How Hard Is It To Buy A House

There are some minimum score requirements that banks use in order to determine if the applicant is financially able to take on a large mortgage. To understand how firm these requirements are, its helpful to have a basic understanding of how the mortgage industry works.

Some lenders arent interested in keeping your mortgage. There are two reasons why your lender may sell your loan to another lender; to free up capital and/or to make money. Lenders who need to free up capital, do so in order to provide loans to other consumers. The other reason is when a lender sells a mortgage they can make money in interest, origination fees, and even selling it for a commission. Your loan being sold is not necessarily a bad thing, but it is something that you, the mortgagee should be aware of. Everyone has different standards for acceptance after all, they dont want bad mortgages. This is where minimum score requirements come into place.

Heres a quick look at the minimum credit score requirements for the various types of mortgages.

Minimum Credit Score Requirements for Mortgages Types

| Mortgage Types | |

|---|---|

| 580 and a 3.5% deposit | |

| FHA 203K Loan | |

| VA | 620+ |

Of course, these are just the minimum requirements and dont necessarily mean automatic approval. Lets take a closer look at how many people were denied a mortgage, by credit score range, to give you a better idea of how difficult it can be to qualify for a home loan:

Mortgage Denial Rates

| 93% | 91% |

The main benefits include:

Improving Your Credit Score

If youre considering applying for a mortgage, its a good idea to check your credit score to see if theres room for improvement.

Start by requesting your credit reports and looking for errors, which could potentially drag down your credit scores. You can get a free credit report from TransUnion®, Equifax® and Experian every week through April 2021. If you find inaccurate information, file a dispute with the creditor and the credit reporting agency. Getting rid of errors may help boost your credit score.

Next, get to know how credit scores work. Heres a list of what influences your credit score and how to make improvements before applying for a mortgage:

What Are Fha Credit Score Requirements In 2021

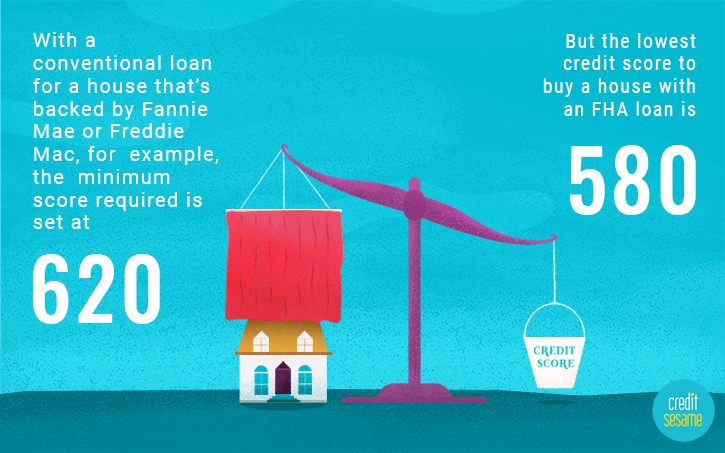

The Federal Housing Administration, or FHA, requires a credit score of at least 500 to buy a home with an FHA loan. A minimum of 580 is needed to make the minimum down payment of 3.5%. However, many lenders require a score of 620 to 640 to qualify.

Thanks to a new FHA policy, lenders appear to have started reducing their FHA minimum credit score requirements starting in 2017, opening homeownership to thousands more home buyers.

FHA loans have helped untold thousands of home shoppers complete their purchases despite low-to-average credit scores. You no longer need to wait to have excellent credit before you buy a home.

Now FHA has implemented a policy that may open the floodgates of new home buyers rushing into the market.

Analysts predict the change could allow 100,000 additional families per year to buy a home with an FHA loan.

Since its inception in 1934, the FHA loan program has enabled more than 40 million families to buy or refinance property. Its extreme popularity is a direct result of its flexibility. The program was built from the ground up to promote homeownership among a portion of the population that would not otherwise qualify.

Don’t Miss: Does Paypal Credit Do A Hard Pull

What Credit Score Is Required To Refinance Student Loans

Mar 12, 2021 But some lenders eligibility requirements allow applicants to have scores in the fair range, between 580 to 669, to qualify. For example,;

Jun 4, 2021 But you still have to find FHA-approved lenders to access these loans, and those lenders can add extra minimums on top of what the FHA requires.

How Much Income Is Needed For A 200k Mortgage

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

Also Check: Does Paypal Credit Report To Credit Bureaus

Why This Is Important

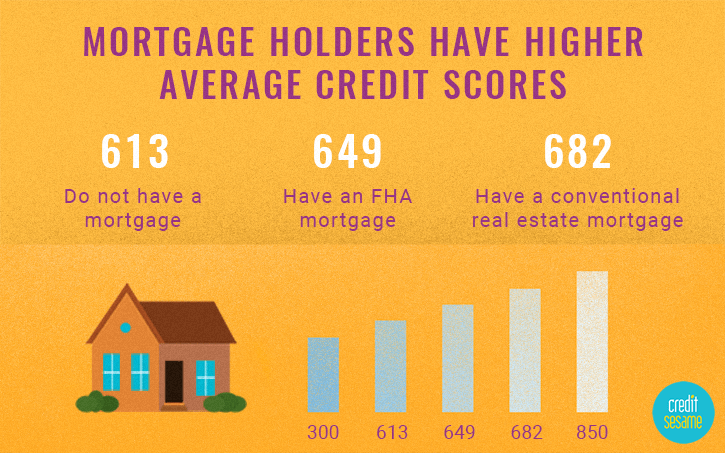

Each lender has its own formula for determining where the cutoff point is in a credit score. As the experts will tell you, the better your credit rating, the more likely you are to get a low-interest rate and favorable terms when you apply for a mortgage. Someone with a credit score of 850 is very likely to find they will pay less per month than someone with a comparably priced home but a lower score of 680.;

Take steps to improve your credit score. Improving your score will help you thrive financially when you find the house of your dreams. If you are credit-ready, dont let the news of higher credit standards scare you from buying now. No one knows if, or when, lending standards will change again. These standards may be the new normal.;

What House Can I Afford On 80k A Year

So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

You May Like: How To Get Credit Report Without Social Security Number

The Answer Depends On The Lender And Which Loan Type You Apply For

Your credit scores can be an important factor in the homebuying process. Thatâs because the lender will typically check your credit scores when you apply for a mortgage. A good credit score generally makes you an attractive borrower because it shows youâve managed your credit well. And the better your credit scores, the better chance you may have of being approved for a mortgageâand a lower interest rate.;

The minimum credit score needed to buy a house depends on the mortgage program and the lender. According to mortgage company Fannie Mae, a conventional loan usually requires a credit score of at least 620. But you may qualify for a government-sponsored loan with a lower score. Read on to learn more about credit scores and how they impact the homebuying process.

How To Solve Common Credit Issues When Buying Ahouse

If your credit score orcredit history is standing in the way of your home buying plans, youll need totake steps to improve them.

Some issues like errorson your credit report can be a relatively quick fix and have an immediateimpact on your score. Other issues can take much longer to resolve.

You should start checking your credit early on, ideally 6-12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Here are tips on solvingsome of the most common credit issues faced by home buyers.

Also Check: Innovis Consumer Assistance Letter

What Should Your Credit Score Be To Buy A House

What should your credit score be to buy a house? Here’s what you’ll have to know about your credit before signing the dotted line on your next home.

;Sarita Harbour

If you’re even considering the possibility of buying a house in the near future, your mind is probably already buzzing with questions about the homebuying process, borrowing to buy a house, and how to pay for the costs that turn up after the place is yours. What should your credit score be to buy a house? What’s the best way to pay for furniture for your new house?;

We’ve got answers! Here’s what you need to know about credit and buying a house.

Is It Possible To Buy A House With Bad Credit

You can purchase a home with poor credit, though your options will be limited and you may have to pay a higher interest rate. According to a report from the FHFA, only 19 percent of borrowers in 2016 had a credit score below 620. While it is possible to get a home loan with a lower score, it may be difficult. If your score is lower than 500, you wont qualify for a home loan at all.

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

What Is The Minimum Credit Score To Get A Mortgage

Several different types of mortgage loans exist, and each one has its own minimum credit score requirement. Even so, some lenders may have stricter criteria in addition to credit score they use to determine your creditworthiness.

Here’s what to expect based on the type of loan you’re applying for:

If your credit score is in great shape, you may have several different loan types from which to choose. But if your credit score is considered bad or fair, your options may be limited.

Mortgage Lenders Pull All Three Reports But Only Use This One

According to;Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,”;tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

Also Check: Experian Boost Paypal

Im An Elder Millennial With $2 Million In Investments But A Low Monthly Income Should I Spend My Savings To Buy A Home In San Franciscoyour Browser Indicates If Youve Visited This Link

I am an elder millennial living just outside the San Francisco Bay area. I dont have any kids, nor do I plan to. I would love to purchase a house in this area but have a lot of competition from high-paid tech workers in Silicon Valley living in two-income households wherein each of them are making low-to-mid six figures.

Morningstar, Inc.

Dont Miss: Does Klarna Report To Credit

Maintaining Good Credit Throughout The Homebuying Process

Check your credit sooner rather than later. That way, if you find any credit issues on your report, you’ll have time to take care of them and;boost your credit score;before a mortgage lender reviews your credit.

Applying for a mortgage preapproval, finding a home, getting the final mortgage approval, and then pulling off the final house closing often takes between six weeks and three months, but prepare for it to take longer. During this time, it’s important to maintain good credit so nothing throws a wrench into your final mortgage approval.

To prevent any credit issues that could result in less favourable mortgage terms, prevent a final approval, or damage your credit, remember to do the following.

- Avoid completing multiple mortgage applications with different lenders in a short time frame. This may flag you as a credit seeker and lower your credit score.

- Hold off on applying for other credit, such as a car loan or a loan for household appliances, that could increase your total monthly debt payments.

- Make all existing credit payments, including car loans, car leases, student loans, credit cards, and credit lines on time and in full.

You May Like: Speedy Cash Collections

What Credit Score Do I Need To Refinance My Mortgage

Apr 9, 2021 The credit score you need to refinance depends on the mortgage lender you work with and your individual situation. In general, its possible;

May 10, 2021 When it comes to the credit score needed to refinance, 620 tends to be the minimum for a conventional loan. FHA refinances are possible if;

The average minimum credit score for conventional refinancing programs is 620 to 680, although the best rates are generally available to homeowners with scores;

See If You Qualify For A Mortgage With 600 Credit

To recap, a 600 credit score is high enough to qualify for a few different types of home loan.

But credit isnt the only thing that matters.

Before approving you to buy a house, a lender also needs to verify your employment status, income, and debts.

So the best way to find out whether you can buy a house with 600 credit is to check in with a few lenders.

Applying with a lender is usually free, and it will give you a concrete idea of whether you qualify and how much home you can afford.

Popular Articles

You May Like: How To Get A Bankruptcy Off Your Credit Report

How To Check And Understand Your Credit Score

A free credit report does not show a lender enough information to approve you for a mortgage loan. This type of credit report shows what is called “consumer credit.” Consumer credit uses a different scoring model to rate an applicant for a retail credit card or a car loan.

Mortgage lenders pull a different set of scores to paint a more reliable picture of your borrowing habits. This is a credit report that only lenders can run, and most will do it free of charge to earn your business.

So as a borrower, you can’t tell from your free credit report whether you will qualify with a lender. And most lenders won’t pull a more comprehensive credit report until they know you are serious about applying for a loan. In the meantime, your scores help you understand where you might fall on the spectrum as a potential borrower.

Many lenders use the FICO score, which grades a consumers credit-worthiness on a 300 – 850 range.

- Poor = 579 or lower

- Very good = 740-799

- Exceptional = 800 or higher

A potential borrower with higher credit score is generally viewed as more reliable and less of a risk for lenders; the borrower with a lower credit score is seen as higher risk. A better credit score also qualifies you for a lower interest rate on your loan.

What Score Is Needed To Buy A House In California

There is no standard cut-off point used in the mortgage industry for credit ratings. This is one common misunderstanding. The truth is that different lenders have different standards , different business models and different risk appetites. So the credit score required to buy a home in California would depend partly on who you work with.

In general terms emphasis on the word generally mortgage firms prefer to see a score of 600 or higher for approval of loans. That number, however, is not set in stone. It is just a phenomenon in the industry. So dont be discouraged by dropping below that point. Either way please contact us. Well gladly review your financial situation to see if you are a good candidate for a home loan from California.

Here too, the type of home loan you use plays a role. For example , home loans from the Federal Housing Administration require a minimum score of 580, if the borrower wishes to take advantage of the 3.5 percent down payment option. Credit score requirements tend to be a bit higher for conventional mortgage loans, because there is no government insurance.

As described above, when assessing loan applications, the borrowers prefer to look at the big picture. Every lending scenario is different, because it is different for every borrower. So a low credit score may not necessarily be a deal-breaker by itself. Having said that, a higher credit score would usually increase a borrower s chances of qualifying for a California home loan.

You May Like: Why Is There Aargon Agency On My Credit Report

What Credit Score Do You Need To Buy A House

Its possible to get an FHA loan with a credit score of 580 or 500, depending on the size of your down payment. VA, USDA, and conventional loans do have a set minimum credit score but lenders will generally require a credit score of at least 620.

Of course, remember that the minimum square will tell you whats required to qualify, but a lower credit score also usually means higher interest rates.

This table outlines the minimum credit scores typically needed to buy a house based on the type of loan: conventional, FHA, VA or USDA.

| Loan Type |

- Co-borrowers who do not plan to live in the home

- Down payment gift money, but no down payment of their own

- Properties that are in need of repair

Without FHA, millions of homeowners would be stuck renting years longer than they should. Yet, there is still room for FHA to expand its capacity to serve more aspiring homeowners.

Want To Buy A House Heres The Credit Score Youll Need To Do It

Your credit score plays a major role in your ability to secure a mortgage loan. Not only does it impact your initial qualification for a loan, but it also influences your interest rate, down payment requirements, and other terms of your mortgage.

Are you considering buying a house, and making sure your credit is ready? Heres what you need to know.

Recommended Reading: Why Is There Aargon Agency On My Credit Report