I Need A Credit Card To Earn Rewards

Using credit cards to earn rewards can be risky. It’s only a wise financial decision if you pay your balance in full each monthin other words, if you can actually afford the purchases you make on your rewards credit card. You also have to weigh any annual fees against the rewards you might earn.

It’s also important to remember that the card issuer offers its rewards because most people are not going to pay their credit cards in full each month. The company earns a profit on the balance a customer carries on a rewards card, and that profit is often much higher than what the rewards cost the company.;As with store credit cards, there are debit cards available now that offer rewards points.

The 5 Best Credit Cards For A 550 Credit Score

- Milestone® Mastercard® – Less Than Perfect Credit Considered

- Discover it® Secured Credit Card

Before applying for a card, make sure to check out its terms and conditions, or a FAQ page if there is one, just to make sure you fit the criteria for eligibility. You can also try getting pre-approved for a credit card. It wont hurt your credit, and it will give you a good idea of your odds if you decide to apply.

What’s the easiest unsecured credit card to get approved for?

One of the easiest unsecured cards to get approved for is the . You can get approved for it even with bad credit. It offers a $300 starting spending limit. And you can use it wherever VISA is accepted.

This isnt your only option, though. WalletHubs editors compared all of the unsecured credit cards in our database of 1,500+ offers. And we selected our favorite easy-to-get offers.read full answer

Applying For A Credit Card

Before you complete a credit card application, make sure you understand all of the terms and conditions that apply to the card.

If you apply for a credit card from a federally regulated financial institution such as a bank, the application must include an information box. The information box must present key features of the credit card such as interest rates, fees and other charges in a clear and easy-to-understand way.

Recommended Reading: Credit Report Without Ssn Or Itin

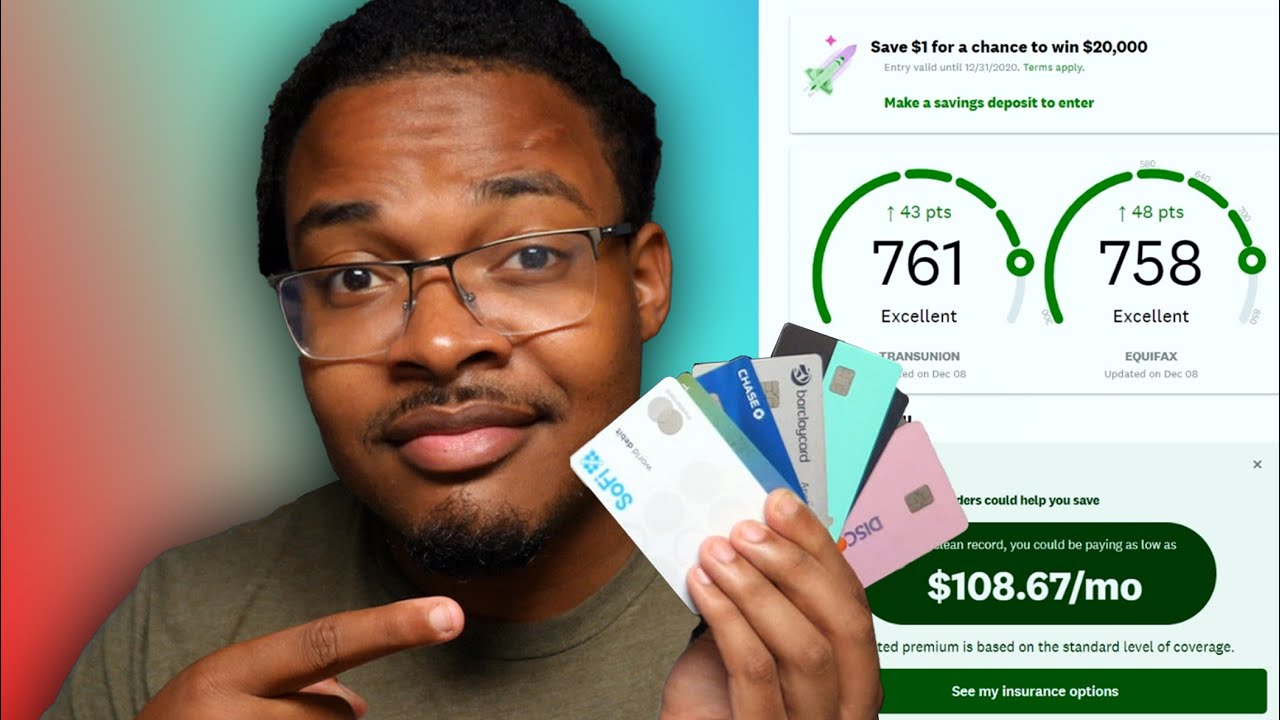

Check Your Credit Report And Score

If you havent checked your and scores yet, this is a good place to start when trying to improve your odds of getting a credit card. Your credit report is a collection of information thats used to calculate your credit scores. This includes things such as payment history, account balances, inquiries for new credit, delinquencies, and public records.

You can get your credit report for free once per year from the three main , Experian, Equifax, and TransUnion, through the AnnualCreditReport.com website. If youve never checked your credit report before, it may be helpful to get all three reports at the same time to see how your credit history compares. You may have a creditor that reports to only one bureau instead of all three, for example, which could affect your credit score.

As you review your reports, check to make sure all the information is correct. If you see an error or inaccuracy, you have the right to dispute it with the credit bureau thats reporting the information. If the bureau verifies that an error exists, it is legally required to remove it or correct it, either of which could potentially add a few points back to your score.

What To Do If Youre Rejected

One of the worst mistakes people make is giving up when theyre rejected for a credit card.

If you receive a rejection letter, the first thing you should do is look at the reasons given for your rejection. By law, card issuers are required to send you a written or electronic communication explaining what factors prevented you from being approved.

Once youve figured out why youve been rejected, call Chases reconsideration line. Tell the person on the phone that you recently applied for a Chase credit card and you were surprised to see that your application was rejected and you would like to speak to someone about getting that decision reconsidered. From there, its up to you to build a case and convince the Chase agent on the phone why you deserve the credit card.

If you were rejected for too short of credit history, you could point to your stellar record of on-time payments. If you were rejected for missed payments, you could explain that those were a long time ago and your record since then has been perfect. Of course, theres no guarantee that this will work, but Ive had about a third of my rejections reversed on reconsideration. At the end of the day, its worth spending 15 minutes on the phone if it might help you get the card you want.

Related: Are there any long-term problems if you get declined for a credit card and what you can do about it?

Read Also: How To Get Credit Report Without Social Security Number

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

What Credit Score Is Needed For A Credit Card In Canada

Where you sit on the scale will determine your general ability to qualify for lending or credit requests. When applying for a credit card, you can expect the following based on your credit rating:

- Poor. Your credit needs work, but you can potentially qualify for .

- Fair. You may need to build up your score before you can get some forms of credit.

- Good. You could still apply for most cards but may not be eligible for the lowest interest rates.

- Very good. Your score is good enough to be approved for most credit cards.

- Excellent. You should have very few problems getting a credit card, loan or mortgage.

You May Like: How To Get Credit Report Without Social Security Number

I Need A Credit Card To Save Money On My Purchases

Many stores will offer discounts for having a store credit card. Stores do not offer cards to give you discounts, however; they offer cards because they realize that, while most people intend to pay the card off every month, few actually do. They make more back on interest than they do on the discount they offer to you.Unless you pay the card in full every month, you will likely pay more in interest than the 10% discount you saved. If you really need or want access to in-store discounts, some stores now offer a debit card option with similar savings.

What Kind Of Credit Card Can I Get If I Have Bad Or No Credit

Those with a credit score below 650 will likely find it difficult to be approved for premium cards. However, there are a few different types of cards that you can still qualify for that may help you build your credit score.;

Retail Credit Cards

One option is to apply for a retail credit card. A retail credit card is an offering created when retailers partner up with banks or banking networks to provide a credit service. Typically, retailers are less stringent on credit ratings and there have even been cases where they do not conduct a at all. Getting a retail credit card can also entitle you to discounts and loyalty rewards programs as long as you keep your account in good standing. A downside to retail credit cards is that interest rates tend to be higher, which will increase your interest expense if you do not have the cash flow to clear the account balance each month.

Prepaid Credit Cards

Prepaid credit cards are another alternative for those with low credit scores. These cards require the cardholder to top them up with cash before any purchases can be made. After funds have been added to the card, it can be used just like any other credit card. However, prepaid credit cards will not help you build your credit as it is not a credit product.

Student Credit Cards

Secured Credit Cards

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

You May Still Have Credit Reports

A lack of a score doesn’t always mean you have a complete lack of credit history. Equifax, Experian, and TransUnion each track things a bit differently, but one or all could have data on you. It’s also possible that your credit report will show activity that’s too old to be counted in a or too recent to show up. Scores generally only count the past two years in their scoring model.

How Does Your Credit Score Affect Your Credit Card Application

Banks use your;credit score to estimate;their risk that you wont pay back your credit card charges. The higher your credit score, the less risky and the higher your chance of getting approved for a credit card.

Whats the lesson? Know your credit score. You can use our free credit score estimator or find credit monitoring;tools to check your score online.

Keeping track of your credit score can alert you to problems in your credit report and show you how timely payments are paying off as your score goes up. You can also compare your score to national averages so you know how good a job youre doing managing credit.

Also Check: How Bad Is A 524 Credit Score

Compare Card Offers Carefully Before Applying

Credit card companies routinely change up . While they may not explicitly state what minimum credit score theyre looking for from consumers, many of them do give a general range that indicates who the card is suited for. For example, a credit card company might offer a cash-back card with one rewards rate for consumers with good or fair credit and reserve a card with a higher cash-reward rate or better perks for consumers who have excellent credit.

Taking time to do your homework and research card options can help you narrow the field to the cards for which youre best suited, based on your credit profile. From there you can streamline the list further by determining which cards best fit your needs. For instance, if you carry a balance, you may prefer a card that offers a low annual percentage rate on purchases. Or you might be interested in a card that offers travel miles or points rather than cash-back rewards.

Remember to look beyond credit scores and consider the other requirements a lender may set, such as a minimum income threshold. Also, check the card options your bank offers against what other banks advertise. If you have a positive banking history with your bank or credit union, you may find it easier to qualify for a card. Take time to review the APR and fees of any card you choose, so you know what the card will cost you.

What Credit Score Is Needed For A Credit Card

Tom Giancola, chief credit risk officer with Mercury Financial, which has offices in Austin, Texas, and Wilmington, Delaware, said that consumers typically need a FICO score in the low 600s to qualify for a basic, no-frills credit card. For a basic rewards card, youd need a score in the mid 600s to the low 700s.

And to qualify for premium cards with the most valuable rewards programs? That usually requires a FICO score of 740 or higher, according to Giancola.

Those rewards are expensive, Giancola said. The banks cant tolerate high loss levels if they are paying out that much in rewards expense. So they reserve these cards for the safest of applicants.

You May Like: Cbcinnovis On My Credit Report

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to;this top balance transfer card;secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt.;Read The Ascent’s full review;for free and apply in just 2 minutes.

What Credit Score Do You Need To Get A Credit Card

There is no magic credit score needed to be approved for a . It ultimately depends on the specific card provider and the requirements for each card . In Canada, most card providers view a credit score of 650 as satisfactory and those with credit scores above this level should have no issues being approved for a credit card. However, those whose credit score falls below the 650 mark may find it more difficult to qualify for premium options.

One thing to note is that you have more than one credit score. The two main are Equifax and Transunion, and they both have their own formula to calculate an individuals credit rating. You can request one credit report for free every 12 months. Credit card providers tend to poll one or the other, so you can research which credit bureau they pull from to know whether you are likely to qualify.

Read Also: How To Get A Bankruptcy Off Your Credit Report

Fair Or Average Credit

In this category, youre probably in your first year or two of the credit-building process, or youre recovering from a few negative items, like missed payments. Its possible you have very high credit card balances relative to your available credit, a ratio known as credit utilization, which can be a negative signal to credit card issuers.

If youre at this level, your goal in getting a card is probably to build credit so you can qualify for better cards and terms in the future. To learn more about how to build credit with credit cards, read our guide.

At this level, your options are a little more limited. Youll want to be smart by not applying for too many cards that are designed for better credit levels since youll get a hard inquiry every time you apply for a card. Too many hard inquiries could make it harder to get approved for cards in the next 12 years, and theyll also generally decrease your credit scores.

Depending on your exact credit history, you may have mixed results when applying for cards at this credit level.

Retail store cards tend to have worse terms that cards issued by big banks or credit unions, but sometimes they have lower approval requirements, so a store credit card may be another option for you to start building credit if you cant get approved for other cards. Just make sure youre paying your bills on time and in full every month.

See our picks for best credit cards for people with fair credit here.

Try To Fix The Problem

If your credit score is low, take a few months to build it up. Use your credit card responsibly, make your payments on time and try to pay off the entire balance each month so youre not charged interest. Good credit habits will help you get approved on your next application. Plus, make sure you meet the eligibility requirements like youre the age of majority and your income meets the threshold.

You May Like: Is 524 A Good Credit Score

Do You Have A Stable Job

You almost always need to have a constant source of income to apply for credit. If you dont get a regular paycheque, how can a lender be sure that you will make your payments each month? If you do have a steady job, a lender may not be comfortable to extend credit to you until you have past your 3 month probationary period. In bad economic times, lenders can become even more cautious. The bottom line is dont expect to get credit if you just landed a new job unless you have a stable employment record and this new job is clearly a step in the right direction for your career.

Include All Income In The Application

Issuers consider your credit scores an indicator of creditworthiness, but scores dont reflect your income. Card issuers use income to calculate your;debt-to-income ratio, which helps determine your ability to make payments. Change your ratio by either increasing income or decreasing debt.

If you earn money outside your full-time job, include it on your application. As long as youre 21 or older, you can include your household income, including;income from your spouse or partner, on your credit card application.

Resist the temptation to overstate your income. If an issuer finds that you knowingly provided;false information;on your application, you could be charged and convicted of credit card fraud.

Being;unemployed;doesnt automatically disqualify you from getting a credit card.

Read Also: Does Carmax Check Credit

Know The Benefits Of Getting Preapproved

There are many benefits of getting preapproved before applying for a credit card:

- Allows you to focus on the credit cards you may qualify for before applying

- Provides you with unique offers specific to you

- Protects your credit score against needless hard inquiries that may harm your credit score

A hard inquiry occurs when a lender is permitted to check your credit report when youre applying for a new loan or line of credit. The inquiry will typically be recorded on your credit report for a minimum of 24 months and, in certain circumstances, could negatively affect your score.