Minimum Credit Score Needed By Home Loan Type

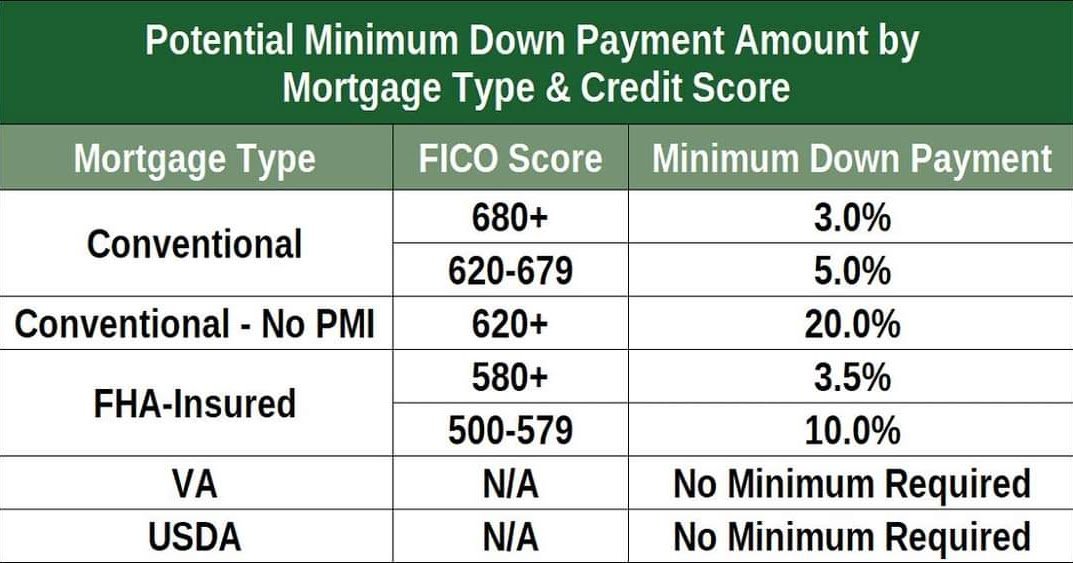

Theres a different minimum credit score needed for each type of mortgage loan. Heres a quick overview:

| Loan type | ||

|---|---|---|

|

||

| FHA |

|

|

| VA | None |

|

| USDA |

|

See: How Your Credit Score Impacts Mortgage Rates

How Do You Choose Which Credit Score To Use

-

During pre-approval, we typically use the Experian FICO-II credit score from Experian. This is a soft credit check and won’t affect your credit score. If you apply with a co-borrower, we use the lower of your two scores.

When you want to continue with your loan application, with your authorization we pull your credit scores from all three major credit bureaus and use the median of the three scores received.

Related questions

Home lending products offered by Better Mortgage Corporation. Better Mortgage Corporation is a direct lender. NMLS #330511. 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007. Loans made or arranged pursuant to a California Finance Lenders Law License. Not available in all states. Equal Housing Lender.NMLS Consumer Access

Better Real Estate, LLC dba BRE, Better Home Services, BRE Services, LLC and Better Real Estate is a licensed real estate brokerage and maintains its corporate headquarters at 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007. A full listing of Better Real Estate, LLCs license numbers may be foundhere. Equal Housing Opportunity. All rights reserved.

Better Settlement Services, LLC. 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007

Homeowners insurance policies are offered through Better Cover, LLC, a Pennsylvania Resident Producer Agency. License #881593. 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007

Improving Your Credit Score

If youre considering applying for a mortgage, its a good idea to check your credit score to see if theres room for improvement.

Start by requesting your credit reports and looking for errors, which could potentially drag down your credit scores. You can get a free credit report from TransUnion®, Equifax® and Experian every week through April 2021. If you find inaccurate information, file a dispute with the creditor and the credit reporting agency. Getting rid of errors may help boost your credit score.

Next, get to know how credit scores work. Heres a list of what influences your credit score and how to make improvements before applying for a mortgage:

Also Check: What Credit Score Does Les Schwab Require

Your Credit Report And Credit History

Youris used in all aspects of life, from signing up for a cell phone plan or utility service to applying for a job or looking for insurance. This is no different when applying for a mortgage. Your mortgage lender will look at your credit history and your credit score to see how you have been handling credit with other creditors. If youve had a rocky past with other lenders by not paying on time or even by defaulting on previous loans, this will be a large red flag that your lender will carefully scrutinize.

Lending out hundreds of thousands of dollars to someone is something that mortgage lenders take very seriously, which is why having a good credit score is so important when applying for a mortgage. Your credit score is calculated based on your credit report. Your credit report contains information that lenders have sent to Canada’s two main credit reporting agencies: Equifax Canada and TransUnion Canada.

Your credit report contains information such as your payment history, the balance of your debt, your credit limit and the age of your accounts, the type of debt that you have, any bankruptcy or past-due collections history, and a record of when lenders have checked your credit report.

How Can My Fico Scores Affect My Mortgage Interest Rate

When a loan officer gets your mortgage application, they may use a pricing grid to figure out how your credit scores affect your interest rate, says Yves-Marc Courtines, a chartered financial analyst with Boundless Advice. Generally, higher scores can mean a lower interest rate, and vice versa.

From there, a mortgage loan officer will likely look at the rest of your loan application to decide whether your base interest rate needs any adjustments. For example, if youre making a smaller down payment, you may be given a higher interest rate, says Courtines.

A banks pricing grid may change on a daily basis depending on market conditions. However, heres an example of what you might expect your base interest rate to be, based on your credit score, on a $216,000, 30-year, fixed-rate mortgage.

| FICO® score range |

|---|

Source: myFICO, November 2020.

You May Like: How To Get Rid Of Repo On Credit

What’s The Difference Between Base Fico Scores And Industry

Base FICO Scores, such as FICO Score 8, are designed to predict the likelihood of not paying as agreed in the future on any credit obligation, whether it’s a mortgage, credit card, student loan or other credit product.

Industry-specific FICO Scores incorporate the predictive power of base FICO Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking. For example, auto lenders and credit card issuers may use a FICO Auto Score or a FICO Bankcard Score, respectively, instead of base FICO Scores.

FICO Auto Scores and FICO Bankcard Scores have these aspects in common:

- Many lenders may use these scores instead of the base FICO Score.

- It is up to each lender to determine which credit score they will use and what other financial information they will consider in their credit review process.

- The versions range from 250-900 and higher scores continue to equate to lower risk.

How Is Your Credit Score Calculated

Most talk of credit scores makes it sound as if you have only one score. In fact, you have several credit scores, and they may be used by different lenders and for different purposes.

The three national credit bureaus Experian, Equifax and TransUnion collect information from banks, credit unions, lenders and public records to formulate your credit score. The most common and well-known scoring model is the FICO Score, which is based on the following five factors:

Also Check: Does Titlemax Report To Credit Agencies

How To Get A Mortgage With Bad Credit In Canada

Most banks in Canada require a minimum credit score of at least 600 to get a mortgage, which means that having a credit score less than 600 will cause you to be rejected by Canadas major banks. Manyprivate mortgage lendershave no such requirement, and so they and B lenders are some of the onlyalternative mortgage lenderoptions available to those with bad credit.

Getting a bad credit mortgage from a private lender is an option since private lenders are more flexible and have less stringent lending requirements compared to the major banks, and so they can help you no matter your financial situation. Rather than focus on your credit score and credit history, private lenders will place more emphasis on your home equity. If something goes south and you default on your bad credit mortgage, private lenders want to be able to sell your home quickly through apower of salewhile recouping the full amount of their investment.

However, be aware that a private mortgage can be much more costly than one from a traditional bank.Private mortgage ratescan be multiple times higher than regular mortgage rates. Youll also need to have a large down payment or home equity, as in a lowloan-to-value ratio, in order for private lenders to take on your bad credit mortgage. Since having a low LTV will make it easier for private mortgage lenders to recoup their lost investments on defaulted bad credit mortgages, private lenders can even work with those who have recently gone through a bankruptcy.

What Credit Score Is Needed For A Usda Loan

Home loans issued by the U.S. Department of Agriculture are designed to help low- and moderate-income individuals and families buy and improve homes in non-urban America .

There are three types of USDA home loans, including those intended for very low-income applicants, homeowners wishing to improve their property and qualified moderate-income applicants who want a low interest loan with a small down payment. Mortgage rates and borrowing limits on USDA loans vary according to prevailing property values in different parts of the country.

The USDA doesn’t specify minimum credit score requirements for the loans it backs, but the minimum FICO® Score requirement nationwide is about 640.

Read Also: What Credit Card Is Syncb Ppc

The Average Credit Score Had Decreased Since Mortgage Origination For Borrowers Who Later Deferred Mortgage Payments

The difference in credit score between borrowers who did and those who did not defer mortgage payments stemmed from 2 factors:

- At mortgage origination, the average credit score of borrowers who later deferred mortgage payments had been lower than that of borrowers who did not.2

- After origination, the average credit score of borrowers who later deferred mortgage payments had decreased in relation to that of borrowers who did not.

Figure 3 shows the average change in consumer credit score during the period from when a borrower originated a mortgage to February 2020. For borrowers who deferred mortgage payments between March and October 2020, 45% of them had experienced a decline in their credit score since their mortgage origination. For the upper 2 age groups, the credit score had increased, on average, for borrowers who deferred payments. However, the level of the increase was smaller than that for borrowers who did not defer payments.

The Scoring Model Used In Mortgage Applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

- FICO® Score 2

- FICO® Score 5

- FICO® Score 4

As you can see, each of the three main credit bureaus use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors , but the categories are weighed a little bit differently.

It makes sense: Borrowing and paying off a mortgage arguably requires a different mindset than keeping track of and using a credit card responsibly.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on , have proven to be reliable when evaluating good candidates for a mortgage.

You May Like: Check Credit Score Without Social Security Number

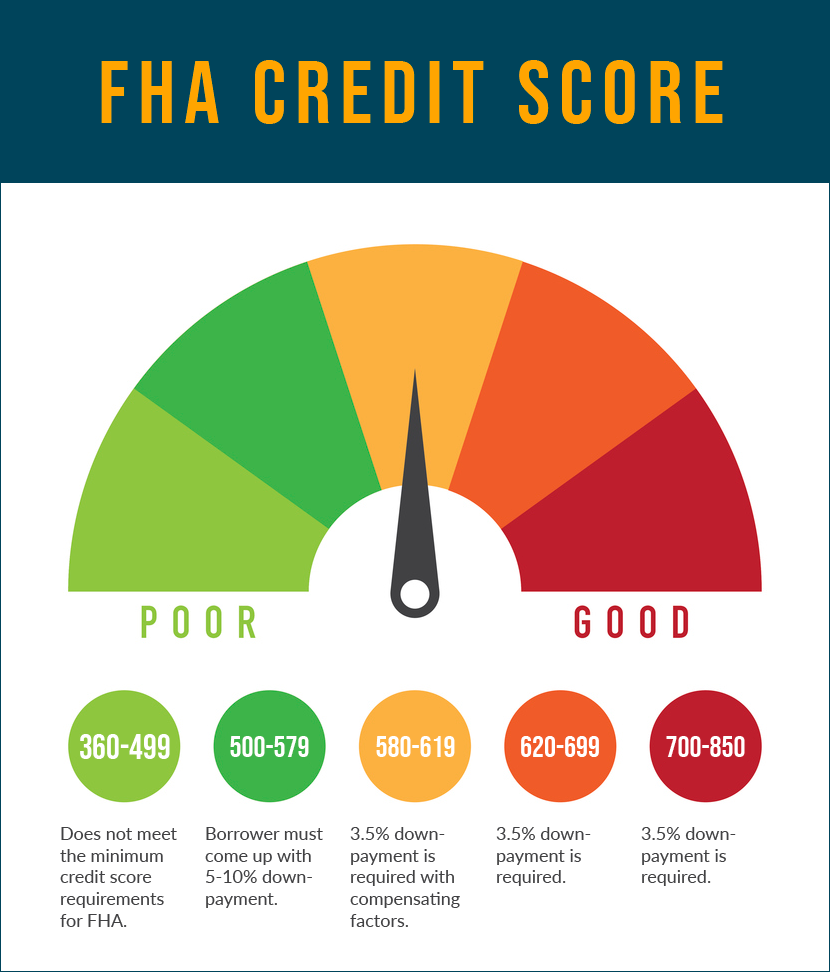

Bad Credit Score Home Loans

A bad credit score is usually one thats lower than 640. While you might be able to get a home loan with bad credit, the potential drawbacks include:

- Needing a larger down payment

- Paying a higher interest rate

- Spending more money on mortgage insurance premiums

Why would you spend more money on mortgage insurance?

With bad credit, you might be able to secure an FHA loan, a VA loan, a higher down payment conventional loan, or a USDA Loan:

Find Out: Can You Buy a House with Bad Credit?

What Mortgage Lenders Look For When Approving A Home Loan

When you apply to get pre-approved, your lenders will review your credit history and consider your current credit outlook. This includes looking at:

- How on-time have you been with your payments and obligations?

- What does your current debt load look like, and how is spread out?

- How much experience do you have managing credit?

- Have you been recently trying to acquire access to new sources of credit?

- Do you let items go into collection?

- Have you previously filed for bankruptcy?

Lenders ask these questions to get comfortable about you. Your financial health isnt the only consideration lenders make, but how you manage your bills tells a large part of your story.

Lenders also look for specific credit events known as derogatory items, like bankruptcy or delinquent accounts.

Derogatory items dont disqualify a mortgage approval. Generally, its only required that theyre historical events and not current ones. For example, you can get approved for a mortgage if youve declared bankruptcy in the past, or if youve lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. Whats important is whats happened in the time since the derogatory event occurred.

Don’t Miss: Can Public Records Be Removed From Credit Report

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Which Credit Scores Do Mortgage Lenders Use

When you apply for a mortgage, lenders will generally request all three of your credit reports and a FICO® Score based on each report. However, the type of FICO® Scores they request are often older versions, due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac. It can be important to know about these different FICO® Score versions when you’re planning to buy a home.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

Why Is My Mortgage Credit Score So Much Lower

There can be a disconnect between the credit scores you obtain for free and the ones your mortgage lender is using.

Typically banks, credit card companies, and other financial providers will show you a free credit score when you use their service. Also, credit monitoring apps can show free credit scores 24/7.

But the scores you receive from those third-party providers are meant to be educational. Theyll give you a broad understanding of how good your credit is and can help you track overall trends in your creditworthiness. But they arent always totally accurate.

Thats partly because free sites and your credit card companies offer a generic credit score covering a range of credit products.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back large debts.

For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan.

Mortgage lenders, on the other hand, are required to use a unique version of the FICO score almost exclusively.

Since mortgage companies loan money on the scale of $100,000 to $1 million, theyre naturally a little stricter when it comes to credit requirements.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back those large debts.

So theres a good chance your lenders scoring model will turn up a different lower score than the one you get from a free site.

Open A Secured Credit Card

A secured credit card is a great way to rebuild your credit or get you started if you have no credit history. With a secured credit card, you make a deposit with a credit card company, which then becomes your credit limit.

For example, if you put down $500, then your credit limit is $500. If you pay your balance off regularly, you may be able to upgrade to an unsecured card after some time.

So, a secured credit card is a great way to build your credit and make you eligible for a loan from an Ontario-based mortgage lender.

Recommended Reading: Synchrony Networks On Credit Report

Consumer Credit Scores And Mortgage Deferrals

An analysis of trends in the credit scores of consumers before they deferred mortgage payments.

This analysis examines trends in the credit scores of consumers before they deferred mortgage payments. The data is from the credit rating agency Equifax Canada, and is as reported to that agency.1 The data covers approximately 80% to 85% of the Canadian market for residential mortgages and includes both insured and uninsured mortgages.