What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 711 in 20202.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

Factors That Affect Your Credit Score

Your credit score is determined by a number of factors, from your payment history to the types of credit accounts you have open. Heres a closer look:

- Payment history : Your track record for making on-time and in-full payments on credit affects a large chunk of your credit score. Late payments, delinquent accounts and debt in collections can adversely affect your credit.

- Amounts owed : How much money you owe on credit accounts can negatively affect your credit if it appears that your finances are stretched thin. Maxed-out credit cards, for example, can hurt your credit score.

- Length of credit history : A long credit history can positively affect your credit. On the flip side, a short credit history could be harmful, as theres less evidence that you can manage credit for long periods of time. Factors assessed for this part of the score include the average ages of all accounts and how long its been since youve used them.

- Showing an ability to manage different types of credit products can have a positive influence on your credit score.

- New credit : Opening several credit accounts at once can be a red flag.

How A Bad Credit Score Isbad

As mentioned previously, a bad credit score is anything listed below 670. If you want to get more specific, a score varying between 580-669 is thought about fair, while anything in between 300 and 579 is considered poor. This is going off the FICO scoring thats most typically used.

Not sure what your credit score is? . Its free!

Having a bad score can stop you from doing a great deal of things. This includes getting approved for much better charge card, home loans, apartment or condos, individual loans, organization loans, and more.

Plus, any loans or credit cards you do get approved for will be a lot more pricey . This is due to the fact that lending institutions charge much higher interest rates to those they consider high risk in order to offset the additional danger they feel theyre taking by loaning you money.

How do they get more expensive? By charging greater interest rates. If you take out a $10,000, 48 month loan on a automobile with a 3.4% interest rate, youll pay about $704 in interest over the course of the loan. If you got that exact same loan with a 6.5% rate due to bad credit, you d pay about $1,376 in interest. Thats nearly double!

You May Like: Bp Syncb Pay Bill

Increase Your Available Credit

Work to increase your available credit over time by applying for new lines of credit. Consider applying for a mix of credit that includes both revolving debt and installment debt . Dont apply for too much credit at once, because that could lower your credit score due to the hard credit inquiries associated with each application. Instead, wait between three and six months before adding another line of credit to your account.

What Are The Benefits Of 850 Credit Score

Everyone dreams of having an 850 credit score. Its the highest score possible under most FICO scoring formulas. Its been listed as one of the most common wishes that American adults would make. Get to know the benefits of 850 credit score?

Very few people in the United States actually have a credit score of 850, though. So we set out to answer the question: what does an 850 credit score actually get you? But first, lets break down some information about credit scores and why an 850 is so good.

Don’t Miss: What Credit Bureau Does Affirm Use

Reduce Your Credit Card Balance

Most experts recommend keeping your credit utilization rate below 30% though those with at or near-perfect credit scores typically keep that utilization rate below 7%, according to Ulzheimer. So, consider chipping away at those credit card balances and minimizing how much you charge if you want to work toward higher credit.

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

Also Check: Does Paypal Report To Credit Bureaus

Why Is My Fico Score Higher Than Credit Karma

Why your Credit Karma credit score differs This is mainly because of two reasons: For one, lenders may pull your credit from different credit bureaus, whether it is Experian, Equifax or TransUnion. Your VantageScore® 3.0 on Credit Karma will likely be different from your FICO Score that lenders often use.

What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

Recommended Reading: Credit Inquiry Removal In 24 Hour Free

How To Get A Perfect Fico Score If You Want One

Even though you don’t technically need a perfect FICO® Score, you may still want one. If you do, there are a few key things you can do to try to get the highest possible score:

- Always pay your bills on time. A single late payment will make a perfect score all but impossible to achieve.

- Keep your credit utilization ratio as low as possible. This is the amount of available credit used versus the amount available. While keeping it below 30% avoids hurting your score, those with the best FICO® Scores have an even lower utilization rate.

- Avoid getting too many inquiries on your credit report. When you apply for credit, you get a new hard inquiry that stays on your report for two years. Recent hard inquiries or an excessive number make it difficult to get a perfect score.

- Keep old credit cards open. The older the average age of your accounts, the higher your score should be.

While doing these things won’t necessarily mean you earn a perfect score, they’re essential prerequisites if you want one. Ultimately, it will take time and a lot of responsible borrowing behavior to get an 850 score.

Watch Your Credit Utilization

The term credit utilization refers to the percentage of your total available credit that you use every month. For example, if you have a credit card with a $1,000 limit and you put $100 on your card, you have a utilization rate of 10%. Your credit utilization contributes to about 30% of your credit score.

When you have a low credit utilization rate, your credit score goes up. This is because lenders assume that you dont overly rely on credit. To reach an 850 credit score, try to keep your credit utilization at or lower than 10%. If thats not possible, shoot for less than 30% utilization.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Whats The Average Fico Score Powered By Experian

Your FICO Score powered by Experian data can range from 300 to 850 and can influence what credit is available to you, how much interest youll pay and even things such as your utilities and mobile phone options. Approximately 1% of consumers with a credit score between 740 to 799 are likely to become seriously delinquent in the future.

How To Get A Perfect Credit Score

Want to know how to get a perfect credit score? Start by building good creditwhich you can do by making all of your on time and keeping your below 30 percent. Once you have established good or excellent credit, you can start taking the extra steps that may, with time, help you achieve perfect credit.

Read Also: Why Is There Aargon Agency On My Credit Report

What People With 800+ Credit Scores Have In Common

Only about 1 in 6 American consumers has a FICO credit score of 800 or higher. A FICO score in the mid-700s is generally considered good enough for the best rates and terms from lenders, but those with 800+ scores do have some things in common.

Obviously, they dont miss payments. LendingTree said everyone in the 800-club pays their bills on time every month, which aligns with the fact that payment history is the most important factor of a credit score, weighed as 35% of the score.

They also use only a small portion of their credit limits each month. Credit utilization is the second-most important factor in determining credit scores, and those with scores of 800 or higher come no where near their maximum available credit lime. LendingTree said the average credit utilization for those with the highest scores is less than 6%.

But, since those people are more likely to have considerably higher credit limits, 6% can go a long way in terms of how much actual money accessed that is.

It really does give a bit of an advantage to higher-income folks who are more likely to have a higher credit limit, which gives them a larger margin for error than a lot of folks have, said Matt Schulz, chief industry analyst at LendingTree.

The 800 club also tends to have some long-established accounts. Those with scores of 800 or higher have had at least one open account for an average of more than 27 years.

Monitor Your Credit Regularly

Consider credit monitoring to make sure your efforts to achieve credit score perfection are accurately reflected. Credit monitoring services can help you spot inaccuracies, and even possible identity theft. My LendingTree is one service that offers credit monitoring, and can also help you shop for loans.

Recommended Reading: What Credit Score Does Carmax Use

Ways To Improve Your Credit Score

If you want to get a loan or a credit card, you want to have the best credit score possible. If youre looking to improve your score, there are a few things you can focus on:

- Pay your bills on time: This is one of the most important aspects of your credit score, so make sure you are staying up to date on any and all bills you owe each month

- Keep your credit card balances low: While it is important to use your credit cards to prove you can pay them off, make sure to keep your balances relatively low. Generally you want your balance each month to be less than 30% of your total available credit.

- Avoid having too many credit cards: Dont get new credit cards just because you can get a free gift or because the deal looks too good to pass up. Only open new cards as needed.

- Rectify inaccuracies on your credit report: There could be mistakes on your report dragging down your score. Deal with those.

- Dont close your credit card accounts: If you dont use a card anymore, thats fine, but dont close the account. Just keep the card in a drawer.

There isnt any foolproof plan to raise your credit card in a short time frame, so dont fall for anyone telling you thats possible. Just follow these general rules and be smart, and you could see your score rising over time.

Is It Possible To Get An 850 Credit Score

It is possible to get an 850 credit score. In my entire life, including my time as a bank manager approving credit cards, mortgages and lines of credit, Ive seen it one time. I sat with my dad, who has a credit history with more years than my age, and pulled up his score on Credit Karma. He had the coveted 850.

But in reality, his 850 credit score is worth little more than a FICO credit score of around 780 and above. Once you reach the top tier with a high credit score, you will be approved for virtually all loans with the best interest rates if the rest of your personal finances are in good shape. Odds are, with an 850 credit score, you have things well under control.

Recommended Reading: How To Report A Death To Credit Bureaus

Review Your Credit Reports

Dont forget to review your credit reports regularly and dispute any errors you find. Many Americans dont realize that their credit reports contain inaccurate informationyour credit report might list a credit account that actually belongs to someone with a similar name, for exampleand those kinds of errors can drag down your score.

Do You Need A Perfect Fico Score

While a perfect FICO® Score may get you bragging rights, you don’t really need one to qualify for the best rates, access to the best rewards credit cards, or maximize your loan approval chances. A score of 800 or higher is considered to be exceptional, while a score of 740 to 799 is classified as very good.

In 2019, 45% of all American consumers had scores that were classified as either very good or exceptional, while an additional 21% of consumers had scores considered to be good. This means that a majority of Americans shouldn’t have a difficult time borrowing at good rates, even if they aren’t one of the elite few with an 850 score.

Read Also: Credit Report With Itin Number

How Do You Get An 850 Credit Score

If you are determined to improve your credit to reach that perfect score for bragging rights, you may have a long journey ahead. There are just a few . If you manage them all well, you can get the best possible 850 credit score.

Start by keeping your revolving credit balances low and consider trying to raise your . These are accounts like credit cards and lines of credit. Some experts a reasonable is when you keep the balance below 20% or 30% of your total available balances. In reality, however, the best balance to get the highest credit score is $0.

At the same time, you should never, under any circumstances, make late payments. You can use automatic recurring payments or sign up for payment reminders to help make sure you dont miss a due date. Just one late payment will keep you from a perfect credit score for at least seven years.

You will also need a large mix of accounts to join the 800+ credit score club. The Self Credit Builder Account counts as one credit line if you are a customer. Perfect credit requires a mix of both revolving credit and installment loans. Installment loans are loans with a fixed payment like student loans, a personal loan, a car loan or a mortgage.

Signing up for new credit can harm your score in multiple ways, and just an application or two in the last two years may keep an otherwise perfect score in the 780-849 range. New stay on your credit report for two years.

A Perfect Credit Score Of 850 Is Possible But It Probably Doesn’t Matter

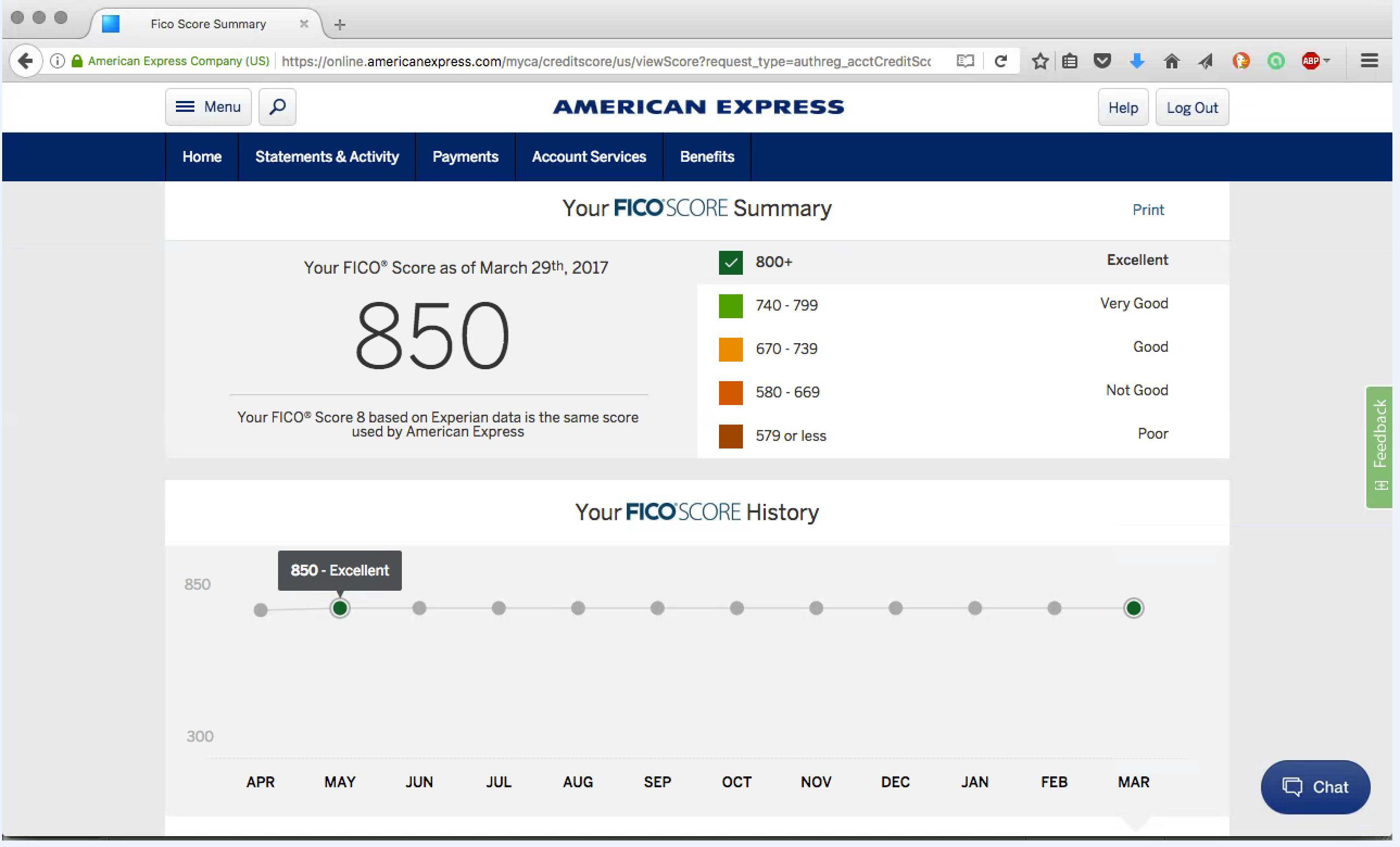

Lyn Alden recently accomplished something that few people have: She earned an 850 .

The Atlantic City, New Jersey, resident, who provides market research to individual investors and financial professionals, achieved her perfect credit score three months ago, up from 841 in prior months and 832 a year ago.

It was no easy feat. Out of the 200 million Americans who have FICO credit scores the most commonly used credit scoring model only about 1.4% have perfect 850s, Bloomberg reported.

Alden points to her long credit history, no missed payments and very low credit utilization for her 850 score. I dont open new accounts too frequently to churn for credit card rewards and have successfully paid off numerous student loans, she added.

But what, exactly, is the winning formula for a perfect credit score? If there is one, no one except perhaps the credit scoring analysts truly know. There is a multitude of factors that affect scores, and they can change depending on your specific situation. Plus, FICO keeps its scoring model largely a secret.

Even so, we do know the basic factors that influence credit scores. So if youre chasing the elusive 850, you have to crush it in every category.

Also Check: Does Paypal Credit Report To Credit Bureaus