How To Report A Delinquent Tenant To The Credit Bureau

Posted by Aaron Cox& filed under Landlord-Tenant Law.

No landlord wants to deal with delinquent tenants. A tenant who doesnt pay their rent is not only a problem for you but a problem for future landlords as well. Reporting delinquent tenants to the credit bureau can indicate to other landlords that they shouldnt rent to this particular person.

However, reporting a delinquent tenant to the credit bureau is more complicated than simply filling out a form. Heres what you need to know:

Review Your Reports For Mistakes Inaccuracies Items That Shouldn’t Appear

After you get your credit reports, be sure to review them and dispute any inaccurate information you find. If you’re planning to make a big purchase, like a house or a car, or a significant financial commitment, such as refinancing your mortgage, you might want to review information from all three agencies well in advance.

How Long Does Information Stay On Your Reports

The FCRA limits how long a credit reporting agency can report negative items in your credit report. Items that aren’t negative but are neutral or positive can be reported indefinitely. Review the rules below and then check your credit report for negative items that are too old to be reported.

No Negative Credit Reporting If You Make an Agreement Due to Coronavirus

Under the federal Coronavirus Aid, Relief, and Economic Security Act, if you make an agreement with a creditor to defer one or more payments, make a partial payment, forbear any delinquent amounts, modify a loan or contract, or get any other assistance or relief because COVID-19 affected you, the creditor must report the account as current to the credit reporting agencies if you weren’t already delinquent.

Read Also: How Often Do Companies Report To Credit Bureaus

Get All Three Of Your Credit Reports

Your three credit reports from consumer reporting agencies Equifax, Experian and TransUnion are not identical.

The old debt in question might be listed in some credit reports but not others. To find out, get a copy of all three of your reports. Federal law entitles you to request a free copy of each report once every 12 months. You can download them for free at AnnualCreditReport.com.

Once you find out which bureaus are listing the debt, contact them. Your credit report will include contact information and dispute instructions. Equifax, Experian and TransUnion will give consumers free weekly credit reports until April 20, 2022.

Why this is important: If youre only looking at the copy of your credit report from one credit bureau, you may be missing inaccurate information that is on another report.

Who this affects most: Mistakes with credit reports can happen to anyone with old debt on any of your credit reports.

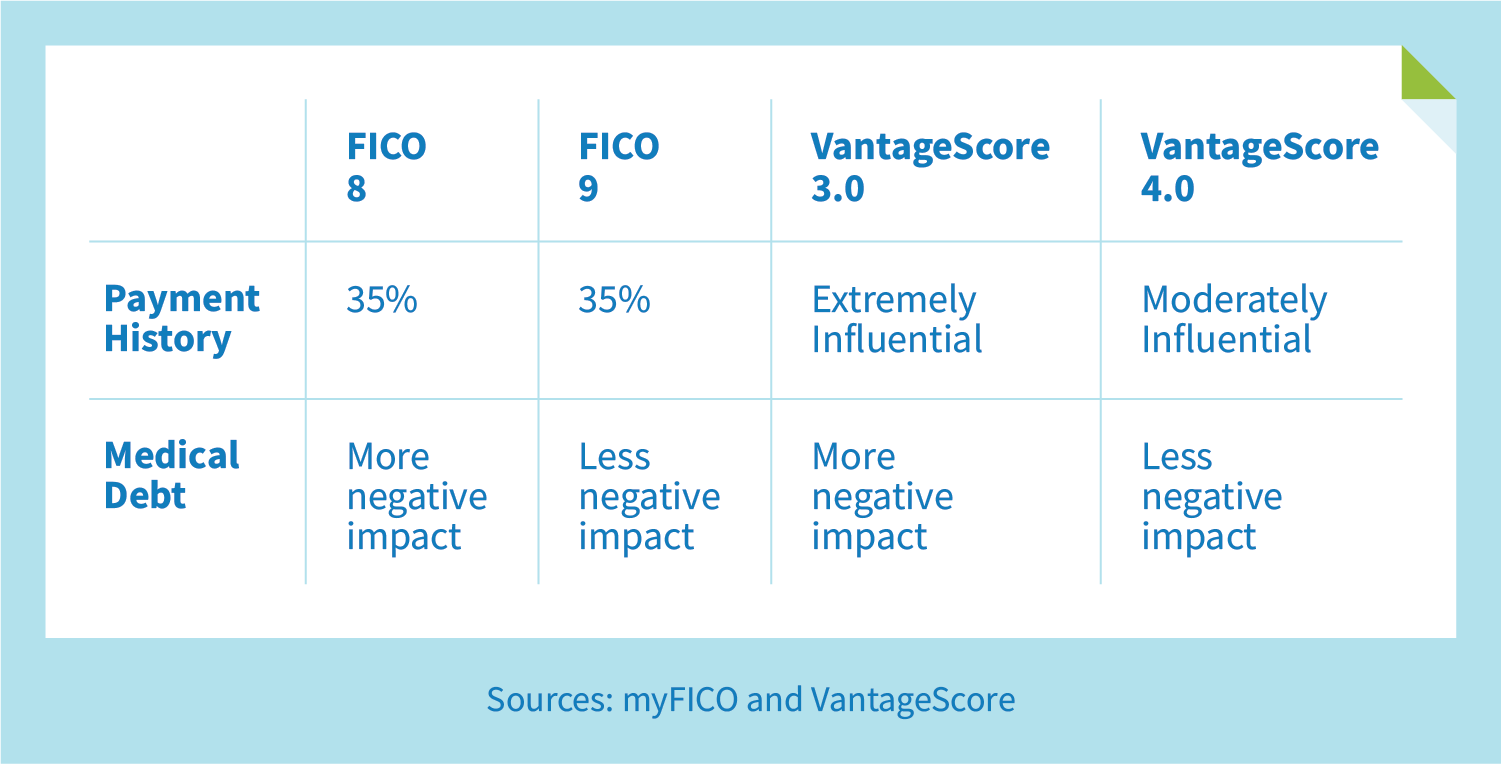

How Does Positive Payment History Impact Your Credit

Payment history is the biggest factor in credit scores, so paying your bills on time, every time is the most important thing you can do to build a strong credit history.

If you are just starting to establish your credit, it can take time to build a solid history of positive payments. Here some tips to help you begin building your credit history:

Also Check: What Does Serious Delinquency Mean On Credit Report

You Can Negotiate With Debt Collection Agencies To Remove Negative Information From Your Credit Report

By , Attorney

If you’re negotiating with a collection agency on payment of a debt, consider making your part of the negotiations. You can ask the collector to agree to report your debt a certain way on your credit reports. Here’s how: The three major credit reporting bureausExperian, Equifax, and TransUnionproduce credit reports. Ask the collector to tell the bureaus to remove any negative information about the debt from your credit files. The collector might not agree, it might have to get the creditor’s approval first, or you might have to pay a bit more on the debt but it doesn’t hurt to ask.

And if you get the collector to agree to accept less than the full amount to settle the debt, be sure the collector also agrees to report the debt as “paid in full” on your report.

Can A Collection Agency Report An Old Debt As New

Collection agencies cannot report old debt as new. If a debt is sold or put into collections, that is legally considered a continuation of the original date. It may show up multiple times on your credit report with different open dates, but they must all retain the same delinquency date. They should also all be discharged on the same date seven years after the original open date.

Recommended Reading: Does Wells Fargo Business Secured Credit Card Report To Bureaus

How To Report Bad Debt To The Credit Bureau

Related

As a business owner, you will periodically encounter customers and clients who do not pay their bills or invoices. Reporting the debt to a credit bureau may be an option, but there are limitations on the types of businesses that can directly file reports with consumer credit bureaus.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Your Options Will Vary Depending On What You Want To Report

There are a number of services available that allow you to proactively add information to your reports or self-report your data to a lender.

They all work slightly differently and use different information to bulk up your financial profile. Experian Boost, for example, zeroes in on your cable, phone and utility payments. UltraFICO pulls an even wider variety of information from your account, including your cash flow, spending habits and account history.

Meanwhile, rent reporting services, such as Rent Reporters and Rental Kharma, will relay your on-time rent payments on your behalf.

Alternatively, you can work directly with a lender that uses alternative data and link your bank accounts so they can assess your transaction history. Or, you can use a nontraditional score service, such as PRBC, and ask a lender to consider it.

Depending on your goals and financial history, you could even use multiple alternative data reporting services to showcase your financial history.

If youre confident that giving lenders a more comprehensive view of your financial situation will help give you an edge, rounding out your financial profile with alternative data could be really useful especially if your credit history is thin or nonexistent.

Tip: In general, you cant remove accurate negative items from your credit report. And theyll stay there for up to seven years. But in some cases, black marks such as missed payments can be removed by contacting your creditors.

Why Is This Happening Now

Medical debts have become a bigger problem, and they sometimes come out of nowhere. The COVID-19 pandemic has made things worse.

According to the federal Consumer Financial Protection Bureau, 20% of U.S. households have medical debt, and medical-debt collection issues appear on 43 million credit reports. As of the second quarter of 2021, 58% of debts that were in collection and which appeared on credit records were tied to medical bills. Also, debt collectors contact people more about medical bills than anything else, the CFPB said.

The Covid-19 pandemic has subjected more Americans to testing, hospitalization and related health costs. The credit agencies said they have studied the prevalence of medical-collection debt in consumer reports and are making the changes to help people focus on wellbeing and recovery.

Because some individuals have delayed routine or other health needs because of the pandemic, the CFPB expects overall medical expenses and debts to keep rising.

Don’t Miss: Dla On Credit Report

Contact Your Mortgage Lender And Ask If They Report To Experian

If your mortgage account does not appear on your credit report, the first thing you should do is contact your mortgage company and ask them if they report to Experian. If your lender confirms that they do report to Experian, you can request that they contact their Experian representative for help in determining why the account is not appearing in your report. Ask them to review the identifying information on the account to ensure that the account is being reported under the correct name and Social Security number.

You also can contact Experian and explain the situation so that it can be researched. You can reach Experian by phone at 888-EXPERIAN, or by mail at:

Experian P.O. Box 9701 Allen, TX 75013

Simply explain that you have an account that’s not appearing on your report and that the lender has verified it is in fact being reported. Be sure to include your complete identification number, including your Social Security number, so that Experian can locate your credit information.

Unfortunately, if your lender does not report, you won’t be able to have your account added. When you apply for credit in the future, ask the lender if they report account history to one or more of the national credit reporting companies. If they don’t, you might consider applying elsewhere to ensure your positive account payments help you build a strong credit history.

What Changes Are Coming

There are three key modifications to the way unpaid medical debts will be reported in consumer credit reports:

The first involves medical debts that went into collection but eventually were paid. These debts no longer will show up in credit reports. That change takes effect July 1.

Second, unpaid medical collection debt wont show up in credit reports for one year, up from six months currently. That will give consumers more time to work with insurance and/or healthcare providers to address their debt before it is reported, the credit bureaus said in a joint statement. It also will give health insurers more time to finalize billing and make adjustments.

Third, the three credit agencies pledged no longer to include medical collection debt under $500 in consumer reports, effective sometime in the first half of 2023.

You May Like: Procedural Request Letter To The Credit Bureaus

Becoming A Data Furnisher

Because credit reporting can have a significant impact on a business or the life of an individual consumer, credit bureaus restrict who can provide information that is included in reports.

Consumer Credit Bureaus

The federal Fair Credit Reporting act and other laws governing the accuracy of credit reports prescribe strict penalties for consumer credit bureaus that provide inaccurate information in their reports. As a result, credit bureaus are very careful about what kind of businesses they allowed to become data furnishers.

Each credit bureau has its own standard for approving a data furnisher. Issues that may be considered include the size of your business, how long you have been in operation and security standards throughout your organization. In many cases, small businesses simply do not meet these criteria and cannot become data furnishers on their own.

Business-to-Business Bureaus

The Fair Credit Reporting Act does not apply to business-to-business credit bureaus and, as a result, becoming a data furnisher may be an easier process. Still, you may have to turn over a fair amount of information to the business-to-business credit bureau, something that you may not feel comfortable doing.

Tip

How Many Points Does A Collection Drop Your Credit Score

When an account goes into collections, the number of points your score drops depends on dozens of factors unique to you. The higher your score, the more it can fall. A 90-day late account may swipe 50 points from someone with excellent credit but only 10 points from someone who was already in the lowest tier.

Recommended Reading: Carmax Loans To Bad Credit

The Debt Is Then Charged Off Or Sold To Collections

Then, the creditor is likely to charge off the debt. Its status will be changed to “charged off” and “sold to collections.” “Charged off” and “sold to collections” are both considered a final status. Although the account is no longer active, it stays on your credit report.

When the debt is sold or transferred to a debt collector, a new collection account is added to your credit history. It appears as an active account, showing that the debt collector bought the debt from the original creditor. If the debt is sold again to another collection agency, the status of the first collection account is changed to show that it was sold or transferred. Once again, the final status shows that the first collection account is no longer active, but that status continues to appear as part of the account’s history.

Collection Agencies Dont Always Play By The Rules

Collection agencies can sometimes be pushy, and some may even violate the Fair Debt Collection Practices Act, which prohibits debt collectors from using abusive or deceptive practices in an attempt to collect from you.

If you suspect youre being harassed or treated unfairly, its important to know your legal rights. We recommend consulting with a legal professional as a matter of course, but you can start by checking out our guide to your debt collection rights.

You May Like: Carmax Finance Rate

What Happens When You Dont Pay Collections

Whether you pay the collection or not, it stays on your credit report for the entire credit reporting time limit. Then, when that time period elapses, the collection will fall off your credit. Youll still owe the debt and the collector still can come after you, but your credit report wont show the debt any longer.

Why Medical Debt Is So Tricky For Consumers To Manage

McCall explains that its often difficult for consumers to know what expenses theyre on the hook for and what will eventually be paid by insurance, if they have coverage.

An account that went to collections but has since been paid stays on your credit reports for about seven years after it gets sent to collections. Were punishing consumers for something that happened unexpectedly seven and a half years ago, that theyve paid off, McCall says. Theyre still being punished for it.

Read more: How To Remove Collections From Your Credit Report

Errors in medical billing make matters worse, McCall explains. Medical bills frequently include coding errors, which could result in the patients financial responsibility being far larger than expected.

McCall of this: When she was in the hospital giving birth, she was given an aspirin. But the bill she received later indicated that instead of being charged for one aspirin she was charged for the entire bottle .

The credit reporting system forces patients and their families to pay bills whose accuracy they doubt, said Consumer Financial Protection Bureau Director Rohit Chopra in a statement on March 1. The announcement from the three credit bureaus came shortly after the CFPB announced it would scrutinize credit bureau practices regarding medical debt and investigate potential improvements to the medical billing and collections system.

Don’t Miss: How To Delete Inquiries

Can You Dispute A Collection With The Credit Bureaus

You can absolutely dispute a collection if you think its erroneous. Formal disputes must be filed individually with each credit bureau and can usually be done online through each credit bureaus website. You should also dispute the information with the company that provided the information.

can help you dispute errors on your TransUnion® credit report. We can also help you file a dispute with Equifax directly if you see an error on your Equifax® credit report.

How Credit Bureaus Work

Consumer and business credit histories and reporting help small businesses in a few ways. First, you can review credit reports to determine whether you want to extend credit to a business or individual customer. Second, the threat of being reported to a credit bureau is an inducement to both individuals and businesses to pay their bills on time.

You May Like: What Credit Bureau Does Paypal Credit Use

Can I Get Medical Bills Off Of My Credit Reports

If your medical bill is in collections by error and is hurting your credit score, youre probably wondering if it can be removed. If the bill is less than 180 days old or if it has now been paid by insurance, you should be able to dispute the error with the credit bureau.

Theres no guarantee the error will be removed from your credit report. But the effort is worth it because poor credit scores can make borrowing money really expensive.

Here are the steps to take:

Gather evidence. Collect as much documentation as you can to prove the bill was paid. Ask for payment records from your doctors office, find copies of canceled checks or dig up old credit card statements.

File your dispute with any credit bureau that’s reporting the error. Make sure to check your credit reports from all the three bureaus. Through April 2022, you can get a free copy of your credit report weekly from each bureau.

Keep communicating. The Fair Credit Reporting Act requires the credit bureaus to follow up on all credit reporting error disputes. Keep communicating with the companies to check on the status of your dispute, and be prepared to provide additional documentation if requested.

Help Your Customers Build Business Credit

By reporting those payments to commercial credit agencies you can help your clients build positive business credit references that help them build strong business credit scores. Your customersgood payment histories will be reflected in their credit scores. Not all companies report to these agencies, and as business owners learn about the importance of establishing strong business credit, they often seek out and do business with companies that report.

Check out Business Boost

Get your full business credit reports & scores, PLUS Nav reports your account payments to the business bureaus as a tradeline.

Recommended Reading: What Score Is Needed For Care Credit