Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.

How To Order A Free Credit Report

An amendment to the FCRA requires each of the nationwide credit reporting agencies — Equifax, Experian, and TransUnion — to provide you with a free copy of your credit report, at your request, once every 12 months.

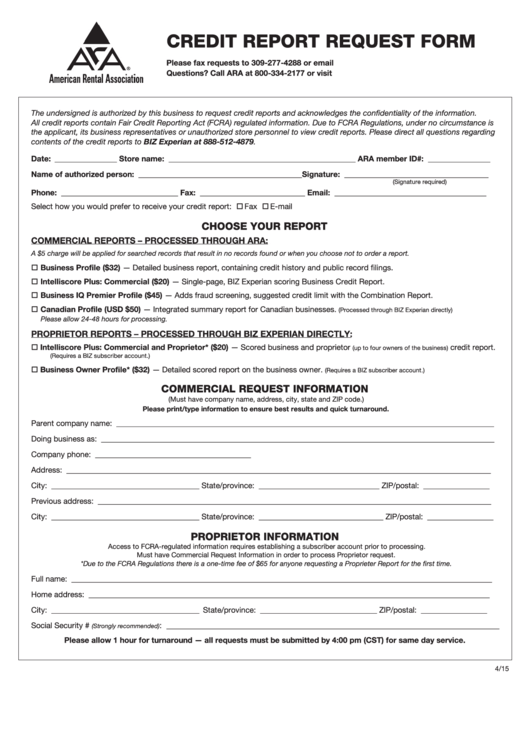

The three nationwide credit reporting agencies have set up one website, toll-free telephone number, and mailing address through which you can order your free annual report. To order, visit annualcreditreport.com, call 1-877-322-8228, or complete the Annual Credit Report Request Form and mail it to:

Do not contact the three nationwide credit reporting agencies individually.

You may order your reports from each of the three nationwide credit reporting agencies at the same time, or you can order from only one or two. The FCRA allows you to order one free copy from each of the nationwide credit reporting agencies every 12 months.

You need to provide your name, address, Social Security number, and date of birth. If you have moved in the last two years, you may have to provide your previous address. To maintain the security of your file, each nationwide credit reporting agency may ask you for some information that only you would know, like the amount of your monthly mortgage payment. Each company may ask you for different information because the information each has in your file may come from different sources.

Specialty Consumer Reporting Agencies

Specialty consumer reporting agencies prepare reports on consumers’ histories for specific purposes. The reports cover employment, insurance claims, residential rentals, check writing, and medical records. Think about ordering a specialty report if you are ready to buy homeowners or automobile insurance, open a checking account, apply for private health or life insurance, or rent a home or apartment.

Property Insurance Claim Reports: Insurance companies often check reports of this kind when you apply for homeowners or automobile insurance. One of these reports is the CLUE report .2 CLUE reports contain information on property loss claims against homeowner’s insurance and automobile insurance policies. A CLUE report contains personal information, such as your name, birth date, and Social Security number. It also contains a record of any auto or homeowner property loss claims you submitted to an insurance company. It includes the type of loss, date of the loss, and amount paid by the insurance company. It lists inquiries, or companies that have checked your claim history.

Another property loss report is called A-PLUS . The A-PLUS database is compiled by a smaller company and is less commonly used than the CLUE database. You may order a CLUE report and an A-PLUS for free once every 12 months.

Tenant History Reports: Landlords sometimes check your tenant history as well as your credit history. You may order a free copy of your tenant history report once every 12 months.

Read Also: Does Paypal Report To Credit Bureaus

Fill Out One Online Submission Form

If you’re requesting through the website, you’ll have to fill out one submission form, regardless of whether you want one, two, or all three of your allotted credit reports. The form will ask for your name your current address your last address if you’ve lived at your current address for less than two years and your Social Security number.

What Is Your Free Credit Score

Your credit score is the single most important financial score youll ever get. Yes, its even more important than matric aggregate, body fat count, or golf handicap, since credit providers use this credit score when deciding whether or not to extend credit to you. So be sure to maintain a good track record!

Your Experian credit score is calculated via a credit bureau check, using information from your full credit profile. Experian evaluates all of your accounts, your negative and positive information, and your payment history to assign you a credit score of 0999. The higher your credit score is, the better your credit profile, and the lower your risk will be of defaulting on an account or loan would be.

You May Like: Does Paypal Credit Affect Credit

Keep A Copy Of Your Request To Lexisnexis

After you have drafted your request and assembled the necessary support documents, sign your request letter and make a photocopy. Even after you have gone to the trouble of assembling all the necessary documentation, LexisNexis may still not send your report. If so, you will need a copy of your request to enforce your rights. Make sure to keep a copy of all the supporting documents along with the letter. Keep an electronic copy of this this request with your other LexisNexis credit reporting materials. If you don’t know how to organize your credit file, you can email us through this site or call 400-CREDIT | 400-2733 to get help.

How To Get Your Annual Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until April 20, 2022, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

Don’t Miss: How Personal Responsibility Can Affect Your Credit Report

Who Can I Contact To Obtain My Free Annual Credit Report

There are three ways that you may obtain your free annual credit report.

Online: You can order your free annual credit report online. If you want to order your credit report online, make sure you go to AnnualCreditReport.com, and not to another Web site that looks similar. Identity thieves can set up look-alike websites and trick you into providing your personal financial information, including your Social Security number. To protect yourself, use the link provided on this website, or on the Federal Trade Commission website. If you order your credit report online, you will be asked to provide your Social Security number and you will be asked some questions to confirm your identity. You should receive your credit report almost instantaneously.

You can also order your free annual credit report by mail. To do so, you can fill out an Annual Credit Report Request Form and mail it to the address provided on the form. Consider shading the circle on the bottom right of the form so that the report mailed to you includes only the last four digits of your Social Security Number. Also, be careful when you are mailing your Credit Report Request Form and make sure you mail it using a secure U.S. Postal Service mailbox or take it to your local Post Office. DO NOT mail it using an unsecured mailbox in front of your house anybody can pick it up and gain access to your Social Security number and date of birth.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

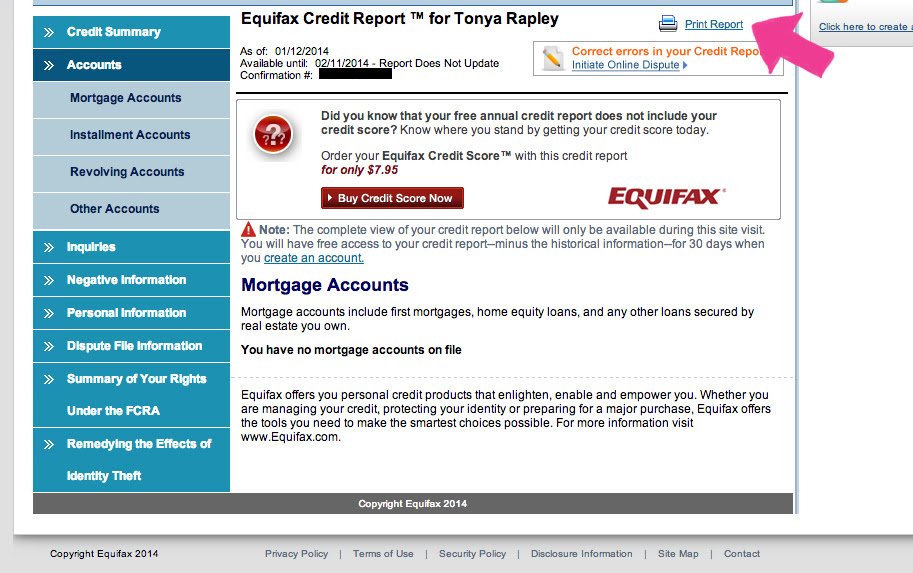

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Go To Annualcreditreportcom Or Call 1

You can only request your credit report through AnnualCreditReport.com or by calling the verified phone number 1-877-322-8228. If another source claims to have your credit report in exchange for personal information, it’s probably a fraud.

Requesting your credit report won’t negatively affect your credit, but again, you’re limited to three reports per 12 months under federal law.

You May Like: How Bad Is A 500 Credit Score

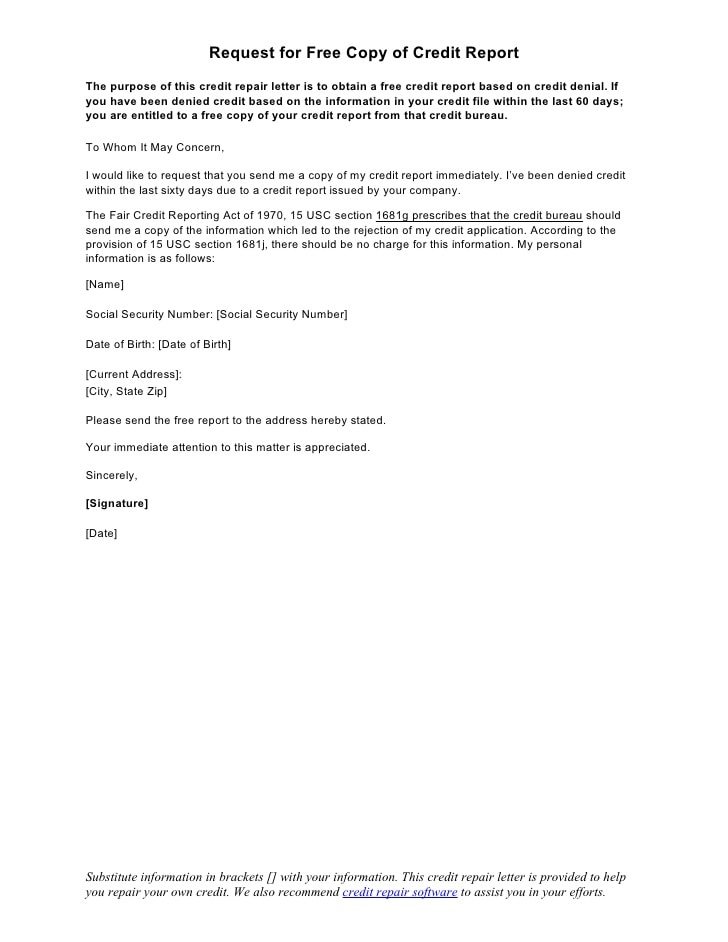

Sample Letter Request For Credit Report

You are entitled to a free credit report of the Fair Credit Reporting Act) in situations when a company has denied your application for credit, insurance, or employment, based on information in your report. You must ask for your report within 60 days of receiving notice of the action.

Once every 12 months, Equifax, Experian, and TransUnion must provide you with a free copy of your credit report if you do so request.

Youre also entitled to one free report a year if your report is inaccurate because of identity theft or fraud, and if youre on welfare or unemployed and plan to look for a job within 60 days.

Don’t forget to date and sign your letter and keep a copy of the letter for your records.

What To Do If You Find Inaccurate Or Fraudulent Information

If you do find something on your report that you dont recognize, search the lender online first. Its possible that the account is legitimate, but the lender uses a different name for credit reportingfor example, Chase credit card accounts will show up as JPMCB Card.

If youve had a debt sent to collections, you may also not recognize the collection agency if they havent yet contacted you.

If you can confirm the information is incorrect or fraudulent, it may be a good idea to check your other credit reports to see if you need to file multiple disputes. If you checked your report through AnnualCreditReport.com, you can start the dispute process directly through the website. Alternatively, you can contact the credit bureau directly.

Provide as much information you can about the account, including documentation to show the details are wrong if you have it. Once youve filed a dispute, it can take up to 45 days to complete the process, but it often happens more quickly.

Once the inaccurate or fraudulent information has been removed, you should see your respond accordingly, especially if the data was negative.

Also Check: Credit Score With Itin

What Is A Credit Freeze

A credit freeze, also known as a security freeze, is a tool designed to help protect you from fraud and identity theft. It limits access to your credit report unless you lift the freeze, or “thaw” your credit. Having a freeze in place won’t affect your credit scores, but it will prevent your credit report from being accessed to calculate scores unless you first lift the freeze.

Freezing your credit can help prevent identity thieves and other criminals from using stolen personal information to apply for new credit in your name. Since checking your credit report and credit scores are typically the first steps in processing any credit application, freezing your credit at the national credit bureaus can help stop unauthorized credit accounts from being opened.

The major drawback of credit freezes is that, along with preventing unauthorized credit applications, they also block authorized checks. This can complicate legitimate applications for loans, credit cards and other things because you’ll need to unfreeze your reports before the process can move forward.

You must contact each national credit bureaus individually to freeze your credit reports. They’ll do so for free upon request.

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone this process doesnt require security questions.

Recommended Reading: How To Get Credit Report With Itin Number

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Read Also: Creditwise Score Accuracy

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

Also Check: Does Lending Club Show On Credit Report

Generate Your Report Online

Once you access your credit reports, download them to your computer or print them before you exit out of the window for later review.

If you have trouble requesting an online copy of your credit reports, you can also request to receive a free copy by mail or phone. To receive a free copy by mail, fill out the mail request form and send it to this address:

Annual Credit Report Request ServiceP.O. Box 105281

The form asks you the same questions as the online form.

If you prefer calling instead, dial 877-322-8228.

Submit Your Request And Review Your Report

The site will produce your credit report within a few seconds. If you request your report over the phone, it will be sent by mail and could take up to 15 days to arrive.

The report is separated into five sections:

- Personal information: Your name, past and current addresses, year of birth, and phone numbers.

- Accounts: This is where you’ll find the entire history of every line of credit you have or have had in the past the current balance, date opened, status of the account, highest balance, minimum payment, credit limit, etc.

- Public records: If you have been involved in legal matters, filed for bankruptcy, or experienced a tax lien, it will be listed here.

- Hard inquiries: If you have applied for a new credit card or loan in the last two years, the name of the lender will appear here with the date of the inquiry and the date it is set to expire.

- Soft inquiries: If an employer, landlord, insurance company, or credit-card lender has ever made a soft inquiry into your credit, it will appear here. Soft inquiries don’t affect your credit score and thus aren’t disputable.

Don’t Miss: Syncb/ppc On Credit Report