Tip : Pay Bills On Time And In Full

Payment history is the most important factor making up your credit score. If you miss a payment, it will show up on your credit report, and multiple missed payments can make it impossible to achieve an excellent score. For this reason, you should always pay at least your minimum payment.

It’s also a good idea to pay off your bill in full each month to avoid potential late payment fees, penalty and interest charges that often result from carrying a balance.

As a rule of thumb, set up autopay for at least the minimum payment, so you can avoid forgetting a payment. You can also schedule email, text or push notifications through your card issuer.

If you struggle to remember to pay your bills each month , there’s an easy fix: autopay. If you’re not sure you’ll be able to pay your bill in full, you can set it so you just pay the minimum as a safeguard to avoid missed payments.

Here are some tips:

The sooner you start paying on time, the sooner your score will begin to improve. And just as a bit of motivation, older credit penalties, such as late payments, matter less as time passes. So start now and stay consistent.

Some credit building credit cards reward cardmembers with an automatic credit limit increase after they make six on-time payments. An example is the Capital One Platinum Credit Card.

See our methodology, terms apply.

Why Does A Good Credit Score Matter

A good or excellent credit score will save most people hundreds of thousands of dollars over the course of their lifetime. Someone with excellent credit gets better rates on mortgages, auto loans, and everything that involves financing. Individuals with better credit ratings are considered lower-risk borrowers, with more banks competing for their business and offering better rates, fees, and perks. Conversely, those with poor credit ratings are considered higher-risk borrowers, with fewer lenders competing for them and more businesses getting away with high annual percentage rates because of it. Additionally, a poor credit score can affect your ability to find rental housing, rent a car, and even get life insurance because your credit score affects your insurance score.

Your Business Will Be Financially Stable

Long-term success in business means building on a conservative financial basis and taking risks when new expansion is necessary. To achieve and maintain a good credit score, you need to develop certain financial habits. That means youll be saving money, planning your financial future and creating a stable and sustainable company. Having and maintaining a good business credit score means building a successful, long-term company.

Key takeaway: Having a good business credit score has several advantages, including better financing options and vendor terms that ease cash flow.

You May Like: Does Navy Federal Report To Credit Bureaus

Pay Your Balance In Full Every Month

The best habit you can build is to pay your card in full every month. If you nail this habit while youre learning to establish first-time credit, youll be light-years ahead of many long-time credit users.

Remember, it only takes a few casual swipes on your credit card to raise your balance to more than you can afford. While small charges dont feel like theyll add up to much, they do and fast.

Whats more, if you carry a balance over from month to month, then the interest charges can multiply your balances more than you could have imagined. So do yourself a favor and pay off your secured credit card every month.

Need help reading and understanding your credit statement? This template from the Consumer Financial Protection Bureau helps you see what to look for on your monthly credit card bill.

Next Steps: Build Excellent Credit

Once creditors start reporting information to the credit bureaus, the credit bureaus can use that information to create credit reports. Scoring companies can then analyze your credit reports to create credit scores.

Dont worry if you cant get a FICO® credit score immediately, because you need to have an account thats been opened for at least six months on your credit report before youre eligible for a FICO score. In contrast, VantageScore can provide you with a score after just one month. You can access your free VantageScore 3.0 credit scores from Equifax and TransUnion on Credit Karma anytime from any device.

As you start building credit, your financial goals may go beyond simply getting a credit score. Good or excellent scores can help you qualify for the best offers and not get held back by a lack of credit. Here are some steps you can take as you work toward building excellent credit.

While there are many intricacies to credit, you dont need to know all the ins and outs to build excellent credit. Start by opening accounts with creditors that report to the main consumer credit bureaus, paying your bills on time and limiting your credit card usage and, over time, you can get there.

Recommended Reading: What Does Dt Mean On Credit Report

How Long Does Improving Your Credit Score Take

There is no set minimum, maximum, or average number of points by which your credit score improves every month, and there is no set number of points that each action will gain. How long it takes to boost your credit depends on the specifics for why your credit score is low. If the major negatives on your credit score are credit utilization, and then you pay off your balances, your score can improve drastically in a single month. If your credit is low because of multiple collections and poor payment history, then it will take several months of on-time payments to see any positive movement in your score.

Pay Off Any Existing Debt

To reduce your credit utilization ratio quickly and improve your score, use the debt avalanche or debt snowball method to pay down existing debt:

- With the debt avalanche method, you focus on paying off your highest-interest debt first, followed by the debt with the next highest interest rate, and so on. However, be sure to make the minimum payments on any other cards in the process to avoid any penalties.

- The debt snowball method, on the other hand, focuses on paying off your smallest balances first while still meeting the minimum payment requirements for your other cards. This method is meant to help build momentum as you get a sense of achievement from paying off one card after another.

Read Also: Does Missing A Credit Card Payment Affect Your Credit Rating

Have Rental Payments Reported

If you pay rent on time each month, those payments could also potentially help you build credit. Like utility payments, rental payments are typically not included in your credit report. But you could ask your landlord or property management company to report your on-time payments through a service like Experian RentBureau.

If that’s not an option, third-party rent payment services may report payments to the credit bureaus for you. These companies may charge monthly or annual fees, which is something to consider when signing up.

How Is A Credit Score Determined

There are several factors that go in to your credit score. Its a good idea to understand how these impact your score both good and bad.

Your payment history: This looks at whether or not you pay your bills on time.

- Tip: Always pay the minimum payment due on time. Signing up for automatic/electronic payments can make this easier to remember.

Your credit utilization ratio: This measures how much credit you use compared to your credit limit.

- Tip: Use less than 30% of your total credit limit across all your cards. If you use more credit, your credit score may be lowered.

Your length of credit history: This basically means the longer youve been paying on time, the better.

- Tip: Instead of canceling old credit cards, consider keeping them open and active, without using them every day. To do this, try setting up a small automatic reoccurring charge that you can easily pay off each month.

Your credit mix: This looks at what types of credit you use: installment or revolving .

- Tip: Dont worry if you dont have a mix of these accounts today. Installment accounts likely come with time as you purchase larger items, like a car or a home.

: This looks at how often you are applying for new credit.

- Tip: Dont apply for, or close, several credit accounts in a short period of time. Doing so can ding your credit score.

Learn more about credit scores as well as how they are determined and how common each category is.

Also Check: What Does Transferred Closed Mean On Credit Report

What Makes Score Goals Different

What makes the Score Goals concept unique is that it offers tailored recommendations based on an individualâs specific credit score aspirations. Users should choose a goal based on their unique financial circumstances and will be presented with achievement timeframe options of 6, 12, 18 or 24 months. The model offers different recommendations based on each timeframe.

Depending on how close or far you currently are from your credit goal, it could take as little as a few months or up to a few years to achieve the score youâre seeking. Every time you log into the program, youâll see updated recommendations and information about your progress.

Why Is It Important To Have A Good Credit Score

With a high credit score, you’re more likely to get a better interest rate or terms when you look to borrow money. This can save you thousands of dollars over time.

Lenders examine a credit score to decide whether to approve home, payday, personal, title, auto, student and small business loans, security deposit financing, credit cards and buy-now-pay-later plans.

A good credit score isn’t just important for borrowing money. A wide range of other institutions also takes it into account. Here’s a short list of who may look at your credit score:

- Banks, credit unions and payment processors

- Retailers that accept personal checks

- Rent-to-own dealers

- Any business that extends personal credit

- Buy-now-pay-later companies

Building an on-time payment track record can give you access to credit when you need it most. With a good credit score, you’ll also have an easier time buying a home, auto or other big purchase.

Also Check: Does Sprint Report To Credit Bureaus

Building A Good Credit Score

Every financial decision you make may impact your credit score and your ability to get a job, loan, credit cards, basic utilities and services, even rent an apartment or lease a car. Good financial choices help lenders and businesses see you as low-risk. You’ll be more likely to receive financial opportunities, including higher credit limits and lower interest rates.

Are you wondering how to establish credit that will improve your credit report? You’ve come to the right place.

How to build credit history that benefits you:

Start earlyThe length of your credit history is a key factor in determining your credit score

Start smallLenders assume you don’t plan to live within your means when you apply for a lot of credit in a short period of time

Open store charge card or credit cards to build creditPay your balance in full each month or keep your balance low. If you don’t qualify for a store charge card or credit card:

How to rebuild your credit score:

Create a planDevelop a time frame and budget for paying off current debts

Become An Authorized User To Build Your Credit

Another potential option for using to start building credit history with responsible use is becoming an authorized user on someone elses credit card.3 Heres how it works: A credit card holder often a parent or family member adds you to their existing credit card account as an authorized user. You receive a personal credit card linked to their account, and as long as the primary cardholder agrees, you can use the card to make purchases. Although youre not the primary cardholder, the account is still reported to your credit report, which can help you to start building credit history with responsible use.3

However, its important to note that your and the primary cardholders can be impacted positively or negatively by each others credit card usage. So make sure that you communicate openly with each other and that expectations about purchases and payments are clear on both sides as youre working to build your credit.

Whether youre just learning how to start building your credit or working on a credit reboot, you can take advantage of the options discussed here to start building credit with a credit card. You can also monitor your progress along the way by staying on top of your credit score with a service like Discovers Credit Scorecard.2

If you prefer not to receive your FICO® Credit Score just call us at 1-800-DISCOVER . Please give us two billing cycles to process your request. To learn more, visit Discover.com/FICO.

You are leaving Discover.com

Don’t Miss: What Credit Score Is Needed To Buy A Lawn Mower

Build A Healthy Personal Finance Routine

One of the best ways that you can do to change long-term behaviors is to change short-term habits.

The most effective way of increasing my personal credit score has been having a long history of paying off the balance on my credit card, said Jacqueline Sanchez, a real estate developer and co-owner of Invested Wallet.

For Sanchez, keeping an organized track record of her finances has been a game-changer in her personal finance routine. For my personal household finances, I use Google spreadsheets. I created custom formulas and have multiple categories to track my households spending. I followed this practice before starting a small business. However, when I started my small business, I used Quickbooks since I didnt have as many transactions starting, she added.

While you do need a good credit history for a good credit score, try spending the money you already have on your debit card. Use your credit card for points and rewards but make sure you already have the money to pay your debt off at the end of the month!

See: 19 Ways To Tackle Your Budget and Manage Your Debt

How Do I Get My Credit Score Up 100 Points In One Month

Increasing your credit score by 100 points in a single month is almost impossible, especially if youre starting from nothing. However, if you have a significant mistake on your credit report, like a default that never happened or a credit card that doesnt belong to you, removing it can boost your score significantly.

Also Check: What Happens To Your Credit Score When You Get Married

Simple Steps Can Lead To A Bright Financial Future

. And having good credit can make it easier to rent an apartment, take out a car loan and buy a home, among other things. But it can be hard to know how to establish credit for the first time.

You might have no credit history, otherwise known as âcredit invisibility.â Or you might have thin credit, which means you donât have enough credit history to be scored. Whatever the case, there are several ways to establish credit. The general idea behind each strategy involves building a solid history over time with responsible credit use.

Where To Check Your Business Credit Score

Some third-party sites offer companies notifications when their credit scores change at the big agencies. This can be a good option for monitoring your credit score throughout the year. Another option is to check with individual business credit reporting agencies on your own. Its not complicated to do so, but you may have to register directly with the agencies, which include Experian, Dun & Bradstreet and Equifax.

Tip: To maintain your business credit score, you must continue to build healthy financial habits, such as paying your bills and taxes on time. You should also monitor your business credit score for accuracy.

Recommended Reading: Will Checking Credit Score Lower It

What Do You Mean By Credit Score

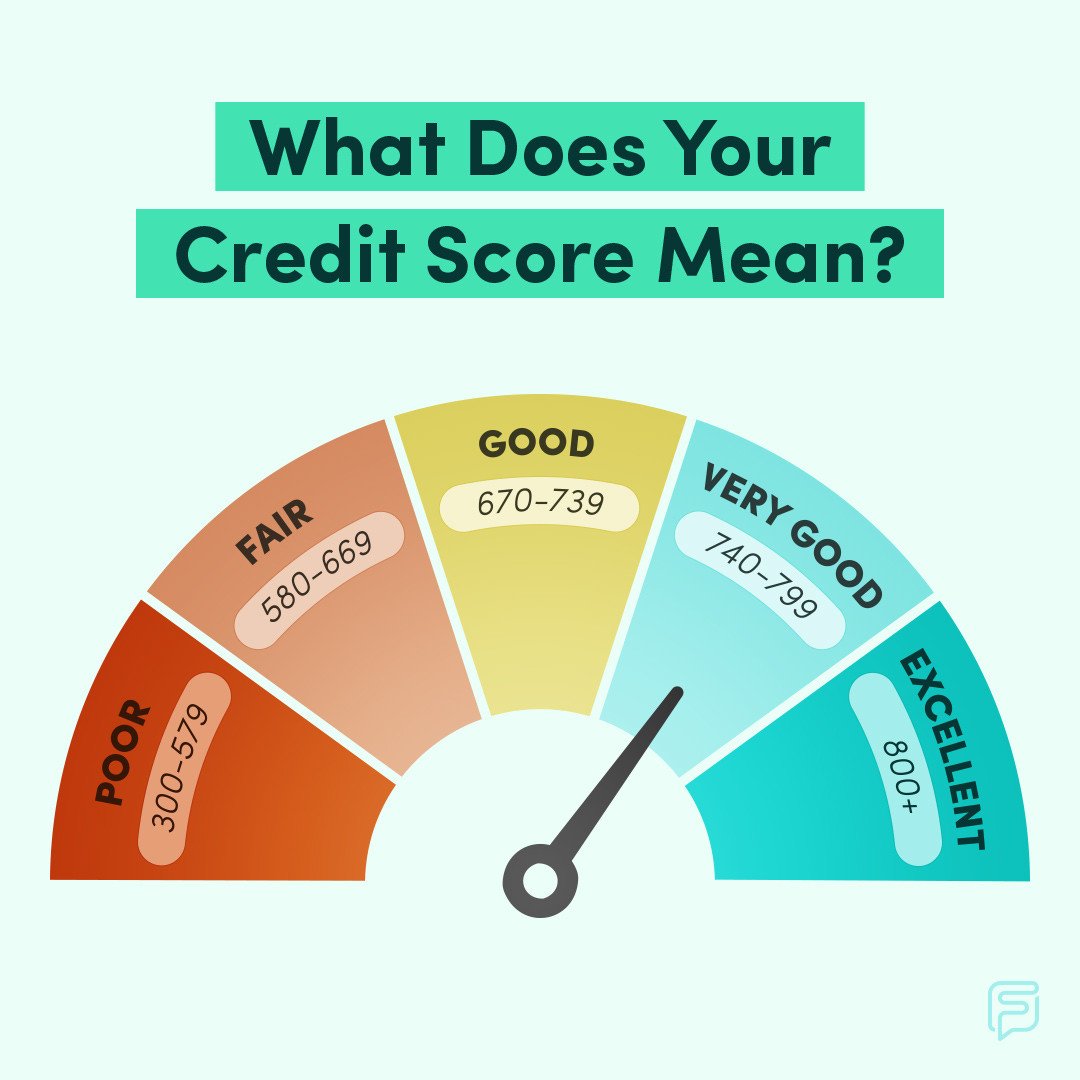

A credit score is a number that ranges between 300 and 850. It takes time years, actually to build and is determined by your credit history, or a long record of your payments and purchases, among a few other factors.

Understanding how your credit score is calculated.

There are three credit bureaus that collect and maintain consumer credit history in the U.S.: Experian, Equifax, and TransUnion. As there are some differences between the bureaus, 90% of lenders use something called the FICO system to calculate a credit score:

Exceptional:Fair:Poor:

While a credit score may sound subjective, there is some objectivity behind it. FICO credit scores are broken down as follows:

Payment history

Here, creditors will check to see if you made payments on time, and what kind of payments you made. For example, did you make the minimum payment due, or did you pay off your entire balance? Hands down, late payments can be the most damaging aspect in a credit score. For that reason, paying at least the minimum balance due on time is crucial to building credit.

Accounts owed

This factor examines how much you owe, compared to how much credit youve been given. This is calculated through a debt-to-credit ratio. Lets say someone has taken out an $8,000 loan, and still owes $4,000. Regarding just this particular loan, their debt-to-credit ratio would be 50%, because they still owe 50% of the credit theyve been given.

New credit

Heres how.