What To Do Before You Apply For A Credit Card

You can start by checking your FICO® Score for free with Experian. It’s a good first step because submitting a credit card application can lead to a hard inquiry, which could lower your credit score slightly. With this in mind, you might not want to submit an application unless you’re fairly confident you’ll get approved. But there are ways to find credit cards that are a good fit without hurting your credit score.

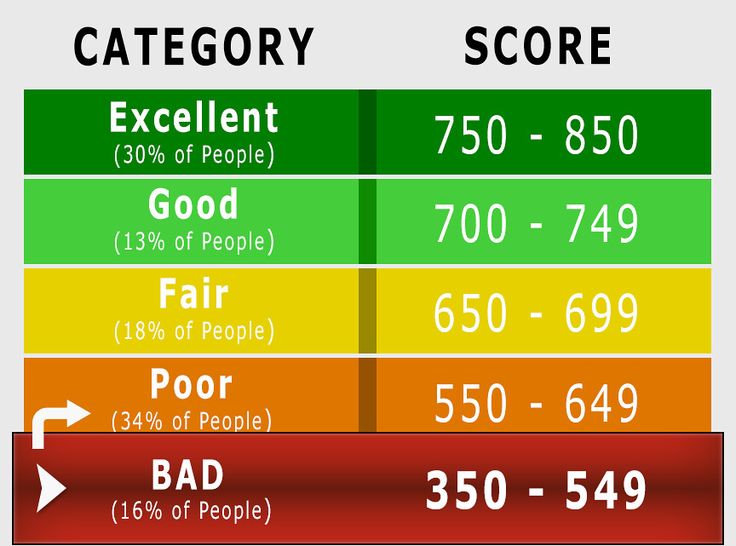

If you have a bad score, such as a FICO® Score below 580, one option is to look for preapproved credit card offers. You might receive these in the mail or from your current financial institutions. If you’ve gotten these offers, it’s because you’ve been prescreened and meet the card issuer’s requirements to extend a firm offer of credit.

Credit card issuers might also let you request a . Don’t be thrown off if the website says preapproval rather than prequalificationsome card issuers use the two terms interchangeably.

When you submit a prequalification, the card issuer reviews your basic information and may invite you to apply for certain cards. You may be presented with several card offers, but if you don’t get prequalified, you might want to look for options from other card issuers.

Preapprovals and prequalifications aside , you could focus on credit cards that are generally available to people with low credit scores.

What To Watch Out For When You Have Bad Credit

The best credit cards for bad credit may not seem very attractive, but the goal is to use them to boost your credit score so you can qualify for better offers later on. But there are a few gotchas to be aware of and watch out for, including:

- Fees: While you should strive to avoid annual fees if you can, you should also be aware that some credit cards, especially those for people with bad credit, try to charge an account opening fee or a program fee. Avoid these offers as much as possible.

- High APRs: Watch out for high interest rates that can make carrying debt incredibly costly. In fact, if you plan to use a credit card to improve your credit, you should try to avoid carrying a balance on the new card entirely.

- : Finally, watch out for mistakes that hurt your credit in the first place. The worst thing you can do is pay your credit card bill late, as it will have a major negative effect on your credit score, so avoid it at all costs.

Self Credit Builder Account + Secured Visa Credit Card: Best Financial Product For Establishing Credit

Why we picked it: The Self Credit Builder Account + Secured Visa Credit Card doesnt require a credit history. You start out with a credit-builder account, but will automatically be eligible for the secured credit card once youve made three consecutive monthly payments on time, have at least $100 in savings and are in good standing.

Pros: You also enjoy features like credit monitoring and account alerts to help you stay on track. Your payments are reported to the three credit bureaus, and unlike other secured card options, your repaired credit could be stronger since this loan-and-card combo helps build a credit mix worth 10% of a good credit score.

Cons: Youll pay a monthly fee, plus an administrative fee, for the account and youll have to wait until your 12- to 24-month payments are complete to receive your deposit.

Who should apply? This hybrid product could be a good option for people who cant afford to put down a large upfront security deposit or people who want to be forced to save some money while they build their credit.

Who should skip? Anyone who is looking for a credit card in short order should pursue other options as youll need to make at least three consecutive on-time monthly payments on the personal loan before qualifying for the secured credit card.

Read our full Self Credit Builder Account + Secured Visa® Credit Card review or jump back to this cards offer details.

Also Check: How Can I Check My Credit Score Without Ssn

Know Your Credit Score

You probably know you have bad credit because you’ve previously applied for a credit card, loan, or other credit-based service and have been denied. If you haven’t already, check your credit score to see exactly where you stand.

You can obtain free versions of your credit score for free from sites such as CreditKarma.com, CreditSesame.com, Capital One’s CreditWise, or the Discover Scorecard. Alternatively, you can purchase your credit score through FICO.com or any of the three credit bureaus. You may also receive a credit score automatically in the mail after being denied credit if your credit score was the reason that you were denied.

Beware of websites claiming to offer free credit scores as a gimmick to sign you up for a subscription credit monitoring service. If you have to enter your credit card number to get the “free” credit score, it’s a sure sign that you’re enrolling in a trial subscription and you’ll be charged if you don’t cancel.

Your credit score is driven by the information on your credit report. If you’re concerned about the information affecting your score, you can request a credit report through one or all of the three major bureaus: Equifax, Experian, or TransUnion. Federal law gives you the right to a free credit report through each bureau once every 12 months through AnnualCreditReport.com.

You can get a free credit report each week through AnnualCreditReport.com through April 20, 2022.

If No Credit Card Is Likely To Accept You Or You’ve Been Declined You Can Wait Or Try A Special Credit

Sadly there’s no such thing as guaranteed approval of credit cards. So, if you’ve tried the steps above and not found a card you’re eligible for, it’s likely your credit rating won’t permit you to get any card.

Important. If you’ve been declined for a card, don’t keep on applying for more.

Apply for too many cards and receive multiple rejections in a short period and you could shoot your credit rating in the foot for years. So for safety, you’ve now got two options:

- Wait until your bad credit history is less recent. Then try again and/or

- Try the ‘credit-builder’ product below. It’s hard to quantify how much of a positive effect using this will have in comparison to waiting a year before applying for credit. However, this option is fee-free and essentially gets you into a good savings habit, so could be worth a try.

Also Check: Navy Federal Credit Score For Auto Loan

Mission Lane Visa Credit Card: Best For Soft Credit Pull + Unsecured Credit

Why we picked it: The Mission Lane Visa® Credit Card is a relatively low-cost unsecured credit card for people with bad credit, given it doesnt charge monthly maintenance or activation fees. As an unsecured credit card, it also doesnt require an upfront security deposit.

Pros: The issuer will review your account after six months of on-time payments to see if youre eligible for a credit limit increase. All cardholders start with a minimum credit limit of $300.

Cons: That minimum credit limit is pretty low and the variable 26.99% APR range is high, even for this card category, so youll want to avoid carrying a balance on this card Theres a $0 to $59 annual fee, though even the higher end of that range is lower compared to some other cards in this category.

Who should apply? If you have bad credit and are hoping to obtain an unsecured credit card, the Mission Lane Visa is an option.

Who should skip? If you have even fair credit, you could potentially qualify for a card with more favorable terms and conditions. See the best credit cards for fair credit.

Read our full Mission Lane Visa® Credit Card review or jump back to this cards offer details.

Can You Prequalify For A Credit Card With Bad Credit+

You certainly can, though not all issuers offer prequalification. Luckily, those that do typically determine who prequalifies for a card with a soft credit pull, which wont impact your credit score. That said, your application can still be denied even after youve prequalified. Credit cards for bad credit that offer prequalification include: Credit One Bank Visa for Rebuilding Credit, Indigo Platinum Mastercard, and Milestone Gold Mastercard.

Read Also: Is It Possible To Remove Hard Inquiries From Credit Report

Are There 0% Intro Balance Transfer Credit Cards For Bad Credit

Typically, no. Balance transfer offers for a 0% intro APR are usually made to attract customers with higher credit scores and balances who are considered lower risk and able to steadily pay off their balances.

If you have a credit score between 300 and 579, it could be difficult to find a balance transfer card in general. Youll do better with a credit score of 580 or higher.

You could find a solution with a balance transfer card but it likely wont be at a 0% intro rate. High balances and APRs mean paying the minimum monthly repayments wont help, but a lower interest rate could help cut some time off paying off your debt.

If You Can’t Repay In Full Always Repay At Least The Minimum Repayment On Time

If you can’t repay in full, the minimum repayment is the lowest amount you must repay each month, on or before your statement due date. This is crucial, or you’ll likely get both a £10ish late fee and a negative missed payment marker on your credit report .

To ensure you don’t miss a payment, set up a monthly direct debit to automatically pay off the minimum amount . If you know you won’t be able to pay, contact your provider immediately and work with it to agree a different repayment plan.

Recommended Reading: Does Walmart Do Klarna

Oakstone Gold Secured Mastercard

- No minimum credit score requirements! We invite all credit types to apply! No processing or application fees!

- Includes Free Real-Time Access to Your Credit Score and Ongoing Credit Monitoring powered by Experian

- Helps strengthen your credit with responsible card use. Reports to three national bureaus

- Fast, easy application process. Choose your credit line and open your Personal Savings Deposit Account to secure your line.

- Nationwide Program though not yet available in NY, IA, AR, or WI

- Get a fresh start! A discharged bankruptcy still in your credit bureau file will not cause you to be declined.

- See website for additional Oakstone Gold Secured Mastercard® details

| $49 |

Responsible Credit Card Use Can Improve Your Credit Score

Depending on where you look, your creditworthiness may be displayed by a score, a color, or just an adjective. Of course, no matter if you call it poor or bad or even just give it a bright red frowny face having a bad credit history and low credit score is never good.

Most importantly, a low credit score is a strong indicator of financial risk to potential creditors. Even lenders specializing in subprime borrowers will check your credit to determine your creditworthiness before making a decision about your credit card or loan application, and your rates and fees will reflect this fact.

The best way to ensure you are able to qualify for the credit products you need is to build or rebuild a healthy credit history. A pattern of good financial behaviors over time, such as paying your credit card balance as agreed each month, will help improve your credit score, demonstrating your creditworthiness to future lenders and making you a better potential borrower.

Recommended Reading: Mprcc On Credit Report

Secured Credit Cards Vs Unsecured Credit Cards

Sure, a poor credit history will limit the cards available to you, but thats not to say you dont have much choice. For starters, when using a credit card to rebuild your credit score, youll first need to choose between a secured and an unsecured card. A secured credit card is offered on the condition that you secure it with collateral, usually in the form of a refundable deposit that can be claimed by the lender if you default on your payments. These cards are marketed directly to those with bad credit, so they have an easier approval process and come with no frills. And lenders report back your activity to the credit bureau, which builds up your score as you continue to repay responsibly.

Alternately, while not generally available to those with bad credit, unsecured cards are occasionally offered to consumers with fair credit scoresgenerally in the 600 to 650 range. As the name suggests, an unsecured card doesnt require a deposit. Plus, unlike secured cards, many unsecured credit cards offer rewards . That said, they can command tougher approval requirements than unsecured cards. And like all contracts, its always a good idea to read the fine print when selecting your card.

$500 Credit Limit Cards For Bad Credit Provide Spending Power & Opportunity

Our review of $500+ credit limit cards for bad credit demonstrates multiple options available to you to expand your spending power. We also discuss several that may be easier than credit cards to obtain.

Whatever your current credit limit, financially responsible behavior can help improve your credit scores and open the way to higher limits.

Recommended Reading: How To Get Car Repossession Off Credit Report

The 5 Best Credit Cards For Poor Credit

Having a bad credit score can be a strenuous task to correct. However, there are methods that can be used to replenish your score. Secured credit cards are one of the easiest cards to get and are also ideal to enhance your credit score. Some of the best credit cards for bad credit in the country are mentioned below.

More About The Ocean Credit Card

The Ocean Credit Card is issued by Capital One plc and has an interest rate of 39.9% APR representative variable with no annual fee. There’s an initial minimum credit limit of £200 which can go up to £1500 and the amount offered varies by customer depending on their credit history and financial situation. This is an unsecured card and you are required to undergo a credit check before your application is accepted. There is no sign-up fee. Ocean Finance is a trading name of Intelligent Lending Limited.

You May Like: How To Check Credit Score On Usaa

S To Take If You Have Limited Credit History

Its important to note that simply having a credit score isnt a sign you can get approved. Bad credit can is just as hard to overcome as no credit. Either may present challenges on major financing approvals, like what you get when you apply for a mortgage.

With that in mind, if you only ever had one loan and had trouble with repayment, or youve had several service accounts slip into collections then your credit score may be problematic to future loan and credit approvals. What limited credit history you have to generate a score would be negative.

In this case or even in the case that youve never had any credit at all and really have no credit score you should take the following steps:

Home Trust Secured Visa *

The Home Trust Secured Visa stands out because its a secured credit card with no annual fee . To open an account, you need to make a $500 deposit. And while the interest rate is standard at 19.99%, this wont kick in unless you carry a balanceand if youre looking to build your credit, you should aim for that not to happen. As with other secured credit cards, you can improve your credit score by making payments on time, and preferably in full. Note: If you dont use your card at least once a year, theres a $12 inactivity fee, so make to charge at least one purchase to the card annually.

- Annual Fee: $0

Read Also: Les Schwab Credit Score Requirements

Honourable Mention: Unsecured Retail Credit Cards

Itâs worth knowing your credit score before applying for a new card as it might be higher than you thought. If you have a credit score above 600 and no recent history of bankruptcy or consumer proposals, itâs possible that you might qualify for a conventional credit card and may not need a secured credit card to build your credit.

Like many credit cards issued by retailers, the Triangle Mastercard from Canadian Tire has more accessible approval requirements and is easier to obtain when compared to conventional rewards credit cards offered by banks . The card has no annual fees and no specific income requirements, but you will need to be a resident of Canada, not have reported bankruptcy within the past seven years, and be employed.

The Triangle Mastercard earns up to 4% in Canadian Tire Money at a number of affiliate retailers including Canadian Tire, Sport Chek, and Markâs clothing store.

Card details

- No annual fee

- Get 4% in Canadian Tire Money at Canadian Tire, Sport Chek, and participating Mark®/LâÃquipeur and Atmosphere locations

- 1.5% on the first $12,000 spent at eligible grocery stores each year

- 0.5% on everything else

- Earn 5¢ per litre back in Canadian Tire Money at Gas+ and participating Husky locations

- 25 PC Optimum Points per $1 spent at Shoppers Drug Mart / Pharmaprix

- 30 PC Optimum Points per litre at Esso/Mobil

- 10 PC Optimum Points per $1 spent on all other purchases

Best Prepaid Cards For Poor Credit

In some cases, an applicant may not want a traditional credit card, but may still wish to take advantage of many of the benefits of paying with plastic. For them, the best option may be to obtain a prepaid credit card. Similar to a secured credit card, prepaid cards require an initial deposit to use the card.

Unlike secured cards, however, a prepaid card is not actually a line of credit. Instead, a prepaid credit card behaves more like a gift card, with each purchase reducing the amount of the initial deposit until the entire amount is spent. Once empty, prepaid cards require the cardholder to reload the card, by making another deposit, to continue use.

| No | 9.5/10 |

Since prepaid cards arent actually credit products, obtaining and using a prepaid card will not have any impact on your credit . You cant use a prepaid card to establish new credit or to rebuild existing credit, as the prepaid card issuer wont be reporting to any of the credit bureaus.

Other than having to be reloaded and having no impact on your credit prepaid cards act just like regular credit cards when used to make purchases. For instance, a prepaid card issued by Visa can be used to make purchases at any location that accepts Visa credit cards, including online retailers.

Read Also: How To Remove A Repo From Credit Report