What Is My Real Credit Score

Companies can choose which score to purchase and use when reviewing applications and managing customers’ accounts, which is one reason there’s competition in the credit scoring world. With this in mind, there isn’t a single, “real” credit score.

For example, when you’re shopping for an auto loan, you may try to get offers from several lenders. One lender might use a FICO® Score 8, another a FICO® Auto Score 2, and a third a VantageScore 4.0. Your scores may vary, but each is very real in the sense that the lender is using it to determine if you qualify for a loan and the rates and terms to offer you.

Generally, you won’t know which of your three credit reports or which credit score a lender will use. However, because credit scores all rely on the same underlying data, building positive credit can help you get good credit scores regardless of the model. Conversely, negative items, such as late payments or a bankruptcy, could hurt all of your credit scores.

Vantagescore And Fico Are The Two Main Credit

But even if you have pretty good credit habits, dont be surprised if you check your scores and find that youre below 850.

Perfect credit scores can seem to be inexplicably out of reach. Out of 200 million consumers with credit scores, the average FICO score is 704. And FICO says that as of April 2019, just 1.6% of Americans with credit scores had perfect FICO scores.

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

Read Also: How To Check Your Credit Score Chase

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

The Main Factors That Affect Your Scores: Fico Vs Vantagescore

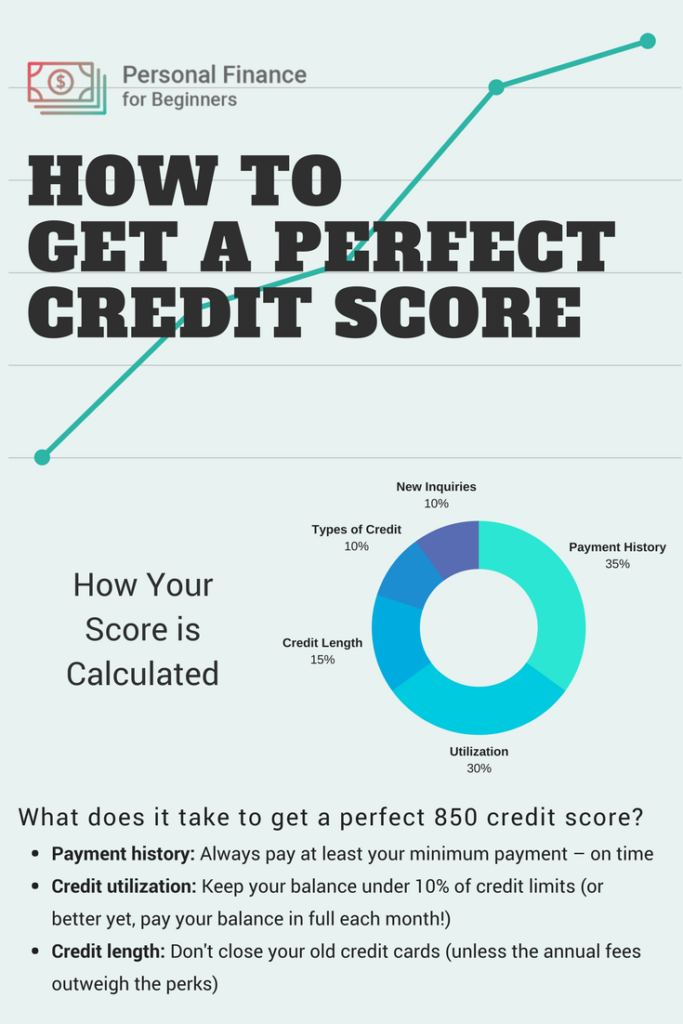

While VantageScore and FICO scoring models have differences, both make it clear that some factors are more influential than others.

For both models, payment history is the most important factor, followed by the total amount of credit you owe .

FICO uses percentages to indicate the importance of each factor to your credit scores.

| FICO |

|---|

|

Less influential |

Recommended Reading: Does Eviction Show On Credit Report

Neo Financial Mastercard Essential*

The Neo Financial Mastercard Essential works with thousands of partnering vendorsbig box, chains and localacross Canada to deliver noteworthy cash back rewards. Spends earn you an average of 4% cash back, with 1% being the minimum. That guaranteed 1% beats most cards, as the typical base rate for cash back cards is 0.5%. And Neos bonus rewards of 15% back on your first purchase sweetens the deal. Those looking for even beefier bonuses can consider the Neo Financial Mastercard Plus or Max for higher earn rates .

To find out if a local business is a partner, check Neos local map guide in its app. When you use your Neo credit card, you can score special deals plus cash back. Its a win-win. It also has bigger partners too, like Bell, Canadian Tire and Esso.

- Annual fee: $0

- Welcome offer: Earn 15% cash back on your first purchase.

- Earn rate: It does vary, but it averages 4% back on the free standard plan, with a minimum 1% cash back.

- Additional benefits: Mastercard Zero Liability fraud protection freeze your lost card

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Remove Payday Loans From Credit Report

What To Do Before Applying For A Credit Card If Your Fico Score Is 700 To 749

Even if youve been in the 700 to 749 credit score range for a long time, never assume thats still the case. Credit scores are a moving target! The score you have today will be different a month from now, and again a year from now.

For that reason, there are a few steps you should take before you even make application for a credit card.

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

You May Like: How To Get An Eviction Off Your Record In Texas

Pc Financial World Elite Mastercard*

Due to its association with Loblaws stores and Shoppers Drug Mart, the PC Optimum program offers members access to a wide variety of ways to earn PC Optimum Points, including gas, drug store and grocery purchases. With an earn rate of 30 points per $1 in Loblaws-owned stores , 45 per $1 at Shoppers Drug Mart, and 10 everywhere else, this card is one of the best no-fee cards for gas and groceries on the market. Its simple to redeem points. You simply show the card at checkout anywhere PC products are sold and get $10 back for every 10,000 points. Theres even an included package of travel and car rental insuranceand it carries no annual fee.

- Annual fee: $0

- Earn rate: 30 points per $1 in Loblaws stores and PC Travel 45 points per $1 spent at Shoppers Drug Mart 30 points per litre at Esso and 10 points everywhere else

- Income requirement: $80,000 or $150,000 , as well as a $15,000 minimum annual spending requirement

- Additional perks: Travel insurance car rental coverage

Why Experts Say 760 Is The Credit Score To Aim For

While it might be exciting for some to aim to join the 850 club, it comes with no additional benefits that you likely won’t already get with a 760 score.

“The best published interest rates for auto loans are 720+ and for mortgages 760+,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select. “As such, I always tell people, shoot for 760 or better. That way, they’re safe for all loan types and cards.”

For Jim Droske, president of the credit counseling company Illinois Credit Services , the threshold is 760 as well. But he says aiming for 780 is even better to be “the safest” in any type of lending situation. Anything higher, though, won’t be more beneficial, nor would it get you a better offer with more favorable terms.

“If you’re above 760, or 780, certainly you’re already getting the best you can get,” Droske tells CNBC Select. “You’re already hitting that pinnacle of what care about.” A high enough credit score shows lenders and credit card issuers that you are less of a risk and more likely to pay back the loan, versus if you had a lower credit score.

“Anything above that is really just maybe a little pride,” says Droske. “When you have already reached the summit, no need to look for a ladder.”

Read Also: Qvc Card Credit Score

What Is An Excellent Credit Score

You probably already know that your credit score is a three-digit number based on the information in your credit report, which includes items like your loan payment history and credit card balances. Multiple companies have models that calculate credit scoresFICO and VantageScore, for example, which both operate on a scale from 300 to 850.

Generally speaking, a higher credit score can translate to cost savings, perks and more. Your credit score is a key factor considered by lenders, so a better score can help you get more credit at attractive interest rates . Landlords and employers can also check your credit score as part of their due diligence process. And some of the best reward credit cards are only available to those with the highest scores.

So how high should you aim? Getting a perfect score is extremely difficult, so many credit overachievers strive for a score in the high 700s or 800+. That puts you squarely in the highest range for most credit scoring models .

If youre nowhere close, dont worrythe tips below will still help you improve your credit score over time. You can actually reap many of the benefits listed above with a score thats considered good. But if good doesnt cut it, read on for your roadmap to excellent credit.

What Is The Most Accurate Credit Score

Although there are many different scores and scoring models, there is a light at the end of this confusing tunnel.

Among all the credit score models, the FICO credit score is used by more than 90% of major U.S. lenders.

You might have a different score calculated by a different scoring model with a different provider.

However, it’s very likely that the lender or creditor will use the FICO score to determine if they’ll approve your application for a new line of credit.

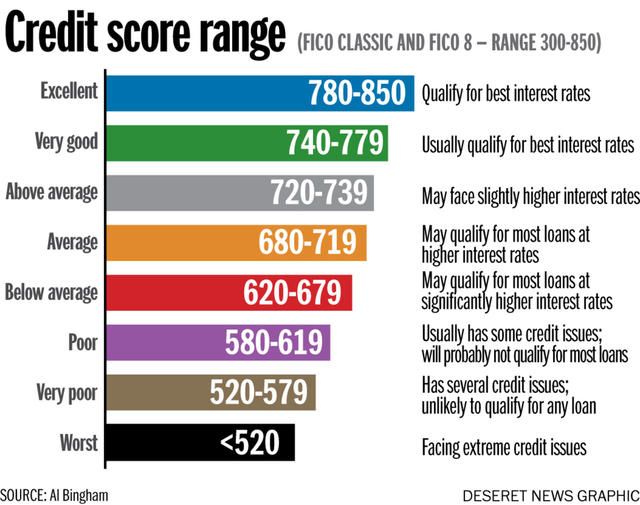

Because of this, you might want to keep your eye on your FICO score, rather than many of the others that are available, simply because this is the number the lenders care about most. A FICO score ranges from 300 to 850 .

Also Check: How Are Account Numbers Displayed In A Credit Report

Length Of Your Credit History

After your credit utilization ratio, the length of your credit history impacts your credit rating the most. It accounts for 15 percent of your FICO score.

When calculating this factor, FICO considers:

- How long your credit accounts have been established, including the age of your oldest account.

- The average age of your accounts.

- How long specific accounts, such as revolving credit, auto loans, etc., have been active, and how long it has been since certain accounts have been used.

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

You May Like: Does Home Depot Report Authorized Users

Dispute Any Errors Promptly

If there are any errors on your report, you need to dispute them immediately. Contact the creditor, open a dispute, and provide documentation supporting your claim. Have the creditor provide written confirmation of the error, then ask them to report the corrected information to all three credit bureaus.

Wait 30 days and pull your credit again. If the error still appears, write a letter to each of the three credit bureaus , and include a copy of the creditors letter acknowledging the error. Based on that letter, the credit bureaus can remove the error and fix your credit report.

American Express The Platinum Card*

If youre looking for a premium card with all the perks, youd be hard-pressed to find anything better than The Platinum Card from American Express. The included travel insurance alone is worth a second look, but add to that complimentary airport lounge access with unlimited passes to Priority Pass and Centurion lounges, an annual $200 travel credit, hotel upgrades and Platinum Concierge services, and youve got the key to an upgraded experience. The card offers plenty of Membership Rewards points earning opportunities on dining, travel and everyday purchases, and comes with a sweet welcome bonus. Another advantage of joining the Amex system is that youll gain access to the lucrative Fixed Points Travel program, and youll be able to transfer your points to dozens of other loyalty programs.

Also Check: Aargon Agency Phone Number

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

Common Credit Score Ranges

Though credit score ranges vary, the two most common credit scoring models for FICO and VantageScore have scores that range from 300 to 850. The lower your score is on each model, the harder it will be for you to qualify for financing. For FICO, the lowest credit score range is 300 to 579 the lowest credit score range for VantageScore is 300 to 499.

Also Check: Does Applying For Paypal Credit Affect Score

Smart Money Podcast: Covid Tests And Reversing A Credit Score Drop

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Welcome to NerdWallets Smart Money podcast, where we answer your real-world money questions.

This weeks episode starts with a discussion about how to get COVID-19 tests right now.

Then we pivot to this weeks money question from a listeners voicemail. Here it is:

“I have a question. I took a personal loan for $3,000 and my credit score went down like 30 points, and I was surprised with this big drop. I was thinking maybe five points or seven points. So question is: It’s for a three-year term if I pay off this loan, let’s say next week, can I get back my 30 points on my credit score or no? Well, I appreciate your help. Thank you.”

Check out this episode on either of these platforms:

What Does It Mean If Your Credit Score Is High

Lenders tend to look at your credit score when you apply for credit, such as a credit card. Theyâre looking for someone who will be able to meet the repayments – someone who is low risk.

A higher credit score means your credit report contains information that shows youâre low risk, so youâre more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, youâll be considered a reliable borrower.

If you have a high credit score, your application is more likely to be accepted. Youâre also more likely to be offered the best interest rates and higher credit limits.

Check your eligibility: See what offers you’re eligible for with your credit score.

Read Also: When Do Credit Companies Report

A Good Credit Score Is In The Eye Of The Beholder

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

The Credit Score Needed To Buy A House

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Read Also: 888-826-0598