Become An Authorized User

A family member or significant other may be willing to add you as an;;on his or her card.;Doing so adds that card’s payment history to your credit files, so you’ll want a primary user who has a long history of paying on time.;In addition, being added as an authorized user can reduce the amount of time it takes to generate a FICO score.

You;don’t have to use or even possess the credit card at all in order to benefit from being an authorized user.

Ask the primary cardholder to find out whether;the card issuer reports;authorized user activity to the credit bureaus. That activity generally;is reported, but youll want to make sure ;otherwise, your credit-building efforts may be wasted.

You should come to an agreement on;whether and how youll use the card before youre added as an authorized user, and be prepared to pay your share;if that’s the deal you strike.

You Have Fewer Options For Credit

While you can still access some forms of credit without a credit score, itâs very difficult to do so. Plus, itâs likely that youâll be shut out of some of the better credit options. Yes, itâs true that you need credit to get credit. So, what should those without a credit score do? Consider some of the other credit-building activities listed later in this article.

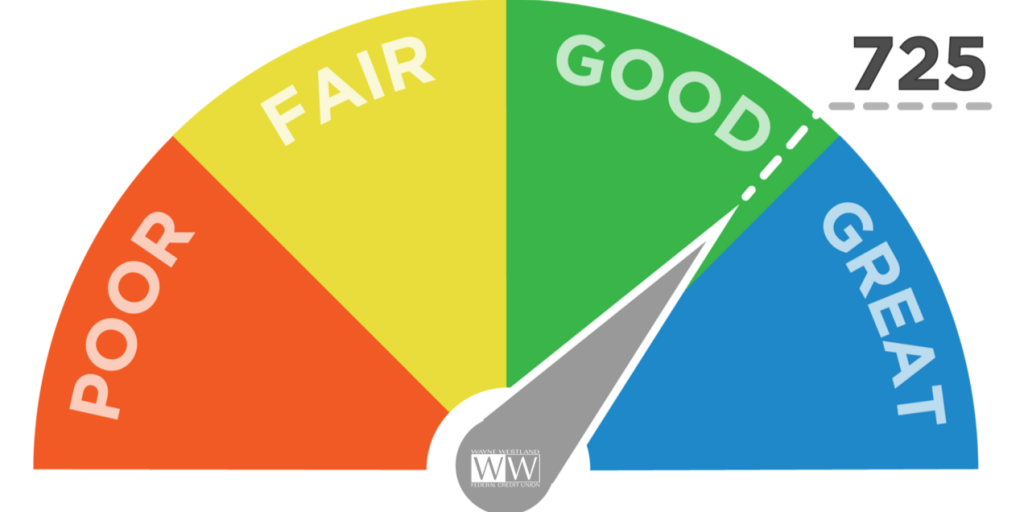

A Good Credit Score Is In The Eye Of The Beholder

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

Also Check: Transunion Credit Report Without Ssn

Option : Get Credit For Paying Monthly Utility And Cell Phone Bills On Time

Having a credit card is not the only way to build credit. If you are already responsible about making your utility and cell phone payments on time, but you don’t have a credit card, then you should check out;Experian Boost. It’s a free and easy way for consumers to improve their credit scores. Roughly two out of three people see instant increases to their credit scores, with an average increase of 10 points, and many people become scoreable for the first time as a result, according to;Rod Griffin, senior director of consumer education and advocacy at Experian.

The way it works is simple: Connect your bank account to Experian Boost so it can identify your utility and cell phone payment history. Once you verify the data and confirm you want it added to your Experian credit file, you’ll get an updated FICO score delivered to you in real time. Visit;Experian;to read more and register. By signing up, you will receive a free credit report and FICO score instantly.

Why Do Credit Scores Start At 300

Sometimes, industries adopt a standard because of habit even though it might be difficult for individuals to understand. Fair Isaac and Company built the flagship FICO score, which utilized this range, to help lenders improve risk underwriting.Their product dominated the market, so the 300 to 850 became the lender standard. The strange scaling range became a problem later when consumer interest grew, but it was too late to change by then.Similarly, the US uses the Fahrenheit scale because of habit even though the Celsius is much easier for people to grasp. When you grow up thinking in Fahrenheit, it is hard to transition.

Search the Site

You May Like: Does Paypal Credit Report To Credit Bureaus

Protect Credit Against Fraud

Learning how to protect your credit score, finances and identity from fraud, coupled with monitoring your accounts and utilizing credit card services, can increase your personal security both on and offline and make sure someone elses attack doesnt hurt your credit.

You now know a lot more about your starting credit score including that it cant be zero, and being credit invisible wont help much if youre interested in applying for credit cards or other loans. The good news is that whatever your initial score is, there are several ways to build a positive credit history and keep a good credit history and credit score.

If you prefer not to receive your FICO® Credit Score just call us at 1-800-DISCOVER . Please give us two billing cycles to process your request. To learn more, visit Discover.com/FICO.

Get Credit For The Bills You Pay

Rent-reporting services;such as Rental Kharma and LevelCredit take a bill you are already paying and put it on your credit report, helping to build a positive history of on-time payments. Not every credit score takes these payments into account, but some do, and that may be enough to get a loan or credit card that firmly establishes your credit history for all lenders.

Experian Boost;offers a way to;have your cell phone and utility bills reflected in your credit report with that credit bureau. Note that the effect is limited only to your credit report;with Experian and any credit scores calculated on it.

You May Like: Can You Have A Credit Score Without A Social Security Number

Can I Have A 300 Credit Score

Even though you dont start at 300, you can have a credit score that low if you dont practice smart credit habits. People with multiple collection accounts, repossessions and bankruptcies on their credit reports could find themselves in this range.

If youre currently credit invisible, it doesnt take long to get a credit score perhaps even a very good score.

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

You May Like: Credit Score 524

Understand What Goes Into Your Score

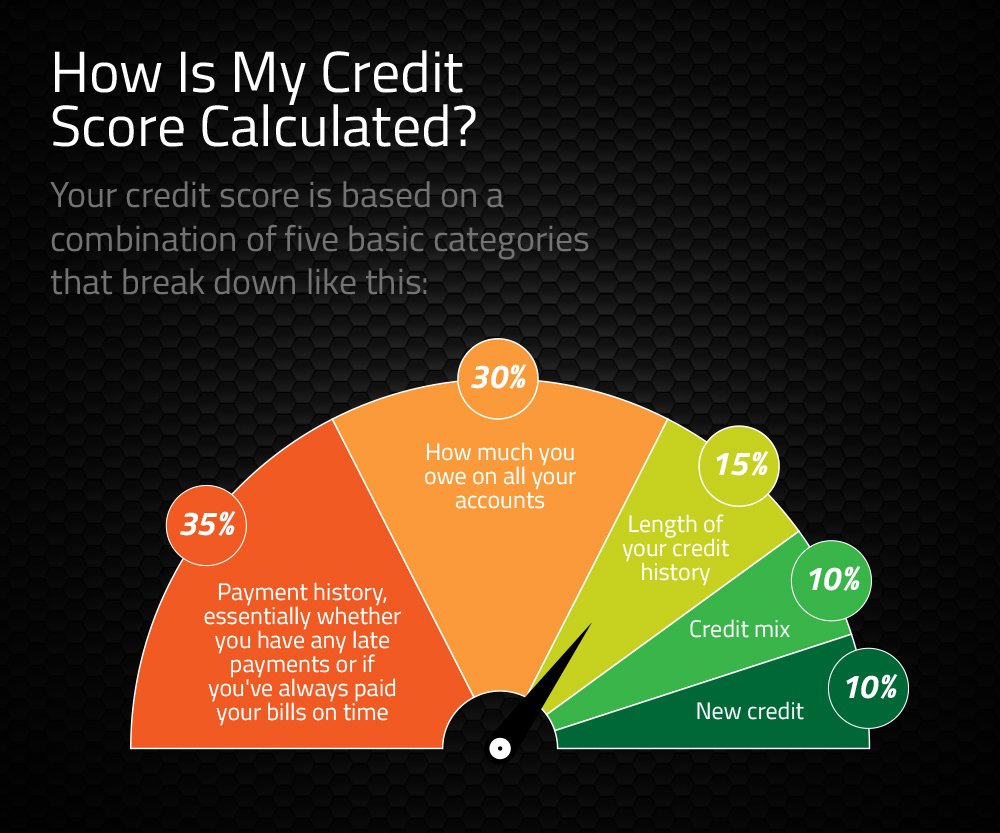

Five factors contribute to your FICO score, though some carry more weight than others:

Payment history

This is the single most important factor, making up over a third of your score. It shows lenders whether you have a history of late or missed payments on loans, credit cards and sometimes other bills.

While youre building your credit score, its essential that you make all of your payments on time.

Even one late payment can cause your score to drop. And if you fail to make up for a missed payment within 30 days, your account could be labelled delinquent, a stain that will stay in your credit history for up to nine years.

Your utilization ratio is the amount of credit youre currently using divided by the total amount of credit you have available to you, expressed as a percentage.

Ideally, you want to keep your utilization ratio below 30%. So if youve only got one credit card and it has a $1,500 limit, you should aim to have less than $500 in debt on it at any given time.

If possible, try to pay off all your balances in full each month. That way, your credit utilization will be 0%.

The amount of time youve had credit also plays a role. If youre a new user, the length of your credit history will be quite short, and there isnt much you can do about it but wait.

Once youre a bit further along, make an effort not to cancel old credit cards even if you dont use them very often. All active cards count toward your credit length.

Hard inquiries

Understand How Your Credit Score Is Calculated

Your credit score may look like a simple three-digit number, but it’s determined by math formulas that consider many different financial factors. Ultimately, a credit score is an attempt to summarize your history with borrowing and repaying debts. Here are the main components that go into calculating your credit score:

It’s also important to understand the types of financial accounts that impact your credit scores. Checking and savings accounts do not play a role. Instead, your credit file focuses on the accounts you’ve opened to borrow money. These come in two forms:

- Installment credit: This is a loan in which you borrow a set amount and repay in fixed monthly installments with interest. Once you’ve repaid the loan in full, you’re done with it. Examples include personal loans, auto loans, mortgages and student loans.

- Revolving credit: This type of credit includes credit cards and lines of credit. Rather than providing a lump sum that you repay over time, revolving credit allows you to borrow repeatedly up to a given limit and repay it in variable amounts. You only pay interest on what you use.

Also Check: How To Check Credit Score Without Social Security Number

Keep Your Balances Low

As you begin to build your credit history, try to keep your credit card balances as low as possible. You might be tempted to use your new credit to make purchases that you might not be able to pay off right away. But carrying a high credit card balance month-to-month could cost youin both interest charges and credit score points.

Remember, 30 percent of your credit score is based on the amount of credit youre currently usingso if youre trying to build good credit, dont let your balances get too high.

What Does Your Credit Score Start At When You Turn 18

Have you ever wondered what credit score everyone starts at? You might be surprised to learn that it takes over six months to get to square one!

We all begin without a credit history, and reaching your 18th birthday does not automatically set the wheels in motion at the consumer reporting agencies.

Credit scores need data to make predictions about future behavior. Therefore, you have to build a file from scratch by borrowing money before getting your first rating.

Fortunately, you can find lenders willing to approve first-time borrowers without a consumer file or rating. Then, your behavior determines where your initial credit score will fall relative to the average.

Don’t Miss: Does Opensky Report To Credit Bureaus

What A Fair Credit Score Means For You:

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

What Your First Credit Score Means

Simply having a credit score to begin with tells you a lot. For starters, it indicates that you have enough credit history to actually generate a score. Your first credit score will also clue you in to the following:

- The nature of your initial performance as a borrower, considering that mistakes are magnified in a thin file. So if you start with a bad score, it will be obvious that some measure of habit change is in order.

- The types of financial products youre likely to garner approval for as well as which are best left alone. For instance, if your first credit score is 650, then youll have a good chance at getting a limited-credit credit card but not an offer that requires good or excellent credit for approval.

- The possibility of identity theft. If youve yet to intentionally kick off your credit career, the mere presence of a credit score could be an indication that someone applied for credit in your name. Dont jump to any conclusions, though, as you could have built a bit of credit as an on a parents account, for instance.

You can sign up for WalletHub to get your free credit score and learn more about what it means. We update our scores on a daily basis, provide in-depth analysis of your credit standing and offer customized credit-improvement advice.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

Also Check: Opensky Billing Cycle

What Is Your Credit Score If You Have No Credit

If you have no credit history, you are credit invisible. That means none of the three major credit bureaus have a credit history on you. That might be because youve never applied for credit or youve paid for everything in cash. If youve never used credit or applied for a loan, youre credit unscorable. That means that you may have a credit file at the major credit bureaus, but theres not enough history to calculate a credit history.

Limit Your Requests For New Creditand ‘hard’ Inquiries

There can be two types of inquiries into your credit history, often referred to as “hard” and “soft” inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you preapproved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because you’re facing financial difficulties and are therefore a bigger risk. If you are trying to improve your credit score, avoid applying for new credit for a while.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

How To Earn A Fair Credit Score:

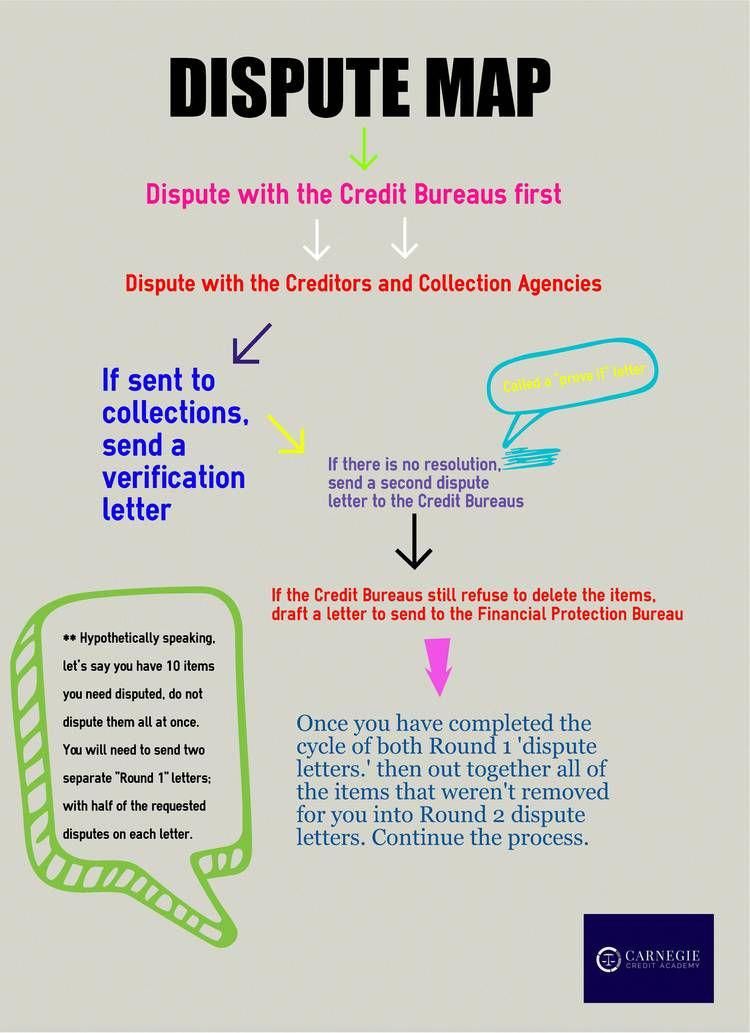

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

When Does The Reporting Clock Start

The credit reporting time period for debt collections starts from the date of the delinquency that caused the collection. With collections resulting from a charge-off, it starts the date the account was charged off . So, if you were first late in February 2013 and the account was charged off in July 2013, the account should fall off after July 2020. Some versions of your credit report may include phrasing that indicates when the collection will fall off your credit report, such as, “Scheduled to report until 06/2020.

The for debt collections is based on your delinquency with the original creditor, not when the debt collector started collecting on the debt.;

Also Check: What Is Cbcinnovis On My Credit Report