What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

How Does A Mortgage Affect Your Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When it comes time to buy a house, few people can afford to pay entirely in cash.

Most opt for a mortgage, or a home loan. Like all major lines of credit, a mortgage will appear on your credit report. This is probably a good thing: A mortgage can help build your credit in the long run, provided you pay as agreed. Heres why.

You May Like: Syncb/ppc Closed

Can I Offer More Than My Pre

Yes, you may choose to make an offer that is more than what you were pre-approved for. If your offer is accepted and you go ahead with the purchase, you’ll need to find a way to finance your mortgage. If your offer is significantly more than your loan pre-approval amount, then you may need to make a larger down payment. If the difference is small, you may be approved for a larger mortgage when it comes time to apply for an actual mortgage.

How To Get Preapproved For A Home Loan

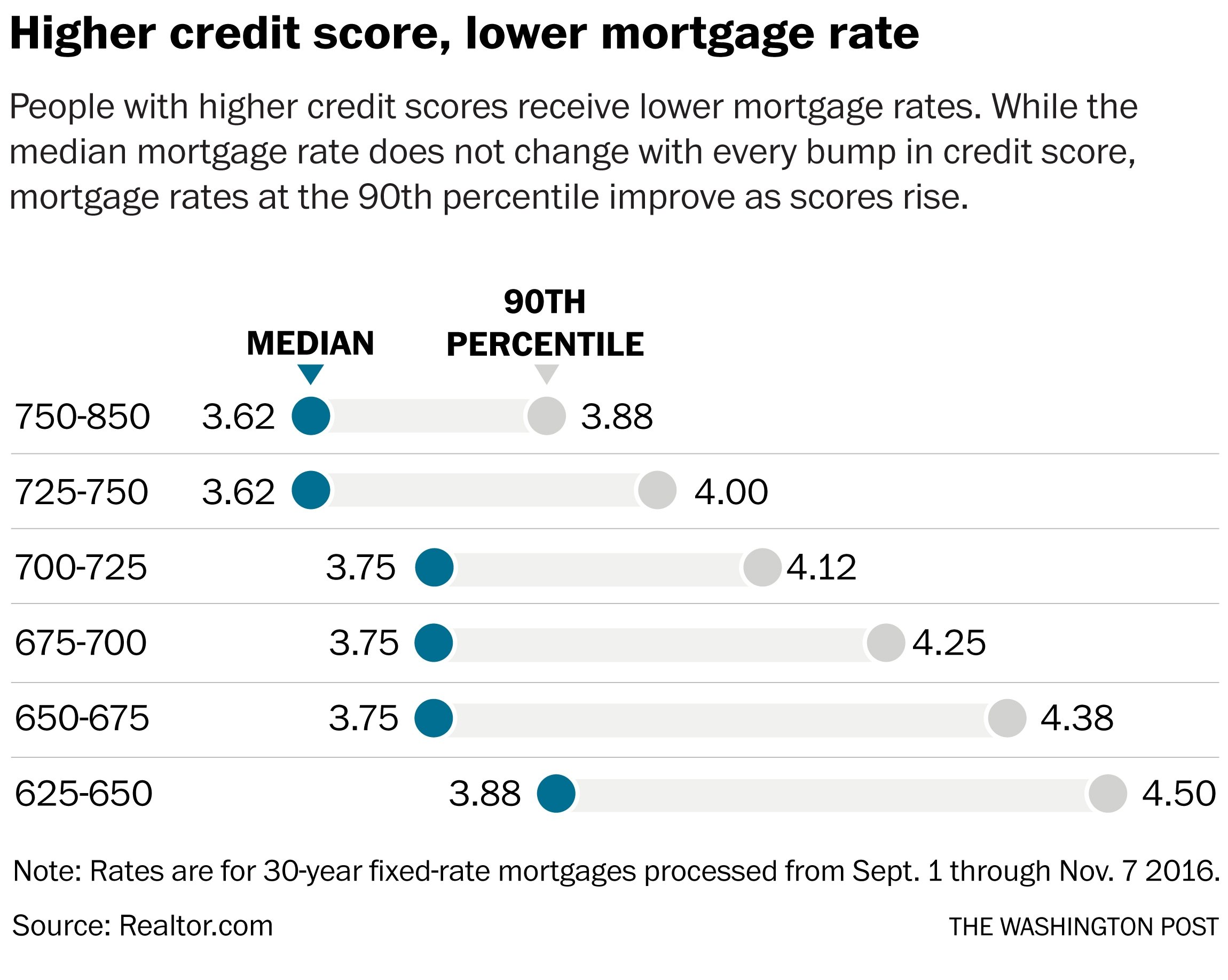

Get your free credit score. Know where you stand before reaching out to a lender. A credit score of at least 620 is recommended, and a higher credit score will qualify you for better rates. Generally a credit score of 740 or above will enable most borrowers to qualify for the best mortgage rates.

Check your credit history. Request copies of your credit reports, and dispute any errors. If you find delinquent accounts, work with creditors to resolve the issues before applying.

Calculate your debt-to-income ratio. Your debt-to-income ratio, or DTI, is the percentage of gross monthly income that goes toward debt payments, including credit cards, student loans and car loans. NerdWallets debt-to-income ratio calculator;can help you estimate your DTI based on current debts and a prospective mortgage. Lenders prefer borrowers with a DTI of 36% or below, including the mortgage, though it can be higher in some cases.

Contact more than one lender.;Comparing offers from multiple lenders can help you compare rates and fees and save you thousands of dollars over a 30-year mortgage. Going through the mortgage preapproval process shouldnt hurt your credit score. FICO, one of the largest U.S. credit scoring companies, recommends confining those applications to a limited time frame, such as 30 days.

You May Like: Does Klarna Report To Credit

What Is Recorded On My Credit File

When you apply for a mortgage, credit card, personal loan or any other debt facility, the following will be recording on your credit file:

- The enquiry date.

- The credit amount you applied for.

- The reason for the enquiry.

Generally speaking, banks arent comfortable lending to someone who has made any more than one or two enquiries over a 6-month period.

Do I Need A Mortgage Pre

If youre looking to purchase apre-construction condo, your builder will most likely ask that you obtain a mortgage pre-approval as a condition of your purchase agreement. Depending on your agreement, the builder might not ask for a mortgage pre-approval right away, but they may still have the right to ask for one at any time. If youre unable to get pre-approved for a mortgage, then your purchase can be canceled.

Its a good idea to get a mortgage pre-approval during the 10-day cooling period after signing your pre-construction condo purchase agreement. That way you can cancel your purchase without penalties if youre unable to be pre-approved for a mortgage. While your occupancy and closing date might still be far away, a mortgage pre-approval is required by condo builders so that they have some assurance that you will be able to follow through with the purchase of your condo unit. However, themortgage rateoffered in your pre-approval may differ from your actual mortgage rate if the closing date is still years away.

Don’t Miss: Does Paypal Credit Affect Your Credit Score

Whats The Difference Between A Hard And A Soft Inquiry

You may have heard a credit check described as a hard or soft inquiry. Both are referring to the act of pulling your credit report to assess your financial behavior. However, there are significant differences between the two.

- Soft inquiry on your credit report

When you or someone else checks your credit report but doesnt submit a new application for credit, its considered a soft inquiry or soft pull. Examples include employers checking on potential new hires or credit card companies looking for pre-qualified customers. According to the credit reporting company Experian, these types of inquiries wont affect your credit score.

- Hard inquiry on your credit report

When you actively apply for a new line of credit, such as a credit card or an auto loan, the lender requests your credit report. Your credit score and the financial information on your credit report determine if youll be approved by the lender, as well as the terms of your loan. This credit pull is considered a hard inquiry or hard pull. Unlike soft inquiries, hard inquiries can negatively impact your credit score. But the impact is typically small, and credit scores tend to rebound within a few months if no new negative information gets added to your credit report, according to Experian.

You Never Know When Youll Need It

We often think that we can call up the bank and request a credit increase when we need it, but thats not always the case.

For example, say John gets a new job and has to buy a car within the week. To simplify the process , he plans on paying for part of the vehicle and purchasing insurance on his credit card. However, John will spend over 30% of his total credit. He calls the bank to request a credit increase, but the time needed for approval is too long. John ends up paying for his car using a debit card and loses out on any bonuses from his credit card rewards program.

Similarly, if you lose your job, having a line of credit as a back-up source of income would be a relatively inexpensive way to make ends meet. But if youre already unemployed, youre going to have a hard time getting approved for any new credit.

Also Check: What Credit Report Does Paypal Pull

When To Get A Preapproval

The best time to get a mortgage preapproval is before you start looking for a home. If you dont, and you find a home you love, itll likely be too late to start the preapproval process if you want a chance to make an offer. As soon as you know youre serious about buying a home that includes getting your finances in home-buying shape you should apply for a preapproval.

If youre following mortgage rates, you can to determine the right time to strike on your mortgage with our daily rate trends.

What A Mortgage Pre

Once you have been pre-approved for a mortgage, you will receive a pre-approval letter or certificate. You can then use your pre-approval letter as proof to sellers that you will be able to afford the home purchase or use the pre-approval amount to help guide you on your home search. Your pre-approval letter will include information such as:

- Your preapproved mortgage amount: This is the maximum amount that the lender is willing to let you borrow.

- Home price: This is the maximum price of a home that you can afford to buy based on your down payment.

- Mortgage interest rate: This mortgage rate is locked in for a period of time. If you apply and are approved for a mortgage within this period, you are guaranteed to have this rate, even if market rates have increased.

- Expiry date: Mortgage pre-approvals usually have a rate lock that expires in a certain period of time, from 60 days to 120 days. After this date, your mortgage rate is no longer guaranteed.

- Mortgage type: Your letter will show what mortgage terms your pre-approval was based on, such as the amortization, mortgage term, and LTV ratio. Your pre-approval letter may also specify your down payment and monthly mortgage payment amount.

Also Check: How To Get Bankruptcy Off Credit Report Early

How To Get Prequalified

You may prequalify for certain credit cards or loans without taking any action.; This can happen when financial institutions request lists from credit bureaus on specific groups of people, such as consumers with above average credit scores, to market their products to. The bank or credit union then sends a letter or other promotion to the individuals on the list to let them know they prequalify.

When financial institutions use credit reports for marketing purposes, the activity is recorded on your credit reports, but it has no negative impact on your scores.

Borrowers who need a credit card or loan dont have to wait for a prequalification letter to show up in the mail, however. Many lenders offer prequalification tools on their websites.

Online prequalification generally requires you to enter personal information. That information is used to determine which credit cards, auto loans or other products youre eligible for. Some online application tools generate your prequalification offers in as little as one minute after receiving your information.

Common information you should be prepared to provide can include:

- Social Security number

- Bankruptcies or foreclosures

Want To Learn More About Buying A Home

From saving for a down payment to what to do after closing, our first-time home buyer’s guide walks you through the home buying process.

And dont forget another key step to buying a home is properly insuring it. Your mortgage lender may recommend you an insurer, but its up to you to find the right provider that best fits your needs and thats where we come in! At American Family, you can control what you pay for insurance by customizing a homeowners policy built around you. Reach out today, our agents are ready to help discuss the best ways to protect your hard-earned dream.

Also Check: Does Speedy Cash Report To Credit Bureaus

Should I Tell My Real Estate Agent How Much I Am Pre

To help tailor your home search,your real estate agentwill ask for your price range and may even ask to see your pre-approval letter. You can let your real estate agent know the maximum amount that you have been approved for, but it is more important to let your agent know the maximum home price that youre willing to look at. Just because you have been pre-approved for a large number doesnt mean that you need to purchase a home for that amount. While your agent might want to know your price range, you also do not need to let them know your income or how much money you have.

What Do Lenders Look At And Use To Process Your Pre

Lenders look at your credit report when completing your pre-qualification and pre-approval application process. As a borrower, you give your chosen lender the permission to access your credit score.

Remember, your credit report is a very powerful tool not just to measure your financial health but to also verify your identity. In fact, credit scores are used not just by banks and credit card companies but also by insurance groups and telecom firms.

There are two kinds of credit enquiries: hard and soft. A mortgage pre-approval is a hard enquiry, and can affect your credit score if done multiple times. Other checks that may be considered a hard enquiry are car loans, credit card application, or retail credit. Soft enquiries, on the other hand, include those checks done by employers, insurance companies, or by yourself.

Generally speaking, every enquiry will be recorded in your credit file the information includes the date of your enquiry, the lender, the amount you applied for, and the reason for the check.

Banks may not be happy to lend someone who made several enquiries over the recent months. However, if all your pre-approvals have gotten the green light and are recorded on your file, then banks might be satisfied with your credit standing. This is not always the case, though, as some banks do not report the go-ahead of pre-approvals.

Don’t Miss: How To Remove Items From Credit Report After 7 Years

How To Improve Your Chance Of Getting A Mortgage

Lenders like to see debt-to-income ratios that are 36% or lower, with no more than 28% of that debt going toward mortgage payments

Feb 21, 2020 Use NerdWallets free mortgage prequalification calculator to see whether you Get my lender match. What is mortgage pre-qualification?Getting Pre-Qualified for a · Get preapproved · What Not to Do During

Oct 28, 2020 Getting approved for a mortgage is never easy. But taking the following steps can help you avoid being among the denial statistics.

Does The Interest Rate Depend On The Length Of Mortgage Pre

Yes. The length of time your offered interest rate is locked-in for after pre-approval plays a role in determining your interest rate. The longer the time, the more risky it is for the lender as they still have to offer you the lower rate even if their other rates increase. However, this is not the main factor that determines your interest rate: other important factors include your credit score, whether your documents are complete, and your financial situation. In general, if a lender deems you to be a risky borrower who may lack the ability to pay them back, your interest rate will be higher.

Don’t Miss: How To Check Credit Score Without Social Security Number

What Should I Get Preapproved

In todays housing market, it will be almost impossible to get a seller to consider your offer unless you have a mortgage preapproval . There are simply too many buyers for sellers to be willing to take a chance on one who hasnt at least talked to a lender about getting a mortgage.

Another important reason to get preapproved: It gives you an idea of how much home you can afford based on how much money a lender is prepared to let you borrow. This can save you time during house hunting by eliminating properties out of your price range.

How Does Prequalification Affect Credit Scores

There are two types of credit inquiries that financial institutions run to determine whether a person qualifies for a loan.; A soft credit inquiry, which is used during the prequalification process does not affect credit scores, so there is no risk in trying to find out whether youre at least in the ballpark for approval for a specific loan or credit card. Viewing your own credit scores and reports also counts as a soft inquiry.

A hard credit inquiry, which takes place when you actually apply for a loan or credit card, will have a negative impact on credit scores, although the impact will be temporary. Hard inquiries are made during the pre-approval or approval process, when the lender examines your credit report to determine whether there is anything that would make you a credit risk.

But what about shopping for a mortgage? Does getting prequalified for a mortgage hurt your credit score?

Just like other loans or credit cards, mortgage prequalification doesnt hurt your scores since its also based on a soft inquiry. Having your credit report evaluated is a mandatory and necessary part of the mortgage process, Bey said. Because of that fact alone, there would be no benefit to the bank or anybody involved in the transaction to punish the prospective buyer for having their credit evaluated by a bank.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Does Rate Shopping Hurt Your Credit Score

Rate shopping is when you ask for a pre-approval more than once in a short period of time. Youre curious about what it takes to get approved for a loan;with this particular lender, so you ask them to see if you can be pre-approved for a mortgage. They will perform a hard inquiry to see your credit report and check your income and get back to you with whether or not they feel comfortable approving you for a mortgage.

Rate shopping can hurt your credit score if you decide to have several banks run a hard credit check in a short amount of time . Just as with any other loan, running too many hard credit inquiries over a small period doesnt look good to the credit bureaus and they may ding your score.

However, if you have just a couple checks over lets say a few months, youll probably be okay. Or if you get two or three back to back within the pre-approval period, the credit bureaus will see that and will likely give you a break. Ideally, you really only want your credit to be checked once, but if you were to decide on a different lender, in the end, two checks wouldnt do much damage to your credit.

Pre-approval really does depend on what state your credit score is currently in, but overall, expect a hard inquiry to change your credit score very little when you keep the number of credit checks low.