Is All Debt Bad For Your Credit Score

The answer to this question depends on what you mean by debt. If you are asking if having credit is bad for your credit score absolutely not. In fact, if you have credit and are paying back on time and the right amount, this is very good for your credit score and will make it go up.

Having no credit history is much worse than showing you can pay back the money you borrowed on time.

Why, you ask? Well, having credit and paying back as promised shows that you can handle your finances and stick to an agreement.

But if you are asking if debt is bad for your credit score and you mean debts from unpaid loans and credit cards, then yes, this is probably bad for your credit score. It shows you failed to keep to an agreement and repayments and will send your credit score down as a warning to any other loan company or bank that may consider lending you money.

Is It Better To Settle A Collection Or Pay In Full

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you havesuch as late payments or settled debtsthe better.

Review Your Credit Reports

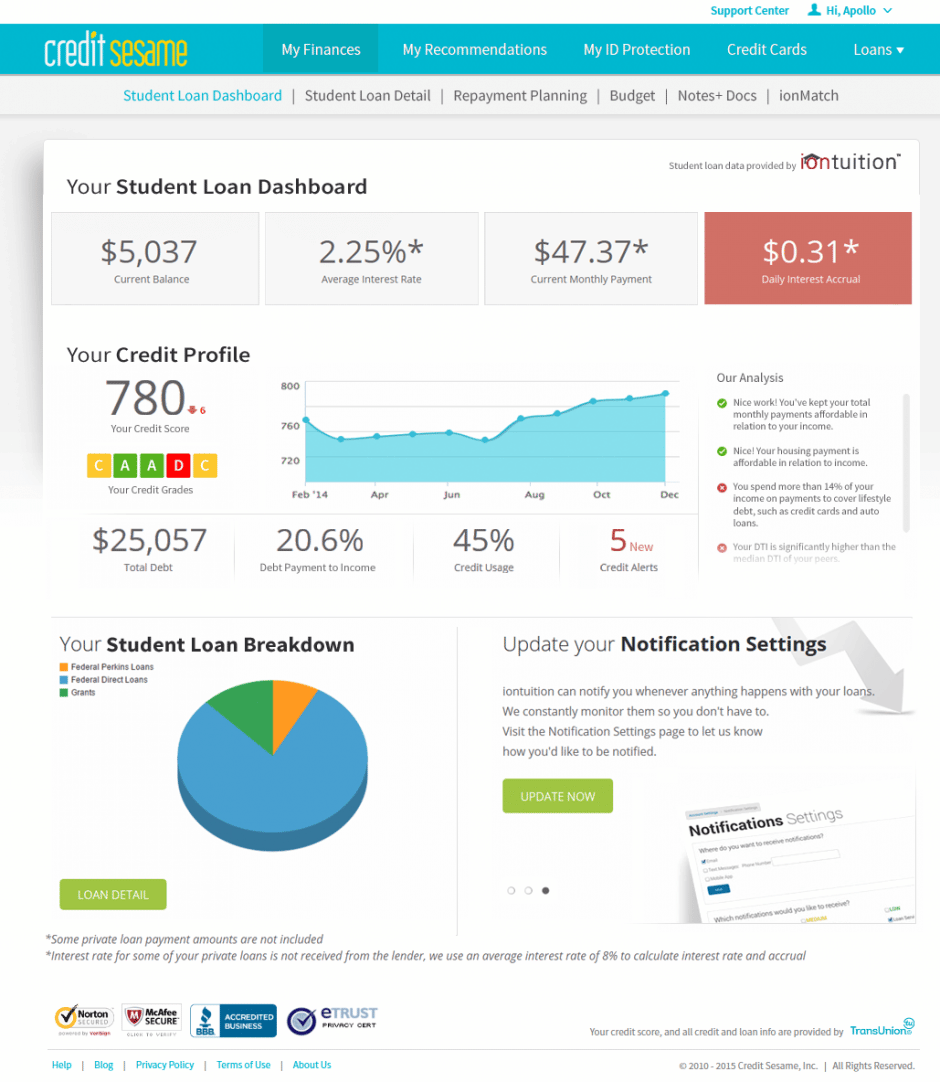

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then, review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

Recommended Reading: How To Get A Truly Free Credit Report

When Do Your Credit Scores Get Updated

Since your are based on the information in your , your scores can be updated whenever your reports are updated. And how often your reports are updated might depend on how often the three major credit bureausâEquifax®, Experian® and TransUnion®âreceive information from lenders.

Every lender has its own schedule for reporting information to the credit bureaus. And lenders typically donât report information to each of the credit bureaus at the same time. But information is typically reported every 30 to 45 days. And your scores could change every time new informationâlike new accounts or changes to your account balancesâis reported by a lender and reflected in your credit reports.

Because every lender has its own reporting schedule and policies, your credit scores can change oftenâeven multiple times a day. Itâs normal for your scores to fluctuate a little.

And keep in mind that you have many different credit scores. Thatâs because there are many credit-scoring modelsâmathematical formulas used to calculate credit scores. And each formula is a little different. Formulas can use information from just one credit report or a combination of different reports. Then, each formula might assign different levels of importance to that information.

Can Paying Off Collections Raise Your Credit Score

Contrary to what many consumers think, paying off an account that’s gone to collections will not improve your credit score. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Also Check: What Is A Great Credit Score

How Can I Get My Credit Re

If youre trying to raise your credit score a few points to get approved for a loan or to qualify for a better interest rate, your mortgage lender might be able to pay a fee for a rapid re-score that updates your credit report in two or three days. But only if theres proof of a credit report error or youre able to pay off an account right way and need the balance to reflect on your credit report.

Build A Credit History If Needed

A low credit score doesnt always mean you have bad credit. It can just mean you have thin credit. In other words, you havent demonstrated enough creditworthiness to potential lenders, at least that they can see on your credit report.

If thats the case, you may need to open a credit account, such as a credit card, and make payments on it regularly. Try to get a card with no annual fee, if possible. Dont overspend, or use this as an excuse to take out loans you dont need.

You could get a secured credit card, for example, and pay for gas and other regular expenses with it. To avoid paying high interest charges or building credit card debt, track your balance throughout the month and pay the balance off every month.

Don’t Miss: How Long Does Something Stay On Your Credit Report For

How To Choose Your First Credit Card

When youre ready to get your first credit card, be aware that you may not have access to the best rates and terms. Looking at interest rates, looking at how that interest is going to be compounded will help you understand what it will cost to carry a balance, says Sokunbi. Youll also want to be mindful of any fees associated with maintaining the account.

When selecting a credit card, You dont only look at the costs associated with that account, but also the benefits to you, says Griffin. Try to choose a card that aligns with your lifestyle. For example, if youre feeding a large family, choose a credit card that gets cash back on groceries. Or if youll be traveling abroad, choose a card with travel insurance and no foreign transaction fees.

What About Settled Debts

Sometimes you might not pay off a debt in full and may agree on a debt settlement figure. This means you didnt manage to pay off the whole debt and it will show as such on your credit score. If you settle a debt for less, then this will show on your credit file for six years like many other debts. However, your score might not increase as much if you settled the debt without paying everything back.

Recommended Reading: What Does Dt Mean On Credit Report

How Long Does A Poor Credit Rating Last

Your credit rating, or credit score, is based on the information shown in your credit report at a given time. Equifax gives the following timeframes for how long different kinds of information may stay on your credit report.

|

|

| Seven years |

|

|---|

*Where you cant be contacted, a lender can immediately list the debt as a clearout and does not need to wait 60 days.

With bankruptcy, debt agreements and personal insolvency, when you enter into an agreement and when it ends can affect how long the information is kept on file. For example, Experian says a bankruptcy will remain on your credit record for five years from the date of listing or two years after discharge, whichever is greatest. If you pay an overdue debt, it will still generally be listed on your credit report for five or seven years . However, your credit report will be updated to show you have made payments, which could help your score start to improve.

Social Security Number Change

It is difficult and unusual to change a Social Security number, but it is sometimes necessary. For example, someone facing continuing damage due to fraud perpetrated using their stolen Social Security number may be able to obtain a new one. As with other identifying information, new numbers should be provided to creditors, who will pass that information along to credit agencies.

The credit agencies have differing policies about Social Security number changes:

- Experian: Update your number with your creditors. It is not necessary to change it directly with Experian.

- Equifax: If you would like to change your number directly with the agency, submit a request to update it with Equifax at the address on your credit report. One of the following types of documentation is required:

- Copy of the new Social Security card

- Pay stub with the number

- W-2 form or 1099 form

- Medicaid or Medicare documentation

Recommended Reading: What Are Collections On Credit Report

Don’t Miss: Does An Arranged Overdraft Affect Your Credit Rating

Your Credit Scores Change As Time Goes On

Your credit scores change naturally over time.

Even if you maintain the status quo and dont apply for any new accounts, your credit scores could change as your existing accounts age. The negative impact of a late payment from the past may lessen over time, for example. And just having longer account histories can have a positive impact on your scores.

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO® Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO® Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

Don’t Miss: Do Loans Affect Credit Score

What About Collections Accounts

If the debt you paid off was one that had gone to a collections agency, you might or might not see a change in your score. It depends on the being used.

Some credit scoring models exclude collections accounts once theyve been repaid. In that case, you might see a credit score change in 30 to 45 days.

And if another credit scoring model is being used? The debt will stay on your credit report for seven years as a Paid Collection. Thats not ideal. However, future lenders would likely rather see a paid-off collections account than an unpaid one. Sure, you had money issues but ultimately, you paid what you owed.

Note: Sometimes a collections account can be removed from your credit report. Its worth a try.

So What Does That Mean

What that means is that your credit report can be constantly changing, especially if you have a lot of accounts. And since your credit report can change often, so can your since scores are based off the data from your credit report.

Lets put this into a real world example. Lets say you had a really rough month with your kitchen appliances and they all broke beyond repair at the same time.

You decide to buy new appliances for $7,000, and pay with an existing credit card account with a $10,000 limit. Also hypothetically, say this particular credit card company reports data to the credit reporting companies immediately after you make your purchase. For a period of time, your account will have a high credit utilization ratio, meaning that your spending is close to the credit limit.

Of course, once you start paying down the balance on the account, your will decrease, and your credit scores will reflect that positively.

Does Having Your Credit Card Declined Hurt Your Credit?

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well.

Resources

Recommended Reading: How Long Do Closed Accounts Stay On Credit Report

When Does Your Credit Report Update

The three nationwide credit bureaus generate your credit reports from information provided by lenders, debt collection agencies, and other companies that handle debts. These companies are known as data furnishers.

Every time a data furnisher provides new information about your credit activity to the bureaus, theyll update your report .

Types of information your credit report may be updated with

The information that data furnishers provide to the credit bureaus includes your:

- Payment history: Your payment history is a record of your activity on all of your credit account reports going back 7 years. It indicates whether you usually stay on top of your bills or sometimes make late payments.

- Outstanding debt: Your current debts also show up on your credit report.

- New credit applications: If you apply for new credit, your potential lender will usually check your credit. This will also show up on your credit report and affect your credit score.

Tips For Improving Credit Score After Paying Off Debt

While paying off your credit card debt is important, what matters more is on-time payments and your utilization rate. Many times, borrowers will ignore these factors, thinking that clearing up their debt as quickly as possible is the key to a stellar score. But there are a few other methods to consider:

- Be strategic with the order in which you pay off your debts. Personal loans and credit cards often have higher interest rates than mortgages, car loans and student loans. Paying off those first not only helps keep your credit utilization in check, but will also save you money in interest. You can also use a debt paydown calculator to help .

- Check your credit utilization. If youve paid off your debt and your credit score went down, look at just how much of your credit you are using. If its above 30 percent, you might consider charging less each month. If that isnt an option, you could speak with your issuer about increasing your credit limit. Both of those should help increase your credit score.

- Open another credit card. While opening accounts could temporarily lower your score due to hard credit checks, opening a new card could increase your total available credit and spread your charging among several cards.

Read Also: How To Get Things Removed From Credit Report

Did You Know It’s Not Just The Score That Counts

Lenders will look at your credit score when dealing with an application for credit. But their lending decision won’t be made on the score alone. They will scrutinise the whole report to get an overall picture of the kind of borrower they are considering.

This is a good reason for making sure you have actioned a “financial disassociation” from any ex-partners you may have held a mortgage or any other kind of credit with.

What Is A Credit Score

A credit score is a rating of your ability to manage your money. Everyone in the UK has a credit score based on their ability to pay debts on time. For example, if you pay your council tax bill, rent and utility bills in full on time each month, this will help improve your credit score.

At the same time, you might have unpaid debts that took you longer to pay off than you hoped, or you might have had debt written off that you couldnt afford. These things will make your credit score less impressive.

Also Check: What Credit Report Does Capital One Auto Pull

Lower Your Credit Utilization Rate

The fastest way to get a credit score boost is to lower the amount of revolving debt youre carrying.

The typical guidance from personal finance experts is to use no more than 30% of your credit limit, which applies both to individual cards and across all cards. For example:

- On a card with a $500 credit limit, spend no more than $150.

- On a card with a $700 credit limit, spend no more than $210.

- On both cards , spend no more than $360.

How much will this action impact your credit score?

Reducing your balances is the single most effective way to boost your credit score. Provided you have no derogatory marks on your credit reports, such as late payments or delinquencies, you are guaranteed to see a big jump in your scores quickly if you knock down your balances to $0 or close to zero.

Still, if your utilization is currently over 30%, and simply paying the debt off immediately isnt a viable option, there are a few other ways to lower your credit utilization rate.

Correct Errors On Your Credit Report

Correcting errors on your credit report is a relatively quick way to improve your credit score. If its a simple identity errorlike a credit card thats not yours showing upyou can get that corrected within one to two months. If its an error on one of your accounts, though, it could take longer, because you need to involve your creditor as well as the credit bureau.

The entire process typically takes 30 to 90 days. If theres a lot of back-and-forth between you, the credit bureau, and your creditor, it could take longer.

The first step to correcting errors is to get a copy of your free credit reports from TransUnion, Equifax, and Experian . You can do this at no cost once a year at annualcreditreport.com.

Next, review your credit report for errors. If its an error on one of your accounts, you must refute that error with the bureau by providing documentation arguing otherwise. For example, if you paid a credit card on time and the card issuer is reporting a late payment, find a bank statement showing that you paid on time.

Don’t Miss: What Credit Report Does Chase Pull