Mystery Credit Card: Simple Error Or Identity Theft

You mentioned a mysterious credit card with a balance of almost $2,000 appearing on one of your credit reports. There are two possible explanations for this charge: a mistake or identity theft.

Mistakes occur when a data entry clerk at Equifax, Experian, or TransUnion has incomplete information about the owner of an account, and guesses who the owner might be. Alternatively, a harried clerk working for a creditor may have selected the wrong “Mary Smith” and reported the wrong information to the CRAs. This is sort of like a reverse lottery a clerk picked your name and you lose. If that happened here, disputing the account will remove it from your credit report.

Quick Tip

Too much debt getting you down? Talk to a Bills.com debt resolution partner to learn your options for resolving your debt.

But if the mystery account is due to identity theft, then you must take more actions to protect yourself. Identity theft is when someone uses your name and Social Security number to open accounts in your name. It is difficult to describe the difference between a CRA clerical error and identity theft. You will know it when you see it. A clerical error is one account. Identity theft leaves a trail of opened accounts indicating a pattern of intentional activity.

Who Can Request A Copy

- lenders and creditors

- insurance companies

- landlords

- potential employers

If a person denies you credit or increases a charge or fee and if you request it within 60 days you must be told:

- the nature and the source of the information

- the name and address of the consumer reporting agency reporting the information

What Are Public Records On A Credit Report

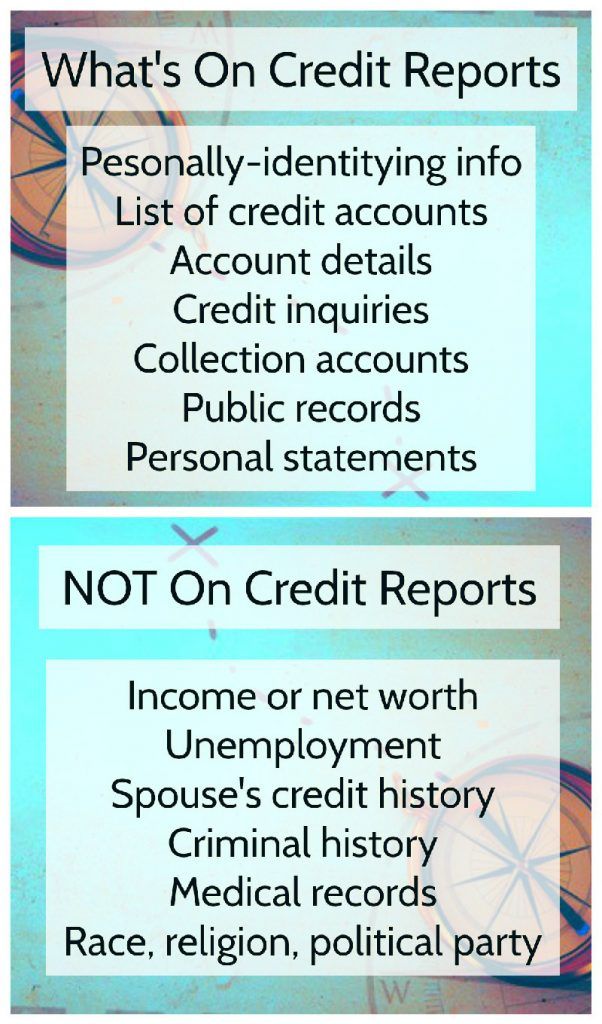

Your credit report is an evolving compilation of your financial history. The report contains personal information, including current address and Social Security Number, and credit accounts, like credit cards and car loans. The report also contains public records, so it’s beneficial to understand what a public record is and its potential impact on your finances.

Recommended Reading: Check Credit Score Usaa

What Are Public Records

Public records are documents or pieces of information that are not considered confidential. Some examples include arrest records, marriage certificates and some court records. These are records that other people or entities could look up about you, as the information isnt private or protected.

In the context of your credit report, historically, only three types of entries were public records: tax liens, civil judgments and bankruptcies. Now, only bankruptcies should show up as a public record on an individuals credit report.

How To Fix An Inaccurate Credit Report

While credit bureaus make every effort to report accurate and up-to-date information, your reports may have misinformation and are subject to human error. If you notice wrong information in any one of your credit reports, you can start a dispute with the credit bureau that made the error.

Recent court rulings prompted all three reporting bureaus to promise they would expand their investigation departments and act more promptly and professionally when an error is in dispute.

When you start a dispute, contact the company you believe supplied the inaccurate data and the credit bureau that reported the error. For example, if you notice that your Equifax report has an error about your credit card payments, contact both Equifax and the credit card company.

To contact the credit bureau, follow the instructions listed on your credit report, or visit the bureaus dispute page.

Start a dispute with:

The best way to contact the business that reported an error is to write a letter and send it to the address listed on your last bill or statement. When contacting the business and the reporting bureau, youll need to give identifying information like your name, address, and account number.

The credit reporting agency must contact your creditor within 30 to 45 days after you file a dispute. If your creditor cannot find a record of the information in question, the credit bureau will delete it from your report.

Also Check: How To Get A Repossession Off My Credit

Public Records And Your Credit Reports

Not all public records are included on credit reports. In fact, some types of public records were included in the past but have since been removed thanks to policy changes. Well get into that later.

Heres an overview to help you understand which types of public records might show up on your reports now and cause potential credit damage.

Which Public Records Appear On Credit Reports

Public records that could appear on your included bankruptcy, judgment, or a tax lien. In some states, foreclosure and repossession are also public records. These entries are also the worst types of entries to appear on your credit report because they show a serious delinquency. However, since 2017, only bankruptcies can appear on your credit report.

Read Also: Carmax Finance Rates 2015

How Can You Remove An Eviction From Your Record

The only way to remove an eviction from your record is by petitioning the court to remove it and winning the case. Follow the steps below if you wish to dispute your eviction:

1. Petition the court. Youll need to go to the county where the case was filed and petition the local court to remove eviction from your record.

2. Prove you didnt violate the terms of your lease. Its essential to prove that you paid your rent on time and left the property in good condition.

3. Prove the landlord didnt follow the due process of eviction. State laws vary when it comes to eviction processes. Ensure you familiarize yourself with the legal procedure governing eviction suits in your state, then prove to the court that the landlord failed to follow the due process.

If you can prove that you didnt violate the terms of your lease or the proper eviction processes werent followed, youll have a good chance of winning the case. The eviction will be removed from your record if you convince the judge there was no wrongdoing on your part.

Recommended Reading: Does Aarons Report To The Credit Bureau

Whats A Public Record On The Credit Report

A separate section on your credit report concerned with your public affairs is what we are talking about here. If you have any file with a local, county, state, or federal court then these are also available here. If you have any serious cases against you including bankruptcy, judgment, foreclosure, repossession, or a tax lien then they also appear here in your credit report. This can be a serious problem as it might cause your creditor to file a case against you.

The three major consumer credit bureaus, Experian, Equifax and TransUnion, have recently adopted stronger public record data standards for consumer credit reports.

Although all the three bureaus try to eliminate any mistakes in the credit report that wont help you to get rid of a bad report which is a result of you doing something that doesnt fit in their rules and regulations. Thus, its best to understand those things so you have a complete idea of all the things that can cause your credit reports to be adversely impacted.

Recommended Reading: What Card Is Syncb/ppc

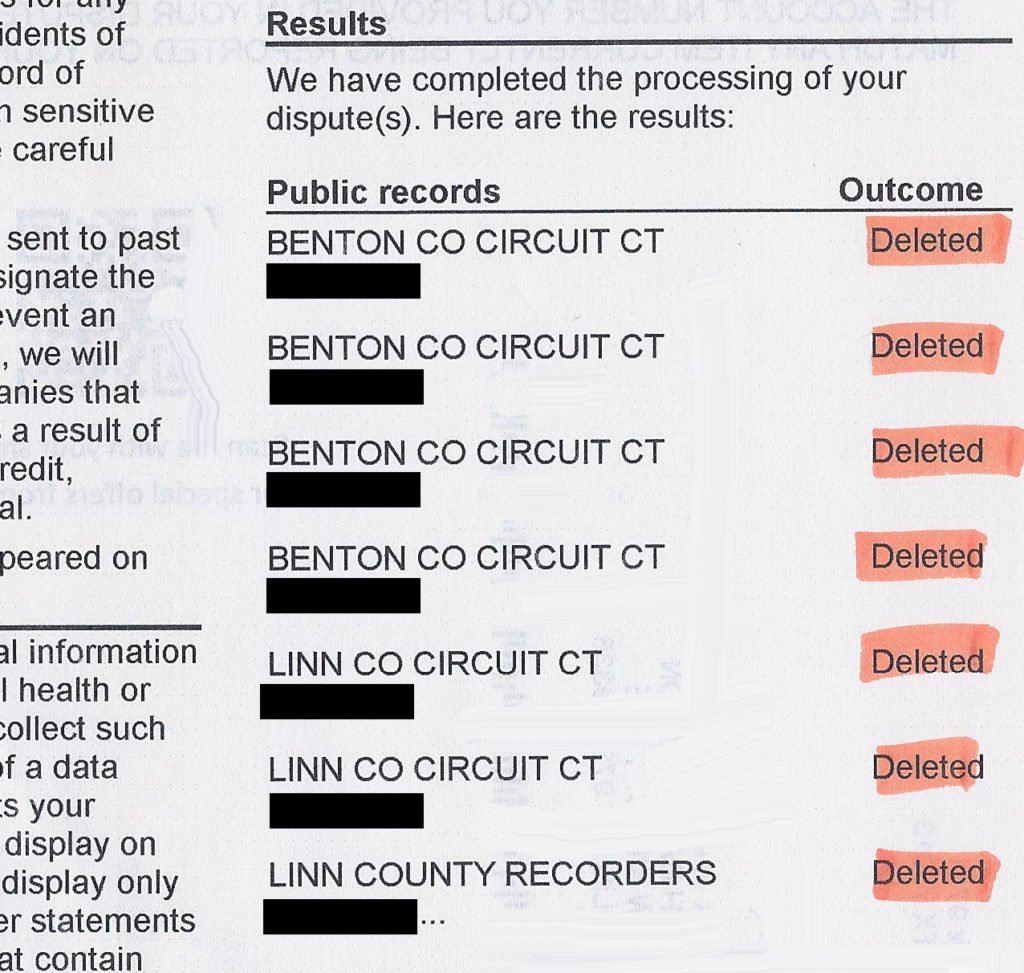

How To Remove A Public Record From Your Credit Report

Removing a public record from your credit report requires filing separate disputes with all three major credit bureaus.

If you have a public record on your credit report, you can attempt to dispute the negative information with the credit bureaus to have it removed. The Fair Credit Reporting Act gives consumers the ability to dispute incomplete and inaccurate information contained in their credit reports with the credit bureaus.

The credit bureaus decide whether or not a dispute is frivolous solely based on your communication and any proof that you can provide. Public records also involve government agencies and courts. Therefore, some additional steps may need to be taken in addition to disputing the information with the credit bureaus.

This is one of the reasons that many people hire a credit repair company when it comes to repairing their credit and removing public records from their credit reports.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Read Also: How To Get Evictions Off Your Credit

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Read Also: When Will A Repo Show On Your Credit

Public Records Could Plague Your Credit For The Better Part Of A Decade

Even if you repay the money you owe, public records with negative information typically remain on your credit reports for seven to 10 years.

Public records with adverse information may even occasionally wind up on your credit reports by mistake. According to a 2012 study by the Federal Trade Commission, one out of five consumers had an error on at least one of their three credit reports that was corrected by a credit reporting agency after it was disputed.

The good news is, in some cases, you may qualify for relief.

Experian®, Equifax® and TransUnion® have begun removing unverifiable public records from about 12 million credit reports.

The three major consumer credit bureaus recently adopted stronger public record data standards for consumer credit reports, requiring tax liens and civil judgments to include your name, address and either Social Security number or date of birth.

Millions of old public records dont contain all of this information, so the credit bureaus are removing them from consumer credit reports.

Theyre also removing medical collection accounts that have been or are being paid by insurance.

If you spot an error or an unverifiable public record that doesnt belong on your credit report, Credit Karma may be able to help you dispute it. And if all else fails, we can show you ways you can rebuild your credit.

Just remember, youre not alone. Were here to help.

Top Rated Local Credit Consulting

Your credit score is a very important part of your life in todays world. From purchasing a home and getting better terms on a credit card to financing a vehicle and obtaining loans, the number in your credit score determines the terms that lenders are willing to offer. If there are negative public records or judgments against you, then your credit score will not have the influence you want it to have among lenders.

Recommended Reading: Suncoast Credit Union Credit Card Approval Odds

How To Get A Credit Report

The Fair Credit Reporting Act requires Experian, Equifax and TransUnion to provide you a free copy of your credit report once, every 12 months.

There is a charge for credit scores, but the credit report is free.

To get a free credit report, go online to www.annualcreditreport.com or call 1-877-322-8228 and request it. This is the only website authorized to fill orders for free credit reports. Once there, each agency must supply you one credit report every 12 months. You could receive all three reports at once, or spread them out over 12 months depending on the purpose you have.

If you want to examine the three together and compare all the information contained in each report to be sure its accurate , you should request all three at the same time.

Since the information on all three should essentially be the same, you may want to ask for one report every four months and verify each time that the information remains accurate.

If you already received a free report from each of the bureaus and want to check your credit report again, you can contact any of the three reporting agencies and order one for a small charge, usually under $10.

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

Recommended Reading: Does Pre Approval Hurt Credit Score

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

What Is A Public Record On The Credit Report

Knowing the credit report is essential in your banking and loans journey. This article talks about the public record on credit reports and the information on credit reports.

A credit report has a separate section on it which is for public records. A public record is necessary to know about your financial affairs and how you deal with your bills and other financial matters. It can affect your . These come from government documents and any negative information can hurt your credit scores. The public report is very important when the financial institution is trying to look for how frequent youre with paying your bills and also if you have any negative financial history.

A bad public record on the credit report can stay there for a long time due to which you might suffer. Legal actions may be initiated. Lets look at it in a bit more detail to see what a public record on a credit report is and how it works.

Read Also: How To Remove A Repo From Your Credit

How To Rent With An Eviction On Your Record

Renting after youve been evicted can pose some real challenges. Almost all property managers rely on screening to decide whether a potential renter is a good risk, and a prior eviction raises a red flag. If you werent able to clear an eviction from your record, these tips can make renting after an eviction easier.

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

You May Like: When Does Self Lender Report To Credit Bureaus