How To Maintain Your Credit

Maintaining your credit score once youve built it up is simple though its not always easy. To maintain your credit score, youll have to stay on top of your credit card bills, being sure to pay them on time and in full each month. Another important aspect of maintaining your credit score is using your credit responsibly.

Youll need to keep your , as well as trying not to carry a balance on your credit cards from month to month. You should also avoid applying for new credit cards too often, as each credit card application requires a hard inquiry and can temporarily ding your credit score.

Access To Credit Reports

- If you are over 18 and you have taken out credit or borrowed money before, . In a limited number of European countries e.g. Spain, lenders only provide local credit reference agencies with information pertaining to unfulfilled financial obligations, such as missed or late payments, judgment orders on debts, and other adverse or negative information. So, in those countries, credit reference agencies will not hold any information about you even if you have taken out credit and have repaid on-time.

- You can request your credit history via a basic statutory report for free. You should receive it within one month.

- It is a good idea to check your report every now and then but the main reasons for checking it include: if you are changing job or moving home if you are applying for credit if you are worried about ID fraud.

- Getting your credit report will not hurt your credit score. When you look at your own credit history, that search is not visible to companies on your credit report.

How Do I Check My Credit Score

CIBC clients can check their credit score using the CIBC Free Credit Score Service in the CIBC Mobile Banking® App.

You can also contact one of Canada’s credit bureaus to receive a copy of your credit report by mail, free of charge. For a fee, you can view your credit report online.

For more information, contact one of the credit bureaus directly at:

- Equifax Canada: www.equifax.ca

You May Like: Zzounds Paypal

To View Your Score In Online Banking:

- Sign in to Online Banking

- Scroll down to the box on the right-hand side labelled My Services

- In the My Services box, select View Your Credit Score

- Review the legal disclaimer and select Continue

- Review the CreditView Dashboard agreement and select I Accept & Continue

Your credit score appears, along with various tools, calculators and educational information about credit reports, credit monitoring, credit cards, mortgages and much more.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Don’t Miss: Do Evictions Show Up On Credit Report

Start With A Local Store Or A Secured Loan

If you have steady income and have used the same mailing address for at least one year, you may wish to apply for credit with a local business or department store, or for a secured loan or credit card through a financial institution. Paying credit obligations on time will help you develop a good credit history and may enable you to obtain additional credit in the future.

How Do I Establish A Good Credit Rating

The easiest way to establish a good credit rating is to pay your bills on time. If you don’t have a credit card, apply for one, and use it responsibly. If you make your minimum payments, you can develop a good credit history. This will have a positive impact on your ability to borrow in the future.

To find out more about establishing credit, talk to a CIBC advisor.

Read Also: 688 Credit Score Credit Card

Top Sources For Free Credit Scores

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

What Is A Credit Score

A credit score is an objective summary of the information contained in your credit report at a particular point in time. If you have any credit accounts, such as credit cards, mortgage or loans, you likely have a credit report. Your credit report is a record of how you manage your credit obligations. This data is then distilled and calculated to create your credit score. Your credit score is a number that lenders may use to help them decide whether or not to extend you credit. It represents the risk related to whether or not they can expect you to repay, according to the agreement you sign with them. Credit scores can give lenders a quick, objective and impartial snapshot of a credit file and are helpful in making approval decisions

Checking it won’t lower it.

While the overall purpose of credit scores is universal, each lender will use his or her own criteria to measure an individuals credit worthiness

Also Check: Affirm Credit Score Requirement

The Importance Of Knowing Your Score

As we mentioned above, you shouldn’t go through life without knowing your credit score. This number is updated regularly. It goes up or down usually every month, but it may even be changed more frequently based on who’s reporting.

Knowing your score means you’re more likely to make better decisions about your finances. Having a lower score may make you more cautious about applying for new credit as there’s a good chance you’ll be denied. If you have a lot of inquiries and very few accounts, your score drops, and lenders may refuse to grant you a new account. On the other hand, knowing you have a higher credit score makes you a more attractive applicant to .

Keep in mind that checking your credit score isn’t the same as checking your . Your credit report provides a detailed history of your financial life, including any accounts you have, how often you’ve paid them on time, any delinquencies, bankruptcy reports, flags and messages, write-offs, and inquiries. The report also includes the dates of any changes to your credit history. You can use this history to account for and report any discrepancies.

You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to AnnualCreditReport.com to check your report for free. Each agency gives you access to your report once every 12 months. You’ll have to pay them if you want your credit score. But why pay when you can get your score for free?

Capital One Platinum: Best For Someone Dedicated To Their Credit

Beyond helping you build credit, the Capital One Platinum Credit Card doesnt have a ton to offer , but thats sort of the point. This card is designed to help someone on their credit-building journey graduate to the next level. Cardholders will get unlimited access to Capital Ones credit monitoring tool CreditWise, and youll be considered for an increased credit limit automatically after six months of on-time payments.

Cardholders can expect a pretty middle-of-the-road interest rate at 26.99 percent variable APR. This card also offers some savings in the way of its $0 annual fee. Youll need a credit score of at least 580 to qualify for this card.

Don’t Miss: Remove Repossession From Credit Report

What If The Cifas Marker Is There By Mistake

If you think a Cifas warning has been put on your credit file in error, you can contact the lender who put it there to see if theyll remove it.

Be aware that credit rating agencies are unlikely to remove any entry on your report if they believe the reason the marker was put on your credit file was justified. Lenders are legally obliged to report any fraudulent attempt on your account to the credit reference agencies.

Find out more about Cifas markers on the Cifas website

How To Access Your Credit Report

You can access your credit report through one of the CRAs. You can request a copy of your credit report online, in writing or verbally. If you do ask verbally, it can be useful to follow this up in writing.

You can make online requests directly from one or all of the 3 CRAs at:

You may need to create an account with each of the providers to be able to access your credit report.

-

your name

-

your full address

-

your date of birth

If you’re requesting a copy of your credit report in writing, you can write to the CRAs at:

Don’t Miss: Removing A Repossession From Credit Report

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Does Accessing Your Credit Report Lower Your Score

Checking your own credit report or credit score wont affect it. Its only impacted when lenders do a search on your credit file.

There are two types of searches lenders can do soft credit checks and hard credit checks.

Soft credit checks generally dont leave a footprint and will often show you the type of rates you could get. Theyre likely to be used by comparison sites and by tools when checking your eligibility for a certain rate or product.

Hard credit checks leave a visible footprint and generally take place when you apply for credit.

Explore more: Hard vs soft credit checks: what’s the difference?

Don’t Miss: How Long Do Repos Stay On Credit

How Lenders Use Credit Reports

Be aware that different lenders look for different things when reviewing your credit report and deciding whether to lend to you. They can also take other factors into account.

For example, you might have been furloughed and taken a payment holiday during the coronavirus pandemic. While this won’t directly affect your credit score, it may affect your ability to borrow in the future.

How Can I Get A Copy Of My Credit Report And Credit Score

You can ask for a free copy of your credit file by mail. There are two national credit bureaus in Canada: Equifax Canada and TransUnion Canada. You should check with both bureaus.

Complete details on how to order credit reports are available online. Basically, you have to send in photocopies of two pieces of identification, along with some basic background information. The reports will come back in two to three weeks.

The “free-report-by-mail” links are not prominently displayed the credit bureaus are anxious to sell you instant access to your report and credit score online.

For TransUnion, the instructions to get a free credit report by mail are available here. For Equifax, the instructions are here.

If you can’t wait for a free report by mail, you can always get an instant credit report online. TransUnion charges $14.95. Equifax’s rate is $15.50.

To get your all-important credit score, you’ll have to spend a bit more. Both Equifax and TransUnion offer consumers real-time online access to their credit score . Equifax charges $23.95, while TransUnion’s fee is $22.90. There is no free service to access your credit score.

You can always try asking the lender you’re trying to do business with, but they’re not supposed to give credit score information to you.

Also Check: Will Evictions Show On Credit Report

Helping Consumers In The Context Of Covid

1. We are recording debt moratoria in a way that does not negatively impact credit files. The fact that credit reports are not negatively impacted by mortgage or other payment holidays means that consumers and businesses ability to get credit in the future should not be negatively impacted, other things being equal.

2. We are engaging directly with consumers to remind them about their right to ask for a free copy of their credit report, which should allow them to verify the accuracy of their credit histories in the light of the measures taken during the COVID-19 pandemic.

3. We are offering our data analytics to governments / public authorities, to help them understand, anticipate and respond to the pandemic in order to minimize the financial stress on households and businesses.

Check out the ACCIS pubic position on COVID-19.

Understand Your Credit Report

The major credit bureaus refer to credit reports in different ways:

- Equifax refers to your credit report as

- TransUnion refers to your credit report as consumer disclosure

Its normal to feel overwhelmed when you receive your credit report. Theres a lot of information to decipher, which is why were here to help you work through it. Our blogs What is the Average Credit Score in Canada by Age and may help you understand your credit score ranges and what your credit score means.

Its important to understand what each letter and number on your credit report means. They act as a code for lenders to explain how well you repay your loans.

These codes have two parts:

- The letter shows the type of credit youre using

- The number shows when you make payments

You May Like: Cbna Inquiry

Why Should I Get My Credit Report

An important reason to get your credit report is to find problems or mistakes and fix them:

- You might find somebodys information in your report by mistake.

- You might find information about you from a long time ago.

- You might find accounts that are not yours. That might mean someone stole your identity.

You want to know what is in your report. The information in your report will help decide whether you get a loan, a credit card, a job or insurance.

If the information is wrong, you can try to fix it. If the information is right but not so good you can try to improve your credit history.

The Best Credit Cards For Bad Credit

FICO identifies poor credit as ranging from 300 to 579. Finding the right credit card when you have poor credit can be difficult. Fortunately, there are many cards designed especially for people with bad credit, aimed at helping them boost their credit scores. When your credit is bad, its probably best to look for cards that are designed to help you boost your credit with features like credit monitoring over cards with perks like rewards programs. However, there are some cards that can accommodate both.

Also Check: Who Is Syncb Ppc

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

What Does A Cifas Marker On My Credit Report Mean

Cifas is a national fraud prevention service. It can place Protective Registration and Victim of impersonation warnings on your credit file.

Protective Registration

This is a paid service for people who have recently been victims of financial fraud. It indicates to any lender that youre potentially vulnerable to fraud so that theyll make extra checks every time you apply for a financial product. While this can protect you, it can increase how long credit application approvals can take. It will stay on your credit report for two years.

Find out more, and apply, on the Cifas website

Victim of impersonation

This is filed by your lender for your own protection if youve been the victim of identity fraud. It will stay on your report for 13 months.

If one of these is on your credit report, it gives potential lenders a fraud warning. It tells them youve been a victim of fraud in the past, or could be particularly vulnerable to fraud in the future.

Don’t Miss: Syncb Ntwk

Ask A Friend Or Relative For A Helping Hand

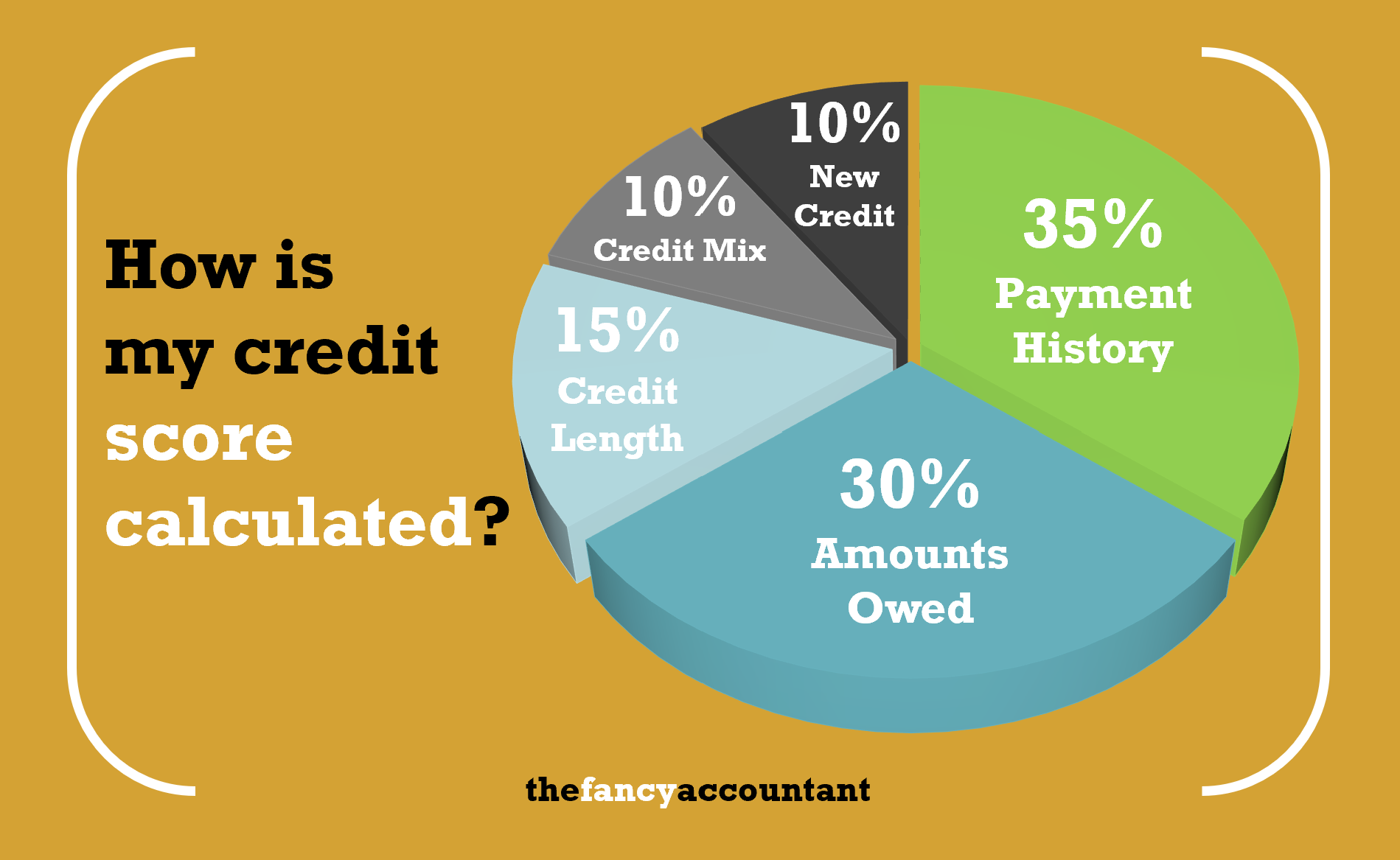

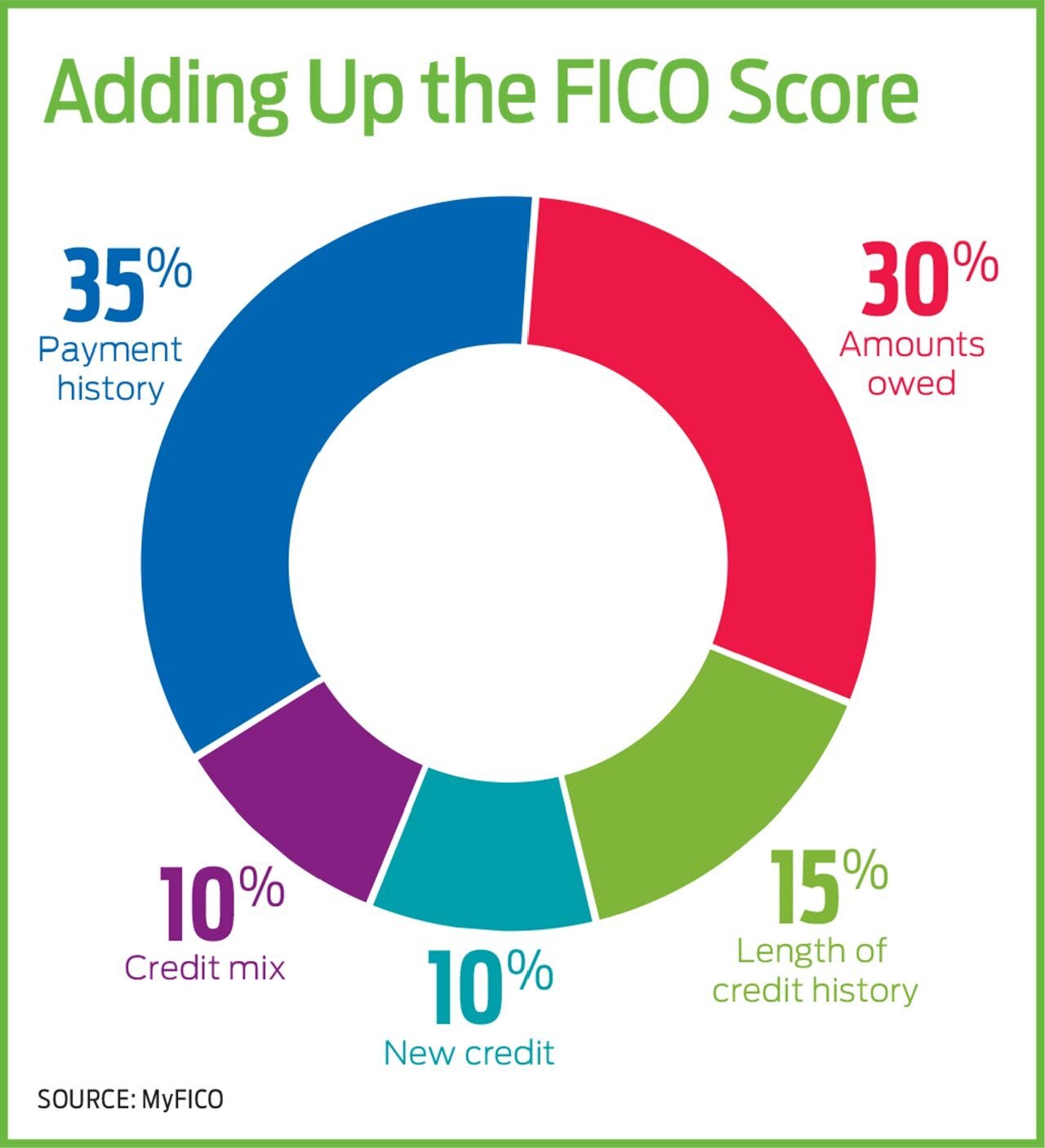

Your length of credit history plays a role in your credit score. FICO bases 15 percent of your credit score on factors such as the age of your oldest account and your average age of all accounts. Older is better.

In many cases, you just have to sit back and wait for your credit scores to improve within this category. However, if you have a loved one with a well-managed credit card account, you may be able to ask for a helping hand.

If a friend or relative adds you to an existing credit card as an authorized user, it might help lengthen your credit history. Assuming the account is in good shape , becoming an authorized user may improve your score if and when the account shows up on your report.

It may be tempting, but be careful not to piggyback onto a strangers credit card. Although there are companies who will help you rent authorized user status on another persons credit card for a fee, this practice may be considered fraud if you apply for financing after the fact.