How Long Does It Take To Get A 714 Credit Score

It depends where you started out.

If you had fair credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

How To Improve Your 714 Credit Score

A FICO® Score of 714 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 714 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

46% of consumers have FICO® Scores lower than 714.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

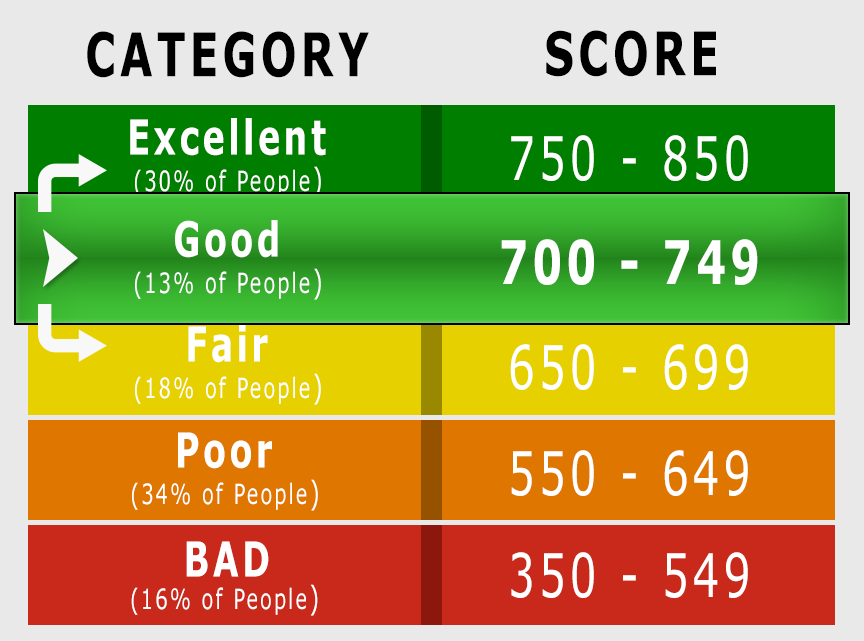

Fico Credit Score Ranges

Heres how to find out exactly where your credit score falls in the range of FICO scores.

- Excellent Credit : With an excellent credit score of 780 or higher you will get the best rates available.

- Very Good Credit : In this range you shouldnt have any problems getting good rates.

- Good Credit : This is a good credit range to be in, but you wont get the very best rates on loans or credit cards.

- Average Credit : Your score could use some improvements, but you should still be able to get decent rates. You can still qualify for most FHA mortgage loans, for example.

- Poor Credit : A credit score in this range means youre higher risk and might have trouble finding decent rates. Youll also get turned down on some credit applications. You could still get some USDA and VA loans if you qualify for those programs.

- Very Poor Credit : Anything less than 580 means that youre very high risk for borrowing. Youll get turned down for almost all credit applications. If you do get approved, the interest rates will be staggering. Dont worry though, this can be fixed!

Read Also: Aargon Collection Agency Bbb

How To Get A 714 Credit Score

While theres no sure-fire way to achieve an exact credit score, theres plenty you can do to build and maintain your credit within a range. Most importantly, youll want to practice healthy credit habits.

Even with so many different credit scores out there thanks to different scoring models and different credit bureau data some general principles apply. Most credit scores take into account at least five main credit factors.

Heres a breakdown of each factor and how it can affect your overall credit.

A 714 Credit Score Is Considered A Good Credit Score By Many Lenders

| Percentage of generation with 700749 credit scores |

|---|

| Generation |

| 14.7% |

Good score range identified based on 2021 Credit Karma data.

With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates and better terms. You might also be approved for credit cards with valuable sign-up bonuses and attractive rewards programs.

Why do these three-digit numbers matter so much to your financial well-being? Well, lenders use your as a gauge of how likely you are to pay back any money they lend to you. So, a good credit score can give a lender the confidence to lend you money at terms favorable to you. It might not be enough to unlock the absolute best financial products or terms, but its a milestone indicating youre on the cusp of excellence.

People often talk about their credit score as if they have only one, so you might be surprised to learn that there are many different credit scores out there. A credit score is based on a credit-scoring model, which differs depending on the company that created it, like VantageScore or FICO. To generate your credit scores, these models can use data from different sources: Equifax, Experian or TransUnion .

Each model has its own standard for what qualifies as good. And to make matters even more confusing, its often not clear which credit score, model or bureaus data a particular lender is using and what other factors the lender may look at beyond scores.

Recommended Reading: What Credit Report Does Paypal Pull

The Average Credit Score By Age State And Year

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective.

- The average American has a credit score of 711, according to data from Experian. That’s considered ‘good’ by FICO’s score ranges.

- People over 50 have average credit scores higher than the national average. Scores in some states, including Minnesota, Wisconsin, and Vermont, tend to exceed the US average, too.;

- Get your free credit score with CreditKarma »

The average credit score in the US is 711, according to credit reporting company Experian, calculated using the FICO scoring model.

Credit scores, which are like a grade for your borrowing history, fall in a range of 300 to 850. The higher your score, the better people with higher credit scores tend to get better interest rates on loans, have access to credit cards with better perks and lower interest rates, and could even pay less for insurance.

Popular Articles

The FICO;model of credit scoring puts credit scores into five categories:;

- Very poor: 300-579

- Very good: 740-799

- Exceptional:;800-850

Based on this scoring system, the average American has a good credit score. But, the average credit score is different by demographic.

How To Find The Best Credit Cards If Your Fico Score Is 700 To 749

If youre in this credit score range, the best credit cards arent hard to find. Nearly all types of cards will be available to you.

At this credit score range, it will be less a matter of finding cards you qualify for, and more about selecting the ones you like best.

Whats more, traditional factors, like annual fee and interest rate become less important. Credit cards in the 700 to 749 range offer the kinds of perks that can actually enable you to come out ahead in using the card. That is, the rewards and benefits will be higher than the annual fee, and even the interest expense if you make a habit of not carrying an outstanding balance.

This guide will offer nine different credit cards if your FICO Score is 700 to 749. You can simply choose the card that offer the best combination of rewards and benefits for you.

Recommended Reading: Does Paypal Credit Affect My Credit Score

Whats Considered Good Credit For A Mortgage

Although its possible to buy ahouse with only fair credit, youll get a lower mortgage rate and better loanterms with a higher score.

So whats considered good creditfor a mortgage? FICOs credit tiers are a good starting point, as FICO is thestandard scoring model used by mortgage lenders.

- Exceptional credit:800-850

- Fair credit: 580-669

- Poor credit: 300-579

Fortunately, you dont need anexceptional score in the 800-850 range to get a prime mortgage rate. Mosthome buyers dont have credit anywhere near that high.

In fact, the average credit score for closed mortgage loans in 2020 was just under 750.

Fannie Mae and Freddie Mac give the best rates to borrowers with scores above 740

Mortgage lenders understand thatperfect credit is not the norm, and they arent expecting sky-high scores.

Fannie Mae and Freddie Mac, the agencies that back most home loans, give the best rates to borrowers with scores above 740 which means the average buyer in 2020 qualified for prime rates.

Pay Down All Installment Loans

I was surprised by this one. I always assumed my credit score wouldnt be affected by the balances on my installment loans.

But I noticed that once I paid off my auto loans and student loans, my credit score jumped more than 20 points.

The key here is that you should pay off as much of the loan as possible, if not all of it. The closer the remaining balance is to zero, the more it will benefit your credit score.

For a little bit of perspective, I paid off a $30,000 auto loan, another $20,000 auto loan, and student loans totaling $11,000. Almost immediately after I did this, my credit score improved.

Also Check: Is 524 A Good Credit Score

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have a mix of installment and revolving accounts.

Of course, you also want to make sure you are making your payments on time from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an important role in your credit score. You want to show potential creditors that you have a long, positive payment history.

Building excellent credit doesnt happen overnight, but you can definitely speed up the process by making the right moves.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

Have At Least Three Credit Cards But Only Use One

This first step comes completely from my own experience after experimenting with different techniques.

To optimize your credit score, it works best to have no more and no less than three major credit cards.

These cards should have long, good payment histories, and low credit utilization .

Its best to use only one of these cards on a regular basis and simply keep the other two cards with a $0 balance.

Its not that you cant ever use the other two cards, but generally, I like to keep their balances at zero. This technique will maximize your credit score.

You May Like: Does Zzounds Report To Credit Bureau

Inaccurate Credit Histories Are Common

Many people in this situation discover they have a few negative entries on their credit reports that are not accurate.

When you discover inaccurate credit information on your credit report, youll want to get that negative entry removed as soon as possible so your credit score can be all that it can be.

Unfortunately, when you apply for credit, credit card issuers and other lenders wont care whether your credit score doesnt really reflect your actual credit risk. No matter how well you explain things, the lender will rely on what myfico says.

The terms of your new car loan or personal loan will reflect this reported credit risk. In other words, youll pay higher interest rates because of your inaccurately low score.

When you have worked hard to establish a long history of on-time payments and responsible credit utilization, these kinds of lending decisions are beyond frustrating!

So removing inaccurate credit information from your credit history is a must. Doing this should restore your credit history within a couple months.

There are a couple ways to go about it:

- Do It Yourself Credit Repair: You can call the lender who reported incorrect credit information and ask that they correct the inaccurate data. I always recommend handling this in writing.

- Professional Credit Repair: If youre the type of person who would rather pay a professional handle it and just be done with the whole thing, I suggest you check out Lexington Law.

What Does Not Count Towards Your 714 Credit Score

There are many things that people assume go into their 714 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Read Also: Shopify Capital Eligibility Review

Credit Score Is It Good Or Bad How To Improve Your 714 Fico Score

Before you can do anything to increase your 714 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

Best Personal Loans For Good Credit

Personal loans are extremely popular. From 2017 to 2019 they were Americas fastest-growing form of credit. That growth slowed during the pandemic, but the versatility of personal loans still makes them very common. Personal loans for good credit are available at reasonable interest rates, increasing their popularity.

Most personal loans are not tied to a specific purpose. Here are some of the most common uses for personal loans, according to a LendingTree survey:

- Debt consolidation: 27.0%

- Moving and relocation: 1.6%

- Vacation: 1.0%

The survey found that more than half of the borrowers were borrowing to pay off other loans or debt. It also found that over 19 million Americans have outstanding personal loans, with the average size of a new loan standing at $6,092.

Read Also: How Long Does A Repossession Stay On Your Credit Report

Credit Score: Personal Loan Options

With a credit score between 700 and 749, youre just one step away from the top rung of the credit score ladder. Working to improve your 714 credit score means getting the best personal loan rates possible. However, interest rates with a score in this range are still ideal. Theyll very from fourteen to sixteen percent, often falling on the lower end of that spectrum.

How To Get A 788 Credit Score

Theres no secret for getting a 788 credit score. Rather, it simply requires consistency and commitment. You need to pay your bills on time, use only a portion of the credit made available to you, and generally work to make any mistakes youve made look like freak occurrences rather than standard practice. You also need to know exactly where youre starting from and then actually track your progress over time to hold yourself accountable. So make sure to regularly check your latest credit score for free on WalletHub as you work your way to a 788 credit score.

You can find specific recommendations for what we recommend doing in your situation on your personalized credit analysis page. And below, you can check out some of the most common steps people need to take to get a credit score of 788.

Recommended Reading: Innovis Consumer Assistance Letter

Is 714 A Good Credit Score

714good714good

That, in a nutshell, is why we consider a score of 750+ to be excellent while a score of 714 is very good. What Does a 714 Credit Score Get You?

| Type of Credit | |

|---|---|

| Auto Loan with 0% Intro Rate | MAYBE |

| Best Personal Loan Rate | MAYBE |

Also, what can you do with a 700 credit score? 10 Things to Do Now If You Have a 700 Credit Score

- 10 Things to Do to Raise Your 700 Credit Score.

- Check Your Credit Score Regularly.

- Make Payments on Time.

- Add Missing Accounts or Utilities to Credit Report.

- Increase Your Credit Limit.

- Make Small Purchases With Your Credit Cards.

- Pay Off Your Maxed-Out Credit Cards.

Consequently, is 714 a good FICO score?

A 714 FICO®Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

What is a good credit score for my age?

Average Credit Scores by AgeGenerally, a very good credit score is one that is 720 or higher. This score will qualify a person for the best interest rates possible on a mortgage and the most favorable terms on other lines of .

How To Improve Your Credit Score From 788 To 800+

A credit score of 788 is on the brink of perfection, and you probably wont have to change much to join the 800+ credit score club. Your personalized credit analysis from WalletHub will tell you what needs improvement and exactly how to fix it.

A few things in particular tend to stand between a credit score of 788 and perfect credit, though. And if you do nothing else, make sure to take the following steps.

Also Check: Speedy Cash Collections