervasive problems can be. Judgments, in particular, are terrible because it shows that you had to be dragged to court in order to deal with certain debtors.

How Long Do Inquiries Stay On Your Credit Report

As weve seen above, soft credit pulls might show up in your rental credit check history, but they dont affect your credit score in any way. They also disappear within 30 days.

On the other hand, hard inquiry credit checks stay on your credit report for 2 years. After this point, they fall off.

For example, If you’ve been turned down for a loan recently, try waiting at least 24 months. After the 2-year period is over, you can apply again so that the previous inquiry will drop off your credit report.

Read Also: Clark Howard Free Credit Scores

Can I Expunge My Eviction Record

Unfortunately, you cannot expunge evictions from your rental record in Texas. However, if you have an active eviction lawsuit, talk to your landlord about the Texas Eviction Diversion Program. The Texas Eviction Diversion Program can help you pay both future and back rent and can seal the current eviction case on your record. Sealing does not entirely remove the eviction from your record like an expunction does, but it does make it so future landlords will not be able to see it when they do a background search.

The Texas Eviction Diversion Program requires an existing eviction lawsuit and a cooperative landlord to participate. You cannot use the program to seal past eviction judgments or lawsuits. You can apply for the Texas Eviction Diversion Program through the rent relief application at texasrentrelief.com.

How Can I Include Rent Payments In My Credit Report

Most credit reports dont include any rent payment history. However, this information can be included if you or your landlord chooses to report it to credit bureaus.

- Check with your landlord or property manager. Your landlord or property manager may already be reporting your rental payment history to the credit bureaus with the help of Esusu. If not, ask them to register for Esusus rent reporting service on your behalf.

- Report it yourself. If your landlord or property manager doesnt want to report your rental payments to credit bureaus, you can sign-up with Esusu yourself. For $50 a year, we help report all your rent payments to TransUnion and Equifax. Learn more and sign up.

Including rent payment history in your credit report is a great way to build credit while avoiding debt. Without opening new lines of credit, you dont have to worry about interest rates or late fees. All you have to do is pay rent on time.

Also Check: Does Affirm Affect Credit Score