Is It Ok To Check Your Credit Score

Checking your credit score doesn’t affect it, so it’s never a bad idea to do so. You can get your free credit score check online via the Credit View service available through your Scotiabank mobile app. This Credit View feature is powered by TransUnion, so you’re getting your credit score directly from one of Canada’s credit bureaus.

Not only will checking your credit score keep you up to date about your progress, but you can also see potential signs of fraud. If there are any unexplained dips in your credit score, you could investigate them right away with the credit bureau directly.

Your Income And Assets

It doesn’t matter to the credit bureaus if you make $1 per year or $1 million per year. Your credit report is all about paying your credit-related bills on-time and managing the balances well. Even if you have a ton of money in the bank, you can have a bad credit score if you miss payment due dates.

If You Have A Goal To Reach A Higher Score Or Just Want To Learn More About Credit Scores In General Its Important To Know What Affects Your Credit Scores And How Your Actions Could Improve Or Hurt Your Credit

Although there are many credit-scoring models, the goal of these formulas is to figure out your credit risk that is, the likelihood of you paying your bill on time, or even at all. And whether youre looking at a FICO® or VantageScore® credit score, your scores are based on the same information: the data in your credit reports.

While various credit-scoring models may treat factors differently, the leading models, FICO® and VantageScore®, place similar relative importance on the following five categories of information. Weve ranked them by which ones are often most important to the average consumer.

Read Also: How To Get A Collection Off Of My Credit Report

Are You Allowed To Keep Us Credit Cards When Living Abroad

If youre about to live abroad or planning on a long stint out of the country, you might ask yourself am I even allowed to keep my credit card if Im no longer living in the US?

The answer is absolutely yes.

You are not the first US citizen to live outside of the US and certainly not the last. Many retirees will retire abroad and all of their finances will still be done in US Dollars. This means banks will want to keep their relationships and business with these clients. If youre moving abroad, do not cancel all of your credit cards unless you are churning like me and know which ones need to be.

Credit Mix And Account Types

Thereâs something to be said for variety, especially when talking about credit. Lenders like to see that you can handle all kinds of credit accounts and loans, and youâll be rewarded for handling different types of credit responsibly with an improved credit score. This category makes up just 10 percent of your score, so how can you make it work for you?

Be aware of the two types of credit accounts: revolving and installment loans . Having a little of both is the best way to keep your score in tip-top shape.

Recommended Reading: How Do You Remove A Repossession From Your Credit Report

Hard Credit Inquiry Vs Soft Credit Inquiry: Whats The Difference

Not all are created equally. Depending on the situation, you might encounter a hard credit inquiry or a soft credit inquiry when borrowing money. A soft credit inquiry allows the financial institution to assess where your credit stands to some degree. But it wont leave a mark on your credit report. As far as your credit report goes, a soft credit inquiry doesnt make an impact. However, not all credit inquiries are minimally invasive. Instead, there are also hard credit inquiries.

A hard credit inquiry happens when a lender or financial institution requests your full credit report from a credit bureau. The information on your credit report affects your credit score, but some financial institutions like to take a closer look at the information for themselves to assess things like your debt-to-income ratio.

Typically, your credit score will dip by 2 to 10 points after a hard credit inquiry. Although the information stays on your report for up to two years, the negative impacts usually stop after a few months. This is why it is important to understand when your credit is going to be pulled and which type of credit pull is being performed. Opening a savings account only has the potential to trigger a soft credit inquiry and it doesnt impact your credit score.

What Are The Most Important Aspects Of Your Report

In addition to determining where you live, and you live, your report details also have an impact on where you work , how and where you can shop, how you handle emergencies, and if you can upgrade other areas of your life. So it’s crucial for you to understand how to maintain a health report. It’s also crucial to understand what’s the most important aspect of your report.

Two of the most important aspects of your report are how you’ve paid your bills, and how much debt you’re incurring. For example, if you pay all of your bills on time, and your debt ratio is relatively low, then you’ll incur a healthy report. On the other hand, if you pay your bills late , and you incur high levels of debt, then you’re going to incur a poor consumer report.

So as you can see, even if you pay for everything with cash, building a good consumer report is a major building block for personal and financial success.

This is not legal, financial or professional advice. Please consult a legal, financial or professional advisor for your specific situation.

Recommended Reading: What Do Landlords See On Credit Report

Less Important Scoring Factors

Your payment history and credit usage are generally what affects your credit scores the most. But other factors can still be important:

- The age of your accounts. The age of your oldest accounts, the average age of accounts, and other age-related metrics can also be factors. The older your accounts, the better. However, closed accounts may count toward these metrics. If you close an account thats in good standing, it will stay on your credit report for up to 10 years.

- Experience with different types of accounts. Managing different types of creditlike a credit card and a loancan help improve your credit mix and may give your score a small boost. Lenders like to see that you can handle multiple types of payments.

- Recent credit applications. A hard inquiry is a record of when a creditor checks your credit report after you applied for credit. New hard inquiries may temporarily cause a small drop in your credit scores. Generally, it is a good idea to only apply for credit when you need it.

Somewhat Important: Length Of Credit History

A variety of factors related to the length of your credit history can affect your credit, including the following:

- The age of your oldest account

- The age of your newest account

- The average age of your accounts

- Whether youve used an account recently

Opening new accounts could lower your average age of accounts, which may hurt your scores. But the hit to your scores could also be more than offset by lowering your utilization rate and increasing your total , making sure to make on-time payments to the new card and adding to your credit mix.

Closed accounts can stay on your credit reports for up to 10 years and increase the average age of your accounts during that time. But once the account drops off your credit reports, it could lower this factor, and hurt your scores. The impact could be more significant if the account was also your oldest account.

Recommended Reading: Do Insurance Companies Report To Credit Bureaus

How Much You Use Credit

Anyone who has a limited credit history may find it hard to borrow money because the lender is not able to determine if the borrower is a good risk. In addition, those customers with frequent and multiple credit applications raise a red flag for lenders because they may be overburdened with too much debt and might struggle with any further credit. Handling credit responsibly will boost your score.

Factor #: Credit History Length

Youre not born with a credit history it has to be built over time. Many college students start the journey by opening their first credit card account. This is a great place to start, though remember that good habits like paying on time and keeping your credit utilization rate down will help build good credit.

And lest you think if you want a new credit card you need to close an old one, you dont. The longer you have relationships with credit companies, the better your credit.

You May Like: How To Dispute Hospital Bills On Credit Report

Less Important: Recent Credit

Creditors may review your credit reports and scores when you apply to open a new line of credit. A record of this, known as a , can stay on your credit reports for up to two years.

Soft inquiries, like those that come from checking your own scores and some loan or credit card prequalifications, dont hurt your scores.

Hard inquiries, when a creditor checks your credit before making a lending decision, can hurt your scores even if you dont get approved for the credit card or loan. But often a single hard inquiry will have a minor effect. Unless there are other negative marks, your scores could recover, or even rise, within a few months.

The impact of a hard inquiry may be more significant if youre new to credit. It can also be greater if you have many hard inquiries during a short period.

Dont be afraid to shop for loans, though. Credit-scoring models recognize that consumers want to compare their options, so multiple inquiries for certain types of loans, like mortgage loans, auto loans and student loans, may only count as one inquiry. You typically have 14 days to shop for these kinds of loans. And though it could be longer depending on the scoring model, you may want to stick to getting rate quotes within those 14 days since you probably wont know which model is being used to generate your score.

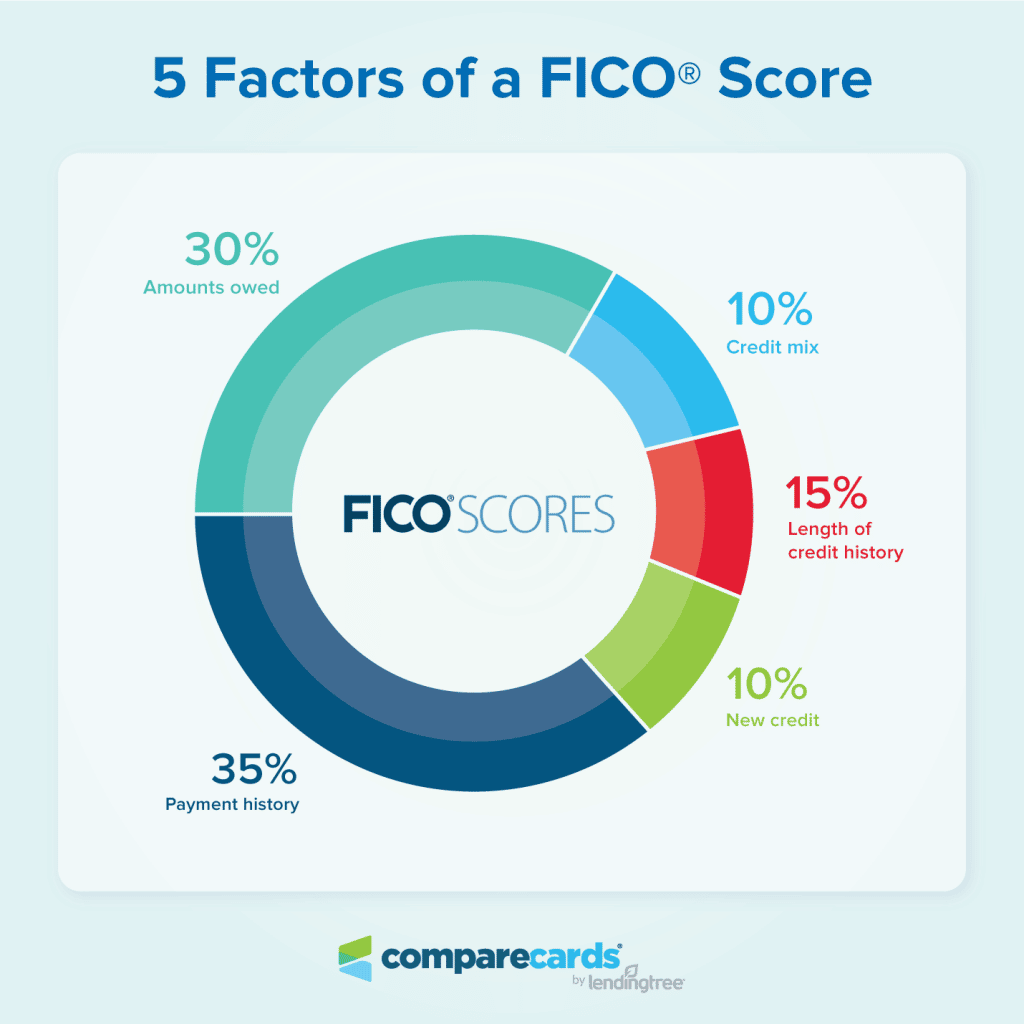

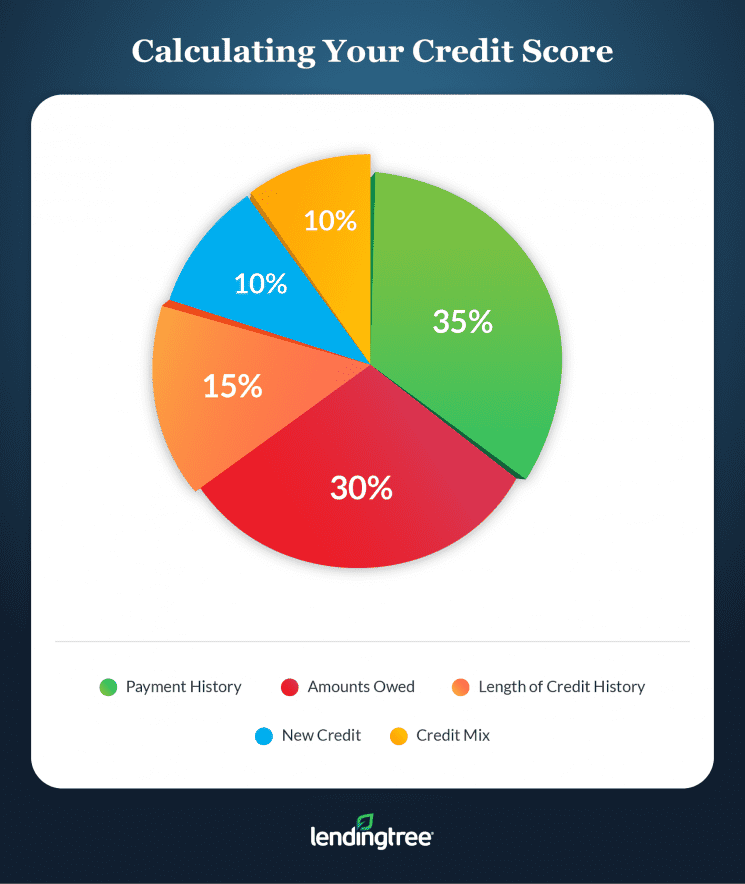

What’s In My Fico Scores

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix .

Your FICO Scores consider both positive and negative information in your credit report. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The importance of these categories may vary from one person to anotherwe’ll cover that in the next section.

Also Check: Does Afterpay Report To Credit Bureau

Types Of Accounts That Impact Credit Scores

Typically, credit files contain information about two types of debt: installment loans and revolving credit. Because revolving and installment accounts keep a record of your debt and payment history, they are important for calculating your credit scores.

- Installment credit usually comprises loans where you borrow a fixed amount and agree to make a monthly payment toward the overall balance until the loan is paid off. Student loans, personal loans, and mortgages are examples of installment accounts.

- Revolving credit is typically associated with credit cards but can also include some types of home equity loans. With revolving credit accounts, you have a credit limit and make at least minimum monthly payments according to how much credit you use. Revolving credit can fluctuate and doesn’t typically have a fixed term.

Do I Have A Credit Score

If you have opened at least one account with a creditor that reports to the credit bureaus and it has been open for at least six months, then you should have a score. If you have any kind of line of credit a mortgage, auto loan, credit card, student loan, personal loan, etc. you will likely have a credit score.

Read Also: How Long Does It Take To Improve Credit Score

Your Level Of Debt Matters

Your debt level determines 30% of your credit score. Credit scoring calculations, such as the FICO score, look at a few key factors related to your debt. The amount of overall debt you carry, the ratio of your credit card balances to your credit limit , and the relation of your loan balances to the original loan amount.

As a guideline, you should keep your credit card utilization at 30% or less, meaning only charge up to 30% of any card’s available limit.

Having high balances or too much debt can heavily affect your credit score. The good news is that your credit score can improve quickly as you pay down your balances.

Factors That Affect Your Credit Score

Your credit score is a powerful number that can affect your life now and in the futurein some ways that you might not even imagine. Your score determines interest rates you pay for credit cards and loans and helps lenders decide whether you even get approved for those credit cards and loans in the first place.

Unexpected businesses, such as insurance companies, have started to use credit scores to make decisions about you. Utility companies check your credit before establishing new service in your name, and some employers check your credit history to decide whether to give you a job, a raise, or promotion.

Protecting and building your credit is more important than ever, and how you handle the following five factors can make all the difference in determining your credit score.

Read Also: How To Fix Negative Accounts On Credit Report

How Does Moving To Another Country Impact Your Credit Score At Home

There are a lot of things to consider when moving to another country. Among the many important factors, your credit score may not be at the top of your list which is very important if you want to open new credit cards while living outside of the US. However, it is worth thinking about how a move could impact your credit rating and what you can do to protect it. Thats because different countries have different systems for tracking credit, so even if you have a good, it may not translate to the new country.

Additionally, certain factors like bankruptcy or late payments can impact your score differently depending on where you are. So before you make the big move, be sure to do your research and understand how your credit will be affected.

Benefits Of Learning What Affects Your Credit Score

When you take the time to understand what affects your credit score, youre taking the first steps toward having better control over your finances. Your credit score is so much more than just a number rather, it can be thought of as a living, breathing thing. It is constantly changing, reacting to the ever-changing information that can be found in your credit report, and it needs to be tended and taken care of.

Your credit score and your credit health have a tremendous impact on your everyday life in ways, you may not even think of. A lower credit score can cost you a significant amount of money in additional fees and interest charges thats a given. But a lower score can also cause you to pay higher car insurance premiums in some states, lose out on an apartment youve been eyeing, or even be rejected for your dream job. By understanding what affects your score, youll know what steps to take to monitor and improve your score.

Read Also: What Credit Score Is Needed For Chase Sapphire

Number Of Credit Inquiries

Each time you submit an application that requires a credit check, an inquiry is placed on your credit report showing that you’ve made a credit-based application. Inquiries make up 10% of your credit score. One or two inquiries won’t hurt much, but several inquiries, especially within a short period of time can cost you many points off of your FICO score. Keep your applications to a minimum to preserve your credit score.

The good news is that only those inquiries made within the last 12 months factor into your credit score. Inquiries completely disappear from your credit report after 24 months.

Note that checking your own credit report results in a “soft” inquiry, which does not affect your credit score.

Using Too Much Of Your Available Credit

Having too many credit cards with a substantial balance or even just a few cards with a high balance and low available credit can be a big factor in what affects your credit score negatively. Financial experts recommend using less than 30% of your available credit – that includes each credit account – to maintain a positive credit rating.

Add up all of your credit card balances and compare that with the available limit on each account. If you discover that youre using more than 30% of your available credit, its time to start making some additional payments to get that debt ratio down and improve your credit score.

Read Also: How To Print Credit Report From Experian

Top 9 Factors That Can Affect Your Credit Score

There are a lot of reasons to want to increase your credit score. A higher score gets you access to lower interest rates, which makes borrowing money cheaper. Bumping up that score can also open doors to higher limits on your existing cards and make you more likely to be approved for important purchases, including a car or home.

So, how can you improve your score? What things will harm it? We take a look at the actions that can affect your score, as well as dispel myths around those that wonât.