Accounts Included In The Bankruptcy

After youve filed for bankruptcy, the accounts included in your bankruptcy will show up as included in bankruptcy on your credit report. Most of them will remain on your credit report for seven years. These include accounts like charge offs, collections, repossessions, and judgments. They can also potentially be removed from your credit report before the reporting limit of seven years.

What Are Fcra Violations

As mentioned, the FCRA, or Fair Credit Reporting Act, outlines guidelines about how consumer data can and cannot be used. Due to the complicated nature of these laws, it is possible to violate them, often unintentionally.

Landlords need to be familiar with the most common types of FCRA violations. Understanding these violations and how to avoid them will protect you from large fines or tough situations in the future.

The most common FCRA violations include:

- Furnishing, reporting, or using data that is not current

- Reporting or providing data that is linked to the wrong name

- Not correcting inaccurate data after a debt dispute is filed

- Not alerting all required parties of any debt disputes or changes

- Releasing information to unauthorized parties

- Accessing a credit report without a valid reason

- Not giving proper notice to the debtor about the credit information

For landlords, the two biggest violations are requesting a credit report without authorization from the applicant and not alerting the tenant when negative credit information was used as part of your decision-making process.

Many of these violations are more likely to be committed by creditors, collectors, or credit reporting agencies. If the organization you use to run credit reports is guilty of any of these violations, it could lead to problems with your own use of the information gathered down the line.

Errors On Your Credit Report

It is always a good idea to check your credit report on a regular basis and ensure that there are no errors.

A mistake on your report could affect your ability to get credit, and mistakes do occur on occasion.

After you have been discharged from your bankruptcy, it is a good idea to check your report to make sure that there are no debts remaining that should have been cleared by the bankruptcy.

You should get your report from both major agencies so that you can check for any errors, and report any that you find.

In addition to any issues with your bankruptcy, its important to check for other errors, including incorrect addresses or even your name being misspelled.

You can get a copy of your credit report online or through the mail.

Using the mail allows you to get a copy of your credit report for free, while you must pay a small amount to be able to access it online.

Errors can be corrected online or by writing to the credit report agency.

Also Check: How To Get A Repo Removed From Your Credit

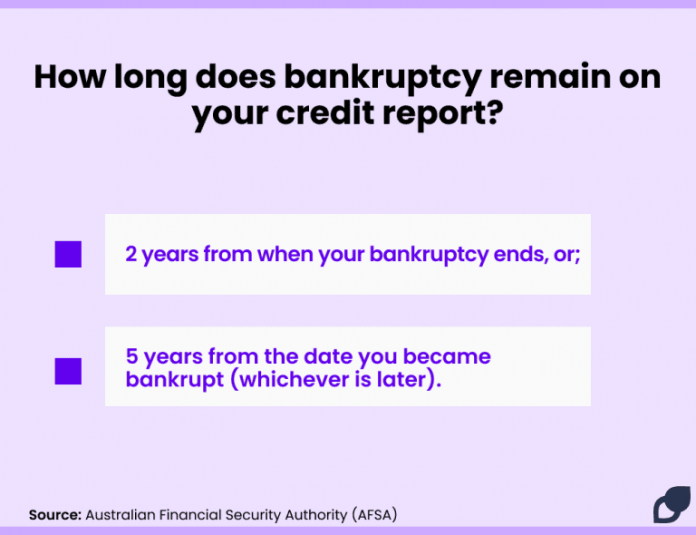

Bankruptcy: How Long Does It Stay On Your Credit Report

Being declared bankrupt can trigger many emotions, and there are consequences that will impact you immediately and longer term. In this article, we cover how bankruptcy can impact your credit score, how long it will stay on your credit report and how it can impact your ability to borrow money in future.

Getting New Credit After Bankruptcy

Assuming that you successfully complete a repayment plan under Chapter 13, you will get a discharge that will show that debts covered by the bankruptcy have been removed. You should be able to get new credit at this point, although you should make sure to keep up with payments and avoid accumulating too much debt too fast. Lenders may charge more interest when you have a Chapter 13 bankruptcy on your record, but interest rates will go down as you show that you can handle the debt responsibly. Over time, your credit score will improve as well.

After you complete your bankruptcy, you should get copies of your credit report from each of the major bureaus. This will allow you to verify that the record reflects a discharge rather than a dismissal of your bankruptcy. Also, you should make sure that all of the debts that were included in the Chapter 13 proceeding are marked as having been included. Any errors or omissions may cause a lender to incorrectly conclude that you have not paid off the debt.

A Chapter 13 bankruptcy case will appear on your credit report for seven years after you file. Since the case lasts for three to five years, it will appear for two to four years after the discharge. By contrast, a Chapter 7 bankruptcy case will appear for 10 years. This is a potential reason to choose Chapter 13 over Chapter 7.

Also Check: Free Karmascore

What Should I Look For

Remember that when you file bankruptcy, you must list all of your debts.

This means that every open credit account in existence at the time of filing should be marked as either included in bankruptcy, or as discharged in bankruptcy.

- Any account that you paid off prior to the bankruptcy should be listed as paid and closed

Without the bankruptcy, all of the delinquent and collections accounts would report to the bureaus every month that you had missed a payment.

This lowers your credit score every month.

How Soon Will My Credit Score Improve After Bankruptcy

By FindLaw Staff | Reviewed by Bridget Molitor, J.D. | Last updated June 30, 2021

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can’t remove bankruptcy from your credit report unless it is there in error.

Over this 12-18 month timeframe, your FICO credit report can go from bad credit back to the fair range if you work to rebuild your credit. Achieving a good , very good , or excellent credit score will take much longer.

Many people are afraid of what bankruptcy will do to their credit score. Bankruptcy does hurt credit scores for a time, but so does accumulating debt. In fact, for many, bankruptcy is the only way they can become debt free and allow their credit score to improve. If you are ready to file for bankruptcy, contact a lawyer near you.

Recommended Reading: Aargon Agency Phone Number

Reporting Debts As Discharged In Bankruptcy

While it might be daunting to think about a bankruptcy filing showing up on your for ten years, it might not be as bad as you think. A bankruptcy discharge can help you clean up debt much faster than you’d be able to do yourself.

For instance, instead of a delinquent or unpaid debt lingering on your report for years, it will show as being discharged as part of your bankruptcy. In fact, creditors won’t be able to report your debt in a variety of ways that could cause your credit to suffer, such as allowing the obligation to show as:

- currently owed or active

- having a balance due, or

- converted to a new type of debt .

Such reporting labels are often the reason creditors deny applicants credit. In some cases, applicants must pay off such debt as a condition of loan approval. Instead, when you pull your report, each qualifying debt should be reported as:

- having a zero balance, and

- discharged, “included in bankruptcy,” or similar language.

Unfortunately, some creditors don’t update information to the credit reporting agencies. This tactic could be a way to get you to pay up, even though you no longer legally owe the debt. If your credit report shows an improperly labeled discharged debt, you’ll want to take steps to correct the problem.

How To Avoid Bankruptcy

A bankruptcy isnt anyones first choice, but we know sometimes it feels like your only option. But it is possible to avoid bankruptcy. It starts with taking care of your Four Walls: food, utilities, shelter and transportation. Once youve got your home in order, its time to get aggressive by selling everything in sight, getting on a tight budget to cut unnecessary expenses, and snagging a side hustle to throw even more money at your debt. And you can always sit down with a financial coach who will guide you through your specific situation. Rememberits never too late to get help.

If youre ready to cut credit from your life and say never again to bankruptcy, Ramsey+ will show you how. Youll learn how to pay off your debt, save and invest so you never have to worry about money again. Start a free trial today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

You May Like: How To Get Credit Report With Itin Number

How A Credit Reporting Dispute Attorney Can Help

If youve already been through the bankruptcy process, you have suffered enough! Dont let a credit reporting agency jerk you around by failing to update discharged accounts or remove bankruptcy notices after 10 years. Contact me online or call me directly at 855.982.2400 and let me know whats going on. Ill guide you through the process of getting the information corrected and, if necessary, filing a lawsuit for damages. You have rights, and Cardoza Law Corporation is here to help you protect them.

|

Related Links: |

Apply For An Unsecured Credit Card

Youll wait to do this for several years. But if youve improved your credit score over the years, you should apply for an unsecured credit card again.

This lets you continue to improve your credit score. Its also a much better deal than an unsecured credit card.

But dont apply for more than one credit card. If you get declined, wait at least six months before you apply for another one.

Also Check: Will Evictions Show On Credit Report

The Length Of Time A Bankruptcy Stays On Your Report

Equifax, which is the largest crediting bureau in Canada, keeps the first bankruptcy on a persons report for six years from the date of discharge or last payment.

For a second bankruptcy, this period is extended to 14 years.

TransUnion keeps a bankruptcy on file for six or seven years from the discharge or for 14 years after the filing date.

Their rules depend on provincial legislation.

A proposal will remain on your credit report for three years from the last payment that you make.

When you are discharged, your trustee will send the information to the Office of the Superintendent of Bankruptcy, which will then report the information to the credit bureaus.

How Can I Rebuild My Credit After Bankruptcy

The most important thing you can do to improve your credit score after a bankruptcy is remove the bankruptcy from your credit report.

Equally important is learning and changing your personal finance habits so that it doesnt happen again. This might involve reviewing your income and expenses or building your emergency fund to prevent future financial hardships.

The most important ongoing habit you can begin is to pay all of your bills on time because your payment history accounts for the largest portion of your credit score. Even a single 30-day late payment can cause a significant dip, so imagine how bad it could be if you regularly miss a payment.

Your other best bet for rebuilding your credit after bankruptcy is to avoid accruing new debt.

Depending on the type of bankruptcy filing, you probably had much of your debt discharged. So even though the bankruptcy itself is a major negative item on your credit report, consider the rest a blank slate.

Avoid racking up additional debt because that also has a significant impact on your credit score.

You may also want to get a secured credit card. Its a credit card designed for people who want to rebuild their credit. The credit card issuer will give you a credit limit based on the security deposit you pay upfront. By making monthly payments on time, you can start to rebuild your credit immediately.

Also Check: Usaa Fico Score

Why Does Experian Report Bankruptcies For 7 To 10 Years

Heres an excerpt from the FTC that provides a summary of your rights under the FCRA:

What this means is that Experian, which is a publicly traded business and not a government agency, can decide to not report chapter 13 bankruptcies beyond seven years even though they could report them for longer.

However, the FCRA is laid out in a 108-page document, and there are zero mentions of Chapter 13 bankruptcies or Chapter 7 bankruptcies within those 108 pages.

If you read the first sentence of the FCRA document, it states, As a public service, the staff of the Federal Trade Commission has prepared the following complete text of the Fair Credit Reporting Act.

The FTC is explained by Wikipedia in this manner: The Federal Trade Commission is an independent agency of the United States government, established in 1914 by the Federal Trade Commission Act.

The FCRA is the authority on how consumer reporting agencies should be reporting data. The FTC enforces the FCRA and has laid out clearly that 10 years is how long a bankruptcy is reportable. They are the final authority on the matter, and their rules stand.

Can You Remove Bankruptcy From Your Credit Report

In most cases, no: You cannot remove a bankruptcy from your credit report. Remember, it will be removed automatically after seven or 10 years, depending on the type of bankruptcy you filed.

In the rare case that the bankruptcy was reported in error, you can get it removed. Its fast and easy to dispute your information with TransUnion. If you see a bankruptcy on your credit report that you didnt file, heres how to dispute your credit report.

You May Like: How To Get An Eviction Off Your Credit

How Can I Rebuild My Credit File After Bankruptcy

The good news is that bankruptcy isn’t the end of the road financially. Here are some steps you can take in the short term:

- Order a copy of your statutory credit report to ensure your credit details are correct

- Add a short statement to your report explaining why you got into debt

- Register for the electoral roll at your current address

- Update all personal details on your credit profile

In the long term, it’s important to show lenders that you can borrow money responsibly. You can do this by using and repaying credit. But before you do so, you need to be 100% sure you can afford and meet the repayments.

- Consider credit designed for people with low credit ratings. This usually means low limits and high interest rates. You may be able to improve your rating by using this type of credit for small purchases and repaying the money in full and on time.

- Space out your applications. Each application for credit will leave a mark on your credit report, so aim to apply no more than once every three months.

- Check your eligibility before you apply for credit. Doing this can help you reduce your chances of being rejected and having to make multiple applications. You can see your eligibility for credit cards and personal loans when you create a free Experian account.

How Do Chapter 7 And 13 Bankruptcy Affect My Credit

Its a question we hear often: How long does a Chapter 7 bankruptcy stay on a credit report?

A Chapter 7 bankruptcy will remain on your credit report for 10 years, but the real impact of a bankruptcy on your credit is not as simple or as harsh as one Q& A tells you. There are factors pertaining to your financial situation that need to be weighed and considered to determine whether bankruptcy is right for you and how a bankruptcy filing will affect your credit going forward.

Sasser Law Firm can provide you with knowledgeable advice about your legal options if you are considering bankruptcy. We proudly represent clients in the Triangle and across North Carolina. Contact us today to learn about your options for getting out of debt.

Read Also: Credit Score Of 714

What Do You Need To Disclose If You Apply For A Loan After Bankruptcy

If you do apply for a loan above a certain limit you must let the lender know about your bankruptcy. This limit is indexed quarterly. At the time of writing, the indexed credit limit set in the Bankruptcy Act and regulations is $5,881. This means for loans worth more than $5,881, you must disclose your bankrupt status when:

- seeking to obtain goods or services on credit, by hire purchase, or cheque

- leasing, hiring, or promising to pay for goods and services

- seeking to obtain an amount by promising goods or rendering services

Related: NILS loans: what are no interest loans?

How Much Will Bankruptcy Affect Your Credit Score

In 2010, FICO released a report that showed examples for the average credit score after bankruptcy. The decrease when you started with a high score is more significant.

| Starting Credit Score | |

|---|---|

| 150 | 530 |

In both cases, you end up with a bad credit score. But the decrease from fair to bad is less than from excellent to bad. Essentially, you have more to lose when you have good or excellent credit. If you already have bad credit then the point-damage may not be that bad. Remember, FICO scores only go down to 300, but its rare to see anything below 500.

Read Also: Remove Repo From Credit