How Much Did Becoming An Authorized User Raise Your Score

Forgive me if this is a common question, but I did a search and didn’t come up with much on this exact topic….

So ya anyways I recently convinced my parents to add me to th one credit card they have, and I’m trying to get an idea of what kinda score bump I might be able to expect???

They have a low 800’s credit score, and I’m pretty sure the card is probably at least 8 years old, and they pay off their entire balance most months. I’m not sure what the llmit is, they are very private about money matters and were kinda leery about doing this, so I didn’t mention that It would be pretty easy to figure out once it showed up on my credit reports

My fico scores range from about 630-644 at the moment due to several new accounts in last 8 months, and heavy utilization lately, though i did just pay 5000 off and the simulators say that should drop my utilzation enough to raise my scores 30+ points, and just aging my credit by 8 months in the simulator adds 20-40 points, so I’m hoping I get that increased age from becoming an AU at least, and that it stacks with the large payment I just made for a total score bump of 50+ points.

Oh my Total credit lines are 24,200 with a 900 increase on the merrick in 3 more months and here are my cards and their ages….

- FST PREMIER 6 Years, 6 Months

- BRCLYSBANKDE 2 Years, 11 Months

- CAPITAL ONE 2 Years, 11 Months

- CHASE 2 Years, 11 Months

- MERRICK BK 4 Months

What If I’m Still Waiting On A Check To Arrive

One thing to keep in mind is that the IRS is targeting specific payment dates . If you have direct deposit set up with the IRS, you might see a pending payment before the actual closing date. That means you might not be able to access the money right away, but that it’s in process. Unfortunately, the advance credit isn’t without the usual hiccups. Around 15% of families that received July’s payment by direct deposit were mailed paper checks in August because of a technical issue.

It could take longer for your payment to arrive if you’re receiving the check by mail. If enough time has passed and you’re concerned there may be a problem, you can use the IRS Update Portal to correct your banking information or address. You can also file an IRS payment trace if you’re worried. Check here for more information about missing payments.

How Many Points Will My Credit Score Increase If A Collection Is Deleted

Owing money can be extremely stressful, especially if your account has gone to collections. Youll keep getting calls and receiving collection notices from them regularly, which can be both frustrating and infuriating.

You might think to pay it off so they would stop harassing you. And you also hope that getting a collection deleted from your record will help improve your credit score. How many points will your credit score increase if a collection is deleted? Up to 150 points if thats the only collection in your report, or none at all if you still have others that arent paid and deleted.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

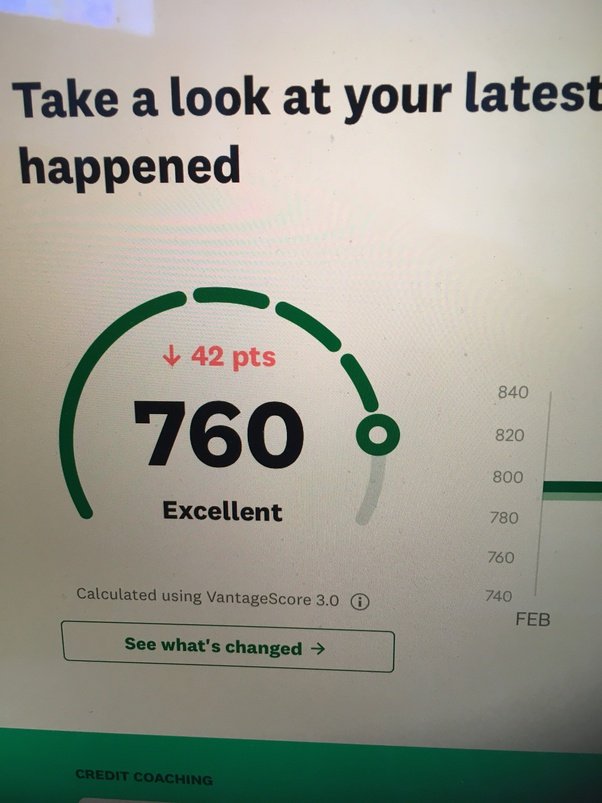

Here’s How Much My Credit Score Fell When My Utilization Rate Topped 50%

by Christy Bieber | Updated Sept. 10, 2021 – First published on March 25, 2019

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Learn why credit utilization matters if you’re trying to improve your credit score.

When you’re trying to improve your credit score, one of the most common pieces of advice you’ll hear is to keep your credit utilization ratio pretty low.

But, what actually happens if you don’t follow this advice? I recently found out, as my credit utilization ratio temporarily topped 50%. As soon as this occurred, my previously-stellar fell because I was using so much of my available credit.

Does Paying Off A Collection Account Affect Your Credit Score

The effects of paying a collection account in full do not vanish instantly. You will have to wait until it hits the limitation period, which is approximately seven years before it is even erased from your credit history. Luckily, the older data has little to no influence on your credit score.

Suppose you suspect you have a wrong collection account on your credit report. In that case, you have the opportunity to challenge the information with the credit company and have it rectified or erased if it is proven to be erroneous. This provision covers collections as well as any elements on your credit report that you feel might be wrong.

As we already stated, if you have had a confirmed collection account on your credit report, it will not be erased until well after seven years. Although it is not generally recommended, you can attach a brief consumer statement to your credit report outlining the collection and telling your side of the story.

Recommended Reading: How To Print Credit Report From Credit Karma

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

How Long Does It Take Your Credit Score To Improve

Thomas J. Brock is a Chartered Financial Analyst and a Certified Public Accountant with 20 years of corporate finance, accounting, and financial planning experience managing large investments including a $4 billion insurance carrier’s investment operations.

Your is a sensitive numberthree digits that can move up or down on any given day depending on how the information in your credit report changes. If youve been working to improve your credit scoreby paying off past-due accounts, correcting errors, making timely payments, or having negative items deleted from your credit report you undoubtedly want to see the results of your efforts as quickly as possible. And if you need your credit score to increase a few points so you can qualify for a loan or better interest rate, you’re probably eager to see improvement soon.

Recommended Reading: Speedy Cash Extension

Heres Why Credit Card Utilization Is Important To Your Credit Utilization

As weve been waying throughout this article, credit card utilization is important and plays a big role in where your credit scores fall .The general rule of thumb is that you want your credit utilization ratios between 10-30 percent.Why?In most cases, the higher your credit card utilization ratios, the lower your credit scores will be.If I have a $20,000 limit and Im using $15,000 of it, my credit utilization is at a high 75 percent.Due to this, its likely my credit scores are going to go down.If I can make a payment on this credit card and get my balance down to $5,000 , my credit scores are likely to take a good jump higher.See how that works?Your goal is to get your credit utilization down to 10-30 percent.

What Are The Other Ways To Improve Your Credit Score

Collection accounts will have less impact on your credit score as they age. Even if they still appear on your credit report, there are other ways to improve your credit score.

- Always check your credit report for inaccuracies. File a dispute right away once you see an error and provide the necessary documents to support your claim. This will let you fix your credit report before it causes damages to your financial situation.

- Avoid adding negative items to your credit score by paying off your debt on time. Making timely payments prevents debts from going into default, which means your lenders or credits dont need to tap collection agencies.

- Keep your as low as possible. Always remember that your credit utilization ratio will be factored in once your credit score is calculated.

- Apply for new credit only when you need it. Applying for new credit results in a hard inquiry, which could bring down your credit score.

Read Also: How To Unlock My Experian Credit Report

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How Much Will My Credit Improve Once My Bankruptcy Falls Off

Bankruptcies fall off personal credit reports after 10 years, after which time a damaged credit score can begin to improve. There’s no way to determine exactly how much your credit score will improve after bankruptcy, because it depends entirely on the decisions you make after the 10-year period. By actively working to improve your credit score, it’s possible to raise it out of the “high-risk” category and eventually into the 700’s or higher, to a maximum score of 850. Rebuilding a credit score requires patience and consistent financial responsibility.

You May Like: What Is Syncb Ntwk On Credit Report

Difficulties You May Face Before A Bankruptcy Falls Off Your Credit Report

Before a bakruptcy is removed from your credit report, you may face the following problems:

- Unsecured credit card applications will not be approved

- Loan applications will not be approved

- Payment of higher interest rates

- Payment of higher insurance premiums

- More difficult time finding a job

- More difficult time getting approved to rent an apartment

- Difficulty taking out a loan to buy a home

Can A Chapter 7 Be Removed From Credit Report Before 10 Years

A chapter 7 bankruptcy can only be removed from your credit report before the 10 year period if there are any inaccuracies in the information thats reported. You cannot remove a bankruptcy from your credit report simply because you dont want it to be there. Most people will have to wait the 10 years before the bankruptcy falls off their credit report on its own.

Recommended Reading: Does Les Schwab Report To Credit Bureaus

What Should You Do To Improve Your Credit Score After A Bankruptcy

After you have filed for bankruptcy, it will be very difficult for you to be approved for any type of credit, including regular unsecured credit cards. So, you should ease back into borrowing money by applying for a secured credit card. A secured card is just as good for your credit as is an unsecured credit card, but there is a difference. With a secured credit card, your credit limit is determined by a security deposit that you give the issuer.

For example, if you want a $500 credit limit, the card issuer will ask you for a $500 deposit. The security deposit is kept by the bank as collateral in the event that you fail to repay your credit card. Usually, if you use the credit card and make all of your payments on time, the card issuer will return the security deposit to you within 12 to 18 months.

Dont be discouraged from applying for a secured credit card after your debt has been discharged. Its one of the greatest ways to build a good credit history after bankruptcy. That said, make sure to make all of your payments on time and dont fall back into the bad habits that cause you to file for bankruptcy the first time.

Here are some quick tips on improving your credit score:

How Much Can A Collections Account Affect Your Credit Score

Whenever a collection appears on your credit report, it can lower your credit score by approximately 110 points, bringing it from fair to bad. You might lose even more points if your credit score is high to begin with.

Potential lenders will know that you have defaulted on a loan and that you could represent the same risk if they let you borrow money through them.

Also Check: Get Repossession Off Credit Report

I Just Paid Off My Credit Card Will My Credit Score Go Up

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Paying off credit card debt is smart, whether you do it every month or finally finish paying interest after months or years. And as you might expect, it will affect your credit score.

If you pay on time and are chipping away at a balance or eliminating it with one big payment, your score will likely go up.

Heres how various credit card payoff scenarios are likely to play out.

How Much Will Credit Score Increase After Bankruptcy Falls Off

Your credit score will increase by 50 to 150 points after a bankruptcy is removed from your credit report. The removal of bankruptcy can dramatically increase your credit score because bankruptcy is the most negative item that can appear on your credit report. The amount of points your credit score will increase depends on other items you have on your credit report.

If you have other negative items bringing down your credit score, you might not see a huge increase. But if nothing else is affecting your credit score, the removal of bankruptcy will likely result in a huge increase in your credit score.

If, after filing for bankruptcy, you open new accounts, make all of your payments on time, you should see a substantial increase in your credit score once the bankruptcy is removed from your credit report.

Many people have reported that their credit score has increased by 50 to 150 points after the bankruptcy fell of their credit report. That said, some saw a 50 point increase, others saw a 91 point increase, and others experienced a 150 point increase. So, your point increase will vary depending on the information in your credit report.

If, after filing for bankruptcy, you opened new credit cards, racked up a lot of new debt, and missed payments on your account, you will be hurting your credit score and the removal of a bankruptcy would have little to no impact on your credit score because the new derogatory information will drag your credit score down.

Read Also: Does Speedy Cash Do Credit Checks

This Is Why Much More Signature Loans Will Cost

Personal loans are usually amounts of money which are borrowed without the equity and are also generally known as “unsecured” financial loans. They often have larger interest rates since thereis no actual asset for loan provider to take back in the event the borrower doesn’t spend. Consumers just who file for bankruptcy just a-year before you take aside an individual mortgage will probably pay, on average, $1,426 much more about a three-year, $10,000 loan.

Consumers can help to save a lot of cash by wishing slightly longer to take out these financial loans, besides — like they may be able making use of the auto loans. Five years after a bankruptcy, the additional cost simply $287 significantly more than in the event that borrower hadn’t experienced they.

Graphics supply: Getty Files.

Top Ways To Raise Your Credit Score

There are several things you can do in the short-term to try and better your credit score.

Improving your credit utilization will likely have the quickest impact. This could be through paying down debt, upping your credit limit or opening a new credit account. Keep in mind, applying for new credit could hurt your score, so its best to prepare beforehand to find the right card for you and increase your chances of a successful application.

Additionally, there are a couple other things you can do to start your journey to an increased score:

- Make credit card payments on time. This is especially helpful for those with no credit history because you have the chance to prove yourself by being consistent right off the bat.

- Remove incorrect or negative information from your credit reports. Often times, you can challenge old information or errors on your report to attempt to get the event removed.

- Hold old credit accounts. Keeping accounts open that improve your length of credit will help your score as you better your habits.

As it is with many of lifes problems, theres no better time to address the issue than now. Through Bankrate, you can get a free credit score each month so take the time to assess where you stand, consider your financial habits and find your path towards better credit.

Also Check: Does Speedy Cash Report To Credit Bureaus

How To Avoid A Big Drop In Your Credit Score

The only way to avoid hurting your credit score by using too much of your available credit is not to use more than 30% of your credit line on any credit card. Ideally, getting this utilization rate as low as possible is ideal.

If you make a big purchase, as I did, you can actually pay off the amount you charged before you get your statement — and before the credit card company has a chance to report your high utilization ratio to the . If I charge so much on my card again, I’ll be taking this approach.

Even if you don’t pay off the card immediately, paying it off ASAP is imperative because when your utilization ratio comes down, your score will go up again. I’ve since paid off my card, and my credit score in December jumped right back up to where it was before.