What Is A Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A credit-builder loan is designed to help people who have little or no credit history build credit. A good score makes approval for credit cards and loans, at better rates, more likely.

Credit-builder loans do not require good credit for approval. They do require that you have enough income to make payments.

These loans can help the “credit invisibles” get on the credit score radar and can be a good choice for credit newbies. Consumers with existing debt are not likely to see as much benefit. A Consumer Financial Protection Bureau analysis of about 1,500 consumers, released in 2020, found that credit scores of participants who did not have existing debt went up 60 points more than those who had existing debt.

Ways To Get A Credit Limit Increase

Each card company has its own process, so start by visiting your card issuer’s website and searching for information on credit line increases. You may be able to submit your request online or on the card’s mobile app. In some cases, you may need to call the number on the back of your card and make your request by phone.

When you request an increase, you could be asked to provide the following information:

- Annual income

- Employment status

- Monthly rent or mortgage payment

You may also be asked why you’re requesting an increase and/or how much of an increase you’d like. Be realistic with your request. If your current credit line is $3,000, asking to bump it to $4,000 is more reasonable than going for $10,000 in a single jump.

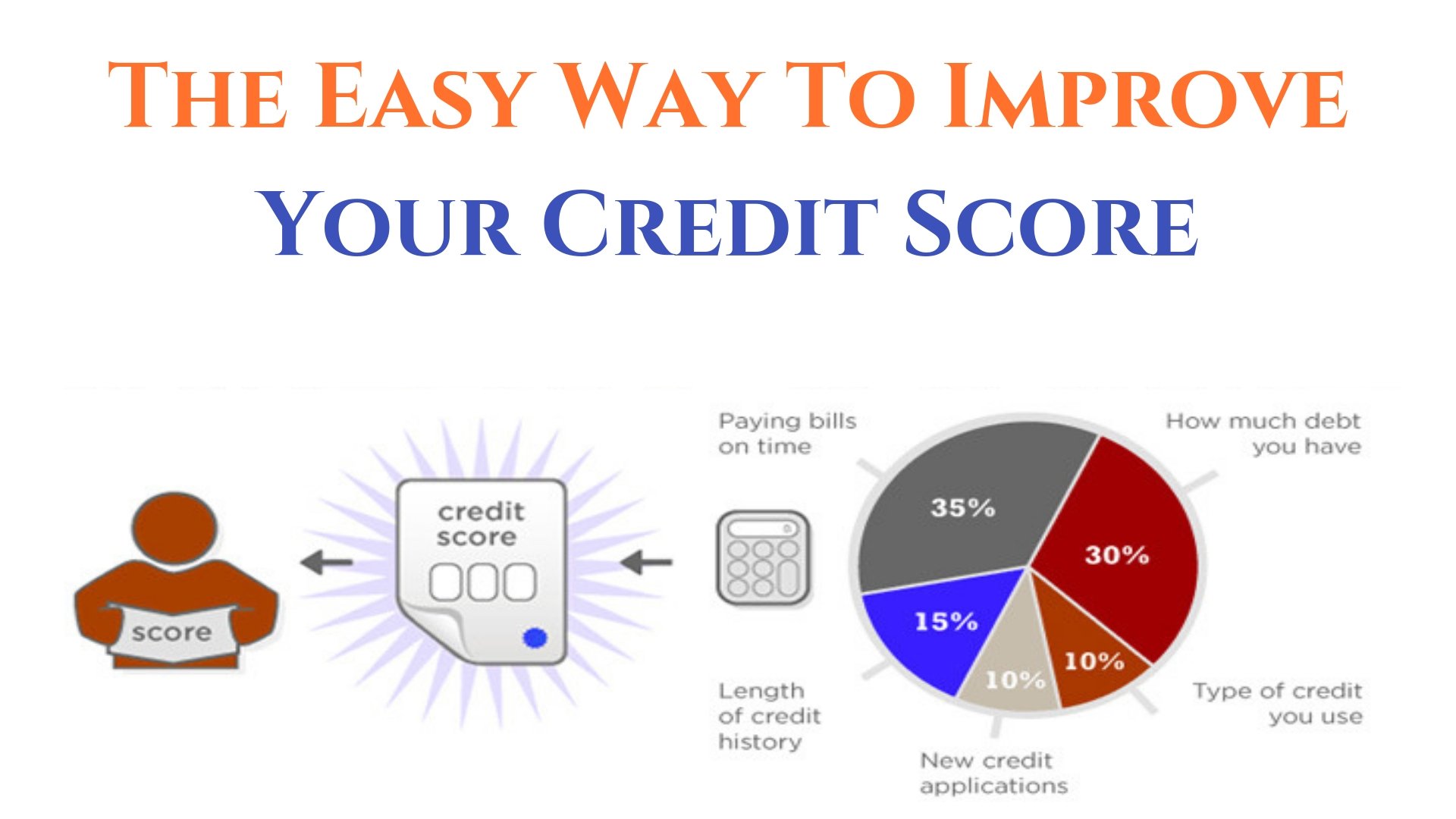

Understanding Your Fico Score

Your FICO score is based on the following:

- Payment history: 35%

- Account age/length of credit history: 15%

- New accounts/hard inquiries: 10%

The VantageScore, another consumer credit rating system, uses similar criteria, in a slightly different formula developed by three .

Clearly, the most important factors are establishing a history of on-time payments to all creditors and keeping debt low in relation to the amount of credit available to you .

Recommended Reading: How To Fix A Repo On Your Credit

Should You Use A Credit Repair Service

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If youve been trying to build your credit score, you may be considering hiring a credit repair service to help. These companies aim to build your credit by disputing outdated or incorrect information on your credit reports, following up on results and monitoring to be sure errors don’t reappear.

Note that credit repair cant do anything that you can’t do on your own, and it can’t remove negative marks from your credit reports if they’re accurate, timely and verifiable.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Read Also: Carmax For Bad Credit

Don’t Let Your Partner Or Flatmate’s Score Wreck Yours

It’s not usually whether you kiss, hold hands, live together or even being married that links your finances, it’s simply whether you have a joint financial product.

If you are financially linked to someone on any product, that means their files can be accessed and looked at as part of assessing whether to accept you. Even just a joint bills account with flatmates can mean you are co-scored.

Therefore if your partner/flatmate has a poor history, keep your finances rigidly separate, and it should maintain access to good credit for you. If your finances are already linked and you’ve split up with your partner or moved out of your flat-share, make sure you take the time to financially de-link and ask the credit reference agencies for a notice of disassociation .

There are currently only four products that can infer financial linking a joint mortgage, a joint loan, a joint bank account , and in certain circumstances, your utility bills. Being jointly named on a bill with a flatmate shouldn’t mean you are financially linked this should only happen when the energy firm is confident you’re a couple .

It’s worth noting that while many people think they have a “joint” credit card, these technically don’t exist. It’s one person’s account, the other just has a second card to access it.

Become An Authorized User On A Credit Card

Ask a friend or family member to contact their credit card issuer and have you registered as an authorized user. The card issuer will need your personally identifiable information in order to process the request. And the payoff can be big: you may find yourself with a credit score boost in a few months time.

You May Like: Credit Karma Rapid Rescore

Pay Down Your Balance

According to Fair Isaac Corp., aka FICO, the company that calculates one of the most widely used credit scores, 30% of your FICO score is based on the amount you owe.

However, its not simply how much you owe thats important. Its how much you owe compared with how much credit you have, a ratio known as your credit utilization rate.

For example, if you have a $10,000 credit limit and a $5,000 balance, your credit utilization is 50%. If youve maxed out that $10,000 limit, your utilization is 100%.

There are many theories on the ideal credit utilization rate, but Experian suggests its best to have a rate of less than 30%. In other words, you should never have more than $3,000 charged at any time if you have a $10,000 limit.

If your credit utilization rate is high, paying down your balances is a quick way to lower that rate and thus boost your score. For more ideas on tackling debt, read 8 Surefire Ways to Get Rid of Debt ASAP.

Figure Out How Much Money You Owe

Gather all your bills and come up with a plan to pay them off. The snowball method focuses on paying off the lowest balances first, while the avalanche method focuses on paying off the balances with the highest interest rates first. If you have too many credit cards to keep track of, you could also consolidate your credit card debt into one balance transfer card to make it easier to manage your monthly payments.All three strategies could help you pay off your credit card debt more quickly, lower your credit utilization ratio and raise your credit scores. So, choose the plan that works best for you, and stick with it.

Also Check: Sync Ppc On Credit Report

Pitfalls To Avoid When Working On Your Credit Scores

When it comes to building credit, its easy to get overly focused on ways to raise your credit scores fast. The truth is that building credit takes time. So take a step back and make sure your strategy doesnt do more harm than good.

Here are a few donts to keep in mind.

- Dont apply for a bunch of new credit cards just because you want to increase your credit utilization. Even though this might help lower your credit utilization ratio, it could also make you look like a risky borrower thanks to the new hard inquiries on your reports.

- For the same reason, dont take out a loan just to improve your credit mix. Only apply for a new loan if you actually need it.

- Dont carry a balance on your credit card just so you can build credit. Carrying a balance can lead to unnecessary interest charges, and it might actually hold your scores down by increasing your credit utilization ratio.

- Dont cancel your credit card after you pay it off unless you have a good reason to do so. Closing your credit card will hurt your length of credit history, so its better to leave it open, even if youre not using it anymore. Of course, if having a card tempts you to spend more, or it comes with an expensive annual fee, you might want to rethink this conventional wisdom.

Have Different Types Of Accounts

Your credit score improves when you have experience with various types of credit accounts. That means having both credit cards and installment loans, especially a mortgage, on your credit history.

You shouldnt necessarily take on new accounts, especially large loans you cant afford, for the sole purpose of boosting your credit score. Instead, open accounts as you need them, but be wise about the types of accounts you open.

You May Like: How To Remove Hard Inquiry From Transunion

Important: Your Credit History Impacts Your Creditworthiness But You Don’t Have A Uniform Credit Score Or Credit Rating

Don’t fall for the misconceptions, as in the UK, there’s no one credit rating or score that is a market-wide judge of your creditworthiness, and there’s no blacklist of banned people.

While individual credit reference agencies may give you a score, that is simply their view of your history, sometimes as a means to sell you that verdict as part of a subscription service.

Yet the agencies just collect data that they share with lenders. It’s lenders that make decisions whether to give you credit and each lender scores you differently and secretly, and their scores are far more important.

Here are our nine other credit rating need-to-knows:

Tips For Making A Career Change From Someone Who Has Done It

Is it better for your credit to pay off your credit card in full each month or keep a small balance?

“Paying off a debt in full every single month is like fairy dust on your credit score. It’s like you paid off a mortgage. It’s like you paid off a car,” Aliche says. It doesn’t matter how big or small your balance is. The credit bureau just likes to see that you pay off your balance, in full, every month. It’s the habit that counts.

You might have heard it’s good to keep a small balance, but Aliche says that’s a misconception.

“Only the credit card companies want you to keep a balance, because if you don’t keep a balance, what are they going to charge you? There’s no fees when you pay off in full.”

What about asking for a credit limit increase? Can you ask for it? Will that hurt your score?

When you ask for a credit limit increase, Aliche says, the credit card company will either do a “hard inquiry” or a “soft inquiry.” A “hard inquiry” is when you give someone permission to “to see all of your grades and then they make a decision whether they want to lend to you.” That inquiry can impact your credit score.

Before you ask for an increase, ask your credit card company if it’s a hard inquiry. If it is, you need to ask yourself if it’s worth the potential credit score hit. There’s no way to know if you’ll be approved for the increase, Aliche says, but if you have strong credit , you’re more likely to be approved.

Now, here’s some credit score 101:

For more Life Kit, .

Don’t Miss: Carmax Bad Credit Loans

Don’t Ask For Credit Too Often

Getting a new card from time to time shouldn’t ding your credit, nor should taking out a car loan or mortgage. People who default on loans tend to rack up a great deal of debt before they default, so lenders keep an eye on how many times you ask. New inquiries are 10 percent of your FICO score.

Lenders will pull your credit report when they are considering making a loan to you, and this type of inquiry is called a hard inquiry. Hard inquiries stay on your credit report for about two years. Lenders look at a cluster of hard inquiries as a sign of financial trouble.

“Soft inquiries are when someone looks at your credit as a background check an employer, for example, might pull your credit report if you’ve applied for a job. And sometimes lenders will pull your report to see if you’re a good candidate for a new credit card. Soft inquiries don’t affect your credit score.

John Waggoner covers all things financial for AARP, from budgeting and taxes to retirement planning and Social Security. Previously he was a reporter forKiplinger’s Personal FinanceandUSA Todayand has written books on investing and the 2008 financial crisis. Waggoner’sUSA Todayinvesting column ran in dozens of newspapers for 25 years.

Also of Interest

Featured AARP Member Benefits

Employing Other Types Of Credit

Car dealerships may actively market to people who have recently emerged from bankruptcy. A few months after receiving their bankruptcy discharge, consumers may start receiving letters from dealerships offering to help them re-establish credit through the purchase of a new car . The terms on these types of loans may fall in line with the terms offered in other parts of the subprime marketthey aren’t good, but they are not horrible, either. Since you recently filed for bankruptcy, you’re considered a risky borrower.

Whereas folks with a decent credit score might get loans at a rate of 5%, these loans could come with rates as high as 18% or more. If you can afford to stick to payments with such high rates, you could use these loans as a way of building credit.

However, this strategy is generally not advisable unless you have the cash or income to support such a high-interest payment. A good rule of thumb for interest payments is that you should try to avoid any interest rate that is higher than the rate you could reasonably expect to earn by investing your money in the stock market .

You May Like: How To Check Credit Score With Ssn

Here Are 10 Ways To Increase Your Credit Score By 100 Points

How To Report And Fix Any Errors On Your File

If you do spot any mistakes, challenge them by reporting them to the credit reference agency.

They have 28 days to remove the information or tell you why they dont agree with you.

During that time, the mistake will be marked as disputed and lenders arent allowed to rely on it when assessing your credit rating.

Its also best to speak directly with the credit provider you believe is responsible for the incorrect entry.

Negative information in your name usually stays on your credit report for six years and cant be removed sooner if its accurate. However, if there were good reasons why you fell behind with payments that no longer apply, such as not being able to work during a period of illness, you can add a note to your credit report to explain this. This note is called a Notice of Correction and can be up to 200 words long

Read about notices of correction on the Experian website

Find out more about correcting personal information on your file on the Information Commissioners Office website

Read Also: How To Dispute Repossession On Credit Report

Reduce The Amount Of Debt You Owe

Your , or the balance of your debt to available credit, contributes 30% to a FICO Score’s calculation. It can be easier to clean up than payment history, but it requires financial discipline and understanding the tips below.

Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score.

Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving debt. In fact, owing the same amount but having fewer open accounts may lower your scores. Come up with a payment plan that puts most of your payment budget towards the highest interest cards first, while maintaining minimum payments on your other accounts.

Don’t close unused credit cards as a short-term strategy to raise your scores.

Don’t open several new credit cards you don’t need to increase your available credit: this approach could backfire and actually lower your credit scores.