Do Pay Down Your Credit Card Debt

Your credit utilization rate, also referred to as credit utilization ratio, is a significant factor in determining your credit score.

You must keep your credit utilization below 30%. Below that 30%, further improvements will earn you only a few points. But a few points is a lot in these circumstances. By coincidence, 30% is also the proportion of your score that credit card balances influence.

Overview Of Home Buying Qualifications

When you initiate the home buying process, the mortgage lender will check your application using different qualifications before you are approved for a loan. Here is a list of these home buying qualifications:

Your Job History

When you are trying to qualify for a mortgage loan, your job history will be an important factor. If you have been working for two years at the same employer, you are considered to have steady employment.

If you have received promotions or made moves within your job for more pay, this is seen as positive by the mortgage lender. If you have not worked continuously for the past two years, you can explain the reason to the mortgage lender.

Bill Payment History

The mortgage lender will also consider your bill payment history when considering you for a mortgage loan. More in-depth and more personal than your credit score, this bill payment history will give the mortgage lender an idea of how you will be paying your mortgage payments.

The mortgage lender may ask you to list all of your debts and liabilities as well as each monthly payment amount. Moreover, the mortgage lender may ask you to list how many years you have left to pay each of your debts.

At this stage in the qualification process, your mortgage lender may order a credit report as verification for the information that you have personally provided.

Get Up To Speed With Payments

Late payments also negatively affect your credit score. Make a financial plan to catch up and stay caught up with your payments. Consider different payment strategies like the avalanche method and snowball method to effectively pay off your debt. Depending on your situation, you may also want to consider consolidating your debts or settling some of your debts.

Recommended Reading: Can I Check The Credit Report Of A Deceased Person

What Interest Rate Can You Expect With Your Credit Score

- Very poor. Youre unlikely to be approved for a mortgage with a very poor credit rating. Instead, you should spend some time improving your score before applying.

- Poor. Unless you have a guarantor or an underwriter is willing to make an exception, its not likely youll find mortgage approval with a poor credit score. If you do find a lender willing to take you on, expect a high interest rate on your loan.

- Fair. You should be able to qualify for a loan with a fair score, but your interest rates will likely be high sometimes significantly more so than with a good or very good score.

- Good. Your credit score may affect your interest rate, but typically not by much. You should expect to get rates close to the APR .

- Excellent. Your credit score will likely help you get the lowest interest rates and the best payment terms the market allows.

What Credit Score Do Mortgage Lenders Use

Generally, lenders will offer their most competitive rates and lending packages to those with great credit, or a score above 760.

The three major credit bureaus Equifax, Experian and TransUnion all monitor your credit history independently. They each create a score of your creditworthiness, otherwise known as your FICO score. The name FICO is an acronym for Fair Isaac Co. Its this score thats used widely among lenders as the gold standard to determine lending risk. The higher the FICO score, the less potential risk a borrower poses to the lender. Typically, a FICO score is based on five main factors:

- Your payment history: 35 percent

- Your debts and outstanding balances: 30 percent

- The age of your credit history: 15 percent

- New credit applications and inquiries: 10 percent

- The mix and types of your credit accounts: 10 percent

Because your good credit rating is worth protecting, its important to have the right coverage to help you recover from identity theft as quickly and stress-free as possible so you can stay on track and keep pursuing whats important. American Familys identity theft Protection and restoration insurance is great additional coverage that provides guidance through the resolution process, minimizing your stress, expenses and lost time. While youre looking at managing your credit rating, nows a great time to pick up this coverage.

Also Check: Paypal Credit On Credit Report

How To Find Out Your Credit Score

You can use ooba Home Loans Bond Indicator to access your credit score. This is a 100% secure, online tool that is available free of charge and without any obligations. Based on the information you provide, the tool will give you an indication of your credit rating, and how much you can realistically afford. The Bond Indicator tool will issue you with a Bond Indicator Certificate that will enable you to house hunt with confidence.

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

Recommended Reading: Do Landlords Report To Credit Bureaus

Considering A Federal Housing Administration Loan

An FHA loan is one option to think about if your score is low or if you have trouble paying high down payments. FHA loans are backed by the Federal Housing Administration and are less risky for lenders. These loans require lower minimum down payments and credit scores in comparison to other conventional loans, so this may be an option for you if youre having trouble securing other types of loans.

A score between 500 and 580 requires a minimum down payment of at least 10 percent. A score of at least 580 requires a minimum 3.5 percent down payment.

Using Credit For Home

Buying a house involves more than simply making payments on your mortgage. The simple truth is that when you own a home, you’re going to have house-related expenses. However, it’s not always possible to drop large amounts of cash on big-ticket items like new appliances, home repairs, or maintenance.

- Use a low-interest credit card: one convenient way to pay for immediate, unexpected, or emergency home costs is with a credit card. Consider getting a low-interest card that you set aside for this purpose while you build an emergency fund. Remember to apply for the card < em> after< /em> closing on your house, though, so you don’t impact your credit. This gives you the option to fund an unexpected housing cost immediately. Use a credit card for things like an emergency furnace repair or an appliance service call.

- Use a line of credit: another option for larger home expenses or repairs is a line of credit. A line of credit works like a credit card in that you can borrow up to a limit. You only pay interest on what you borrow, and then make monthly payments to pay it back. Line of credit rates are often lower than credit card interest rates, and a strong credit score could reduce your rate even further.

You May Like: How Long Does A Delinquency Stay On Credit

Why This Is Important

Each lender has its own formula for determining where the cutoff point is in a credit score. As the experts will tell you, the better your credit rating, the more likely you are to get a low-interest rate and favorable terms when you apply for a mortgage. Someone with a credit score of 850 is very likely to find they will pay less per month than someone with a comparably priced home but a lower score of 680.

Take steps to improve your credit score. Improving your score will help you thrive financially when you find the house of your dreams. If you are credit-ready, dont let the news of higher credit standards scare you from buying now. No one knows if, or when, lending standards will change again. These standards may be the new normal.

What Lenders Look At Besides Your Credit

A mortgage lender will look at more than just your credit rating they look at the whole credit picture. Negative credit history, such as late payments, collection accounts, or excessive debt, could cause your loan to be denied.

- 36 month waiting period after a bankruptcy or foreclosure

- Limited unpaid debt in collections

Read Also: How Often Does Usaa Update Credit Score

Correcting Credit Report Errors

You can and should check yourcredit report before buying a house. Consumers can get one free credit reportper year on annualcreditreport.com.

In the event that you find errors on your credit report, take steps to correct them as quickly as possible.

First, contact the creditbureaus about the errors. You should also contact whichever creditors haveprovided the erroneous information.

Under the Fair CreditReporting Act, each of these parties is responsible for correcting inaccurateor incomplete information in your credit report.

For simplicity, disputes canbe managed online. If all three bureaus report the same error, though, rememberto report the error to all three bureaus. Equifax, Experian, and TransUnion donot share such information with each other.

The law requires creditbureaus to investigate the items in question, usually within 30 days, unlessyour dispute is considered frivolous. Note that you may need to includecopies of documents which support your position. Never send originals!

Within 45 days, the creditbureaus will notify you with the results of the investigation.

Then, youll want to obtain a new copy of your credit report in order to make sure that the errors have been corrected before applying for a mortgage.

How Do You Get A Good Credit Score

- Always pay on time. Its always. Your payment history has a major impact on your creditworthiness. In fact, it is the most influential factor in FICO and VantageScore.

- Optimize the use of credit. Using credit is another important piece of the solvency puzzle.

- Regularly check your creditworthiness for inaccuracies. Identity theft and error messages can quickly ruin your path to a good reputation.

- Be strategic when taking on new debt and closing accounts. Credit scoring models take into account your total credit card balances and outstanding loans.

- Look at your credit.

Also Check: How To Get Public Records Removed From Credit Report

Lenders Might See A Lower Credit Score Than You Do

Perhaps you monitor your credit with free credit score apps from the major credit bureaus, so you know exactly what youre working with when you apply for a mortgage.

But then you talk to a mortgage loan officer, and they tell you theyre seeing a lower score than you thought you had.

In fact, this happens pretty often.

Most people arent aware that they have dozens of credit scores. And the score you see from your bank or credit reporting service is just one of them.

Its common for your mortgage credit score to be lower than the score you see on other platforms. This is because lenders use a tougher scoring model.

Its also pretty common for your mortgage credit score to be lower than the score you see on other platforms.

Thats because mortgage lenders often use a tougher credit scoring model. A home loan is a lot of money, and lenders want to be extra sure youll be able to pay it back.

So, if your score is a little lower than you thought, dont be surprised.

Also, dont be discouraged! Youre still likely to qualify for most loans with a score slightly below 700. And there are plenty of ways to raise your score a few points, then try for a mortgage again.

Why Your Credit Score Matters To Lenders

Your credit score helps lenders determine your ability or inability to repay the mortgage. As part of your scores, they examine your debt-to-income ratio. It is the percentage of monthly debt obligations relative to how much you make.

To illustrate, if you earn $4,000 per month, and have $1,250 in credit card, loans, housing, and other payments, your ratio would be 31 percent. The ideal ratio is less than 36 percent, though some lenders will accept more with a higher down payment.

Recommended Reading: How To Take Hard Inquiries Off Credit Report

Tips To Improve Your Credit Score To Buy A House

If your credit score isnt up to par with what you need to take out a home loan, you should consider taking steps to raise it. This might include paying off outstanding debts, making a plan to get up to speed with your current debts, or partnering with a credit repair firm to remove any discrepancies on your credit report. Take a look at our tips below to learn how you can quickly improve your credit score.

What Is The Minimum Credit Score To Get A Mortgage

Several different types of mortgage loans exist, and each one has its own minimum credit score requirement. Even so, some lenders may have stricter criteria in addition to credit score they use to determine your creditworthiness.

Here’s what to expect based on the type of loan you’re applying for:

If your credit score is in great shape, you may have several different loan types from which to choose. But if your credit score is considered bad or fair, your options may be limited.

You May Like: Usaa Credit Card Credit Score

What If You Don’t Have A High Enough Credit Score To Buy A House

Having bad credit or no credit may mean youre unlikely to get a mortgage unless someone you know is willing to help out. Having a co-signer who has a better credit score could help you secure the loan.

Another option would be to have “a friend or more likely a family member purchase the home,” add you to the title and then try to refinance into your name when your credit scores improve sufficiently, according to Ted Rood, a mortgage banker in St. Louis.

If such assistance isnt available to you, your best bet will be waiting and working on your credit.

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

You May Like: Credit Report Itin Number

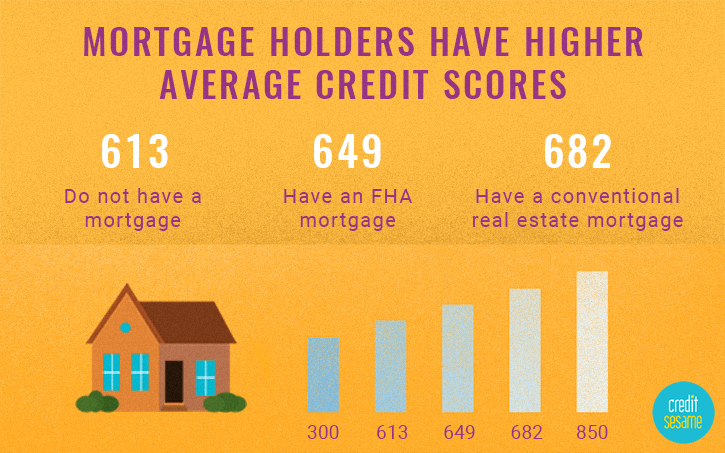

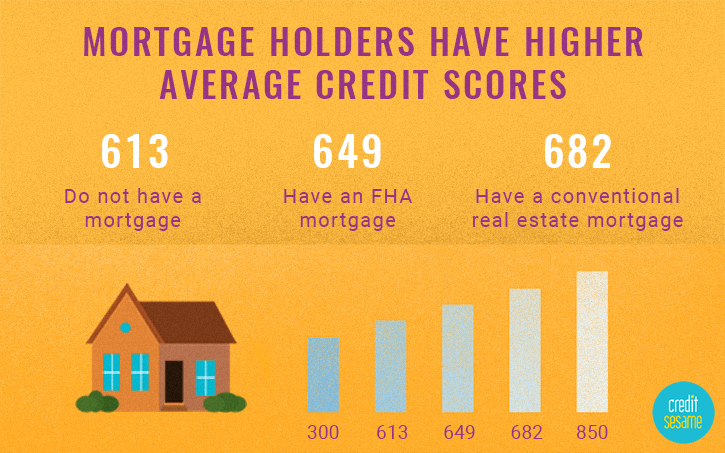

Whats The Average Credit Score For People With Mortgages In Your State

While its common for mortgage lenders to look at FICO scores in their application review process, we turned to Credit Karmas vast collection of VantageScore 3.0 data to get a broad picture of the credit health of people getting mortgages.

Below, you can see the average TransUnion VantageScore 3.0 credit score of homeowners in each state who recently opened a mortgage.

In general, people in the Northeast or on the West Coast who got mortgages had VantageScore 3.0 credit scores averaging 720 or above on the higher end of the spectrum.

On the flip side, the Gulf Coast, Midwest and Southern coastal states tended to have some of the weakest average credit scores .

| State |

|---|

| 41 |

What Can I Get With A 600 To 650 Credit Score

What you can get with a credit score of 600-650 is a solid unsecured credit card or a cheap secured card that allows you to collect money and potentially earn rewards. Use your new card responsibly for six to 12 months and your account should grow enough to get even better cards.

Read Also: Does Carmax Accept Itin Number