Have Different Types Of Credit Accounts

There are two major types of credit accounts. Theres revolving credit, which includes ongoing loans like credit cards, where you can spend and pay each month. The other is installment loans, which include personal loans, car loans, mortgages, and other situations where you borrow a large sum of money up front then pay it back over time in installments. To get the highest possible credit scores, you need both of these on your credit reports.

Keep in mind that you dont need to go out and buy a new car just to boost your creditworthiness with an installment loan. If youre looking to build credit and dont have any installment loan accounts, you can use a to add positive payment history to your credit reports and increase your credit mix.

If youve had an installment loan in the past and paid it off satisfactorily, it will count toward a healthy credit mix while it remains on your credit reports. The idea is to demonstrate you can manage multiple types of credit accounts over time.

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

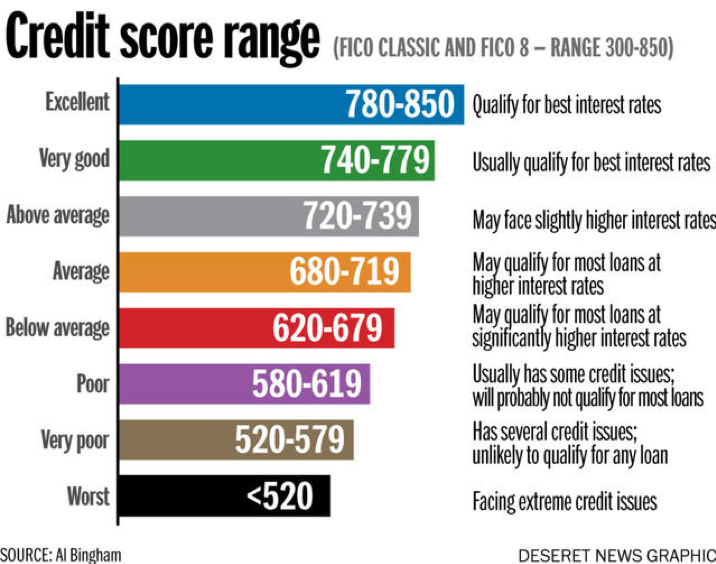

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Don’t Miss: How Do Credit Scores Work When You Get Married

Does Your Credit Score Go Up If You Pay Off A Credit Card

Paying off a credit card doesn’t usually hurt your credit scoresjust the opposite, in fact. It can take a month or two for paid-off balances to be reflected in your score, but reducing credit card debt typically results in a score boost eventually, as long as your other credit accounts are in good standing.

Monitor Your Credit Reports

Because your credit score is constantly being updated, its important to monitor your report regularly. Doing so will help ensure that all the information on your credit report is accurate. If there are errors, you can find out about them and have them removed in a timely manner before they do any damage to your credit score.

Don’t Miss: Can Lexington Law Remove Repossessions

Vantagescore And Fico Are The Two Main Credit

But even if you have pretty good credit habits, dont be surprised if you check your scores and find that youre below 850.

Perfect credit scores can seem to be inexplicably out of reach. Out of 200 million consumers with credit scores, the average FICO score is 704. And FICO says that as of April 2019, just 1.6% of Americans with credit scores had perfect FICO scores.

The Benefits Of A High Credit Score

Having a high credit score can open many doors for you. Most people just think it makes it easier to get approved for credit cards which it does but there are many other perks to being in the excellent score club.

Instant approval: With excellent credit, you have a much better chance of being instantly approved for mortgages, credit cards, rentals, loans and insurance.

Lower interest rates: Higher credit scores come with lower interest rates. This is true for credit cards, mortgages and any other type of loan you may get. You can also refinance your current loans to get a lower rate. With lower interest rates, you can save even more money, putting you in great financial shape.

Higher credit limits: If you want the ability to book your entire vacation on your travel reward credit card, higher credit can help you do that. Credit limits are determined by your credit score, so the higher your score, the better chance that you can get a high credit limit on your credit cards.

The best credit card rewards are reserved for those with excellent credit. You get upgraded to rewards like up to 5% cashback, access to exclusive airport lounges, free hotel breakfast, more airline miles, free memberships, and credits on things like Uber, Lyft, checked bags, and more.

Don’t Miss: 686 Fico Score

How To Stay On Top Of Your Credit Score

Generally, people with a good credit score have a long history of making their credit card and other loan payments on time. Payment history typically makes up 35% of the total calculation. Amounts owed typically makes up about 30%. Other considerations are length of , about 15% credit mix , about 10% and new credit about 10%.

Dont Needlessly Cancel Credit Cards

Since credit history is an important metric, in most cases you wont want to close a credit card, even if you dont use it regularly. Thats because holding a credit card for a long time can have a positive effect on your credit score. If the credit card issuer encourages you to use it occasionally, consider charging it with smaller expenses or set it up as the card where you have a small subscription automatically billed. Just dont forget to make your payments.

Read Also: Remove Serious Delinquency Credit Report

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Also Check: Is 688 A Good Credit Score For A Mortgage

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

What Is The 5 C’s Of Credit

Understanding the Five C’s of Credit Familiarizing yourself with the five C’scapacity, capital, collateral, conditions and charactercan help you get a head start on presenting yourself to lenders as a potential borrower. Let’s take a closer look at what each one means and how you can prep your business.

Don’t Miss: Can A Closed Account Be Reopened

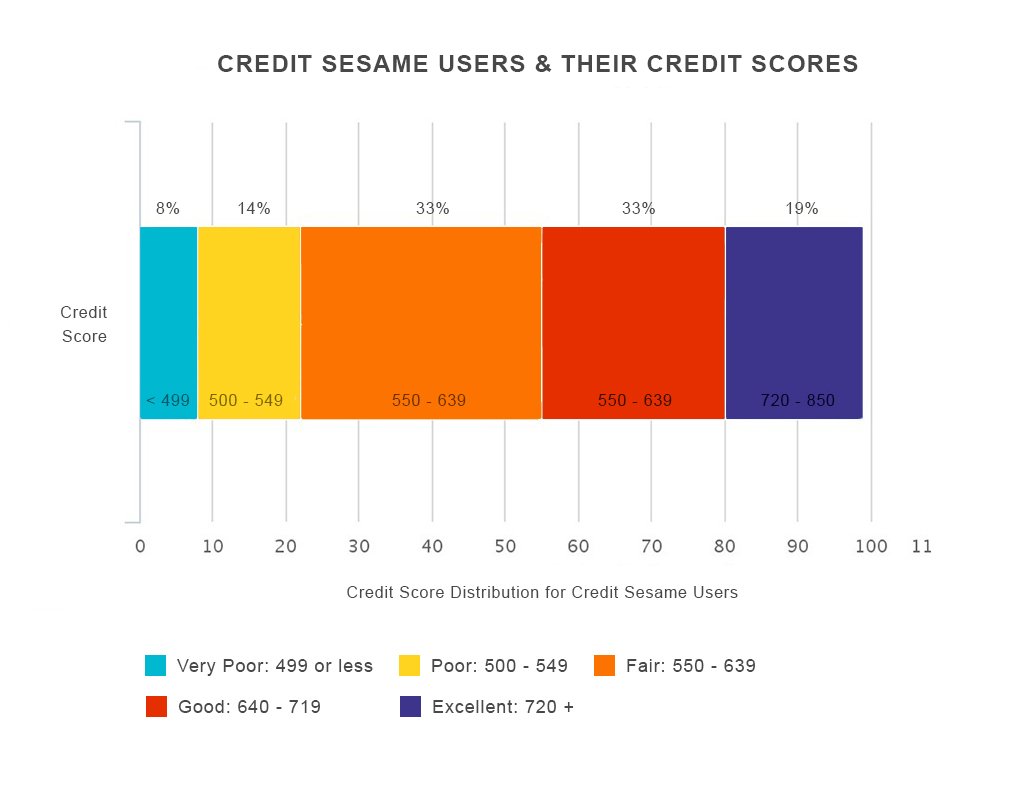

Percent Of The Us Population That Has A Fico Score Below 550

Fortunately, a low percentage of the U.S. population appears to have low FICO scores. Data released by FICO in 2019 reveals that only 11.1 percent of the U.S. population has a FICO score ranging between 300 and 54913.

It also reveals a downward trend, indicating that the average FICO score is on the rise and the average credit card debt and other debts are on the decline for Americans.

What Is A Good Vantagescore

FICO’s competitor, VantageScore produces a similar score using the same credit report data from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores above 780 are considered “superprime” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in July 2021 was 693.

Also Check: Student Loan Fall Off Credit Report

Learn About The Highest Credit Score And Just How Perfect Your Credit Score Needs To Be

If youâve ever wondered what the highest credit score you can have is, itâs 850. Thatâs at the top end of the most common FICO® and VantageScore® credit scores. And these two companies provide some of the most popular in America.

But do you need a perfect credit score? Not necessarily. According to credit bureau Experian娉s research, a score above 760 could qualify you for the best interest rates.

The Credit Score Needed To Buy A House

Your FICO score plays a major role in your ability to secure a mortgage. The type of mortgage that youre looking to secure will determine what your score should be. According to QuickenLoans, these are the following credit scores you need to work with lenders14:

- Conventional Mortgage: 620

- FHA Loan With 3.5 Percent Down: 580

- FHA Loan With 10 Percent Down: 500

If you fall below these guidelines, ask yourself, how long does it take to build credit? Then, come up with a plan of action to help you work towards your goal.

Recommended Reading: Usaa Experian Credit Monitoring

Whats The Purpose Of Getting A High Credit Score

The whole goal of obtaining credit is to convincecreditors that youre reliable enough to get out a loan or line of credit.Having a decent credit score shows lenders that youre trustworthy and have anexcellent financial responsibility history.

Ultimately, a decent credit score is one of the deciding factors of whether or not you get approved for brand new credit. If you do get approved, having a decent credit score can land you a far lower charge per unit, therefore saving you plenty of cash at the end of the day.

Just like building a great reputation, having a high score can give you higher opportunities and additional selections.

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

You May Like: Does Speedy Cash Check Credit

What Is The Highest Credit Rating For You

Your highest ranking is the one you reach by being consistently responsible with your loans, mortgages, and credit cards. No one is perfect, but if you work at your FICO score, you should be able to reach the golden land of 760 and above. And that score is as high as you really need to go.

About the Author

Jeff Hindenach

Jeff Hindenach is the co-founder of Simple. Thrifty. Living. He graduated from Bowling Green State University with a Bachelor’s Degree in Journalism. He has a long history of financial journalism, with a background writing for newspapers such as the San Jose Mercury News and San Francisco Examiner, as well as writing on personal finance for The Huffington Post, New York Times, Business Insider, CNBC, Newsday and The Street. He believes in giving readers the tools they need to get out of debt.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Don’t Miss: Usaa Free Credit Report

Does Anyone Have A 850 Credit Score

The truth is, Americans with a perfect 850 FICO® Score do exist. In fact, 1.2% of all FICO® Scores in the U.S. currently stand at 850. Think of it as the alternateand perhaps slightly less glamorous1 percent. Of course, you don’t need a perfect score to access credit at the best terms and lowest interest rates.

What Is A Poor Credit Score Range

Poor credit score = 550 619: Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk. Although it is possible to qualify for credit, it is often at very disadvantageous terms you will pay much higher interest rates and penalty fees.

If you find yourself in this range, you should begin to address any specific credit problems you have to try to boost your score before applying for credit. Subprime borrowers typically become delinquent 50% of the time.

Don’t Miss: When Does Usaa Report To Credit Bureaus

How Many People Have Perfect Credit Scores

Now that you know what a perfect credit score is, you may be wondering how many people have actually achieved this feat.

FICO® credit scores range from 300 850. According to data from FICO®, about 1.6% of the U.S. population has a credit score of 850. This figure is up from 0.98% in April 2014 and 0.85% in April 2009.

For many people, reaching an 850 credit score can seem like a daunting task. However, when you look at the lifestyle and financial habits of those who have an 850 credit score, youll notice many commonalities.

This starts with where consumers live, as youll see in the chart below. The following five states contain the highest number of individuals with an 850 credit score:

An Excellent Credit Score Is Good Enough

You don’t need a perfect credit score to get the best deals. A score of 720 or higher is generally considered excellent. And scoring 800 or above qualifies you for the best terms offered.

Thats pretty great news if you aspire to get into the group of people who have top-tier credit but you dont want to obsess over every single point in an effort to get the highest score possible.

Don’t Miss: Which Credit Score Does Carmax Use