Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Consider Signing Up For Experian Boost

Offered by the credit bureau Experian, this free service lets you build credit with payments that normally might not count toward your credit score, like your phone bill, utilities and for eligible streaming services.

The average credit score increase with Experian Boost is 13 points , according to the credit bureau. Its worth noting this service will only help your credit score in cases where lenders pull from Experian, but it can still be worthwhile for consumers with limited credit history.

How To Improve Your Credit Score

Reading time: 7 minutes

Highlights:

- If you’re looking to improve your credit score and establish positive credit behavior, there are multiple options available.

- Start the process by learning how credit scores are calculated so you can practice positive credit behavior.

- Remember: Improving your credit score takes effort and patience. There’s no one-size-fits-all solution that will increase your credit score overnight.

Many banks and credit card companies offer credit score dashboards and maybe you’ve already checked yours. Now, you want to know how to increase your credit score. The good news is, with effort and patience, it’s possible regardless of your unique credit situation.

Before we dive into the ways you can improve your credit score, let’s start with some basics.

Also Check: How Long Do Repossessions Stay On Your Credit

How Does Payment History Impact Credit Scores

Remember, your credit score gives lenders an idea of how likely you are to pay back your loans. This might explain why your payment history is an important factor used to calculate your score. And the better your payment history, the better your credit score might be.

Keep in mind that there are many out there, each with its own scoring model. FICO® and VantageScore® provide some of the most commonly used credit scores.

How those companies calculate scores may differ. But their calculations are based on much of the same information from your credit reportâincluding your payment history.

Does Getting A New Credit Card Hurt Your Credit

Getting a new credit card can hurt or help your credit, depending on your situation. It can help to increase your credit mix and improve your credit utilization percentage, but it will add a new hard inquiry to your account and make your average credit age youngerboth of which could lower your score. For those in the credit-building stage, adding a new credit card will most likely lower your score in the short term but also lead to a stronger credit score in the long term.

Also Check: How Long For Collections To Fall Off Credit Report

Consider Debt Consolidation For One Single Payment

Debt consolidation is the process of rolling multiple debts into one loanusing a debt consolidation loan. Ideally, this new loan will lower high credit card balances and other debt payments with high-interest charges. In addition to lowering the interest rates, you will only have to focus on one due date and payment, reducing the chances of a missed payment.

How Do Payments Show Up On My Credit Report

Suppose you dont already know how your credit report works. In that case, it will be helpful to have that information before tackling payments. Your credit history will make up your credit report.

Whenever you take out a loan or a credit card, the lender will report its origination to the three major credit bureaus for American consumers. These credit bureaus are:

Once repayment starts, your lenders will also report each payment you make. These details include the payment amount and the dates you make a payment. Any changes to the outstanding balance will also be reported.

Lenders send that information to the credit bureaus. These bureaus then add that information to your credit report. This is where information on missed payments or on-time payments is reported. For purposes related to your credit report, a late payment is considered a payment made 30 days after its due date.

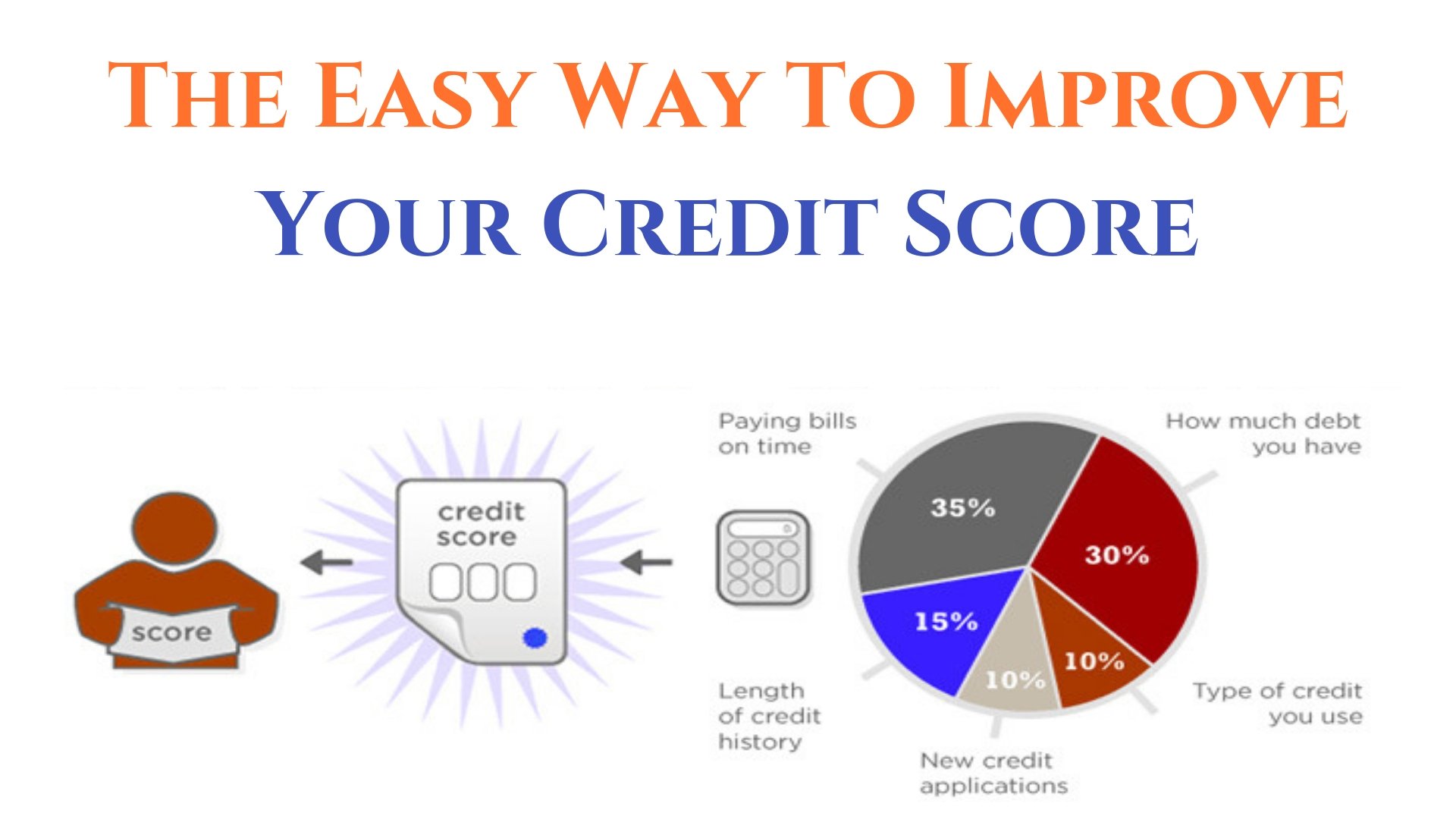

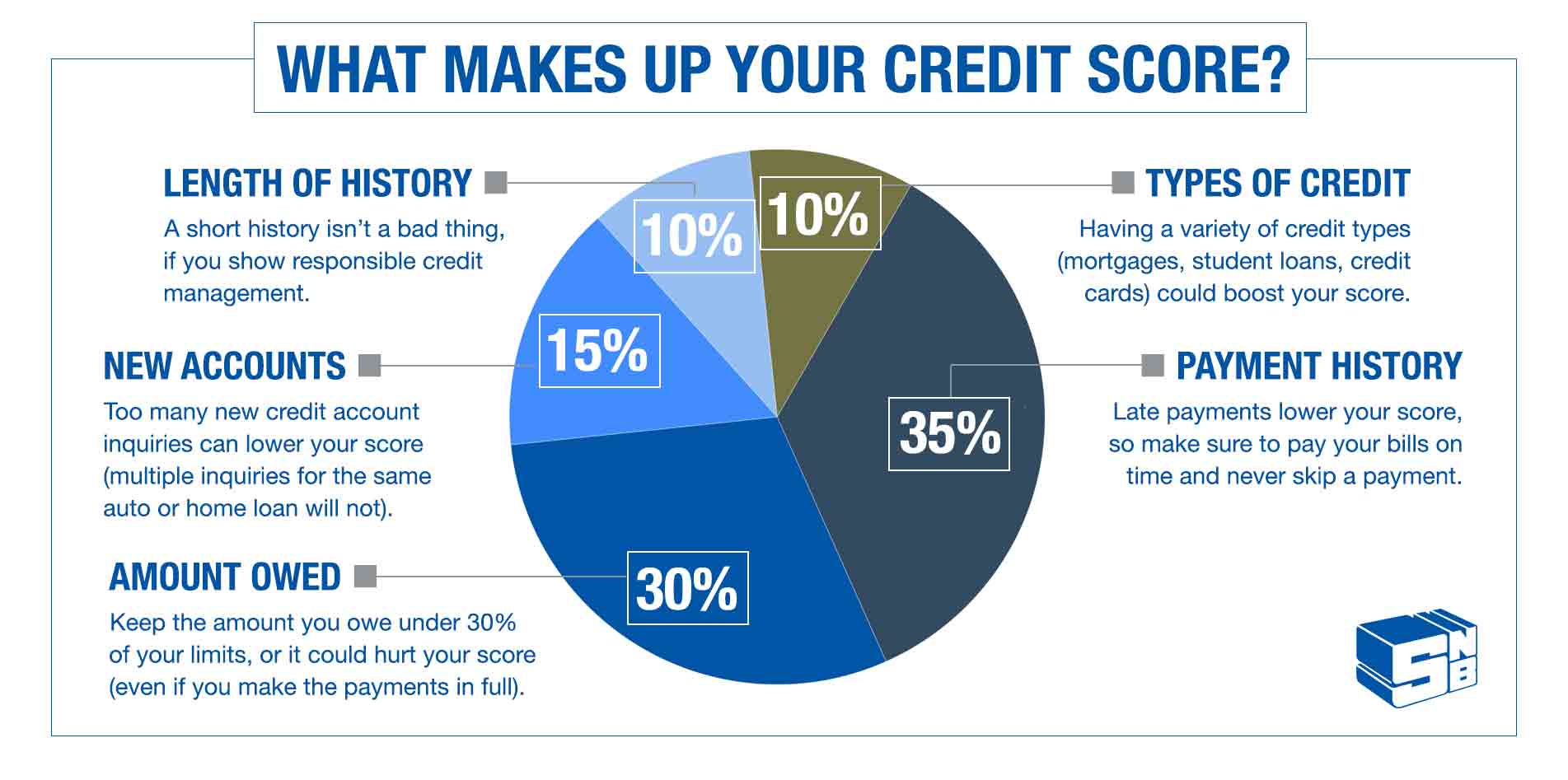

Your credit report and all its information are used by the bureaus to compute a credit score. Payment history makes up 35% of credit scoringthe highest percentage compared to other factors used in a credit score algorithm. And so, its crucial that you try and avoid late payments.

Having even a few late payments on your credit report will negatively impact your credit score for up to 7 years! While having on-time payments will create a positive payment history.

Recommended Reading: How To Remove Serious Delinquency On Credit Report

How Is Your Credit Score Calculated

Your credit score could also vary based on which nationwide consumer reporting agency Equifax, TransUnion or Experian provides the data. This is because not all lenders and creditors report to all three agencies. Some report to only one or two, or even none at all. Thanks to all these variables, you have multiple credit reports and credit scores.

Although scoring models vary, they usually consider the following:

S To Improve Your Credit Score Right Now

Taking the time to review and improve your credit score can improve your financial position and help you weather an economic setback.

Increasing your credit score can lead to lower interest rates on everything from a mortgage or personal loan to and student loans. A lower interest rate means lower monthly payments, freeing up money you can use to bolster your emergency fund, pay down debt or save up for a college fund or retirement.

Increasing your credit score takes time and patience, but the rewards are worth the effort. Follow these tips to help you get started on the road to a brighter financial future.

Also Check: Is Opensky Safe

Wait For Negative Items To Fall Off Your Credit Reports

Its natural to want to improve your credit score fast, but some things take time. Many negative items can stay on your credit reports for seven years or more. But eventually, theyll fall off your reports and wont hurt your credit score anymore. Heres how long it takes certain types of negative marks to disappear:

- Chapter 7 bankruptcy: 10 years

- Chapter 13 bankruptcy: 7 years

- Collection account: 7 years

- Hard inquiries: 2 years

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and, if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

Don’t Miss: How Long Does Car Repossession Stay On Credit

What To Do If Payments Are Inaccurately Reported

If you have reviewed your Experian credit report and believe there is information being reported inaccurately, there are two steps you should take:

- Speak to the lender that is reporting the information. Contact your lender to notify them that you believe they are reporting information incorrectly. If they agree with you, they can contact Experian to correct the information.

- Contact Experian to submit a dispute. The quickest way to dispute information on your Experian credit report is online via Experian’s Dispute Center. Experian will contact the lender on your behalf and notify them of your dispute. The dispute process can take up to 30 days, and you will be notified when the results are ready.

Thanks for asking.

What Kinds Of Payments Show Up On Credit Reports

Not all your monthly payments for bills show up on a credit report. Although paying all your bills on time is always a great idea! Below are the most common examples of debts and their payment histories that will be reported to the credit bureaus:

Revolving Debt

Revolving debt encompasses any credit account you can borrow from as you repay it. Credit cards are one of the most used forms of revolving debt. Any late payments will be reported by your credit card companies.

Installment Loans

Installment loans offer borrowers a steady monthly payment until the loan is paid off in full. Payments for these loans will also show up on your credit reports and impact your credit score.

Personal Loans

Personal loans can vary in size, use, and eligibility requirements. Regardless of what you are using them for or how much you are borrowing, your credit reports will have their origination, balances, and payment history.

In-Store Financing

In-store financing is offered by many retailers, manufacturers, and car dealerships. Although retail accounts may not seem like something that will impact your credit score, they will, in fact, affect your payment history.

Student Loans

Both Federal and private student loan payments will impact your payment history.

Car Loans

Car loans can be available through dealerships, car manufacturers, retailers, or private financial institutions. Regardless of where you borrow from, lenders will report your payment history with a car loan.

Mortgages

You May Like: Navy Federal Auto Loan Reviews

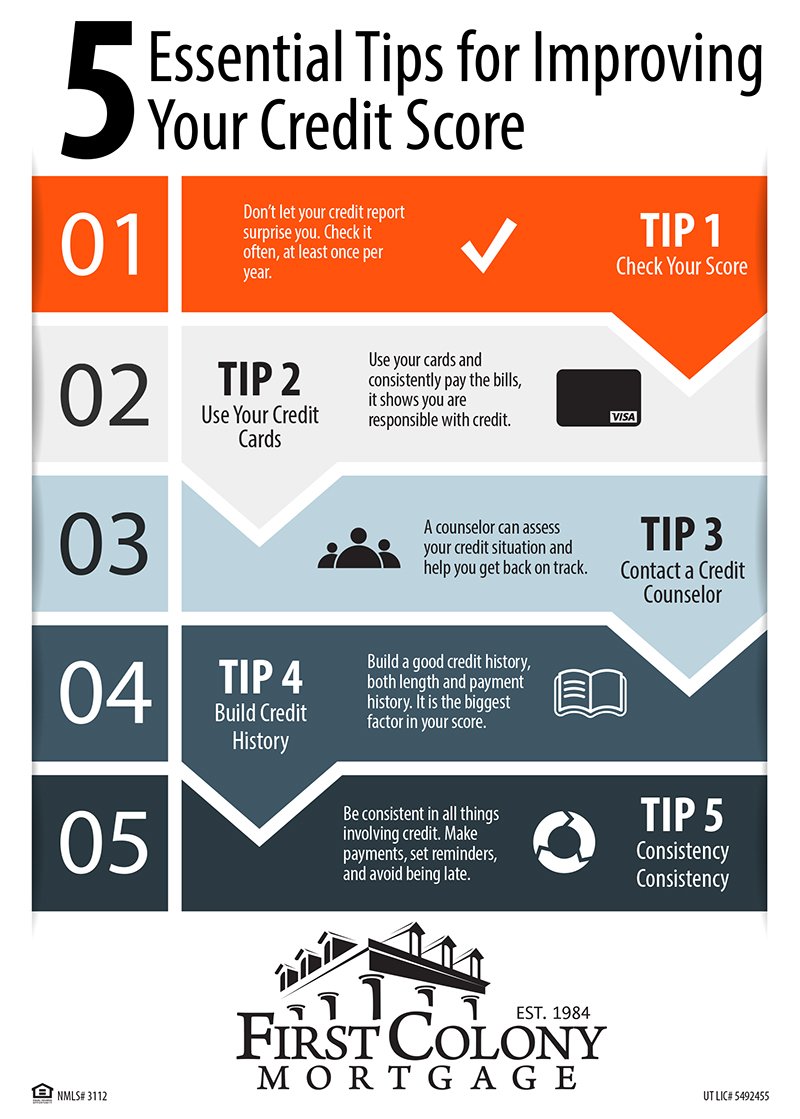

Use Your Accounts The Right Way

While youre trying to build a positive credit history, you should avoid the things that will hurt your credit. Harmful actions include late payments on your bills, high credit card balances, and too many credit card applications.

Don’t be afraid to start small. Expect to get only small credit limits and loan amounts to start, i.e., less than $1,000. Creditors and lenders will give you more credit once youve shown that you can be responsible for a little bit. Once you’ve successfully opened a credit card or loan, dont use up too much of your available credit and pay back what you borrow on time each month.

Adopt Good Financial Habits

Developing smart spending and saving habits are crucial to rebuilding your credit score, and one of the best ways to do this is to create a budget that accurately reflects how much you earn and how much you spend. With a budget youll know how to live within your means, and youll be able to manage your money better.

A budget, essentially, is a spending plan for your money. By giving every dollar a job, youll be able to determine in advance whether youll have enough money to cover all your expenses. And if you dont have enough money to cover your expenses, you can use your budget to prioritize your spend and focus your money on areas that are most important to you. This free budget calculator spreadsheet is a great tool to help you start building a realistic budget.

Once youve developed a budget, its time to get into the habit of setting up money reminders. Create a checklist of all your bill payments and note all your payment dates, either in an agenda, a wall calendar, a smartphone app, or a Google Calendar notification. Whichever method you decide to use, it will serve the same function: itll help you remember where your money needs to go and when, so youll never make a late payment.

Stick with these good financial habits, and itll be much easier for you to reach and maintain your new and better credit history.

You May Like: The Higher Your Credit Score The Brainly

Tips To Increase Your Credit Score

If you are like many consumers and dont know your credit score, there are several free places you can find it. The Discover Card is one of several credit card sources that offer free credit scores. Discover provides your FICO score, the one used by 90% of businesses that do lending. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar, but not identical. Same goes for online sites like Credit Karma, Credit Sesame and Quizzle.

The Vantage Score comes from the same place that FICO gets its information the three major credit reporting bureaus, Experian, TransUnion and Equifax but it weighs elements differently and there could be a slight difference in the two scores.

Once you get your score, as Homonoff suggested, you might be surprised if its not as high as you expected. These are ways to improve the score.

We Get It The Rules Surrounding What Stays On Your Credit Reports And For How Long Can Be Confusing

The answer to how long a late payment will stay on your credit reports is typically pretty simple: seven years.

Before you lose all hope and think your road to financial progress has hit an insurmountable obstacle, take a deep breath. Yes, seven years seems like a really long time. But there are steps you can take to improve your situation over time. So lets dig in and try to understand what your options are and how you can avoid making late payments in the future.

Also Check: How To Remove Serious Delinquency On Credit Report

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So, a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

Get Started With Improving Your Payment History Today

No matter how many late payments you have made in the past, its never too late to start making payments on time! Using a combination of strategies and tools, you are likely to find a personalized solution that works for your situation. With on-time payments, youll see an improvement in your credit score, which is an essential part of becoming financially stable!

References:

Recommended Reading: Speedy Cash Collection Agency

What Is The Impact Of Late Payment On Credit Score

Lenders will often report each payment to one or more of the three largest consumer credit bureaus . Lenders typically report when a payment was received: on-time, 30, 60, 90 days late, or never received.

Many people wonder: how does a late payment affect your credit? According to FICOs credit damage data, one single recent late payment can cause your credit score to drop by as much as 180 points. This is because a late payment is a red flag to lenders that you may be experiencing trouble repaying your debts, making you riskier to lend to and a greater credit risk which increases the lenders risk of losing money by lending to you.

While a 180 point drop is a drastic change, you might only experience a credit score decrease that severe if you had excellent credit before the late payment and made the late payment very late . For most people a 30-day late payment would decrease their score from about 20 to 80 points.

As you can see, a 700 credit score with late payments would be negatively impacted much more than a lower score with late payments. That said, if your goal is to get a 700 credit score, you need to avoid any late payments.

So the answer to: How does a late payment affect your credit score? Is really it depends based on how late the payment was, what your score was before the late payment, and how recently the late payment was made.

What Is Considered A Late Payment And When Does The Seven

Theres no set rule that applies to all lenders frustrating, we know. Each lender decides what is considered a late payment and when to report it to a credit bureau.

In most cases, if your payment is more than 30 days late, the major credit bureaus are notified, meaning the late payment will show up on your credit reports.

A late payment, also known as a delinquency, will typically fall off your credit reports seven years from the original delinquency date. For example: If you had a 30-day late payment reported in June 2017 and bring the account current in July 2017, the late payment would drop off your reports in June 2024.

The same generally applies if you miss two payments in a row. If you had a 60-day late payment reported in June 2017 and bring the account current in August 2017, both late payments would be removed in June 2024.

Recommended Reading: Aargon Agency Debt Collector