How Do I Get Ccjs Removed From My Credit Report

CCJs are automatically removed six years after the original judgment date. If you think the judgment was made in error, you should contact the County Court concerned. The courts will also allow a judgment to be removed if it was paid within one month and a Certificate of Satisfaction has been issued.

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Review Your Credit Report

As with any dispute or request for deletion, the first step is to review your credit report. Make it a habit to always monitor and review your credit reports from all three credit bureaus.

Usually, you could obtain a copy of your credit report for free annually from each credit reporting companybut the credit bureaus offer free weekly reports as part of their COVID-19 relief effort. Additionally, if you have a major credit card, its likely monthly credit reporting is a service offered for free with being a cardholder.Studying your credit reports often will help you notice any inaccuracies or misreporting. Moreover, clerical errors and miscommunications do happen and its important to catch them as soon as they happen. Its possible that you have never had a late or missed payment on an account late but your report shows otherwise.Other common errors include incorrect past due amounts and an incorrect number of missed payments. Also, late payments that are seven years or older still showing on your credit report is another possible error.In the case of any error, you can submit a dispute with either the original creditor or the reporting credit bureau. Make sure to always keep records of your payments to further defend yourself.

Also Check: How To Remove A Repo Off Your Credit

How To Remove Late Payments From Credit Report Sample Letter

Late payments of loans and credit advances can decrease your chances of getting loans in the future. This is because you end up losing your credit scores any moment you record late payments in your credit scores. Because late payment records stay on the credit report for up to 7 years, many people often struggle to find how to remove late payments from credit reports. Whether its a valid or invalid late payment record, you will always suffer when you record late payments in your credit report.

How To Remove Late Payments From Your Credit Report

Late payments can be deleted or updated to never late on your credit report. Its actually quite easy if you do it correctly, and you can choose from a few different options.

The method you should select depends on your general credit history, your relationship with the creditor, and the amount of time or money youre willing to put towards these efforts.

Here is an overview of four ways you can successfully remove a late payment from your credit report.

Read Also: Thd Cbna Bank

How Do I Leave A Notice Of Correction

Send a letter to our Customer Service Team, TransUnion, PO Box 491, Leeds, LS3 1WZ, with the wording youd like to add in your file, your full name, date of birth and address. Please remember to sign your letter. Alternatively, you can email us with the above information at

Please remember the Notice of Correction cant be more than 200 words, defamatory, libellous, incorrect or frivolous. The note will remain on your TransUnion credit file until you ask us to remove it or until the information it is attached to is no longer on your report.

How to issue a notice of disassociation?

How To Remove Credit Card Late Payment Records From Credit Report

Financial institutions and lenders provide loans after assessing your credit report. A credit report is a summary of your credit history for the last 36 months and demonstrates your ability to repay your loans on time. Maintaining an accurate credit report and credit score will facilitate quick loan approvals.

A late payment record can have a significant negative impact on your credit report. Late payments bring your credit scores down which can result in denied credit from almost all lenders. While some lenders might sanction loans even if your credit report has late payments, the interest you will have to pay will be substantially high.

Some studies show payments that are overdue for 30 days or more can reduce your credit score by up to 100 points. Therefore, it is crucial to pay your easy monthly instalments on time.

You May Like: Tri Merge Credit Report With Fico Scores

How To Get Late Payments Off Your Credit Report

As youre likely now discovering, late payments can have a lot of weight on your credit scores. If that wasnt bad enough, late payments can also stay on your credit reports for many years. Yikes! The good news, late payments are not difficult to get removed. Ive been able to remove several late payments and Im going to share how I was able to pull it off.

Why A Goodwill Letter May Not Work

Weve heard from some readers who have said their credit card issuers say its illegal for them to remove late payments, or provide other similar reasons.

Its not illegal for a creditor or lender to change any information on your credit reports including late payment history. Credit reporting is a voluntary process. Theres no law that requires a lender or creditor to furnish data to credit bureaus. Theres also no law that requires the credit bureaus to accept the data a lender/creditor provides and include it on your credit reports.

Companies like lenders, creditors, and collection agencies must apply to be data furnishers with the credit bureaus. The application must be approved before a company can have information about their customers included on a credit report. When a company is approved to furnish data to the credit bureaus, the company has to sign agreements with Equifax®, TransUnion®, and Experian. The agreements say what a data furnisher is and isnt allowed to do when it comes to credit reporting.

Often, the credit bureaus will include language in their agreements which says a data furnisher agrees not to change accurate, negative account information. This is commonly the case for debt collectors, for example, who must agree not to delete a paid but accurate collection account simply because theyve received payment from a consumer.

Recommended Reading: Ccb Credit Inquiry

The Late Payments Dropped My Credit Score By 80 Points

Thats right my FICO score dropped 80 points! Although I really didnt care as much as I usually would, I just bought a new house and car. I wasnt going to be using my credit file again for a while. I knew whenever I needed my credit I could probably get them deleted.

Before I wrote this article, I wanted to try the methods I posted here to see if I could get my own late payments removed from my credit report.

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

Recommended Reading: Can A Closed Account Be Reopened

Faqs On How To Remove Late Payment Records Of Credit Card From Credit Report

Yes, late payment records lower your credit score making it harder to get approvals for loans.

A late payment record will remain for seven years on your credit report from the date it was reported.

A late payment is reported if you fail to pay your outstanding balance within 30 days after the due date.

Your credit score can reduce by up to 100 points due to a late payment record.

If an incorrect late payment has been reported even if you made the payment on time, you will have to file a dispute with the credit bureau. The credit bureau, after investigation, will remove the late payment record if your dispute has been proved right.

Hire A Credit Repair Professional

Lastly, you can hire a credit repair company to do all this difficult work for you.

Hiring a credit repair company can save you lots of time and effort, and as these companies are professional credit experts, they are much more likely to get results.

Also Check: Chase Sapphire Preferred Credit Score Requirement

Also Check: Is Paypal Credit Reported To The Credit Bureaus

Contact Your Creditor For Assistance

If you believe a creditor incorrectly reported the late payment, you may want to start by submitting a dispute directly to them. Include any documentation you havesuch as copies of a canceled check or payment verification email.

If the creditor investigates and agrees that there was an error, it will send an update to all the credit bureaus it reports to and have the late payment corrected or deleted. You can monitor your credit reports for the changes, which may take several billing cycles to appear.

How Long Will A Late Payment Stay On A Credit Report

Once a late payment is recorded on your credit report, you should know that it will be there for six years. Fortunately, as time passes, the impact on your score will decrease, because lenders care more about your recent credit history instead of the old one.

Therefore, its always important to keep up with future payments even though you were unable to make one payment on time. Your score will also improve over time, so it will be easier to get approved for credit.

You May Like: Does Carvana Report To Credit Bureaus

What If There’s Incorrect Information On My Credit Report

TransUnion will contact you with an outcome, by post or email, within 28 days. We will either send you an email or a letter to confirm the outcome of your dispute. The method of contact will depend on how you raised your dispute:

When you raise a dispute, TransUnion will investigate the data accuracy with the data provider and provide you with an outcome within 28 days, in accordance with our obligations under Section 159 of the Consumer Credit Act 1974.

If you decide to raise a dispute, the process can be broken down into these 3 simple steps:

If you use the online portal to raise a dispute, we will email you, or If you email your dispute to TransUnion, we will respond via letter.Here are some examples of potential outcomes:

- No changes made as evidence requested was not received within the 28 day timeframe.

- Data provider advises data is accurate, no changes made.

- Data provider agrees to change incorrect information.

- No response received from data provider within 28 days. If applicable data will be removed or suppressed from view .

What can I do if the information on my credit report is accurate, but I would like to explain the circumstances behind it?

Where your credit report data is accurate, but youd like to explain the reason behind an item, you can choose to add wording of your choice to your credit report in the form of a Notice of Correction .

To add a NOC to your credit report please email your chosen wording to: .

Or alternatively, you can write to us at:

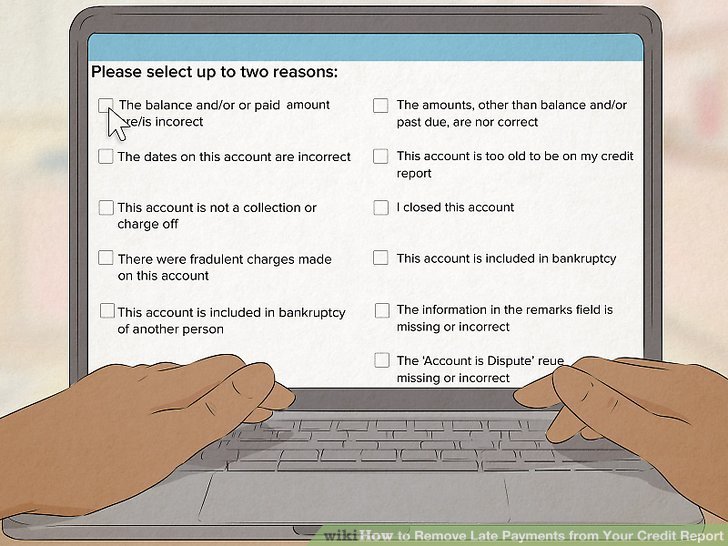

How Do You Dispute An Inaccurately Reported Late Payment

Use this method if theres an incorrect late payment on your credit reports that didnt actually occur. If you were at fault, learn more about removing actual late payments below.

You can also use this method if you actually made a late payment but theres some inaccurate information associated with it. In this case, you probably shouldnt expect to have the late payment record completely removed. Instead, your creditor will probably just correct the error but the delinquency will stay on your report.

Disputing items on your credit report is free. You may need to dispute the late payment with several companies in all. Heres the basic procedure:

Remember to be patient. This process may be solved successfully at step 2, or it could take longer. You shouldnt have much of a problem with the major credit card issuers if they clearly made a mistake, even if you have to spend more time on the phone than youd like. But, its possible that other credit card companies might be more difficult to work with, like issuers of subprime cards.

MoneyHack

Read Also: Itin Number Credit Score

How To Get A Closed Account Off Your Credit Report

Many people close credit accounts they no longer want, thinking that doing so removes the account from their credit report. The Fair Credit Report Actthe law that guides credit reportingallows credit bureaus to include all accurate and timely information on your credit report. Information can only be removed from your credit report if it’s inaccurate or outdated, or the creditor agrees to remove it.

Offer To Sign Up For Automatic Payments

In some instances, a creditor may agree to delete a late payment if you agree to sign up for automatic payments.

This plan works well if youve had trouble making payments in the past but arent significantly delinquent on your account. Youll have better luck negotiating this deal if you can show that youre financially able to make your payments.

It also helps if youve overcome whatever financial hurdle held you back from making payments in the past. Like requesting a goodwill adjustment, this is also ideal for longer-term customers.

You May Like: Does Aarons Build Your Credit

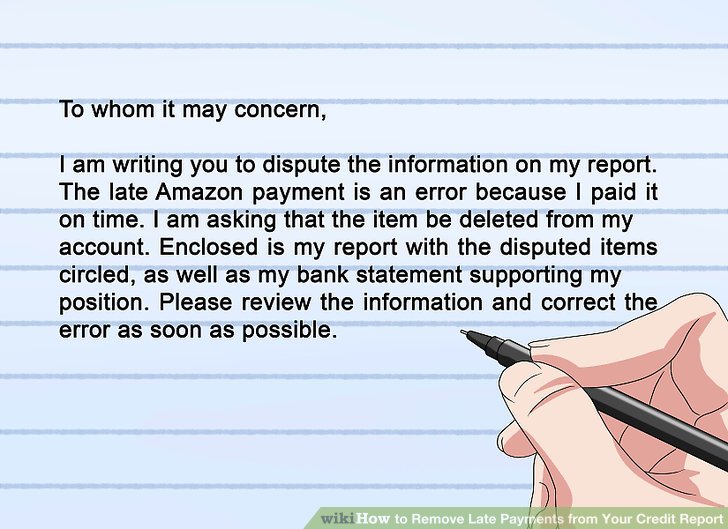

How To Write A Goodwill Letter

Write a goodwill letter as you would anybusiness-related correspondence. Type and print it, and keep it professional,clear and concise.

While you can provide the details about the reasons for alapse in payment or another negative factor, a goodwill letter should not focuson the emotional aspects. The goal should be to show the creditor that theissue was not indicative of how you normally handle credit or that you havesubstantially improved how you handle credit.

This helps the creditor see you as a more valuable client,which can encourage them to do a goodwill favor for you. The goal of a lettershould not be to make the creditor feel sorry for you.

When writing your letter, include details that can helpthe creditor identify your account and the negative item in question. Then,provide a short description of why you think the creditor should remove thenegative mark. You should include:

- Your account number

- The date and type of issue that occurred

- Information that identifies the negative mark

- Information about how long you have had a relationship with the creditor

- Information that shows this is not habitual behavior for you

- Sincere regret that this occurred

- A specific call to action that explains what you are asking of the creditor

How Can I Improve My Chances Of Getting Accepted For Credit

Here are some simple things you can do to improve your credit report:

- Pay your bills and credit agreements on time. Lenders look for evidence you’re able to repay existing credit on time. If you forgot a payment one month, you can use a Notice of Correction. These are notes you add to your credit report to explain why you were late with a particular payment.

- Provide accurate, truthful and complete information on your application form. If you leave anything out or don’t give the true picture, it could affect your ability to get credit in the future.

- Check your credit report regularly so you can close any accounts of financial products youre not using, and check youre registered on the electoral register at your current address.

You May Like: How Long Does It Take For Opensky To Report