Avoid Using Your Cards With A 0 Balance

Another component of credit score relates to the number of open accounts and their balances. If possible, stop using your cards for purchases, especially those with zero balances.

Generally, accounts with zero balances tend to improve your credit score rating. But restraining from using your credit cards will also help you pay down your debt more quickly.

Avoid Taking On Too Much Debt At One Time

The number of loans you take in a fixed period of time should be minimal. Repay one loan and then take another to keep your credit score from crashing. If;you take multiple loans at;once, it will show that you are in an unforgiving cycle where you have insufficient funds. As a result, your credit score will fall further. On the other hand, if you take a loan and repay it successfully, it will boost your credit score.

Additional Read:4 top factors that led to the growth of NBFCS in India

Interpret Your Credit Score

Once you receive your credit report, you have to interpret what your score means. Your credit score is a three-digit number between 300 and 900 . Our blogs can help you understand what is the average credit score in Canada by age, and where your credit score falls on the scale.

Equifax breaks down credit scores into four categories: poor, average, good and excellent.

- Poor credit: under 500

If you need extra support, you can also check out the Government of Canadas resource on understanding your credit report.

Read Also: How To Get Credit Report Without Social Security Number

Plan To Resume Paying Loans

If you’ve taken advantage of relief measures passed in the Coronavirus Aid, Relief and Economic Security Act, such as student loan or mortgage forbearance, you may be preparing to resume those payments. Contact your lender to make sure you understand any modified repayment terms, and review your budget to determine whether the resumed payments will stretch you financially. Consider cutting your expenses or earning extra income through a side job to ensure you can make all of your loan payments on time and in full.

Reducing The Amount Of Debt You Owe

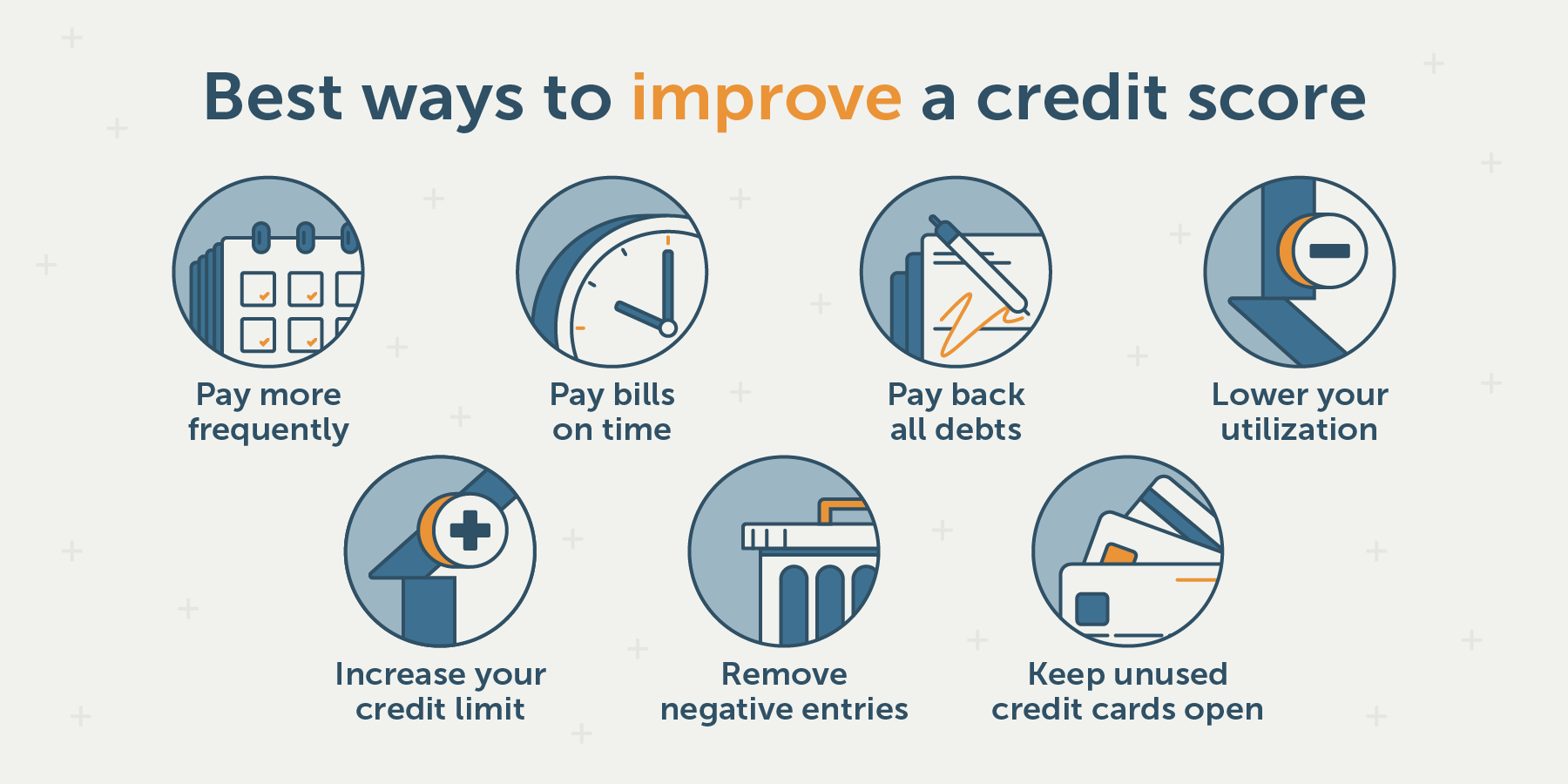

One good step is to start a debt reduction plan to clear up your financesâand set you on the path to a better score. Start by paying off your high interest rate cards: put all your effort into paying off a higher rate card, while maintaining payments on all other cards on auto pay. Once you’ve paid off the balance, don’t cancel your card! Keep it open, even if you don’t use it, so you can boost your credit utilization.

Also Check: Zebit Report To Credit Bureau

Don’t Panic If Your Credit Score Drops Slightly It’s Actually What’s On Your Credit Report That Matters

The idea that getting accepted for credit is all based on a simple score given to you by one of the credit reference agencies is false.;At best, it’s a guide to roughly how good or bad a risk you are.;As we say above, lenders will judge you on three main criteria when you apply for credit:

Yet the first two aren’t factored in to your credit score; so it’s based on incomplete information. Plus, different lenders are looking for different things. When you apply, they assess you based on their own ‘ideal customer’ scorecard; and each lender is different. Just because one lender rejects you doesn’t mean another will do the same. So bear in mind:

The impact of a slight credit score drop is near meaningless

It’s inevitable at some point that your credit score will drop. However, this shouldn’t be a cause for panic, especially if it’s only a slight dip. In general, the impact of your score going down a small amount is near meaningless. Have a watch of this video to see why:;

Don’t Take Out Too Many Cards

Sometimes it seems like a good move to open a new credit card with a merchant to get a discount on an item. But try not to go overboard and take advantage of many discount offers over a short period of time. Each new card comes with a “hard inquiry” on your credit report by the merchant, which can have a negative impact on your credit score.

Read Also: Aragon Collection Agency

The Truth About Raising Your Credit Scores Fast

While a lucky few may be in a situation where they can raise their credit scores quickly, the bottom line for most of us is that building credit takes time and discipline, especially if youre trying to rebuild bad credit. Thats because your credit scores are complex and made up of several interconnected factors .

So trust us: While some credit repair agencies may promise to raise your credit scores fast, theres no secret that will help boost your credit scores quickly.

But if you start developing healthy habits now, you can build credit over time all by yourself.

Not Eligible To Vote In The Uk Add Proof Of Residency

If you aren’t eligible to vote in the UK so can’t be on the electoral roll , send all three credit reference agencies;proof of residency; and ask them to add a note to verify this. This should help you get credit.

Some foreign nationals are allowed to vote in local elections, and therefore can be registered on the electoral roll in the normal way.;

Update: Despite the UK having left the EU, and the so-called transition period having ended, the rules described above about EU citizens and their right to vote in UK local elections remain the same.

Read Also: What Credit Report Does Paypal Pull

Reduce The Amount You Owe

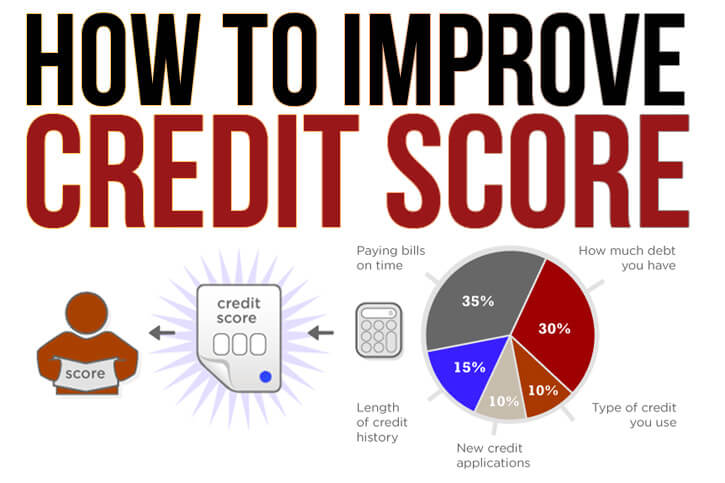

Lenders want you to borrow but not too much. Typically, lenders start to raise their eyebrows when you use more than 30 percent of your available credit on all your credit cards. This is measured by what’s called a credit utilization rate how much credit you’re using divided by the total amount available to you and a low one means you’re probably doing a good job of budgeting. Credit utilization is 30 percent of your FICO score.

And having too little activity can be a problem as well, Griffin says, because if you need a loan, the lender will want to see that you have used credit wisely in the past. Even if you don’t have a credit card, you can ask that utility bills or other regular bill payments be added to your credit report.

For fixed-rate loans, such as home loans or car loans, lenders look at your debt-to-income ratio, which reflects how much of your annual income goes to paying debt. It’s the amount of your monthly debt payments divided by your monthly income. Your debt-to-income ratio doesn’t affect your credit score, but if it’s too high, you might not get many credit-card offers, and it might be harder for you to get a car loan or mortgage.

If you have a card that’s maxed out, or close to maxing out, then pay it down aggressively. You might even consider diverting some money from savings to pay down your credit card. All things being equal, paying down a credit card that charges 18 percent interest is about the same as earning 18 percent on an investment.

Ways To Improve Credit In 2021

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Coming out of a difficult year, it’s natural to evaluate where you’re at financially and consider how you want to regroup and prepare yourself for the year ahead. If the COVID-19 pandemic wreaked havoc on your finances in 2020, either through job cuts or other factors, you may need to lay out a new strategy for financial moves such as a home or car purchase, or readjust savings goals. But whether or not your finances have been affected, when considering financial moves for the year ahead, your credit score likely will come into play.

A good credit score is usually considered anything above 670 in the FICO® credit scoring model, and will allow you to access more loan and credit card options with more favorable interest rates. But the closer your score is to the maximum of 850, the better.

Keep in mind that you likely have many credit scores, due to the various ways scoring models weigh information. But the principle that higher scores indicate stronger credit generally holds true across the board.

Here are 21 strategies to get your credit score in tip-top shape, whether you’re building it from scratch or hoping to propel it into the highest tier.

Also Check: What Credit Report Does Paypal Pull

Keep Credit Cards Open

If;you’re racing to improve your credit profile, be aware that closing credit cards can make the job harder. Closing a credit card means you lose that cards credit limit when your overall credit utilization is calculated, which can lead to a lower score. Keep the card open and use it occasionally so the issuer wont close it.

How To Improve Your Credit Score After Bankruptcy

If you’ve filed bankruptcy, you know it’s not the end of the world. In fact, for many people, it’s the start of a brighter future that will help them finally reach their financial goals.

While bankruptcy is the first step in re-establishing good credit, you can’t just file a case and expect significant movement. You’ve got to work at it. The process will demand your attention, and it’s going to take time, but it can be done.;

Recommended Reading: Opensky Billing Cycle

Don’t ‘spend’ Your Applications Too Often

Every time you apply for a credit product , it adds a footprint to your file for a year.

Too many, especially in a short space of time, can trigger rejections as it makes it look like you’re desperate for credit. Therefore, space out applications if you can and don’t do them frivolously.

In fact it’s almost worth thinking about applications as ‘spending’. Is it really worth spending an application on what you’re doing, or could you save it for something else?

So if you fancy a cashback credit card and have no other credit you need to apply for in the next six months or so, great, spend your application. But if you’re just about to apply for a mortgage, wait until after you’ve done that. Prioritising is important.

For the same reason, if you apply for a cheap credit card and don’t get the credit limit you need, don’t automatically apply for another one. Read the;Low Credit Limit;guide for more information.

Only Apply For Credit You Need

Every time you apply for a new line of credit, a hard inquiry is pulled on your report. This type of inquiry lowers your score temporarily. Applying just to see if you get approved or because you received a pre-qualified offer of credit is not a good idea.

If its a single hard credit pull, the drop will be slight. However, a string of hard inquiries could signal to lenders that you are taking on too much debt. The effects of a hard credit pull on your score, according to a representative of TransUnion, can last up to 12 months.

If you do need to apply for new credit, research your likelihood of approval to ensure youre a good candidate before applying. If possible, get a pre-approval or pre-qualification, as in many instances these result in a soft rather than hard credit pull. Soft pulls dont affect your credit score You dont want to risk lowering your score for a denied application.

You should also refrain from applying for several credit cards within a short time frame, or before taking out a large loan like a mortgage.

When you shop for a mortgage, auto, or personal loan, you can keep hard inquiries to a minimum by making rate comparisons within a short time period. Applications for the same type of loan within a designated time frame will only appear as a single hard inquiry. According to FICO, this span can vary from 14 to 45 days.

Also Check: Removing Hard Inquiries From Your Credit Report

Do You Have A Good Or Bad Credit Score

, which may range from 300 to 850, take into account a number of factors in five areas to determine your : your payment history, current level of indebtedness, types of credit used, length of credit history, and new credit accounts.

A bad credit score is a FICO score in the range of 300 to 579. Some score charts subdivide that range, calling bad credit a score of 300 to 550 and subprime credit a score of 550 to 620. Regardless of labeling, youll have trouble obtaining a good interest rate or getting a loan at all with a credit score of 620 or lower. In contrast, an excellent credit score falls in the 740 to 850 range.

If You’ve Split Up Ensure You Financially De

If you split up with someone you’ve had joint finances with , once your finances are no longer linked, write to the credit reference agencies and ask for a notice of disassociation. You can also call up or find the forms online.

This will stop their credit history affecting yours in the future. However, the agencies say they can’t do this if you still have a joint account open with the ex. The account’ll need to be closed or transferred to an individual account before you can do it. For example, a joint loan would have to be paid off before a notice be given.

Tip Email

Also Check: Is 524 A Good Credit Score

Don’t Open Too Many Accounts At Once

FICO and VantageScore look at the number of credit inquiries, such as applications for new financial products or requests for credit limit increases, as well as the number of new account openings. Making these kinds of inquiries frequently dings your credit, so only apply for what you really need in order to avoid damaging your score.

If you want a new card, but you’re not sure you’ll qualify, you can submit a pre-qualification form online. You can submit as many pre-qualification forms as you want, as they won’t impact your credit score.

Check Your Credit Reports

You may find it surprising to learn that you dont have just one credit score. You dont have just three credit scores either one from each credit bureau. Instead, hundreds of credit scores are commercially available.

You cant control which credit score a lender uses to grade and assess your credit report. Yet, you can exercise some control over;your credit reports, which your credit score is based on. There are many credit scores, but you have only three credit reports.

Its important to check your credit reports from Equifax, TransUnion and Experian. Fraud and credit reporting mistakes are known to happen. If errors occur, you might pay the price in the form of a lower credit score and all of the issues that can come along with it.

However, if you discover a credit reporting error, federal law lets you dispute the mistake with the appropriate credit reporting agency. If you dispute an incorrect, negative account and a credit bureau deletes it from your report, your credit score might improve as a result.

Also Check: Is 779 A Good Credit Score

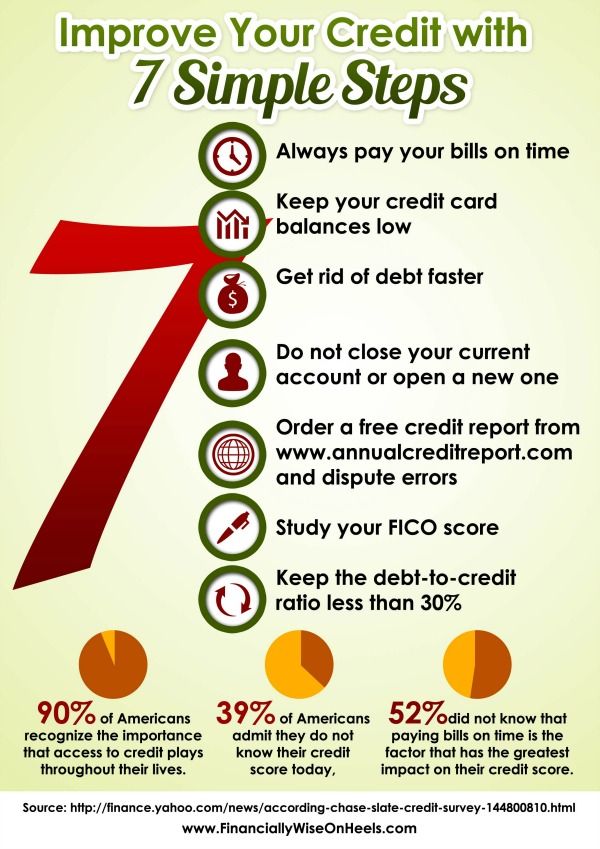

Always Pay Your Bills On Time

If you could do one thing to improve your credit score, it would be to make all your payments on time. Every time.

Thirty-five percent of your FICO credit score hinges on your payment history. For someone with a high score, even one payment that is 30 days late could result in a 90 to 110-point drop, according to Equifax. And the impact is even greater if the payment is more than 30 days late.

A late or delinquent payment stays on your credit report for seven years. The impact on your overall score declines over time, but that negative mark still matters.

If you have a missed payment on your report or want to avoid putting your credit score at risk, put all recurring bills on auto-pay and set payment reminders for other accounts. This keeps a payment from slipping through the cracks.

Pay Down Your Credit Card Balances

The amount of debt you have is heavily scrutinized for your credit score. Your total reported debt owed is taken into account, as well as the number of accounts with outstanding balances and how much available credit has been used. The total reported debt is compared to the total credit available to determine your debt-to-credit ratio. Your credit score can suffer if those numbers are too close together.

Your best plan for lowering your debt is to make a plan to pay it off. In some cases consolidating debt onto one lower interest card might make sense for you. But keep in mind, credit inquiries and opening new credit can lower your credit score, at least in the short term. Closing old cards with high credit limits can also throw off your debt-to-credit ratio. If a new credit offer is too good to pass up, keep your total amount of credit available high by not closing any old credit cards.

Tip: Avoid carrying a balance if you can. Carrying a balance can occur when you’re not paying your credit card bill in full each month, meaning you’re getting charged interest fees on past purchases.

Don’t Miss: Does Zzounds Report To Credit Bureau