How Getting Added As An Authorized User Can Work For Credit Building

A credit check is not required to become an authorized user on someone else’s card. Yet banks and card issuers will often report the full payment history of the card, including the names of each individual card user, to the three main credit bureaus: Equifax, Experian and TransUnion.

That’s how the authorized user approach serves as a credit building tactic. You don’t need good credit to become an authorized user, but if the bank or issuer reports your card’s full on-time payment history to the credit bureaus, you can begin to build a positive credit history.

How To Dispute Credit Report Errors With Bureaus

If you notice incorrect information on your credit report, it’s in your best interest to dispute it right away. One in four Americans have an error on their credit report, according to a 2012 study by the Federal Trade Commission.

If you notice an error on your Experian credit report, check if it’s also present on your TransUnion and Equifax reports. Then dispute the error directly with the credit bureau. Legally, the credit bureau has to report the issue to the other two bureaus. Regardless, you should dispute it directly with each credit bureau to cover all the bases.

The simplest way to dispute a credit report error is online with Experian, Equifax or TransUnion .

A Quick Note On Credit Utilization

One way to improve your credit is to pay down revolving debt, such as credit cards, says Endicott.

You may pay down your debt and not see an improvement right away. Before applying for any new credit, you may want to make sure your lower balances are reflected on your credit. Keep in mind that many factors determine your credit scores, and paying down your revolving debt doesnt guarantee higher scores.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Which Credit Bureau Does Chase Sapphire Reserve Pull From When Doing A Credit Check

Chase uses Experian for hard inquiries on Chase Sapphire Reserve applications â which impacts your credit score. Hard inquiries impact your score around 5 points, but multiple pulls affect your credit . The fastest way to remove unauthorized credit pulls from your credit report is with help from Credit Glory.

Have You Paid The Business Credit Card Late

Most business card issuers only report to the business owners personal credit reports when theres a problem. So, if your company pays late or defaults on its account, theres a very real risk that the business credit card could show up on your credit report at that point. If that occurs, the negative account could hurt your personal credit score and perhaps trigger a chain reaction of other problems.

Late payments can be a serious problem where credit scores are concerned. And if your card issuer reports that you paid late to both the commercial and consumer credit bureaus, the derogatory marks could damage both sets of credit scores.

On the consumer side, late payments can remain on your credit report for up to seven years. Payment history is also worth 35% of your FICO Score. So, when you fall 30 days or more behind on your payment, youre taking a big risk.

Bad credit scores and a history of late payments can also make it difficult for you to borrow money again in the future. You may have fewer financing options available, and the lenders that are willing to work with you will probably offer higher interest rates and less attractive borrowing terms. As a business owner, this could affect your companys ability to qualify for new financing too.

Don’t Miss: How Long Does A Repossession Stay On Your Credit Report

Are You Under Chases 5/24 Limit

Chase has whats known as the 5/24 rule, whereby you typically wont be approved for a Chase card if youve opened five or more new card accounts in the past 24 months. So make sure youre under that, and this is also all the more reason to pick up the Chase Sapphire Preferred early in your credit card journey.

Are You Eligible For The Sign

The Chase Sapphire Preferred welcome bonus of 60K Ultimate Rewards points follows a 48 month rule. Youre not eligible for the bonus on the card if:

- You currently have any Chase Sapphire credit card

- You are a previous cardmember who has received a bonus on a Chase Sapphire credit card in the past 48 months

In other words, you are potentially eligible for the Chase Sapphire Preferred if youve had one of the Chase Sapphire cards in the past, you just cant currently have one of the cards, and cant have received a new cardmember bonus on one of the cards in the past 48 months. Reports suggest that youre considered a previous cardmember a few days after canceling an account.

Note that if youre the authorized user on someone elses Sapphire credit card, youre still eligible to get it for yourself. Eligibility is determined based on whether youre the primary cardmember.

You May Like: Does Paypal Bill Me Later Report To Credit Bureau

Can You Add An Authorized User Without A Social Security Number

Whether you can add an authorized user without a Social Security number varies by issuer. American Express requires you to enter in a user’s SSN and date of birth. You don’t have to enter it when you set up an authorized user account with American Express, but you need to provide it within 60 days or the authorized user account will be canceled. Chase only requires the authorized user’s first and last name, an email address and phone number.

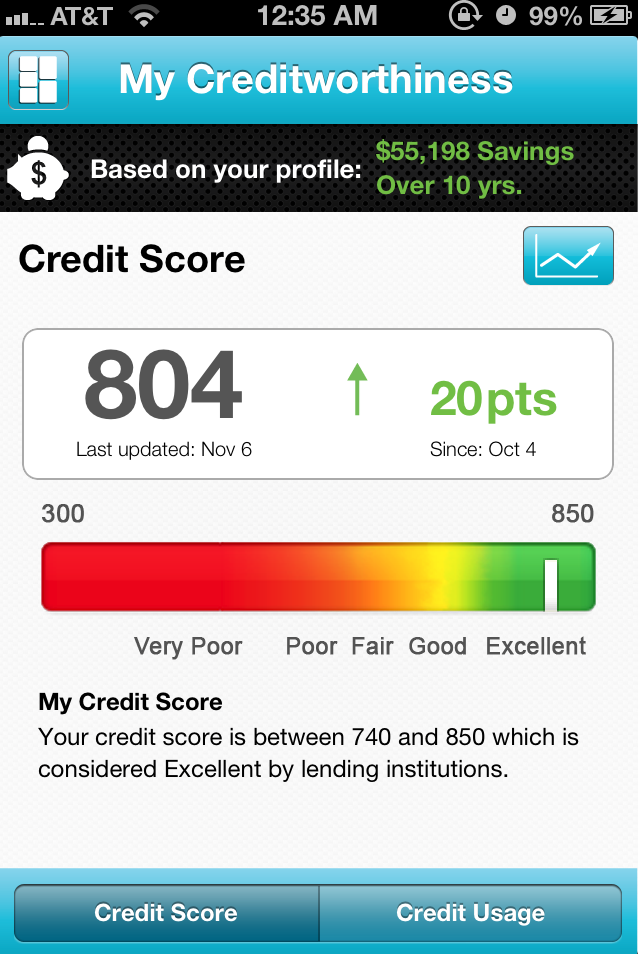

Is It Hard To Qualify For Chase Sapphire Preferred

Many things are taken into account during the decision process. Consider these factors to help improve your Chase Sapphire Preferred approval odds:

- Your credit score: Chase will usually pull your credit report from a couple of the three credit bureaus . Your scores may be different across each bureau. So banks will usually look at more than one to get a more complete overview.

What is the 5/24 rule?

And on the other hand, if you have too high of a credit limit from your cards, you may not be approved either. That would come off a red flag that you’re asking for more credit. This leads to the next factor.

In short, Chase Sapphire Preferred Card offer tremendous value for their $95 annual fee. And the card is now offering a deal that’s practically their best offer.

Read Also: Does Paypal Report To Credit Bureaus

How Often Does Chase Report To The Credit Bureaus

I’m starting to get serious about improving my credit score. My Chase monthly credit payment is due on the 24th of each month. I decided to make a big payment on Nov 10th and a few days later I had an improvement on my credit score as a result. I have used the card for gas and stuff so the balance has risen a bit since then. My question is did Chase report again to the bureaus on the 24th as that’s when my monthly payment is due or do they only report once a month period? Just curious if I should expect my credit score to take a small hit again in a few days.

What Can I Do If Chase Declines My Application

Even with a credit score above 740, you may still be denied the Chase Sapphire Reserve card. Luckily, Chase like most major card issuers has a reconsideration line, meaning you can call 1-888-270-2127 and ask the representative to take another look at your application.

But in some cases, it may simply be that your credit score isnt high enough or you dont meet one of Chases other requirements, such as the 5/24 rule. In that case, spend a bit more time improving your credit score to increase your chances of being approved the next time around.

Read Also: 672 Credit Score

Become An Authorized User

Becoming an on someone elses credit score can provide a huge boost to your credit score. First, adding another credit card to your credit report increases the amount of credit available to you. And assuming there isnt a large balance being carried on that card, youll see your credit utilization go down.

Another benefit of becoming an authorized user is that youll get credit for the payment history of that card. Assuming the primary cardholder has made all of their payments on time, those payments will benefit your credit score as well.

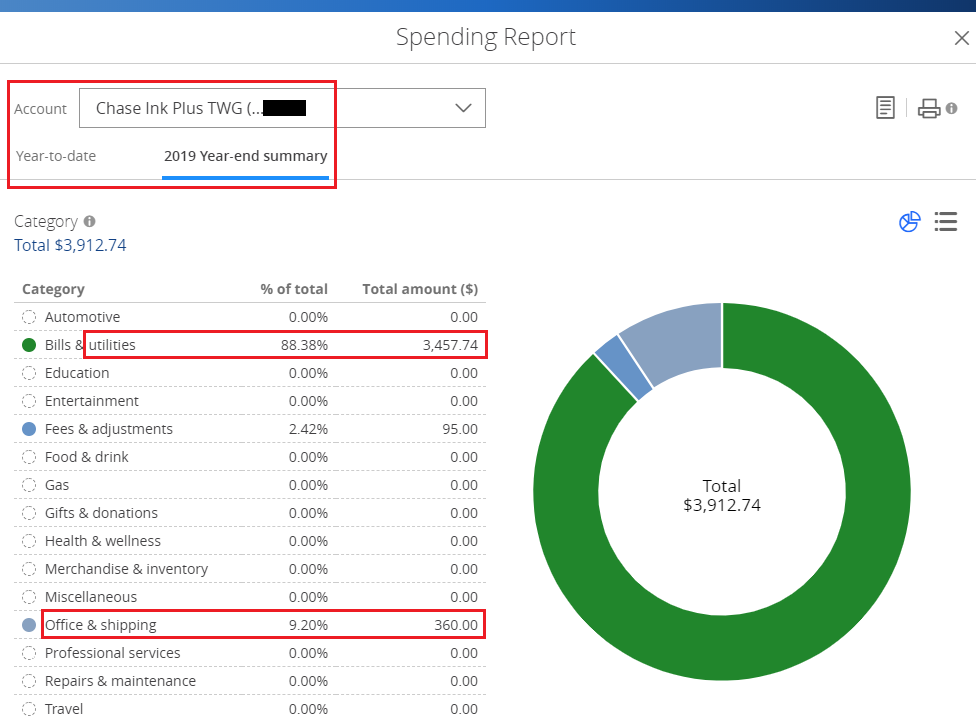

Which Business Credit Cards Do Not Report Personal Credit

The table below shows which business credit card issuers will report information about your business card to your personal credit history.

| Card issuer | |

| No | Yes |

Even among the card issuers that report only negative information to your personal credit, there are different rules for when these reports are made:

- Chase will report late payments on your personal credit report only if you are more than 60 days late in making a payment.

- Amex reports any time your account is not in good standing.

- Bank of America reports any time you are delinquent in paying.

All this could mean that while credit products like the Capital One Spark Cash for Business and Chase Ink Business cards are all great products, they still may not be a good fit for your needs.

Read Also: What Is Syncb Ntwk On Credit Report

Is An Authorized User The Same As A Co

While being added as an authorized user is not the same as earning credit card approval through a co-signer, they are both options to start your credit history if you have little to no credit. There are some important differences between getting added to a card as an authorized user or signing up for a card with a co-signer:

Should You Add Your Child To Your Credit Card To Build Credit

Most issuers will allow you to add a child so long as they are at least 13 years old. In fact, there is no restriction on who you can add as a user even if that person is below the age of 18. There are currently no regulations requiring that the authorized user be a family member, even if they are a minor.

There are clear financial benefits to your child if you add them as an authorized user. As long as the card issuer reports these users to one of the three credit bureaus, then adding your child to your credit card account will make it appear on their credit file. Also, you should only add children to accounts with good payment histories an account with a lot of late payments on record could negatively impact your child’s score .

Normally, young adults need to apply for student credit cards or credit cards for users with no credit. By adding the child to your account, a score will be generated for them, helping them qualify for better cards as well as making their loan terms more favorable. For example, having a high can qualify your child for a lower and higher rewards.

Recommended Reading: Snap-on Credit Score Requirements

Business Credit Cards And Your Personal Credit

Business credit cards have the potential to impact your credit for good or for bad, just like any other type of financing. But whether or not the account has an effect on your credit depends on a few important factors.

Lets take a deeper look at each of these four questions.

When Does Chase Report

Statement closed this morning on my new Chase Freedom. I need one of my new accounts to report to the CRAs so I get a credit score. Anybody know how soon after statement cut Chase reports? Somewhat surprised that the statement cut on the Freedom that I was only approved for on the 8th rather than one of the Cap One cards I was approved for on Jan. 31 and Feb. 1.

Also Check: Does Paypal Credit Report To Credit Bureaus

What Exactly Constitutes Credit Card Fraud

Credit card fraud is a form of identity theft in which one person uses another person’s credit card information to cancel purchases or withdraw money from an account. Credit card fraud also includes the fraudulent use of debit cards and can be carried out by stealing the card itself or illegally obtaining the cardholder’s account and personal information, including card number, credit card number security, and cardholder name. and direction.

Which Credit Card Companies Report Authorized Users

Most of the biggest credit card issuers in the United States report additional users to all three credit bureaus: Experian, Equifax and TransUnion.

In most cases, you’ll need to provide the authorized user’s date of birth and Social Security number for the credit bureaus to update their file. American Express, Bank of America and Discover, for example, require this information in order to add an authorized user. Chase, on the other hand, doesn’t require an SSN to add an authorized user .

Read Also: What Credit Report Does Comenity Bank Pull

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

The Personal Guarantee Explained

Agreeing to a personal guarantee on a business credit card or loan essentially makes you a co-signer for your company. In the event your business doesnt repay the lender as promised, that lender may be able to come after you personally to seek repayment for the debt. This personal promise is the lenders way of reducing risk when it loans a business money.

Part of a personal guarantee may also include language that allows the lender to report details about the account to the personal Equifax, TransUnion and Experian. This is where the potential for personal credit score damage comes into play with a business credit card.

Many lenders will only report a business account to the personal credit bureaus if something goes wrong . However, some small business credit card issuers opt to report business credit cards to both business credit reporting agencies and the personal credit bureaus every month.

Also Check: Is 626 A Good Credit Score

Should You Get A Business Card For Your Small Business

A credit card can be a valuable tool for your business. Just as its important to build your personal credit history, its important to build the credit history of your business. The earlier you apply for a credit card, the sooner youll be able to leverage it for other purposes.

While a business credit card can be beneficial, its likely not right for every business. According to Tom Thunstrom, a small business finance expert with FitSmallBusiness, there are a few situations where a business credit card might not be the right choice.

Put Other Credit Applications On Hold

One thing that can get credit lenders weary is if you have a lot of applications in a short period of time. Even more so, if these applications are coming around a time of large purchases such as a home. While you can, it is generally advised not to apply for more credit than necessary leading up to a big purchase being complete.

One example would be obtaining an auto loan shortly before the closing on a home purchase that is financed. Shortly before the home loan closing, a lender may pull your credit one last time to have peace of mind before lending out potentially hundreds of thousands of dollars. If a large new debt is present, it could throw your debt ratios off causing you the inability to close on your new home.

Recommended Reading: How To Get Credit Report With Itin

Popular Chase Credit Cards For Authorized Users

Below are some popular Chase credit cards to add authorized users. Adding an authorized user to these cards can allow you to earn rewards on the authorized users spending, build the authorized users credit score or get card benefits for the authorized user.

Great for earning rewards with an authorized user

Chase Freedom Unlimited®