Strategies To Remove Negative Credit Report Entries

Negative details on your are unfortunate glaring reminders of your past financial mistakes. Or, in some cases, the mistake isn’t yours, but a business or credit bureau is to blame for credit report errors. Either way, its up to you to work to have unfavorable credit report entries removed from your credit report.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for. To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Get Your Negative Items Professionally Removed

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

If You Already Paid The Debt: Ask For A Goodwill Deletion

You can ask the current creditor either the original creditor or a debt collector for whats called a goodwill deletion.

Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if youre about to apply for a mortgage. Theres no guarantee your request will be accepted, but theres no harm in asking. A record of on-time payments since the debt was paid will help your case.

Your credit record will still show the late payments leading up to the collection action, but removing the collection itself takes away a source of score damage.

Read Also: When Does Care Credit Report To Credit Bureaus

How Do I Get A Serious Delinquency Off My Credit Report

Strategies to Remove Negative Credit Report Entries

Late payments remain in your history for seven years from the original delinquency date, which is the date the account first became late. They cannot be removed after two years, but the further in the past the late payments occurred, the less impact they will have on scores and lending decisions.

Also, how do you get out of delinquency? One minimum will count toward what you owe for the current month and the other will cover one of the payments that you missed. In order to get out of delinquency completely and become current on your account, you must pay the total of your missed minimum payments plus the current months minimum.

Also to know, what is a serious delinquency on credit report?

A serious delinquency is a piece of negative information that will damage your . Most of the time, their origin is from a mistake caused by improper use of ones . The most common example of a serious delinquency would be a late payment.

How long does it take for delinquencies to come off credit report?

seven years

How To Get A Collections Stain Off Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent.

But you may want them off sooner than that unpaid collections can make you look bad to potential creditors. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

Here are steps to remove a collections account from your credit report:

Do your homework

Dispute the account if there’s an error

Ask for a goodwill deletion if you paid the collections

An unlikely option: Pay for delete

Also Check: Carmax Credit Approval

How Do I Know If My House Sold At Auction

How to Find Out If Your House Has Been Sold at AuctionDo an Internet search to find the county clerk’s website for your area. … Register on the website to search for public information about real estate. … Perform a deed search using the property address as the search parameter. … Review the deed record for information about the auction sale.Meer items…

Late Payments And Goodwill Adjustments

Maybe paying bills has been difficult or youre looking for information on fixing bad credit. We know financial stress can be tough. And we want to help.

If you have one late payment or some other negative mark on your credit report, you may have heard that a can quickly fix bad credit. Were required to report complete and accurate information, and thats why we arent able to honor requests for goodwill adjustments. The best way to address negative credit history is to rebuild your credit by moving forward and establishing a solid history of on-time payments.

Recommended Reading: When Does Paypal Report To Credit Bureau

Have A Professional Remove The Late Payments

We understand that credit repair can be overwhelming.

If youd rather have a professional credit repair company help, I suggest you check out Lexington Law.

will typically charge a monthly subscription fee while you work with them but theyre also easy to cancel and theres no long-term commitment.

For someone with items that can be challenged, most times, progress can typically be made in 45 or 90 days.

Free Annual Credit Report

To support you during the uncertainty caused by COVID-19, we offer a free credit report weekly at annualcreditreport.com through April 20, 2022.

Get your free weekly report online through April 20, 2022 at annualcreditreport.com. You can always get a free report every 12 months.

With this credit report youll get:

- Fast, free access to your credit report online

- Control of your credit data, with free reports available from all three credit reporting agencies in one place

- The option to buy a one-time VantageScore® 3.0 credit score

Recommended Reading: Remove Repo From Credit Report

Use Donotpay To Remove A Medical Collection Account From Your Credit Report

DoNotPay has products that can save you time and money on various tasks you may have found difficult to complete with your busy schedule. With the Clean Credit Report product, DoNotPay can assist you in cleaning your credit report in one of four ways.

- Debt Validation Request

- Help To Identify And Dispute Errors

- Goodwill Removal Request

- Pay To Delete Negotiations

How to clean up your credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps:

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more!

Re: Removing History Of Delinquency From Credit Report

Welcome to the forums. If your negatives are over ten years old I am thinking they should have fallen off. Even a Chapter 7 is gone after ten years. Some negatives are gone after seven. I have some 30 day lates due to fall off next year when they are seven.

Have you pulled a recent credit report? That would be a good place to start. Then come back to the forum and lets talk about it.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Don’t Miss: Why Is There Aargon Agency On My Credit Report

File A Credit Dispute

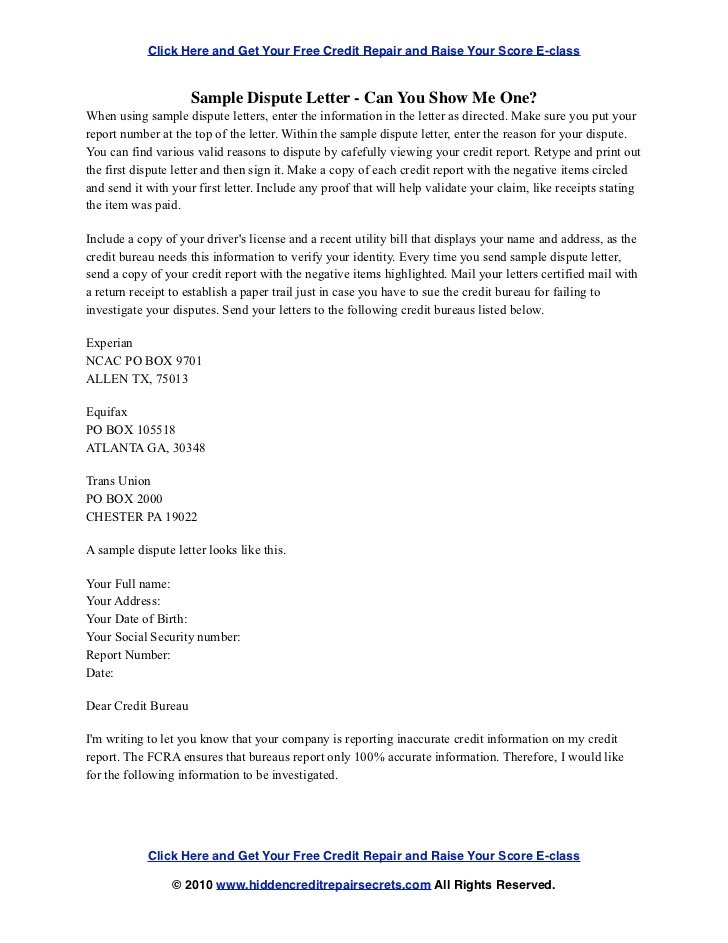

If you find any errors on your credit report, you can file a dispute with the credit bureau that generated the report. You can also dispute the mistake with the creditor.

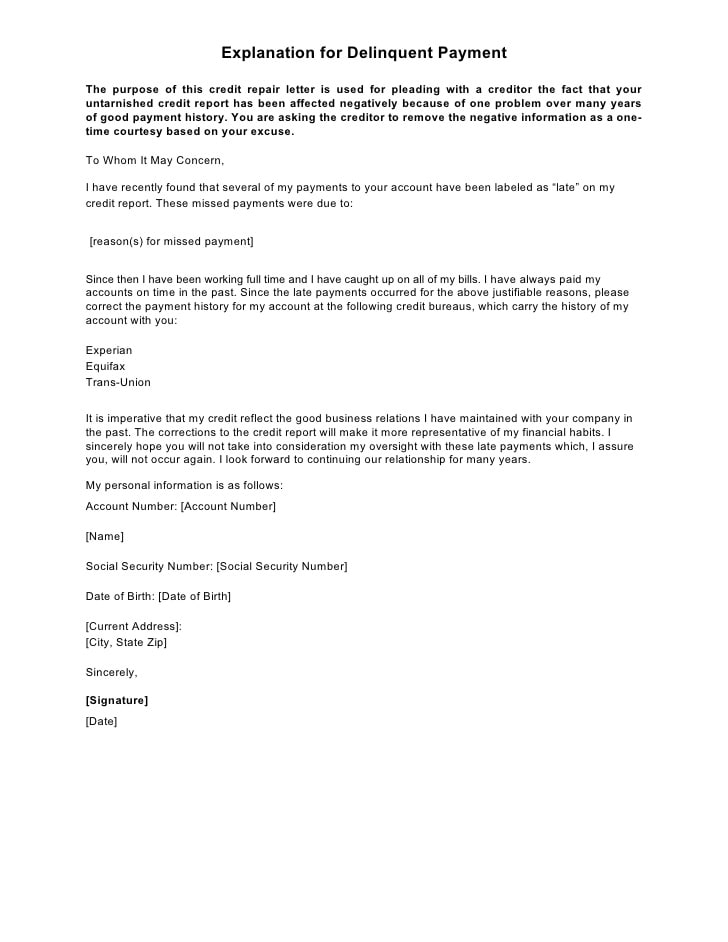

You can start this process by sending a dispute letter to each credit bureau that reported the mistake. The dispute letter should clearly state the negative information youre disputing, include any documentation of the inaccurate information, and request that the item is corrected or removed.

After receiving your dispute letter, the creditor or credit bureau has 30-45 days after receiving your dispute to investigate the claim. You should be notified of the results after the creditor or credit bureau has finished their investigation.

If the creditor or credit bureau has proof that the information they are reporting is correct, it will stay on your credit report. However, if they agree that the information is incorrect, they must remove it from your credit report.

Ways To Scrub A Collections Stain Off A Credit Report

Your credit scores take a hit if you fall behind on payments to a creditor, and again if an account is sent to the creditors collection department or sold to a third-party collector. You may be able to repair some damage to your scores by resolving a collections account on your credit reports.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent. You may want them off sooner than that unpaid collections always hurt your scores. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

There are a few ways to get a collections account off your credit report, depending on your relationship with the creditor and the account status.

First, do your homework

Get information on the debt from two places: your credit reports and your own records.

You can get a free credit report every 12 months from each of the three major credit reporting bureaus by using AnnualCreditReport.com. Some personal finance websites offer free credit report and score information.

Gather your own records for details on the account, including its age and your payment history.

Between the two, verify these details:

- Account number

- The date the debt went delinquent and was never again brought up to date

Once you have the details straight, you can decide which approach works for you.

You May Like: Syncb Ppc On Credit Report

You Can Negotiate With Debt Collection Agencies To Remove Negative Information From Your Credit Report

If youre negotiating with a collection agency on payment of a debt, consider making your part of the negotiations. You can ask the collector to agree to report your debt a certain way on your credit reports. Heres how: The three major credit reporting bureausExperian, Equifax, and TransUnionproduce credit reports. Ask the collector to tell the bureaus to remove any negative information about the debt from your credit files. The collector might not agree, it might have to get the creditors approval first, or you might have to pay a bit more on the debt but it doesnt hurt to ask.

And if you get the collector to agree to accept less than the full amount to settle the debt, be sure the collector also agrees to report the debt as paid in full on your report.

How Do I Get My Name Off Caivrs Report

Apply to rehabilitate your student loan, which involves making at least nine full payments of an agreed amount within 20 days of their monthly due dates over a 10-month period to the U.S. Department of Education. Once your loan is rehabilitated, you are no longer reported as in default and your name comes off CAIVRS.

Recommended Reading: How To Delete Inquiries From Credit Report

Dispute Any Errors With The Lender

If you find an error on your credit report as it relates to a delinquent account, you must take steps to remove it so it doesnt continue to negatively impact your credit. For instance, you may have paid a bill but it was still reported as late.

If this is the case, you can start the removal process by disputing the error with the original lender. Contact the lender and point out the discrepancy. Try to do so via certified snail mail.

The lender will legally have 30 days to respond to you after receipt of your letter. If they agree with your request, theyll need to inform the credit bureaus of the error. If they disagree with you, youll need to take the issue to the credit bureaus directly.

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Recommended Reading: What Does Filing For Bankruptcy Do To Your Credit Score

Don’t Miss: Apple Card Experian

What Are Medical Collections Accounts

When you receive medical service or care, you, your insurance provider, or both will be billed. If your insurance won’t cover the costs, it is your responsibility. Failure to pay can result in these accounts being turned over to collection agencies. They are then medical collection accounts, and just like other collection accounts, they negatively impact your credit. They also linger medical collection accounts remain on your reports for seven years.

How An Error On Your Credit Report Can Affect You

Is it really necessary to keep close tabs on your credit report? Can one error really have an impact on you? Yes. Your credit report contains all kinds of information about you, such as how you pay your bills, and if youve ever filed for bankruptcy. You could be impacted negatively by an error on your credit report in many ways.

To start, its important to understand that credit reporting companies sell the information in your credit reports to groups that include employers, insurers, utility companies, and many other groups that want to use that information to verify your identity and evaluate your creditworthiness.

For instance, if a utility company reviews your credit history and finds a less-than-favorable credit report, they may offer less favorable terms to you as a customer. While this is called risk-based pricing and companies must notify you if theyre doing this, it can still have an impact on you. Your credit report also may affect whether you can get a loan and the terms of that loan, including your interest rate.

Read Also: Commenity Bank Stores

How To Remove Items From Your Credit Report In 2022

Your credit report is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Transunion Score Report & Monitoring

A paid subscription to TransUnion Credit Monitoring can help you improve your credit health, manage your data identity and approach credit with confidence.

A paid subscription to TransUnion Credit Monitoring includes key information and tools you can use, all in one place.

Get key information and empowering tools in one place, including:

- VantageScore® 3.0 credit score & TransUnion credit report free refreshes available daily

- Alerts to critical changes to any of your 3-bureau reports

- Educational resources to help you understand your credit report and steps you can take to reach your score goals

- Identity protection, including 1-touch TransUnion & Equifax credit locks, ID theft insurance and instant inquiry alerts

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

Subscription price is $24.95 per month .

Also Check: Ic System Phone Number

Send A Goodwill Letter

If you find that the delinquency isnt a mistake, you arent out of luck. You can still send a goodwill letter to the lender. While a dispute letter challenges incorrect information, a goodwill letter also referred to as a forgiveness letter or a good-faith letter simply explains your hardship or other difficulties in originally making the payment. It then requests the lender to proactively remove the mark from your report.

Since youre asking the lender for a favor, you should always send a goodwill letter after youve resolved the outstanding debt. Once everything is paid up and your delinquent account is again in good standing, then you can send the letter asking for the item to be removed from your credit report.