How Long Do Collections Stay On Credit Report

How long does an unpaid collection remain on a credit report? In most cases, an unpaid bill can remain on your credit report for up to seven years. An unpaid bill, often referred to as derogatory or negative information, can be reported by your original creditor and collection agency if the bill is associated with it.

Why Its Important To Remove Inaccurate Hard Inquiries

If you spot a hard credit inquiry on your credit report and its legitimate , theres nothing you can do to remove it besides wait. It wont impact your score after 12 months and will fall off your credit report after two years.

However, if you spot a hard credit inquiry you dont recognize, its vital to remove it. There are a few reasons for this. First, it means that youre being unfairly penalized for that error, even if it only has a small impact. Second, it could be a sign of fraud, so its important to investigate it further and to get it removed.

How Multiple Credit Inquiries Affect Your Credit Score

Do you panic whenever a lender or landlord proposes pulling your credit report? If so, a lot of that anxiety may be overblown.

Too many credit inquiries in a short enough period of time will make a dent in your credit score, but this shouldnt deter you from rate shopping for the best offers.

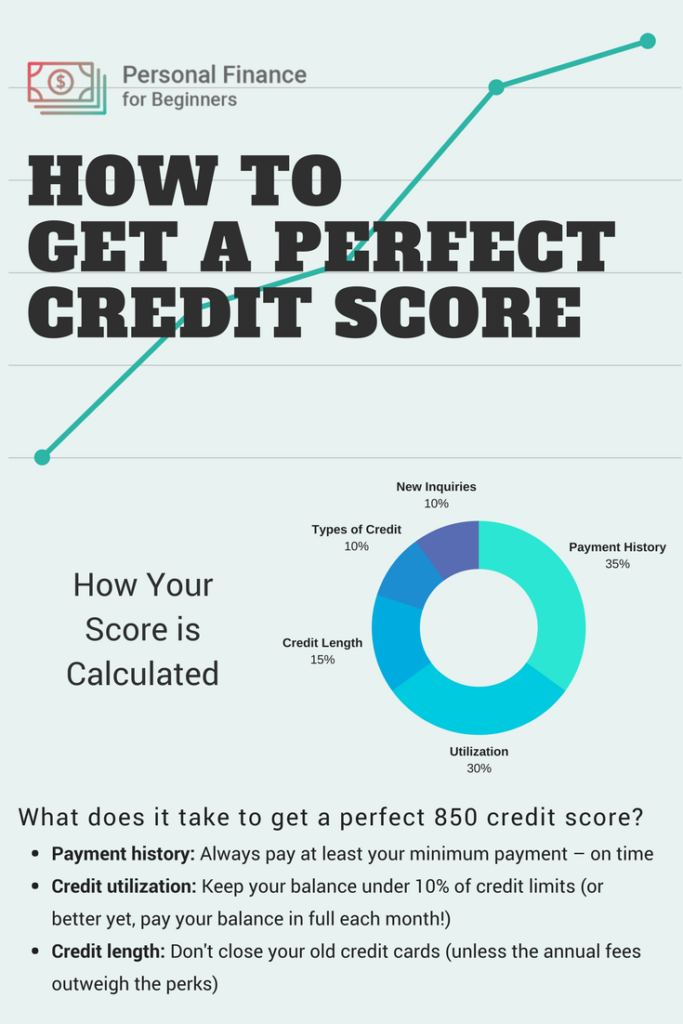

Its ironic that so much attention gets focused on credit inquiries because they are such a tiny part of the FICO score, said Craig Watts, public affairs manager for the Fair Isaac Corporation .

We generalize by saying that typically no more than 10% of a FICO scores weight is determined by a persons taking on new credit, Watts said. But for most people, inquiries have little to no influence on their FICO scores.

To put that 10% into perspective, payment history, i.e. whether or not youve been paying your bills on time, makes up 35% of your credit score.

So, a credit inquiry is just a small nick in your credit report, but not all inquiries are created equal.

Also Check: How Long Does It Take Capital One To Report Authorized User

Avoid Unnecessary Applications Prior To Applying For Home Or Auto Loan

While a single hard inquiry on your credit report can cause a small, short-term decline in your credit score, it shouldn’t have a major negative impact, especially if you have good credit. Having several hard inquiries for different types of credit in a short time, however, could cause a more significant dip in scores and cause lenders to worry that you are having financial difficulty or that you could become overextended.

If you’re seeking a loan for a big purchase like a home or a car, first get a copy of your and review it. Avoid applying for new credit until you apply for your mortgage or auto loan. And consider signing up for free credit monitoringit will help you stay on top of your credit situation and can also help alert you to signs of fraud or identity theft, including unauthorized hard inquiries.

Hard Inquiries Should Be Removed After 2 Years

The only way that a dispute will work is if the inquiry appears in error on your credit report. Fortunately, hard inquiries only appear for two years on your credit report. Most other negative information will remain for seven years. A Chapter 7 bankruptcy remains for up to 10 years, though its effects on your credit score are much more short-lived.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

How To Remove Hard Inquiries From Your Credit Report

Because you often dont control who checks your credit, your first step is to request a copy of your credit reports to review all of the items listing in the Credit Inquiries section.

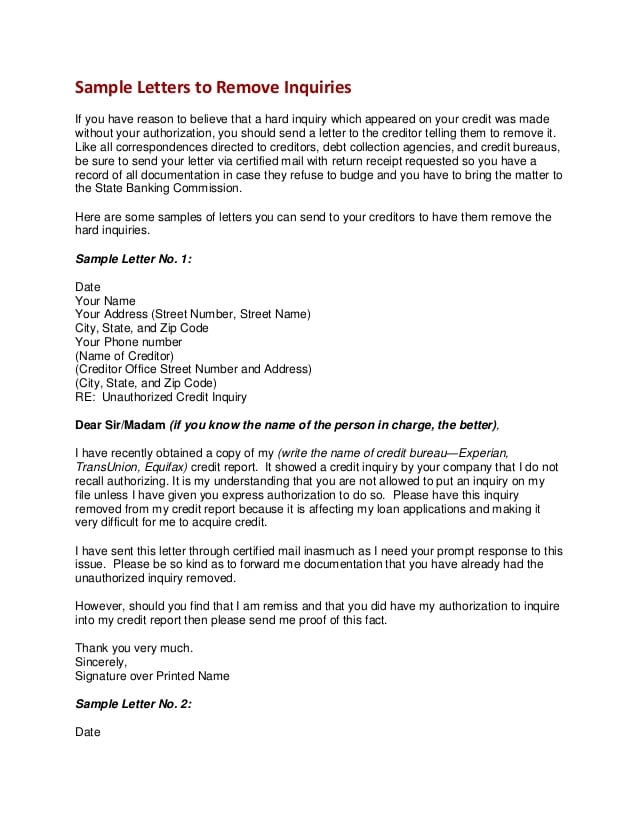

Check each hard inquiry on your credit report carefully. If you didnt authorize it, you can dispute it with the credit bureaus. The Fair Credit Reporting Act says that by law, you can dispute any questionable items on your credit reports and they must be investigated within 30 days. If the hard inquiry cant be verified, the credit bureau must remove it. There are two ways to remove inquiries.

What To Do If You Spot A Problem

If you cant trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau cant confirm it as a legitimate inquiry, its required to remove it. Contact each credit bureau individually:

If you suspect fraud, you can have a fraud alert added to your credit reports, which flags applications in your name as requiring extra scrutiny. Alert any one credit reporting agency it will share information with the other two.

Or, for the best protection, simply freeze your credit with all three bureaus to stop anyone from opening new credit in your name.

Also Check: Synchrony Ntwk Credit Card

Who Is Actually Able To See Soft Inquiries On Your Credit Reports

Soft inquiries will only show up when you personally check your own credit reports . The credit reporting agencies do not disclose information regarding soft inquiries on reports sold to third parties. If a lender, insurance provider, or employer checks your credit report, your soft inquiries will not be displayed.

How Long Does An Unpaid Collection Remain On A Credit Report Tax

Before that, unpaid tax liens will remain on the credit report for 10 years and paid tax liens will remain on the credit report for 7 years. What is withholding tax? Withholding is a claim filed by the Internal Revenue Service in accordance with the government’s right to collect money from a taxpayer who has not paid taxes.

Read Also: How To Get Credit Report With Itin Number

Large Number Of Hard Inquiries

A large number of inquiries on a credit report can make it extremely difficult or impossible for the consumer to buy a house, car or any purchase that requires credit.

Consumers should take the time to review their credit report to find out if there are any unauthorized credit inquiries on their credit report.

If this is the case, they can send a credit inquiry removal letter and have all or some of the hard inquiries removed. This would most likely raise their credit score.

According to the Fair Credit Reporting Act , consumers have the right to dispute any inaccurate information on their credit report.

Combining Multiple Hard Inquiries

Its important not to apply for too many types of credit at one time.

However, the credit scoring models understand that people make multiple hard inquiries to compare terms and rates. So, if youre shopping around for one type of credit, like a mortgage, and make multiple inquiries in a short period of time, they only count as a single hard inquiry.

Lenders have become increasingly lenient in this regard because they know that todays consumers are more likely to perform their due diligence before making a major financial decision. This is true for credit cards or an auto loan as well. They do not impact your credit scores as long as they occur within a 30-45 day period.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

Hard Inquiries Vs Soft Inquiries

The essential difference between a hard inquiry and a soft inquiry is whether or not you gave the lender permission to check your credit report.

Generally speaking, if you let a lender scrutinize your credit report, its a hard inquiry. If a lender or bank peers into your credit report without your knowledge or permission, its a soft inquiry.

As far as your credit score is concerned, soft inquiries are harmless and will mostly go unnoticed. Hard inquiries, however, can leave a mark on your credit report, especially for anyone rapidly applying for credit in a short time span.

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Recommended Reading: How To Check My Credit Score Without Ssn

Dispute An Unauthorized Or Inaccurate Hard Inquiry

Remember, if you did request the credit inquiry because you were applying for a loan, then you cant dispute it with the agencies.

But if something looks suspicious, then lets take action.

If you find you could have a case of identity theft youre dealing with, then you will need to file a police report.

You would need the information from your police report to help you dispute the unauthorized inquiry.

If you think this is a case of a mistake in reporting, then you can work directly with each bureau.

File A Dispute with Each Credit Bureau

Since you receive three different credit reports, youll need to dispute the inquiry with each corresponding bureau.

How To Remove Incorrect Details And Enquiries From Your Credit Report In 4 Steps

Also Check: Paydex Score Chart

Equifax Must Provide Free Copies Of Your Credit Report

A data breach at Equifax in 2017 compromised the personal information of at least 147 million consumers. As part of a court settlement related to the hack, everyonewhether they were affected by the breach or notcan get six more free credit reports from Equifax each year, beginning in January 2020, for the next seven years.

Strategies That Will Get You A Better Credit Score

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow. If you’d like to improve your credit score, there are a number of simple things you can do. It takes a bit of effort and, of course, some time. Heres a step-by-step guide to achieving a better credit score.

Recommended Reading: How To Remove Repossession From Credit Report

What Is A Credit Enquiry

There are two main types of credit enquiries: “soft” enquiries and “hard” enquiries.

A soft enquiry is recorded any time you request a copy of your credit file and doesn’t really have an impact on your credit score.

A “hard” enquiry refers to any request for your credit file that’s made by a third party, such as a lender. For instance, every time you apply for a line of credit, such as a card or personal loan, the lender you’ve applied with will submit a request for your credit file. This request is recorded on your credit history as a “hard credit enquiry”. While a few of these enquiries is usually fine, too many hard enquiries on your credit file can suggest to lenders that you are not able to manage credit accounts responsibly. This may lead to a declined application.

How do I know if I have “too many credit enquiries”?

If you’re concerned about the number of enquiries on your credit history, the first step is to get a copy of your credit file. You can check your credit report and credit score for free with finder and we’ll notify you when something on your report changes, such as a credit enquiry.

When you get your free credit report and look at your credit enquiries, it’s important to note that it’s not so much about the total number of enquiries as it is about the time between them. Less time between credit enquiries increases the chances that they will have a negative impact on your credit score.

A Comparison Of Hard Versus Soft Credit Inquiries

While creditors and other entities can check your credit report and score through either a hard or a soft credit inquiry, there are some key differences between these types of credit pulls.

First, different information may be shown in a hard versus soft credit inquiry. For example, a creditor or other entity performing a soft credit pull for promotional or marketing purposes will only be able to view a limited report. To obtain your full credit file, theyd have to use a hard credit inquiry.

Also, hard credit inquiries can have a negative effect on your credit by lowering your credit score. Even though soft inquiries are still noted on your credit report, these cannot lower your credit score nor do they show up as a negative on your credit report.

Finally, for a lender or a creditor to conduct a hard inquiry, you must first have granted them permission to do so. Therefore, if you discover a hard credit inquiry was conducted without your knowledge or permission, you can often dispute it.

You May Like: Does Klarna And Afterpay Help Your Credit

Hard Inquiries Or Hard Credit Pulls

These can potentially have a negative impact on credit scores.

A hard inquiry usually happens when a lender is checking your credit in order to make a lending decision, such as a bank deciding whether to approve you for a credit card. Hard inquiries may occur when other types of companies check your credit as well, like a cell phone company deciding whether to give you a cell phone contract or a collection agency checking your credit for skip tracing purposes.

How Do I Protect Myself From Fraudulent Hard Inquiries

Inaccurate information on your credit report is uncommon, but it does happen. Check your regularly to avoid fraudulent and other incorrect information going unnoticed. Review whats listed and keep an eye out for anything unfamiliar.

Its impossible to prevent all identity theft, but keeping track of your credit history will keep you in a better position to stop a bad situation from getting much worse.

You should also consider placing a fraud alert on your credit record as soon as you think you are or may be a victim of identity theft. This will make it more difficult for criminals to start a new account in your name.

Putting your credit report under a credit freeze provides even more security. A freeze prevents companies from making any inquiries. While youre looking for a loan or credit, you can unfreeze your credit report to allow a legitimate hard inquiry to go through.

Don’t Miss: Does Removing An Authorized User Hurt Their Credit Score

How Do I Permanently Delete My Yahoo Email Account

How To Delete Your Yahoo Mail AccountStep 1 : Visit the page to delete your Yahoo account and sign in with your Yahoo credentials.Step 2 : After confirming that your Yahoo ID is correct and reading the account deletion warning, enter your Yahoo password.Step 3 : Scroll down and enter a visual or visual code.Step 3 : Click on “Cancel this account”.

Search For Unauthorized Hard Inquiries

Once you have copies of your credit reports, review them for mistakes, errors, and fraud. Search for credit accounts you dont recognize, incorrect credit reporting on valid accounts , and other mistakes. Finally, check your credit reports for unauthorized inquiries.

If you discover inquiries you dont recognize on your credit report, it could be a sign of identity theft. Make a list of any suspicious inquiries you find. Youll need this information to complete the next step.

Recommended Reading: How To Get Credit Report With Itin Number

Review Your Reports For Mistakes Inaccuracies Items That Shouldn’t Appear

After you get your credit reports, be sure to review them and dispute any inaccurate information you find. If you’re planning to make a big purchase, like a house or a car, or a significant financial commitment, such as refinancing your mortgage, you might want to review information from all three agencies well in advance.

How Important Is It To Remove Inquiries From Your Credit Report

Inquiries are the least important items to remove from your credit reports compared to other negative items like missed payments and delinquent debts.

They have a relatively low effect on your credit scores and cause less and less damage over time. Because they only affect your credit score for 12 months and drop off entirely after two years, hard inquiries are by no means the worst thing you can have on your credit report.

Many negative items stay on there for anywhere between seven and ten years. So if your credit history is riddled with several derogatory marks, removing hard inquiries should be your last priority as you work on increasing your overall scores.

It often helps to talk to a professional credit repair company to help you analyze your credit reports and prioritize issues that need to be addressed. They have the legal know-how of what your rights are with your different creditors and how likely you are to get certain items removed.

Also Check: Remove Repo From Credit