No Credit Report Or Credit History Requirements

When applying for a credit card or a secured loan, present a credit report showing a decent credit history with a phenomenal credit score. There are no such requirements in the case of bad credit loans, unsecured loans, and payday loans.

You can get a loan at a minimal credit score or even at no credit score at all.

So, poor credit history doesnt come as a barrier to getting your loan sanctioned when you apply for a bad credit loan.

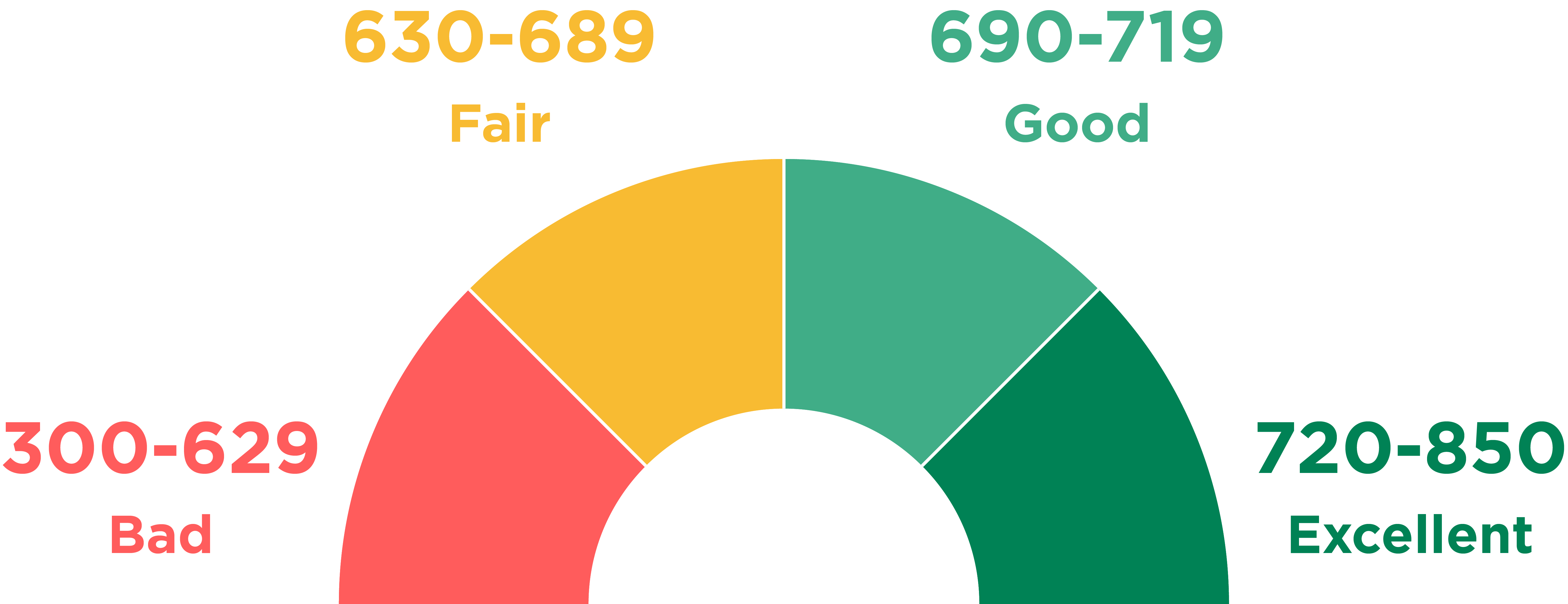

Is My Credit Score Good Or Bad

Your credit score will be on a scale that goes from Very Poor to Excellent. If youve had issues with credit in the past , your score will probably be at the lower end of the scale.

Your credit score is worked out by looking at your credit history. Whether you have a good or a bad score will depend on things like:

-

Do you have any loans, debt or credit cards?

-

Are you linked to anyone else financially?

-

Are you on the electoral register?

All of this info is used to create a score. If you have a good history with credit, you will have a higher score. Things like missed payments on your bills can decrease your credit score.

Lenders consider a number of different factors when deciding if theyll offer you a mortgage, a credit score is important. A low credit score might mean some lenders wont give you one. But specialist lenders are more likely to offer you a mortgage because theyll look at your situation in detail. This means theyre more likely to get the bigger picture of you as a person, rather than refusing you a mortgage based on your credit score alone.

How your credit score is categorised will depend on which credit reference agency you are checking with. Each agency categorises a good or bad score differently. The table below shows how these differ across the three main credit reference agencies in the UK.

| Experian | |

|---|---|

| 0-279 | 0-550 |

Read more in our Guide: How to improve your credit score before you apply for a mortgage.

What Are The Drawbacks Of Having A Bad Credit Score

There are many drawbacks to having a bad the largest issue is it impacts your ability to obtain a loan. Some lenders will specialise in loan applications for providing funds to people with a poor credit history. These lenders will often reduce their risk by charging higher interest rates and monthly account keeping fees or giving penalties for not paying your instalments on time. If you have a bad credit history, you may need some expert advice on the best method to improve it. If youre planning on taking out a mortgage, having the best possible credit rating can give you more choices regarding your lender. When you plan to build your credit rating, you can use the subscription services at Equifax and be alerted of any changes to your credit report. Well also provide protections if your details are being used for identity theft. A stolen identity can hinder your progress in improving your credit score, as youll need to repair any damage caused.

Don’t Miss: Which Credit Bureau Does Comenity Bank Use

How A Bad Or Poor Credit Score Can Hurt You

Before we go further into the poor credit score circumstances, lets find out what is a poor credit score first. The most popular scoring systems generate the three-digit number in the range of 300 to 850.

So, what is considered a poor or bad credit score? Excellent FICO Scores are ranging from 800 to 850. A score that ranges from 740 to 799 is deemed good. Meanwhile, a 701 FICO Score is the average score for Americans.

Now, what about a 670 credit score? Wonder whether the 690-700 credit score is good or bad? A good range starts somewhere at 670. Even with a 739 credit score, your rating is good enough to qualify for a loan or mortgage.

How bad is 600 credit score? Taken into account that a bad rating ranges from 580 to 669, 600 is considered bad. The best thing about a bad rating is that its not forever. Sure, it reflects you have difficulties at this moment, but nothing stops you from improving your score.

Is 650 a bad credit score? It depends.

If you make smart financial decisions today, you can see your credit improvement in the future.

The problem is that a bad score hurts. The lower your credit score, the more likely you pay higher interest rates. Sure, theres no guarantee you wont be rejected for loans or credit cards. For a lender, your poor credit score is a red flag. But a better indicator of your financial success is income.

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Don’t Miss: Remove Eviction From Public Record

What Is Bad Credit And How Do You Improve It

Join millions of Canadians who have already trusted Loans Canada

Your credit is an important tool that lenders, creditors and other entities use to evaluate your likelihood to pay bills and debts. So, if you currently have bad credit, it can be difficult to get approved for a loan, credit card or even an apartment rental. Thankfully, credit can be improved by building better financial habits and using credit responsibly.

How To Build Good Credit

If youd like to improve your credit score and build good credit, heres what you can do:

- Make on-time payments on all of your credit cards and loans. Your payment history makes up 35 percent of your credit score, so dont let late payments drag your score down. If you have any unpaid bills outstanding, pay them off and make a plan to stay on track with payments moving forward.

- Pay down old debt. Your that is, your available credit vs. your current debtmakes up 30 percent of your credit score. Pay off more debt, and your score should go up. If you are paying off a lot of high-interest debt, consider a balance transfer credit card or a debt consolidation loan to reduce your interest burden.

- Take out a new credit card or loan. This might sound counter-intuitive, but applying for a secured credit card or a personal loan for bad credit can actually improve your credit score. Not only will you decrease your , but youll also have the opportunity to prove your creditworthiness by making responsible, on-time payments.

- Check your credit reports for errors and incomplete information. If you find incorrect information, disputing the data with the reporting agencies can make a huge difference in your score. You can get a free copy of each of your reports once per year from AnnualCreditReport.com.

- Monitor your credit score. Know where you stand with your credit so you can work towards improving your credit score.

Read Also: Aargon Agency Phone Number

What If My Partner Has Bad Credit And I Dont

Leaving your partner off of the mortgage can help get you a better mortgage rate. If you have a good credit score and income level, you’ll likely not need to resort to a bad credit mortgage if you apply for a mortgage on your own. Applying in just your name would mean that only your credit score will be looked at, but it also means that only your income will be considered.

A joint mortgage with a spouse or partner will include their income into the calculation, but it will also bring in their credit score and credit history. If they have a particularly bad credit score or a tarnished credit history, such as a lengthy past of previous bankruptcies, then your mortgage application might not be looked at so favourably.

Building Your Credit Responsibly

Youâre not alone if you have a less-than-perfect credit score. Looking for a chance to adopt new habits that could help your score? You could start by learning more about what it takes to rebuild your credit or get a credit card if you have bad credit.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

Recommended Reading: Unlocking Credit Report

What Is Bad Credit

Bad credit refers to a person’s history of failing to pay bills on time, and the likelihood that they will fail to make timely payments in the future. It is often reflected in a low credit score. Companies can also have bad credit based on their payment history and current financial situation.

A person with bad credit will find it difficult to borrow money, especially at competitive interest rates, because they are considered riskier than other borrowers. This is true of all types of loans, including both secured and unsecured varieties, though there are options available for the latter.

How To Improve A Bad Credit Score

If you have bad credit, take some time to review your credit score and identify the cause. Perhaps you’ve missed payments or carried a balance past your bill’s due date. In order to achieve a fair, good or excellent credit score, follow the below.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Consider setting up autopay to ensure on-time payments, or opt for reminders through your card issuer or mobile calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate, which is the percentage of your total credit limit you’re using. To calculate your utilization rate, divide your total credit card balance by your total credit limit.

- Don’t open too many accounts at once. Every time you submit an application for credit, whether it’s a credit card or loan, and regardless if you’re approved or denied, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score by roughly five points, though they rebound within a few months. Try to limit applications as needed and shop around with prequalification tools that don’t hurt your credit score.

You May Like: Apple Card Experian

Myth #: Checking Your Credit Score Will Negatively Affect It

This ones tricky! According to Equifax, While pulling your own credit report does result in a soft inquiry on your credit reports, it will not affect your credit scores. In fact, knowing what information is in your credit reports and checking them regularly may help you get in the habit of monitoring your financial accounts. On the other hand, hard inquiries do affect a credit score. The Equifax website says, When a lender or company makes a request to review your credit reports as part of the loan application process, that request is recorded on your credit reports as a hard inquiry, and it usually will impact your credit scores. The reason for this is that the credit bureaus regard multiple credit inquiries in a short period of time as increasing the likelihood that a borrower is carrying a lot of debt. Borrowers who carry a lot of debt are seen as risky in terms of their ability to repay the debt. Credit bureaus identify those potentially risky borrowers by lowering their credit score. Having said that, most people can have their credit report pulled three or four times per year without negatively affecting their credit score. An exception to the above practice is when you are shopping around for a major purchase like a car or mortgage. Again, according to Equifax, multiple inquires for the same purpose within a certain period of time are generally counted as one inquiry.

How Bad Is My Credit Rating

When you check your credit rating, if you have a number that means your credit rating is in the Very Poor category, then that either means youve had credit issues in the past thats caused your score to be low, or, it could also mean that you dont have a rating yet and therefore your credit score is 0.

If you have no credit history, it means youll have a credit rating of zero, which is the same as having a very poor credit rating. If your credit score is zero, youre essentially invisible to lenders and credit referencing agencies.

Recommended Reading: Does Affirm Show Up On Credit Karma

Get Help Building Credit

If you’re having trouble getting approved for a credit card or loan on your own, you can build credit history with the help of others or with a secured account. Try these strategies:

- Become an on someone else’s account.

- Work with a cosigner who has good credit. When you have a cosigner for a loan or credit card, the lender also considers them jointly responsible for the debt.

- Open a secured account. With a secured credit card account, you place cash in an account and the card issuer allows you to borrow up to a certain percentage of the money.

How Can I Improve My Credit Score

Youve just been declined for a mortgage from a major bank or youve just checked your free credit score online and youve found that you have bad credit – now what? Knowing that you have bad credit when you are already applying for mortgages and need one now might be a sign that its too late to significantly improve your credit score. Thats why its important to proactively check your credit well in advance and to have a plan in place.

Improving your credit score can be as easy as making your payments on time – but of course thats easier said than done. Create reminders for payment due dates to help avoid making late payments. Older credit accounts are more valuable than new accounts, so don’t cancel old credit cards as you will want your credit history to be long.

Not maxing out your credit cards will also prevent hits to your credit score. Keeping your credit card balances to less than 35% of your credit limit will help to improve your credit. A large number of inquiries will also reduce your credit score. An inquiry is every time you apply for credit and someone checks your credit report. Lots of credit checks might show that you’re desperate for credit and are applying at a large number of lenders.

Finally, sometimes there are mistakes on your credit report, such as a lender reporting a payment as late even if you made it on-time. Make sure to carefully check your credit report and report any wrong information to the credit bureau.

Also Check: What Is Considered A Serious Delinquency On Credit Report

Myth #: You Can Only Check Your Credit Score For Free Once A Year

You can actually pull your credit report from each credit bureau once per year for free by mail or phone. This only gives you access to the debts that are listed on your report and their ratings. Getting your credit score requires paying an additional fee. Services such as and Borrowell provide free access to your credit score, drawing on information from the credit bureaus, and provide a good ballpark idea of what your score is. However, it should be noted that these third-party services dont always provide the full picture and can sometimes worry Albertans for no reason. The most reliable way to know your score is by ordering it from the credit bureaus directly.

Myth #: Paying My Utilities Bills On Time Will Improve My Credit

Unfortunately, this isnt the case. Utilities and most cable/Internet providers do not report payment histories to the credit bureaus unless payments are in default. If payments are up to date, they will not influence your credit score. If payments get behind or go to collections, they can be reported and will have a negative affect on the credit score. One exception to this appears to be Rogers Cable, which some have said are reporting to the bureaus regularly. Cell phone companies also report payment histories to the credit bureaus, so keeping your cell phone payments current can help to improve your credit score.

You May Like: Does Affirm Help Credit Score

What Are The Credit Categories

Each credit checking agency uses a different numerical range to determine your credit score. This means youll have a different credit score depending on which credit checker you look at. Although different credit agencies have different ranges, they usually have five categories for credit scores. The categories for credit scores are: excellent, good, fair, poor, and very poor.

In the UK, there are three main credit reference agencies. They all have different ranges for working out your credit score:

-

Trans Union 0-710