Contact The Credit Reporting Company

Whatever your problem, contacting or complaining to the reporting company is your first step. Before you make contact, read our information on:

- your rights

- how to complain.

Your rights

You have rights â and credit reporting companies have rules to follow â under the Privacy Act and the Credit Reporting Privacy Code.

- What can be held: Credit reporting companies can hold specific information about you, eg credit accounts, repayment history, default payments, insolvency applications.

- Time limits: Time limits exist for your credit information, eg four to five years for most information.

- Who can access it: Only certain agencies and companies can access your report for specific reasons, eg lenders considering your loan application.

- Consent for access: Your consent is needed in most situations, eg potential landlords or employers, lenders. Some don’t need your consent, eg debt collectors.

- Identity fraud: Ask to have your credit information suppressed if you think you’re the victim of identity fraud.

- You have access: You can ask to see what information is held on you.

- Errors corrected: You can dispute errors on your credit report.

- Complaints: You can complain to the credit reporting company if you think your rights have been breached.

â Privacy Commissioner

How to complain

A free financial mentor can help you contact the company, or talk to the company for you. Start by contacting the free helpline MoneyTalks.

During the complaint:

Improve Your Credit Score

- Make payments on time: This goes for loan repayments and bill payments.

- Pay credit card in full: Do this every month to build good credit.

- Check your credit scores: You need to check all three credit reporting companies and make sure the information they have is accurate. Ask for any errors to be fixed. If you are turned down for a loan, check your credit history and fix any errors before applying for more loans.

- Don’t share bills: Make sure your name isn’t on any bills with other people, eg if you live with flatmates and the power bill has all of your names on it, your credit score could drop if your flatmates don’t pay the bills.

- Limit credit applications: Every timeyou apply for credit, the lender will do a credit check. Each check negatively impacts your score. Only apply for what you really need.

- Limit payday loans and quick finance options: Seeing these on your credit history can make lenders think you aren’t good with money.

- Cancel unused credit cards and accounts: Multiple sources of credit don’t look good on your credit history. If your credit card/store card isn’t getting used, cancel it .

- Wait for the time limits: Items on your credit history stick around for a set amount of time, four to five years. If you want to apply for new credit, wait until the old history disappears off your credit report, if possible.

No credit is almost as bad as poor credit. It gives a future lender no information about you as a risk, which might lead them to turn you down.

Payday Loans Can Kill Mortgage Applications

Some payday lenders disingenuously suggest that taking them out and repaying on time can boost your credit score, as it starts to build a history of better repayment. This is true to a very minor extent for those with abysmal credit histories though using a;;correctly is generally both more effective and far cheaper.

If you’re getting a mortgage though, by definition you’ll need a far better than abysmal credit score. So you should avoid payday loans like the plague. Not just because they’re hideously expensive see the;Payday Loans;guide but because some mortgage underwriters have openly said they simply reject anyone who has had a payday loan, as it’s an example of poor money management.

Many people were mis-sold payday loans they couldn’t afford to repay. If that happened to you, you can reclaim £100s or even £1,000s and request that any poor payment records on loans deemed to be ‘unaffordable’ are removed from your credit file. See our Reclaim Payday Loans for Free guide.

Also Check: Is 779 A Good Credit Score

Think Carefully Before Applying For Any New Credit

Whether you get approved or not, the fact that you applied for a new credit or loan product will show up on your credit report, which in turn may affect your credit score. If you make multiple applications for credit within a short space of time, this can flag to lenders that you are in credit stress and may have a negative impact on your score.

That being said, applying for credit to replace or better structure a credit product such as taking out a credit card with a balance transfer offer or a personal loan to consolidate debt may ultimately help you get on top of your debt,; improving your credit score in the process. However, this would require you to genuinely pay down your debt, and not simply move it around. Be careful with this strategy, as each credit application is recorded on your credit report and lenders may still view it as a red flag if they see a pattern of lending applications.

How Long Does It Take To Improve A Credit Score

When you are looking to improve your credit score, its important to understand that this process takes time.; As credit scores are based on your credit files, and that information is usually updated monthly at best, theres no practical way to truly boost your credit score overnight.; Even methods or websites claiming to tell you how to improve your credit score in 30 days are a bit misleading, as it often takes longer than this for agencies to update your file, and new scores to be generated.; And it is quite unlikely that any site can provide a magic answer on how to improve your credit score to 800 or beyond.; So much depends on your current score, the details of your credit bureau files, and the actions you take moving forward.

So just how long does it take to improve your credit score?; There are some simple and easy ways to improve your credit score, that dont take months and months of effort on your part.; In general, it may take 6-8 weeks, or even up to 3 months in some cases, for these methods to result in meaningful changes in your credit file and credit score.

Also Check: Does Paypal Working Capital Report To Credit Bureaus

Example Wait To Get New Credit

In her early 20s, Sarah had three credit cards and didn’t take the debt seriously. At one stage she was getting letters from debt collectors. She ended up with a bad credit score. Four years later, she has paid off her debts and wants to buy a house. She checks her credit history and sees her credit card defaults will soon disappear.

Sarah waits one more year to apply for a mortgage, which improves her credit score. While she’s waiting, she makes sure all her bills get paid on time and her current credit card is paid off in full each month. The bank accepts her mortgage application.

Knowing When To Pull The Plug On A Loan Application

Thinking about a personal loan? Learn about lending criteria first. You may decide to wait until your finances improve or you may decide to apply online right away. But if you do decide to push ahead, our digital platform will assess the following credit criteria within a few seconds and provide a credit decision.

3 Minutes

Don’t Miss: Credit Score 524

What Is Considered A Good Credit Score

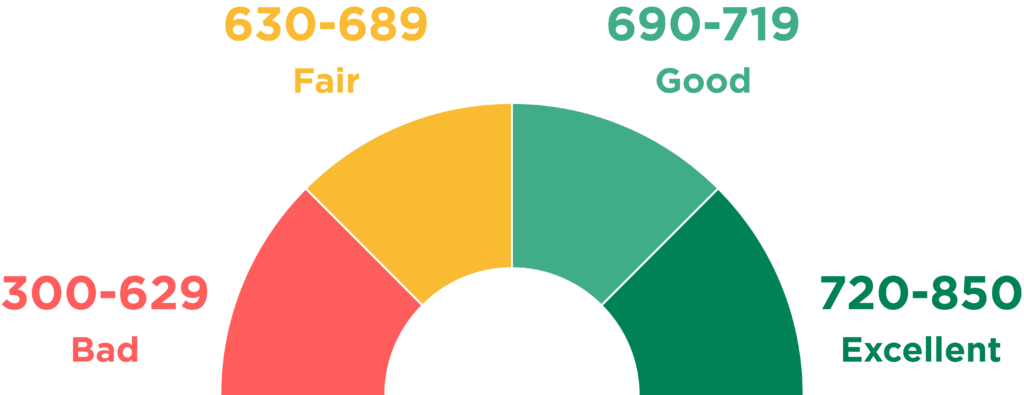

According to Lucey, “scores starting in the high 600s and up to the mid-700s are generally considered to be good.” While slight day-to-day fluctuations in your credit score are common, most lenders require that individuals meet a credit score requirement to be able to gain access to certain financial products like housing, car insurance, and even cell phones, according to Lucey.

If you’re unsure exactly what your credit score means in the eyes of credit bureaus, Lucey provided a simple guide below to use as a reference.

- “If your score is in the 300 to the low-600s range, youre in the ‘poor’ range. You might not be able to get approved for a loan or an unsecured credit card at all. If a lender or issuer does approve an application, it likely wont offer the best terms or lowest possible interest rate.”

- “If your score is in the low-600s to the mid-700s range, youre in the ‘fair to good’ range. Youre more likely to get approved for financial products and may be able to shop around and compare options among different lenders. But you still might not get the best terms.”

- “And if your score is about the mid-700s or above, youre in the ‘excellent’ range. A lender could deny an application for another reason, such as having a high debt-to-income ratio, but those with top credit scores likely wont have their applications denied because of their credit scores. You are also most likely to get offered a low-interest rate.”

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Don’t Miss: How To Get Credit Report Without Social Security Number

Never Miss Or Be Late On Any Credit Repayments It Can Have A Disproportionate Impact

Sounds obvious? Well, it is. Even if you’re struggling, try not to default or miss payments because it can have a disproportionate impact. Doing this once or twice could cause problems that can cost you for years. Defaults in the previous 12 months will hurt you the most.

The easy solution is to pay everything by direct debit, then you’ll never miss or be late. While we normally caution against only making minimum repayments on debts one technique is to set up a direct debit to just repay the minimum, purely as a vehicle to ensure you’re never late. Then manually pay more each month on top.

If you are in difficulties, the cliché “contact your lender” is a good one. Hopefully it will try to help. Changing your repayment schedule is preferable to you defaulting and though it will hit your credit score, it’s better than a county court judgment or decree against you.

What Lenders Really Know About You

It’s important to be aware of exactly what lenders know when you apply, so you can present yourself in the best light. Importantly, it’s more than just what’s on your credit file.

The application form

In many ways this is the most important part. Here, lenders obtain the key details: your postcode, salary, family size, reason for the loan and whether you’re a home owner.

Make sure you fill in the forms carefully. One slight slip, such as a “£2,000” salary rather than a “£20,000” one, can kibosh any application.

Be consistent too,;fraud-scoring;firms filter applications and if there are many inconsistencies such as changing your job title or different phone numbers, it can cause a problem that you may not be told about.

Past dealings you’ve had with the lender

Companies use any data on previous dealings they’ve had with you to feed into the credit score. This means those with limited credit history may find their own bank more likely to lend to them than others.

Of course, those who’ve had problems with a lender in the past may find it more difficult to get accepted there too.

Equifax, Experian and TransUnion credit files

The three UK credit reference agencies compile information, allowing them to send data on any UK individual to prospective lenders. All lenders use at least one agency. This data comes from four main sources:

– Electoral roll information.;This is publicly available and contains details of addresses and who lives at them.

Fraud data

Also Check: Why Is There Aargon Agency On My Credit Report

How To Raise Your Credit Rating

The higher your credit scores, the better shot you have of getting a loan or credit card application approved. Improving your credit scores takes time, but it can be done. Here are some important tips:

Dispute errors. Credit bureaus are required by law to investigate mistakes you bring to their attention and report back to you. Typically, they ask the creditor that reported the past-due information to check its records. If the creditor can’t verify the info or doesn’t respond, the item should be deleted.

Pay your bills on time. Payment history makes up more than one-third of the typical credit score determination, financial columnist Liz Weston, author of Your Credit Score, says, so paying bills on time all the time is essential to maintaining good scores. If you’re forgetful, consider setting up automatic payments through your bank.

Pay down your debts. Lenders look at how much of your available credit on cards and credit lines you are using. If you are maxed out or close to it, lenders could assume you’re on the financial edge and not lend you money.

Keep credit cards and other revolving accounts open. You may be tempted to close old accounts you’re not using, but that won’t help your credit scores and may actually hurt them. It reduces the amount of your available credit, which can lead to lower scores.

If it can happen to the mighty US, it can happen to you.

The overdue debt should be the biggest worry for consumers as it may have long- term ramifications.

Always Check Your Credit Files After Rejection

There’s a nightmare scenario you need to avoid called the rejection spiral. It works like this:

This continues, until finally you check your files and get the error corrected. So…

You apply again. You’re rejected, not due to the error, but because of recent ‘searches’.

If you’re rejected once, check your files are correct immediately. Otherwise you may mess up your score for an age, as more applications mean more searches, compounding the problem. You’ll be told by the lender which credit reference agency it used to assess your info, so focus on that one.

After an error, it’s possible to get successive searches wiped, but it involves negotiating both with the agency and the lender, and it isn’t easy.

The rejection spiral also applies when you apply for credit normally reserved for those with an excellent score when you, say, only have a good score .

If you’re thinking of applying for a new card, check our best buy credit card guides. Our;eligibility calculator;gives an indication of which loans and cards are likely to accept you, plus those likely to turn you down.

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

Who Checks My Credit History

Lenders usually check your credit history whenever you apply for credit whether its a mortgage, a personal loan, hire purchase, car finance or a new credit card. Phone and power companies may also check your credit rating if you apply for those services on credit. A prospective landlord or insurer might check your credit history.;Some employers even make credit checks on job applicants.

They do this by making an enquiry to a credit reporter an organisation that collects credit information and sells reports on an individuals credit history to businesses.

Something to keep in mind is that having lots of checks run on your credit history can make it look like youre taking on a lot of debt. For example, say youre shopping around for a car. You visit five dealers, who all take your licence and do a credit check. Having so many credit checks done in a short period of time can lead to lenders turning you down.;

Tips For Improving Your Credit Score

Hughes shares her eight tips for improving your credit score:

Also Check: Paypal Credit Soft Pull