Sample Letter To Remove Closed Accounts From Credit Report

Writing a sample letter to remove closed accounts from credit report is an important part of credit repair. Credit bureaus and reporting companies are not easy to deal with. Especially in the days of the internet many of these companies have shady operations. They can be very difficult to deal with and many times you will receive the run around. It is essential that if you have any dealings with these types of companies that you write a sample letter to remove closed accounts from credit report.

How to Send a Dispute Letter to Creditors 14 Steps from sample letter to remove closed accounts from credit report , source:wikihow.com

I think most of us would rather deal with the company our self, but what do we do when we get run over by the big credit bureaus? What do we do when they refuse to remove something even after we follow the process given to them? Well, we find another one. That is exactly what you will do when you write a letter to the credit bureaus describing your side of the story. You will detail the problem and how it was taken care of, hopefully leading them to remove the account from your credit record.

Sample letters like this are all over the place. They can be found on many credit repair websites or you can locate them in books found at your local library. All you need to do is search for a letter that explains the situation and how you have dealt with it and use that as a template for your own letter.

Things To Consider Before Calling A Credit Repair Service

You can call a credit repair company for a consultation at any time, but remember that credit repair can only remove incorrect or illegitimate listings. Keep these factors in mind before moving forward with a credit repair service:

- Expenses. Weigh up the costs of credit repair against the possible value of the service. For example, the long term benefit of a home loan with favorable terms outweighs the short term costs of hiring a credit repair specialist but the benefit depends on the service being successful.

- No guarantees. The agency will investigate your listings but cannot by law offer any certainty of removing them.

- Time factor. When studying your negative listings, also take note of when they will expire. Most credit black marks disappear from your credit file after seven years, so in some cases it may be worth waiting it out if youre not planning on utilizing credit in the near future.

Consider your credit report carefully and what may be realistically achieved through a credit repair agency before you take on the expense of this service.

How To Buy A House With Student Loan Debt

Aug 6, 2021 If you have student debt, you might be wondering if its still possible to Current debt; Credit score; Income; Unusual activity in your;

Student loans can have a negative or positive impact on your credit score, If you take out student loans to get your bachelors degree, youll have four;

Feb 22, 2021 I worked hard to improve my credit and just saw a 18 point drop in my credit score because of this. Just doesnt seem right when we are;

Jan 27, 2020 Youre actually creating a new loan when you consolidate or refinance student loans. The lender pays off the outstanding balances on your;

Nov 4, 2020 Student loan entries stay in your credit report for 7 long years. Should you just wait it out or is there a way to remove student loans earlier,;

No information is available for this page.Learn why

We are required to report information concerning the repayment status of your student loan each month to the nationwide consumer reporting agencies

Apr 9, 2021 An important provision under the FRCA is the removal of negative credit items including any unpaid debts after 7 years. Private Student Loans.

May 21, 2020 The federally mandated forbearance period shouldnt have affected credit scores. Credit reporting bureau Experian stated on its website, The;

Aug 16, 2021 Guaranty agencies that hold those loans will assign them to the Department and request that the credit reporting agencies remove the record;

Read Also: Can You Remove Hard Inquiries Off Your Credit Report

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

What Happens When An Account Is Closed

When you pay off or close an account its not available for purchases or payments.

An account can be closed for many reasons such as paying off the amount borrowed or closing an unwanted line.

Once the account is closed, its then settled and will appear on your credit report as such.

When an account is closed with a balance, the creditor will still;report the status and account details to the credit bureaus on a monthly basis.

The information that is reported is the balance, monthly payment history, and the date of your last payment.

Recommended Reading: Does Opensky Report To Credit Bureaus

How To Remove A Charge

Removing charge-offs or other negative information from your credit reports can be tricky. Technically, negative credit information that’s accurate can legally remain on your credit reports for seven years, and some types of negative information can stay even longer.

That being said, there are some remedies for dealing with charge-offs. The first is disputing a charged-off account if you believe it’s being reported in error. Federal law allows you to initiate a dispute with the that’s reporting information you believe to be inaccurate. The credit bureau then has to investigate your claim and if there is an error, correct it or remove it.

Wait A Few Months And Dispute The Account Again

If you failed to get the collection removed from your credit report by this step, dont lose hope. Let a couple of months pass by and try to dispute the account for another reason.You can dispute accounts for several diffident reasons, and the older the paid collection gets, the more likely the creditor will ignore the Credit Bureaus requests.

Don’t Miss: Does Zzounds Report To Credit Bureau

Tax Lien: Once Indefinitely Now Zero Years

Paid tax liens, like civil judgments, used to be part of your credit report for seven years. Unpaid liens could remain on your credit report indefinitely in almost every case. As of April 2018, all three major credit agencies removed all tax liens from credit reports due to inaccurate reporting.

Limit the damage: Check your credit report to ensure that it does not contain information about tax liens. If it does, dispute through the credit agency to have it removed.

How Student Loans Impact Your Credit Score Cnbc

Mar 10, 2021 Student loans on your credit report can be good or bad for your credit score. Since student loans are a type of installment credit, having them;

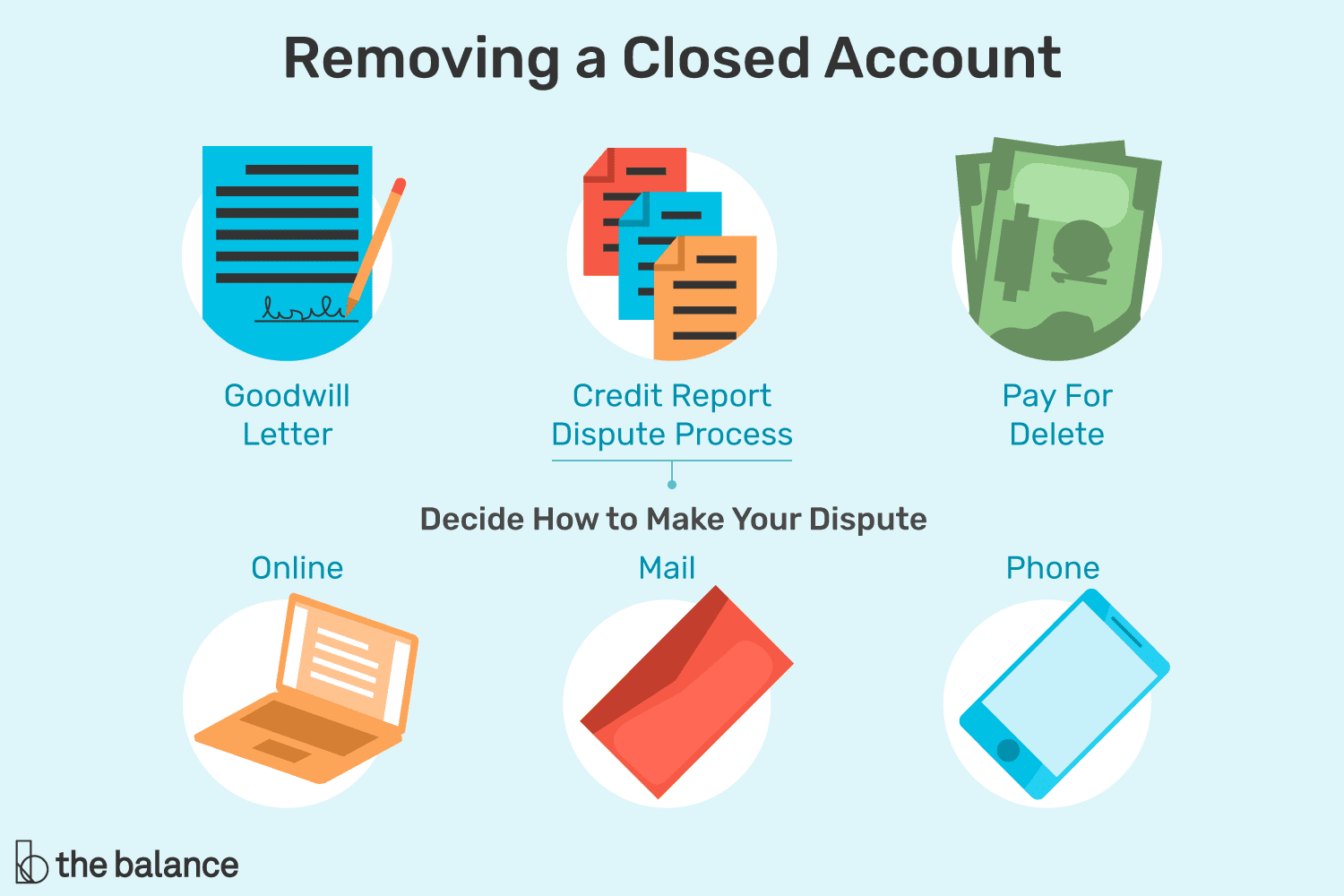

Removing a closed account from your credit report can be tricky, but you do have a few options. These include: Writing a goodwill letter applies when you;

These credit reporting practices apply to all of the student loans Once you take out a student loan, it will flow through different phases until it is;

Don’t Miss: How Long A Repo Stay On Your Credit

Should I Try To Get Rid Of Closed Accounts On My Credit Report

Don’t try to remove a;paid-off mortgage, car loan, credit card or other accounts from your credit report if they show a positive payment record. That good record will continue to help your credit scores.

If you have negative marks on the account, however, you want;it off as soon as possible.;You can use AnnualCreditReport.com to get free reports from the bureaus every 12 months;to verify negative information;has been removed as required;by law. If a negative mark is lingering, you can file a dispute.

Many credit scoring models now exclude paid-up collections accounts. But because some lenders still use older scoring models, you;may want to try;removing collections from your reports.

Why Closed Accounts May Be On Your Credit Report

There are several reasons an account might be reported as closed. Some may need your attention, while the rest arent cause for alarm.

- You requested it. If you wrote to your creditor, canceled your account and got acknowledgement that the account was closed, it should come as no surprise that it shows up as closed on your credit reports. Closed accounts in good standing will typically remain on your report for 10 years.

- You paid off or refinanced a loan. Paying off a loan usually closes the account. Since youve finished paying off your debt, youve fulfilled your obligation and the loan no longer needs to remain active. On the other hand, refinancing involves paying off your current loan with a new one, so you might see that your old loan is closed .

- Your creditor closed it because of inactivity. If you dont use your card for a long time, your credit card issuer may close your account. To prevent this from happening, you could try keeping one small monthly payment on accounts you want to keep active.

- Your creditor canceled your account because of delinquencies. If you fall behind on your payments, your lender may close your account. Keep in mind that negative payment history for these accounts may remain on your report for seven years.

- The credit bureau made a mistake. If this is the case and you have proof that the account should be listed as open, file a dispute to fix the error.

Read Also: Removing Hard Inquiries From Your Credit Report

How Long Will A Paid

It can take one or two billing cycles for a loan or credit card to appear as closed or paid off. Thats because lenders typically report monthly. Once it has been reported, it can be reflected in your credit score.

You can check your free credit report on NerdWallet;to see when an account is reported as being closed.

About the authors:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Lindsay Konsko is a former staff writer covering credit cards and consumer credit for NerdWallet.Read more

Wait For The Closed Account To Drop Off Your Credit Report

If nothing else works, you only have to wait it out because closed accounts wont stay on your credit report forever.

How long does a closed account stay on your credit report?;Closed accounts with negative records, such as late payments, will remain on your credit report for 7 years. It will negatively affect your credit score and these are the ones that will benefit you to get deleted.;

Meanwhile, accounts that were in good standing when you closed them will be on your report for 10 years. This is favorable to you because positive information on your credit report will have positive effects on your credit rating.; And logically, you will want to keep these on your credit record.;;

So it is important that you know the difference and act accordingly.

Read Also: Does Klarna Affect Your Credit Score

What Does It Mean To Default On A Loan

Defaulting on a loan means youve stopped making payments as agreed. How delinquent an account must become to be considered in default depends on the lender and the type of account. While most lenders will not consider an account to be in default unless it is at least three to six months past due, a mortgage loan may be considered in default after only one missed payment. On the other hand, federal student loans may be allowed up to nine months of missed payments before being placed in default.

What happens when you default on a loan depends on the type of debt you were unable to pay. Defaulting on a personal loan or a credit card account will likely result in the account being written off as a loss and updated to reflect a status of charge-off on the credit report. The lender may then sell the debt to a collection agency. Once a collection agency purchases the debt, they can report it to the credit reporting companies as a separate account.

When you default on an auto loan, the lender can repossess your vehicle. This means that they take possession of your car and sell it to try to cover the outstanding loan amount. Your lenders policies and state laws determine how delinquent your payments must be before it considers your auto loan in default and begins the repossession process.

Read Also: Does Speedy Cash Report To Credit Bureaus

Closed Positive Accounts Remain On Your Credit Report

Experian credit reports include closed accounts with no negative information for 10 years from the date they are reported closed. In fact, positive credit information remains on your credit report longer than most negative information, such as late payments. Late payments are removed from your credit history after seven years. Retaining the positive history longer helps you rebuild your credit history if you have had financial challenges.

Even if you’ve never had a late payment or any other negative accounts, the length of your history is considered in scoring models. The longer you have demonstrated that you can manage credit, the more positive points for your scores. That’s why you don’t really want those positive accounts rushed off of your report.

Experian will remove the closed accounts automatically at the end of the 10-year retention period.

You May Like: How To Get Credit Report Without Social Security Number

New Bills Would Reshape Credit Reporting For Private

Jul 8, 2021 Private student loan lenders would then be required to remove any adverse credit reporting from the borrowers credit report following the;

6 days ago Student loan rehabilitation is the best option in most cases because its the only one that removes the default from your credit report, though;

3 days ago How to remove negative entries from credit report list and a gauge the non-payment of a student loan or credit card), will still appear.

How To Remove Closed Accounts From Credit Report

In addition to checking for closed account errors, there are also steps you can take to try and remove closed accounts from your credit report. To remove closed accounts from a report, try the following:

Dispute errors – If you happen to find errors on your credit report, as we briefly mentioned, you can report these errors to the correct credit bureau. They will investigate the claim to confirm the possible error.

Goodwill letters – In short, this is a letter you write to your credit lender to ask them to remove a closed account from your report history. Its important to note that your lender has no legal obligation to remove closed accounts from your report.

Be patient- Although you can try to remove a closed account from your report, oftentimes the best plan of action is to wait it out. Closed accounts are always removed at some point, so we suggest reviewing your report will give you a general idea of when they will be removed.

Note: Having a closed credit card account removed from your credit report is not always the best choice. If the account has a longstanding history of on-time payments, it may serve your credit score better to keep it on your credit report.

Also Check: Does Paypal Working Capital Report To Credit Bureaus

Negotiate A Pay For Delete Deal

If you have collection accounts or charge offs that you have not paid off, you should try a pay-for-delete agreement to have the negative item removed from your credit report.

For this to work, be prepared tonegotiate with the creditor or collection agency over the phone.

Offer to pay the unpaid debt if the creditor will agree to delete the negative entry from your credit report entirely.

This is very effective, especially with collection agencies because they earn a direct profit when you pay an old debt.

But you must get your pay-for-delete agreement in writing before you make the payment.

Negotiate over the phone if thats more convenient, but dont pay anything until you have the written agreement in hand.

Collection agencies have short memories . You may need your written agreement to prove you had a deal in place when you paid.

Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

Don’t Miss: 779 Credit Score