Where To Go From Here

Its important to know which factors make up your credit score. As you can see in the image below, there are 5 factors that make up your credit score.

Pay down your balances and keep your credit utilization under 30%. Its also wise to have different types of credit accounts to establish a solid credit mix because it accounts for up to 10% of your FICO score. So, youll want to have both installment and revolving credit showing up on your credit report.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Building good credit doesnt happen overnight, but you can definitely speed up the process by making the right moves. So give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having good credit.

Categories

Factors That Can Affect The Calculation Of Your Credit Scores

There are five main factors that can affect the calculation of credit scores. If youre interested in improving your credit, understanding what these factors are can help you create a plan to build healthy credit habits.

1. Payment History

How you manage your payments is one important factor used during the calculation of your credit scores. This includes how many accounts you have open as well as all the positive and negative information about these accounts. For example, if you make payments on time or late, how often you make late payments, how late the payments were, how much you owe, and whether or not any accounts are delinquent.

2. Outstanding Debt

Sometimes referred to as a , many credit scoring models take into account how high your balance is compared to your total available credit limit. Specifically when it comes to revolving credit, for examples credit cards and lines of credit.

3. Length Of Credit History

Your credit file includes how old your credit accounts are and will influence the calculation of your credit scores. The importance of this factor will differ depending on the scoring models, but generally speaking, how long your oldest and newest accounts have been open is important.

4. Public Records

Public records include bankruptcies, collection issues, liens, lawsuits, etc. Having these types of public records on your credit report may have a negative effect on your credit scores.

5. Inquires

Additional Reading

Different Types Of Credit Scores

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 642 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Also Check: How To Delete Collections From Credit Report

Can I Get A Mortgage & Home Loan W/ A 642 Credit Score

Getting a mortgage and home loan with a 642 credit score is going to be difficult. Can it be done? Maybe, but thereâs a few simple steps you can take to guarantee less headaches and higher chance of success.

The #1 way to get a home loan with a 642 score is repairing your credit.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

How To Turn A 649 Credit Score Into An 850 Credit Score

There are two types of 649 credit score. On the one hand, theres a 649 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 649 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

Recommended Reading: Is 750 A Good Credit Score To Buy A House

What Does Not Count Towards Your 642 Credit Score

There are many things that people assume go into their 642 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Canadian Credit Scores And What They Mean

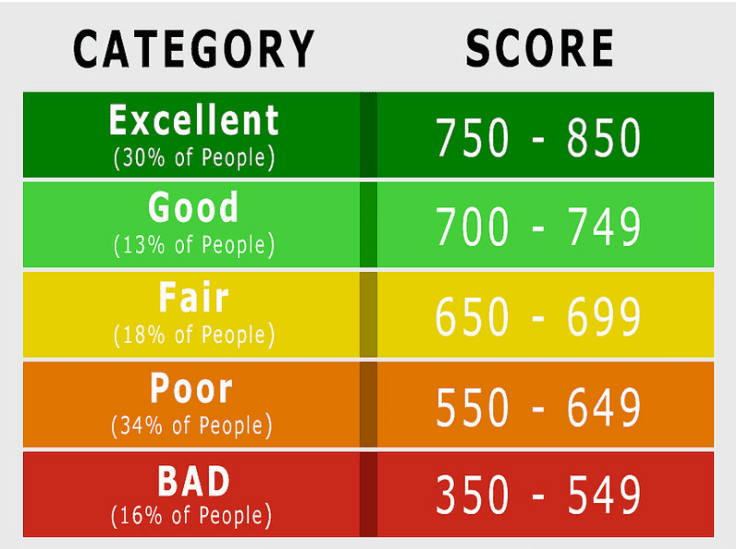

There is no definitive model for what certain credit scores mean to all lenders and creditors. One lender may consider credit scores of 760 to be excellent, while another may consider scores above 780 to be excellent. It all depends on what scoring model that specific lender uses and how they use it during their approval process. That being said, if youre interested in knowing what your credit scores mean, here are some general guidelines that can help.

| Range | Meaning |

| Excellent | Individuals with a rate of 760 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan. |

| Very Good | This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available. |

| Good | An individual who has credit scores that fall within this range has good credit and will typically have little to no trouble getting approved for the new credit. |

| Fair | Scores in this range indicate that the individual is a higher risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates |

| Poor | Credit scores that fall in this range may indicate that a consumer has trouble making payments on time or is in the process of building their credit history. |

Also Check: How To Increase Credit Score

How To Improve A 642 Credit Score

Work on removing all negative accounts such as collections, charge-offs, medical bills, bankruptcies, et al.

Remove as many excess hard inquiries as you can. Get your revolving utilization as low as you can . Ensure you have a good credit mix of installment loans and revolving accounts.

Last but not least, make sure you have at least two revolving accounts older than 2 years

We recommend taking a look at Credit Glory. Give them a call

It’s generally much faster if you worked with Credit Glory, and they happen to have incredible customer service.

Get A Secured Credit Card

As mention earlier, getting a secured credit card is a great way to establish credit. Secured credit cards work much the same as unsecured credit cards. The only difference is they require a security deposit that also acts as your credit limit. The credit card issuer will keep your deposit if you stop making the minimum payment or cant pay your credit card balance.

Don’t Miss: How To Help Your Credit Score

Personal Loans With A 642 Credit Score

Are you in the market for a personal loan?

While you might qualify for a personal loan with fair credit, you could be charged a higher interest rate and more fees than you would with scores in the good or excellent range.

These higher rates and fees might make the loan a less desirable proposition, depending on what you need it for. For example, if you want to consolidate credit card debt with a personal loan, the interest rate with your new loan may not be low enough to save you money in the long run especially considering all the fees you might be charged upfront.

On the other hand, if youre using a personal loan to finance a major purchase, you should consider whether its something you need now or can wait to buy. If you can wait and spend some time building your credit, you might be able to qualify for a loan with a lower interest rate.

When youre ready to move forward with a personal loan, you can compare personal loan options on Credit Karma.

Credit Score: Good Or Bad

At a glance

642 is a below-average credit score, but its approaching the good range. Its considered fair by every major credit scoring model. Scores in this range are high enough to get some types of credit, but you wont qualify for the best interest rates. Well explain what financing you can get with a score of 642 and what you can do to improve your credit score.

Get all 3 credit reports and FICO score monitoring, or book a FREE 5-minute credit repair consultation.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. That’s our first priority, and we take it seriously. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Read Also: Why Is My Credit Score So Low

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that youhave undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

Getting Auto Loans With A 642 Credit Score

There is no credit score too low to get an auto loan, and you should be able to get one when your credit score is 642, but it might have a relatively high interest rate. Before taking out an auto loan, consider whether the potential toll itll take on your finances is worth it or if you can wait until you get your score in the good range.

According to a 2020 quarterly report by Experian, people with credit scores of 642660 had average interest rates of 10.13% on their used car loans and 6.64% on new car loans, whereas people with credit scores of 781850 received average rates of 3.80% and 2.65%. 11 Waiting until your score improves could save you hundreds of dollars each month and thousands of dollars over the life of the loan.

If you need to buy a car before your credit improves, then consider getting a used car that you can pay for upfront.

If youre set on getting an auto loan with bad poor credit, then you should pay as large of a down payment as you can afford, and consider getting prequalified or applying for a preapproval from your bank or credit union to increase your bargaining power.

Don’t Miss: Does Debt Consolidation Hurt Credit Score

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, the best way to help improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows that you can responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

Read Also: Why Is My Fico Score Higher Than My Credit Score

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

You May Like: Does Bankruptcy Affect Credit Score

Can I Get A Car / Auto Loan W/ A 642 Credit Score

Trying to qualify for an auto loan with a 642 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 642 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

How Your 642 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2 Actually opening the account can further hurt your score and have even longer-lasting effects.

If your score is 642, it suggests that you may have one of the following issues with your credit history:

To do this, follow these tips:

Also Check: Who Uses Credit History To Determine Credit Score