Length Of Credit History

Lenders like to see that you can manage credit positively over a long period of time. This is generally measured by how long your current credit accounts have remained open.

Theres no shortcut to increasing the length of your credit history. But in the long run, keeping your old credit card accounts open, even after you get a new credit card, can help your credit age like a fine wine. At the very least, try to avoid closing your oldest credit account.

As someone with fair credit, you may be in the market for your first credit card. If thats the case, it pays to think ahead. Consider shopping around for a credit card that has no annual fee, so theres no pressure to close it if and when you graduate to a better card. You can compare offers for cards with no annual fee on Credit Karma to explore your options. Many of the cards available to people with fair credit tend to charge annual fees, but you might be able to find one that doesnt.

Very Good And Excellent/exceptional: Above Mid

A lender could deny anapplication for another reason, such as having a high debt-to-income ratio, butthose with top credit scores likely wont have their applications deniedbecause of their credit scores.

People in this score range are also most likely to get offered a low interest rate and may have the most options when it comes to choosing repayment periods or other terms.

Should I just apply anyway?

Its best not to because each application can result in a hard inquiry, which could hurt your credit. You can research your likelihood of being approved by checking for a particular card or by getting prequalified for an offer .

Budget For A Higher Interest Rate

Experts recommend that you keep your total transportation costs to less than 10% of your budget. If you have a low credit score, you will pay more in interest, so you should aim for a less expensive car and/or have a high down payment.

Experian reports that successful auto loan applicants with subprime credit scores financed lower average amounts approximately $29,000 to $35,000 compared to those with higher credit scores who had larger loans roughly $34,000 to $39,000.

For example, if you can afford a $450 payment for a 72-month term, heres how much you should finance, based on the average auto loan APR for your credit score. Note that the credit bands are different based on the data source.

| Prime |

Recommended Reading: Credit Score With Itin Number

Best Credit Cards For 600 To 650 Credit Scores Cardratescom

If your credit score sits in the 600 to 650 range, youre likely struggling to qualify for the top cards on the market, and yet, your score is

Is this score better for renting an apartment? This apartment is ideal for renting an apartment because apartment leasing companies understand

700 and above: Excellent / Very Good Credit. You are considered a low credit risk by institutions and would generally qualify for the lowest interest rates and

What Is Average Credit

Average credit actually floats somewhere in the unspecified zone between the upper reaches of fair and the lower end of good credit. In other words, between 650 and 699. When it comes to credit cards, average credit is very subjective. One credit card company might consider it 675 to 724, while another may decide its 640 to 679. But its safe to say if you fall somewhere between 650 and 699, youll be considered to have average credit with most banks.

Don’t Miss: How Long Does Repo Stay On Your Credit

Excellent Credit Score: 750 850

The prime candidates, the goody-two-shoes, they are considered consistent and responsible when borrowing. They have no history of low balances or late payments. Borrowers in this credit range receive the lowest interest rates on loans, mortgages and credit lines as they pose a low risk to lenders.

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Don’t Miss: What Mortgage Company Uses Factual Data

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Pay All Your Bills On

This should be completely obvious, but it bears repeating. A single late payment could drop your credit score 20 or 30 points. That can drop you from average to fair credit in a matter of weeks. Its not just about repaying your creditors on time either. If you get behind with a utility company or a landlord, they may report the unpaid balance to the credit bureaus. That will also drop your credit score. This is why its critical to pay all bills on time, all the time.

You May Like: Credit Check Experian Usaa

Pay Down All Installment Loans

I was surprised by this one. I always assumed my credit score wouldnt be affected by the balances on my installment loans.

But I noticed that once I paid off my auto loans and student loans, my credit score jumped more than 20 points.

The key here is that you should pay off as much of the loan as possible, if not all of it. The closer the remaining balance is to zero, the more it will benefit your credit score.

For a little bit of perspective, I paid off a $30,000 auto loan, another $20,000 auto loan, and student loans totaling $11,000. Almost immediately after I did this, my credit score improved.

How To Get A Good Credit Score

Good credit habits, practiced consistently, will build your score. Heres what you need to do:

-

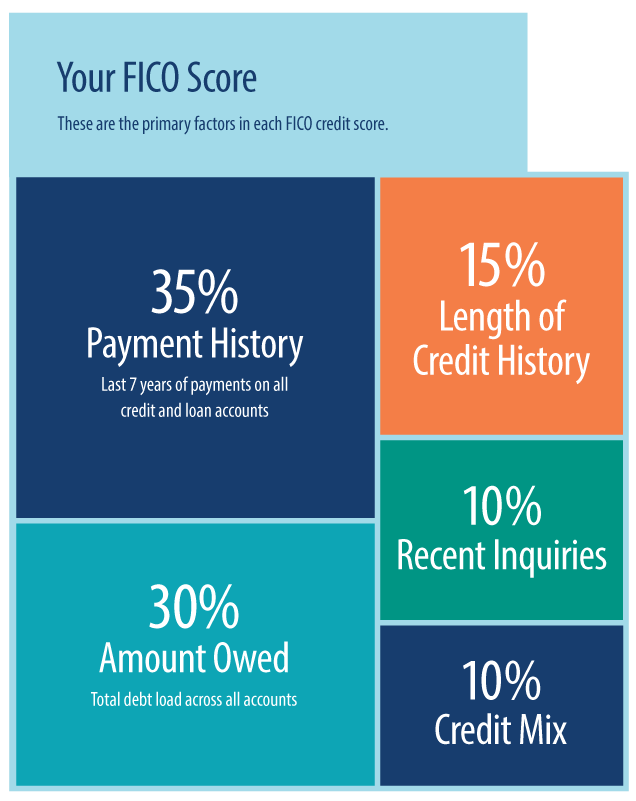

Pay bills on time. This is important because payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to 7 years.

-

Try to keep your credit card balances well below your credit limits aim for, and lower is better. High utilization dings your score, but the damage will fade when you’re able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

-

Keep credit accounts open unless there is a compelling reason, such as high fees or poor service, to close them. Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Also, closing an account cuts into your overall credit limit, driving up your credit utilization.

-

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up. That’s why it’s important to research credit cards before you apply.

-

Monitor your credit reports and dispute information you believe is incorrect or too old to be included .

You May Like: How To Notify Credit Reporting Agencies Of Death

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what “good credit” means as they decide whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

Can I Get A Car / Auto Loan W/ A 654 Credit Score

Trying to qualify for an auto loan with a 654 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 654 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

You May Like: Reporting A Death To Credit Agencies

Car Loan Rates By Credit Score

Lets say, two peoplePerson A and Person Zare shopping for used cars. They each have $2,000 to spend and want to pay off the loan in three years. They settle on the same $10,000 model, and the dealership happens to have two identical vehicles.

The only difference between the two people is their credit score. Person As score is 750, while Person Zs score is 620. Because of this, Person A can secure a loan with a 5% interest rate, while Person Z can only get financing at an 8.5% interest rate. Because of this, Person Z will end up paying more than Person A over the three years of the loan. The additional burden would be even greater on a bigger loan.

Besides your credit score, lenders will consider your income, how much you have for a down payment, and the size of the loan youre seeking.

U.S. News & World Report broke down average auto loan interest rates in 2020 by score:

Cibil Assigns You A Score From 300 To 900 Based On Factors Like

- Your timeliness with repaying credit in the form of EMIs or credit card bills

- Your credit utilisation ratio, when it comes to your credit card limit or loan vs. income

- The number of times you have applied for credit in the recent past and been rejected or approved

Heres how your credit score defines your financial habits and how you can proceed from one category to the next.

Recommended Reading: How To Get A Repossession Off Credit Report

Heres How To Improve A 654 Credit Score:

- Dispute Negatives: If you can prove that negative information on your credit report is inaccurate , you can dispute the record to have it corrected or removed.

- Pay Off Collections Accounts: Once you bring a collection accounts balance down to zero, it stops affecting your VantageScore 3.0 credit score.

- Reduce Utilization: Its best to use less than 30% of the available credit on your credit card accounts each month. You can reduce your credit utilization by spending less, making bigger payments or paying multiple times per month.

- Pay On Time: Payment history is the most important ingredient in your credit score. Paying on time every month establishes a track record of responsibility as a borrower, while a single late payment on your credit report can set back credit improvement efforts significantly.

You can track your credit scores progress for free on WalletHub, the only site with free daily updates and personalized advice.

Was this article helpful?

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

Getting A Credit Account With A 654 Credit Score

With a credit score of 654, youll be able to get a credit card, but you might not have a lot of options other than subprime credit cards, and you wont be able to get rates as good as those offered to people in higher credit score ranges.

The types of credit cards you can get with a credit score of 654 generally fall into two categories:

- Secured credit cards: With these cards, creditors mitigate their risk by requiring you to pay a security deposit, which theyll keep if you default on your debt.

- Unsecured cards with high interest rates: With these, creditors compensate for the lack of a security deposit by charging very high interest rates and additional fees .

Given the choice between those two options, a secured credit card is always your best bet if your main goal is to build your credit. Unsecured subprime credit cards can be dangerous because their high interest rates and fees might jeopardize your finances.

Dont apply for a credit card if you know your credit score doesnt meet the companys requirements. Most applications will trigger a hard inquiry, which will cause your score to temporarily drop. To find out if the card issuer has a minimum credit score, check their website or give them a call.

Takeaway: A 654 credit score is below average, but its not far off from a good credit score.

Additional Credit Scores

Also Check: Usaa Experian Credit Monitoring

Some Lenders Use Their Own Ranges

Many lenders adopt the ranges used by FICO® and VantageScore. Others may develop their own classifications. Major lenders may use different ranges to classify potential borrowers by risk level. Many lenders publish their credit score ranges or provide them on request.If youre considering applying for a credit card or a significant loan, find out what score ranges the lenders youre considering use. Check your score and see where you fit. Dont just consider the minimum standard for approval. Check the ranges that the lender uses to determine interest rates.

What Is A Good Credit Score Range With Transunion

What is a good credit score range with TransUnion? A credit score ranges from 300 to 850 with TransUnion and can impact your ability to borrow money.

It depends on the scoring model used. In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to

To start off, a 654 credit score is considered fair. So just keep that in mind as youre shopping around for a mortgage. A lot of borrowers dont know this,

You May Like: Usaa Credit Monitoring Service

What Is A Good Fico Score

A good FICO score lies between 670 and 739, according to the company’s website. FICO says scores between 580 and 669 are considered “fair” and those between 740 and 799 are considered “very good.” Anything above 800 is considered “exceptional.”

According to FICO, the average credit score in 2021 was 716, which falls in the good range.

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

FICO scores typically express a consumer’s creditworthiness as a number between 300 and 850.

Build Your Credit Before Car Shopping

If you still arent getting car loan rates that work for you, it might be time to delay your car purchase and work on building your credit. That means:

-

Paying bills on time. A payment that goes 30 days past due can devastate your score, so pay at least the minimum on time.

-

Keeping credit card balances low compared to your credit limits. How much of your limits you’re using is called your credit utilization, and it has a big effect on your score. You can try a number of tactics to lower your credit utilization in order to bump up your score.

-

Avoiding applications for other credit within six months of applying for a car loan.

-

Keeping credit card accounts open unless there’s a compelling reason to close them. Closing cards reduces your overall credit limit, which can hurt your credit utilization.

Recommended Reading: Is 650 A Good Fico Score

Tips To Get A Perfect Credit Score

The first thing to keep in mind is that obtaining a perfect credit score takes time.

Its rather easy to remove negative items from your credit report and get a better score, but a perfect score is another story.

Now, assuming you dont have any negative items on your credit report like late payments or a collections account, lets get into the more advanced credit behavior youll need to learn and put into practice.

Keep in mind that all of the steps outlined below are based on my personal experience, not random advice Ive read on the internet.

How Credit Scoring Works

Many creditors use the popular FICO scoring system, which combines financial data collected from major credit bureaus Equifax, Experian and TransUnion. Those credit bureaus also have their own scoring system, VantageScore, which bases ratings on internal financial data.

Your credit score is tied directly to the financial decisions you make, such as paying your loans or on time.

Recommended Reading: Who Is Syncb Ppc