How To Raise Your Credit Score

While a 700 credit score can help you qualify for a mortgage, you might get better loan terms by boosting your score which could save you thousands of dollars over the life of the loan.

If youve been monitoring your credit, you have a good idea of where your credit score stands.

Here are some ways you can improve your credit scores:

- Pay down your debt balances.

- Always make payments on time. Automatic payments or monthly alerts can help.

- Become an authorized user on someone elses credit card account.

- Only open credit accounts that you need.

- If some of your accounts are delinquent or you have a large amount of debt, consider contacting a credit counseling agency.

Best Mortgage Types For A 700 Credit Score

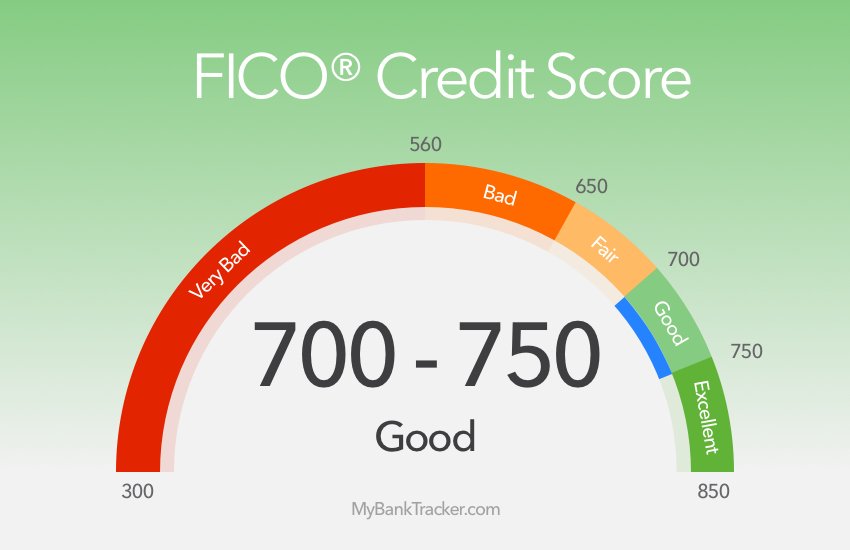

FICO says a 700 score is, near or slightly above the average of U.S. consumers.

And, says FICO, most lenders consider this a good score. That includes mortgage lenders.

So provided you have a steady income and manageable existing debt burden, you stand a good chance of being approved for most types of home loans.

When choosing the right one for you, think about your priorities. Do you want:

- The lowest rate?

- No mortgage insurance?

- An extra-large loan?

Each loan type offers unique benefits to help you meet one or more of these goals.

Here are some of your best options:

Conventional mortgage

A conventional mortgage is often best for those with a credit score of 700 or higher. .

Benefits of a conventional loan include:

- Buy a house with as little as 3% down

- Low rates, especially with a higher credit score

- Higher loan limits than FHA

- Option to avoid mortgage insurance or cancel it later

The big benefit of choosing a conventional loan over an FHA loan is that mortgage insurance can be canceled later on, which will reduce your monthly payments.

And if you make a 20% down payment with a conventional loan, you wont have to pay for mortgage insurance at all.

Pretty much all lenders offer conventional loans, so youll have your pick of the market and the flexibility to shop for lower rates.

VA loan

For those who do qualify, VA loans are often the best possible deal.

Jumbo loan

USDA loan

FHA loan

Monitor Your Credit Score From Now On

You should do this at least on a monthly basis. That will give you an opportunity to identify any irregularities immediately.

Brand-new issues are easier to fix than those that have been sitting for a few months or years. The information will be fresh on your mind, and youll likely have documentation to prove your case.

Also Check: Does Acima Report To Credit Bureaus

Build Your Credit Mix

We generally dont recommend taking out a potentially expensive loan just to build your credit scores. But its true that having a mix of different types of credit can benefit your scores over the long term. Types of credit include revolving credit and installment credit .

But theres a wrinkle: Applying for new credit can lead to a hard inquiry on your credit reports, which can have a negative impact on your scores. While this impact is typically minor, too many hard inquiries in a short time period can be a red flag to lenders. Thats why its important to have a general sense of how likely it is that youll be approved before you apply for a credit card or loan.

Formulating A Plan To Improve Your 710 Credit Rating

First aid foremost, you need to understand that it takes time for you to build up your credit score. Dont expect it to be improved in the next week or the next month, even if you do everything necessary to improve it.

If you have any negative factors on your credit report right now, including a late payment, a bankruptcy, or an inquiry, you may want to pay the bills now and then wait. Remember that time is your ally, not your enemy. In the end, there is no quick fix for rebuilding a credit score. It takes time.

In formulating a plan to rebuild your credit rating, you need to understand how specific actions that you take will harm or hurt your credit score. For example, will working with your creditor to close an existing account in favor of rebuilding a new one with more favorable terms hurt or harm you?

Here are two factors for you to consider: a change to your credit report will affect your credit score , and your score is based entirely on the figures that are already in your report.

A major question that people have is how long it will take for them to improve their credit score. But heres what these people are missing: there isnt anything you can do to boost your actual score. Instead, you can do many things to rebuild your history of credit, and the healthier your credit history, the more elevated your credit score will be.

Recommended Reading: What Credit Report Does Comenity Bank Pull

How To Keep On Track With A Good Credit Score

Having a Good FICO® Score makes you pretty typical among American consumers. That’s certainly not a bad thing, but with some time and effort, you can increase your score into the Very Good range or even the Exceptional range . Moving in that direction will require understanding of the behaviors that help grow your score, and those that hinder growth:

Late and missed payments are among the most significant influences on your credit scoreand they aren’t good influences. Lenders want borrowers who pay their bills on time, and statisticians predict that people who have missed payments likelier to default on debt than those who pay promptly. If you have a history of making late payments , you’ll do your credit score a big solid by kicking that habit. More than one-third of your score is influenced by the presence of late or missed payments.

Utilization rate, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit, and then multiplying by 100 to get a percentage. Find your total utilization rate by adding up all the balances and dividing by the sum of all the spending limits:

| Balance | |

|---|---|

| $20,000 | 26% |

39% Individuals with a 710 FICO® Score have credit portfolios that include auto loan and 31% have a mortgage loan.

Credit Score: Personal Loan Options

With a credit score between 700 and 749, youre just one step away from the top rung of the credit score ladder. Working to improve your 710 credit score means getting the best personal loan rates possible. However, interest rates with a score in this range are still ideal. Theyll very from fourteen to sixteen percent, often falling on the lower end of that spectrum.

Also Check: Experian Boost Paypal

Improving And Maintaining A 710 Credit Score

The most important thing you can do is to stay on top of your credit by requesting copies of your credit report which you can do for free one time each year or for up to 60 days after you have been denied credit. At other times, you can get a copy of your reports for a small fee.

Your credit score will also cost you small fee, usually about $15, if you want to obtain the FICO credit score. The FICO credit score is the most commonly used by lenders, but you can access other credit scoring models for free through TransUnion or Experian credit reporting agencies. Accessing both your credit report and your physical credit score will show you not only where you stand but will give you the critical information necessary to repair and improve your credit.

Start by reviewing your information. Since the data being reported and collected about you has a human element, there is always the chance for human error which can impact your credit score. Take the time to review your reports line by line for accuracy. File disputes with the credit reporting agency per their protocol as soon as you discover errors. The agency then has an obligation to investigate every dispute it receives. If the information is found to be erroneous, your report will be corrected. This task, as simple as it sounds, can have a significant impact on your credit score but it is important that you follow through and then follow up to ensure the report is corrected accurately.

Credit Score Average Mortgage Interest Rate

A 710 CIBIL score means you have good credit, and if you’re looking for a mortgage you can expect interest rates around 2.68%. If you want to qualify for lower interest rates , a seasoned credit repair expert can help. Credit Glory identifies errors on your credit report, removing them , so you qualify for the best deals on loans.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Strategies To Raise Your Score Above 700

The single biggest element in the calculation of your FICO score is the timely payment of bills. This makes up 35% of your score.

But, with your 700 FICO score, you probably already know that. So lets assume youll continue doing so.

What else can you do? Well, here are some dos and donts:

For more tips, see How to raise your credit score fast.

Why Your Credit Score Is 710

Each credit score is uniquely created by the person it belongs to. Your score of 710 represents years of collective financial activity and behaviors as youve earned, spent, borrowed, and paid back money.

This can make it difficult to be overly specific regarding how you got your score to the 710 point. Nevertheless, there are several generic elements that tend to influence your score more than other things.

Consider each of the following six categories. With each one, examine your own personal behavior and consider if it has impacted your credit score in a positive or negative manner.

Read Also: How Long Do Inquiries Stay On Chexsystems

How To Improve Your 710 Credit Score

A FICO® Score of 710 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 710 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

46% of consumers have FICO® Scores lower than 710.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Experian Equifax And Transunion Credit Score Ranges

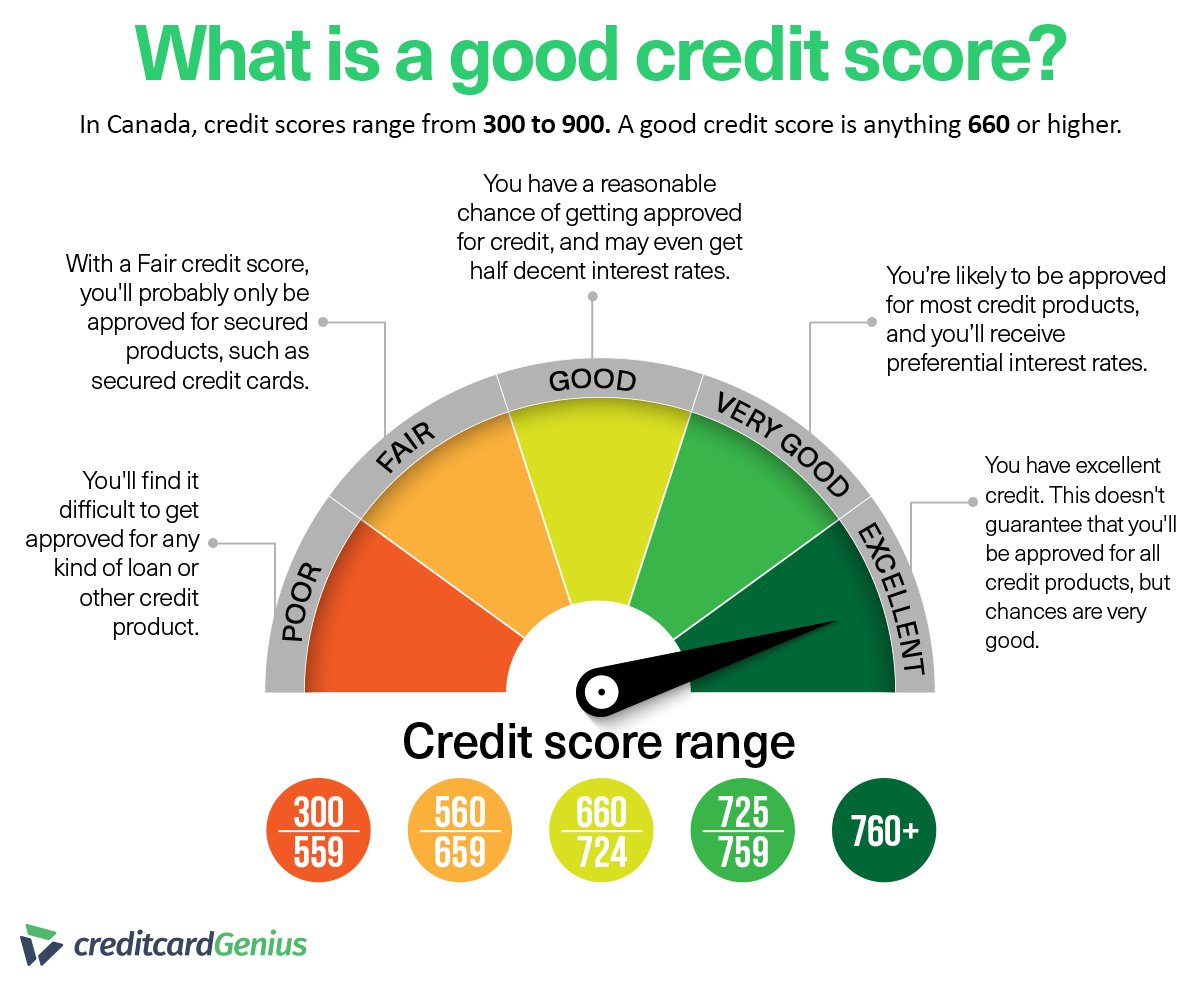

Were often urged to build a good credit score or improve our rating if it isnt good enough, but what exactly is a good credit score in the UK?

With so many different and credit checking websites to choose from, often with varying and ranges, the answer is unfortunately not as simple as one three-digit number.

Here, we explain what each credit reference agency considers to be good credit rating, what credit score you might need for a mortgage, and where you should go to check your credit score.

Also Check: How To Report To A Credit Bureau Landlord

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

How To Improve A 710 Credit Score

Its a good idea to grab a copy of all three of your credit reports from Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law to help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items. They have over 28 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

Read Also: How Can You Get A Repo Off Your Credit

How Long Does It Take To Get A 710 Credit Score

It depends where you started out.

If you had fair credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Can I Get A Personal Loan Or Credit Card W/ A 710 Credit Score

Like home and car loans, a personal loan and credit card isn’t very difficult to get with a 710 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 710 score means you likely have a few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Read Also: Barclaycard Fico Score Accurate

Is 710 An Average Credit Score

To better understand what an average credit score means, you should know what an average credit score is. A three-digit number presents a credit score. Its primary purpose is to give a potential lender an idea of your credit health.

To put it in simpler terms, your credit score provides the lender with an idea of how likely you are going to pay back the money you owe. While it is true that a 710 credit score is not the only factor a lender will assess. Its a very crucial one.

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often

Don’t Miss: Syncb/ppc

What Is A Good Credit Score On Clearscore

ClearScore a popular credit checking website in the UK uses Equifax as its CRA or its source of data, meaning that the information you are presented with on ClearScore has come from Equifax.

This basically tells us that a Good credit score on ClearScore is therefore the same as it is on Equifax anything above 420.

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

Recommended Reading: Ccb Mprcc