Should Consumers Take The Risk

While AfterPay is an easy, convenient payment method for online shoppers, it is always best to proceed with caution. Breaking up payments for a large purchase can be easier on your bank account, however, it can also lead to overspending. Digital solutions like AfterPay make it incredibly easy for you to purchase more than you can afford, leading to an increase in debt.

If you decide to use AfterPay, here are some helpful tips so that you can shop responsibly:

- Have a set budget Use a designated amount set aside for online shopping that you can easily pay back in a set timeframe.

- Link to your debit card, not credit card If you happen to miss a payment, and your credit card is linked to the account, then not only will you be incurring AfterPay late fees, but also interest on your credit card. It is best to link your AfterPay account with your bank debit card from the start.

- Set up reminders for payments once you make a purchase, set reminders for yourself, so that you will never be surprised or miss a payment.

For someone who can make payments on-time, AfterPay is a viable option. As long as you make sure to use it responsibly, it can help you shop at the stores you love and not feel guilty about spending money all at once.

Here at Blackhawk Bank, we want all our customers and clients to have responsible spending habits and understand the products they are using. If you are interested in learning more about how Blackhawk Bank can help you, contact us today!

How Do Affirm And Afterpay Work

Buy now, pay later apps work by splitting your purchases into smaller, more affordable payments. Many of these loans do not charge interest or fees as long as the customer makes all payments on time. The apps primarily make money by charging a fee to the retailer, late fees, and interest on loans. With pay-in-four loans, the customer will pay 25% of the purchase price immediately, then an additional 25% every two weeks until the loan is paid in full.

How Does Buy Now Pay Later Work

Say you want a dress for $400, an example of using a BNPL platform is youd only have to make an initial payment of $100, and over the next 6 weeks, each fortnight you would need to make another payment of $100 until the whole amount has been paid off.

Many retailers now offer Afterpay, or similar BNPL platforms as a method of payment, as an alternative to paying with cash, debit or credit. Typically, all you need is an account via the app or website to make a transaction. This will be connected to a card or bank account, and the payments are commonly deducted automatically. You can also set up an account when youre at the retailer, and once youve provided all your details, you will often get approval within seconds.

BNPL are similar to a loan, although they generally dont come with interest, however, there can be fees associated with this kind of payment method, including late fees, overdraft fees from your bank, and interest if your account is connected to a credit card.

Read Also: Is 524 A Good Credit Score

Will Using Afterpay Rebuild Your Credit Score

As noted above, Afterpay do not operate like a credit card or loan. They do not report payments that have been made on time to credit reporting bureaus. Therefore, Afterpay cannot be used to rebuild a damaged credit score.

Is your credit score getting you down? Check out our useful guide full of tips to improve your credit score quickly!

Does Openpay Affect Your Credit Score

Yes, when signing up for an Openpay account, it will verify your ID, check your credit history and obtain a credit report to assess your creditworthiness. Openpay reserves the right to check your credit score at any time at its discretion and this usually happens when you change the limit on your Openpay account. And of course, if you fail to make a repayment or commit a serious credit infringement, Openpay can disclose this information to a credit reporting body.

Also Check: Les Schwab Credit Score Requirement

Do Banks Look Down On Services Like Afterpay

Ah, the great debate.

While it all depends on the lender, the individual person and their own personal financial situation, these buy now pay later services have raised some concerning red flags for lenders as it could be seen as an ongoing expense.

It might also give the impression that you don’t have enough cash on standby and are living paycheque to paycheque, which may make it harder to get a loan.

Keep in mind that it’s only one part of what lenders look at. So if you’ve got a good savings history, stable income and a good repayment history, you might still be able to win them over.

Affirm Vs Afterpay: Credit Requirements

Affirm performs a soft credit inquiry when you create an account to prequalify you for future purchases. This soft inquiry does not affect your credit score and will not show on your credit report. However, when you do make a purchase, your credit score could be affected if Affirm does a hard credit inquiry. Additionally, your payment history and credit usage may also be reported to the credit bureaus.

Afterpay does not check a customer’s credit to open an account or at the time of purchase. If you are late with a payment, Afterpay also does not report late or missed payments to the credit bureaus. This makes Afterpay an attractive financing option for people with troubled credit or who don’t have enough credit history to get approved by other lenders.

Also Check: Sync Ppc Credit Card

Does Afterpay Do Credit Checks

Afterpay states that it does not do credit checks.³

The algorithm-based technology identifies likely risk spots. As a result, 30% of order requests are not approved.

Afterpay can also approve or decline the purchase based on whether there are sufficient funds on your card, and the length of time you have been using Afterpay.

| If you’ve recently moved to the US you can read some financial tips, including advice on building a credit score. |

|---|

Afterpay Review: Customer Reviews

Afterpay has a 4.9-star rating on Trustpilot. Here, a staggering 97% of reviewers rate the service as Excellent or Great.

Overall, it’s praised for its convenience, and users love it for its accessibility and reasonable repayment plans.

That being said, here’s a more specific look at what Afterpay users have to say:

Great way to buy designer clothing and unique houseware at affordable pricing and pay schedules!!

Great way to budget with no interest!!

I love using Afterpay vs. the other services out there because there are no interest fees, they send you friendly payment reminders, and it is charged bi-weekly instead of weekly.

One user even went as far as to say, Afterpay is the best invention ever. Thomas Edison, eat your heart out

Although, of course, not everyone has been quite as blown away by the service Afterpay provides. Some of the more negative reviews include comments like

One user described the company as deceptive, claiming that they were hit with fees on numerous occasions and warned others who might be considering signing up for Afterpay that its a very misleading service. Their verdict? Youre better off just buying things outright!

Some even went as far as to say theyd give no or minus stars.

If I could give less than , I would, wrote one Trustpilot reviewer. Unethical and no customer service whatsoever.

So, what about Afterpay’s often-criticized customer support? What kind of customer service is on offer

Don’t Miss: What Credit Score Does Carmax Use

Do Zip Pay And Afterpay Affect Your Credit Score

- Money

- Do Zip Pay and Afterpay affect your credit score?

Referred to as interest-free payment providers, Zip Pay and Afterpay are not classed as credit cards or loans, but can they affect your chances of mortgage approval?

Offering a Shop now, pay later, interest-free lifestyle, Afterpay and Zip Pay and other interest-free payment providers offer the benefits of layby with the bonus of taking the goods or services home the same day.

However, Anthony Lieu from Legal Vision says this can translate into making purchases you otherwise may not, and entering into a contract to make payments you cant afford, which may mean damaging your credit rating and your chance

Q5 So Is Using Afterpay Really A Good Idea

Like any financial product, whether or not Afterpay is right for you will depend entirely on your personal spending habits and circumstances. If you want a flexible payment plan and a fee-free alternative to credit cards, Afterpay may be a great option for you.

However, if you already have trouble paying your bills or keeping track of your spending, Afterpay could make this even more complicated.

Ending tip: Always ask yourself this: are you a responsible spender or a vulnerable shopaholic? Because it is important to make sure you can afford the repayments before making a purchase on Afterpay or any other BNPL services. If you struggle to control your impulsive spending, services like Afterpay may lead to you spending more than you can afford. So, here are 5 easy financial tips to follow so that you can avoid such situations from happening.

Thanks for reading this blog! If you have any questions on this topic, feel free to reach out to us across our socials and we would be more than happy to help!

Wait! Weâd love to hear your thoughts

If you enjoy using our app, please take a moment to rate it on the App Store. Your feedback in the past has tremendously helped us at WeMoney improve the app to be the best that it can be. A massive thanks to each one of you for making that happen!

You May Like: What Credit Report Does Comenity Bank Pull

How To Use Afterpay In Stores

Afterpay also lets you shop in brick-and-mortar stores using the Afterpay Card.You can apply to use Afterpay at these stores through its app. If approved, you’ll see a set spending limit in the app.

To use the card, you’ll need to load it to your Apple Pay or Google Wallet. Simply use that to pay in-store when you’re paying for your purchase.

Theres No Need To Stress

The issue with using Buy Now, Pay Later services like Afterpay starts when you cant afford to make your repayments. As long as you are living within your means and you are able to make your home loan repayments, then you shouldnt need to worry about your Afterpay account. Just make sure you disclose your current Buy Now, Pay Later balances when applying for a home loan, to help your application process go smoothly.

You can read our other home loan guide articles on serviceability and to learn more.

Caitlyn Smith

Don’t Miss: Can You Get A Credit Report Without A Social Security Number

How Do I Pay Afterpay

Oddly enough, Afterpay only accepts credit or debit card payments. For U.S. shoppers, the card must be issued within the U.S. International cards are not accepted.

Paying Afterpay with a credit card can be a risky strategy because you’re putting a no-interest charge on a high-interest credit card. This is rarely a good choice. In addition, you may lose out on any points or rewards that come with your credit card. For example, if you purchase a vacation package with Afterpay and pay it off with a travel rewards card, you might lose out on earning travel rewards.

Do Affirm And Afterpay Require A Credit Check

Affirm requires a soft credit check when opening an account, which does not affect your credit score. When you are ready to make a purchase, Affirm may require a hard credit inquiry to verify your score and provide financing options based on your credit profile.

There are no credit checks required with Afterpay. Afterpay doesn’t even ask for your Social Security number when signing up for its account. Instead, your spending limits will grow based on your on-time payments and responsible use of its platform.

You May Like: What Is Cbcinnovis On My Credit Report

What Are The Other Risks Of Buy Now Pay Later Platforms

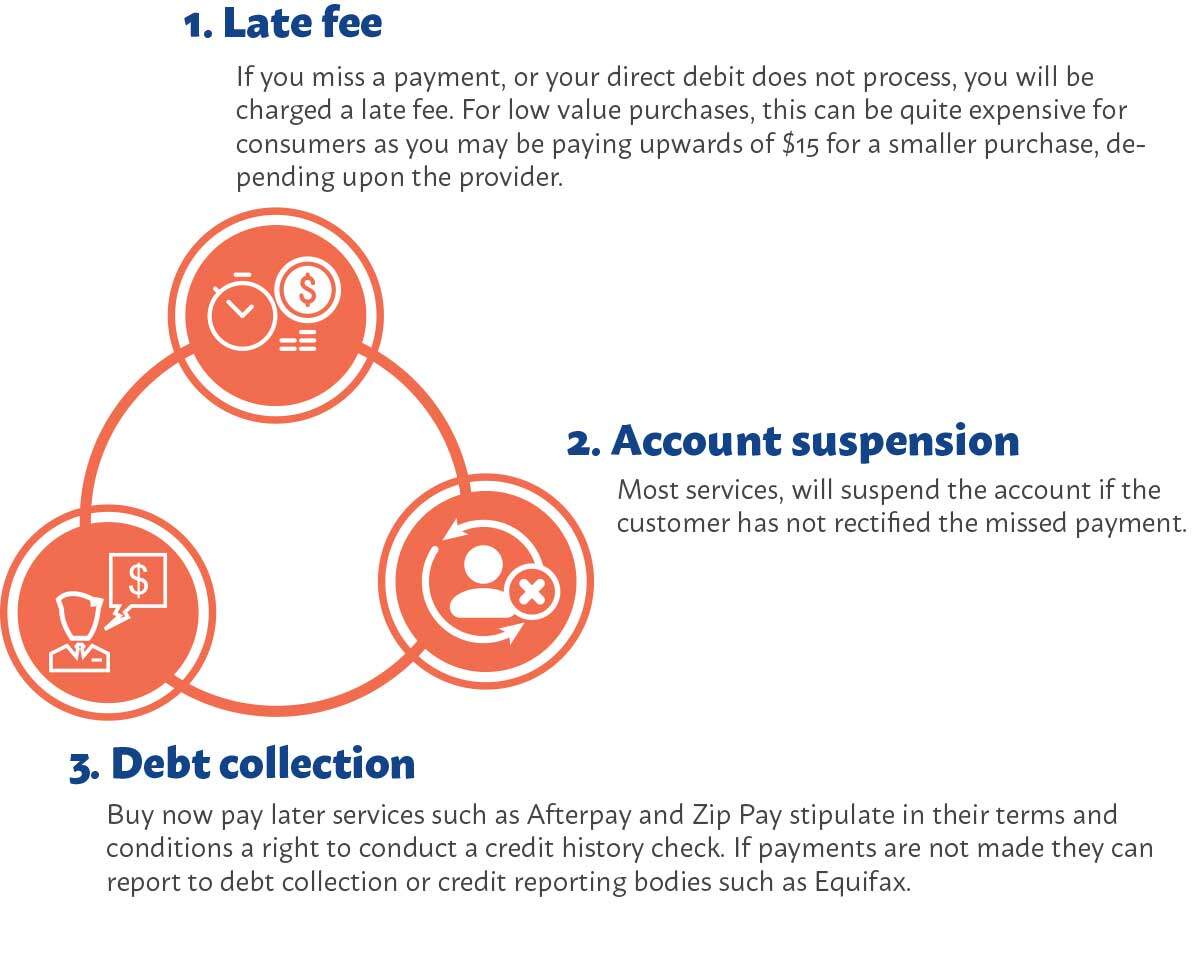

If youre using BNPL platforms, some other risks to be aware of include:

- Fees can add up: Most BNPL providers do not charge interest and instead charge fees. This can include missed payment fees and account keeping fees. ASICs recent report found that BNPL providers reaped over $43 million in missed payment fees in the 201819 financial year, with one in five BNPL users saying they missed a payment in the last 12 months.

- It could impact your future loan applications: According to Moneysmart, lenders consider BNPL spending when you apply for loans .

- It may be difficult to meet your repayments: In order to meet their repayments, ASIC found that 20% of BNPL consumers cut back on or went without essentials such as meals, 15% took out an additional loan and 20% missed or were late paying other bills or loans. If you do miss payments on other bills or loan products, this could also hurt your credit score.

To help manage your BNPL spending, you might like to:

- Create a budget which accounts for essentials like food, rent or mortgage payments and bills first, then see how much you can afford to spend via BNPL platforms.

- Put a limit on your BNPL spending and stick to it.

- Set up payment reminders. If you already have automatic payments set up, make sure you have enough funds in your account before the due date.

- Try to link your BNPL account to your debit card, rather than a credit card. This can also help to avoid credit charge interest and other fees.

Cover image source: cottonbro .

How Do I Pay With Afterpay

In retail stores

To use Afterpay in store, download the Afterpay app on your smartphone and sign up for the service. Then, tap the Card button and follow the prompts to set up an Afterpay virtual card. The app will add the card to your Google Pay or Apple Pay Wallet where you can use your phone to complete the purchase in-store.

You can only use the in-store function at stores that accept Afterpay, so be sure to confirm through their online store directory first.

Online

To make an online purchase with Afterpay, open the app on your smartphone or online and browse through their affiliated stores. When you see the store you want, tap on it and shop online like you normally would.

Once you get to the checkout cart, select Afterpay as your payment option. If you dont have an account or payment method set up already, youll be able to instantly set one up and complete the purchase.

Read Also: How Often Do Companies Report To Credit Bureaus

Do Afterpay Run A Credit Check When Opening An Account

Afterpay have, in the past, reserved the right to run a credit check on new customers, although they said that they rarely did so.

However, theyve updated their credit policy recently, and they now say:

“at Afterpay, we never do credit checks . . . We dont believe in preventing people from accessing Afterpay because they may have had an old debt from a long time ago”

Its there in plain English. Afterpay do not run credit checks, ever. Credit checks made by lenders appear in your credit history, potentially lowering your score. But this won’t happen with Afterpay: no credit check means no entry in your credit history.

What Are The Risks Of Afterpay And Bnpl

Afterpay allows you to make interest-free instalment payments for your purchases. According to its website, youll only incur fees if your payments are late. Another perk of Afterpay is an instant approval decision, where youre notified whether youre approved within seconds.

Whilst this all sounds great, are there risks associated with Afterpay? The simple answer is yes, so lets take a closer look.

Recommended Reading: How To Unlock My Experian Credit Report

Afterpay Review: How Does Afterpay Work

The crux of Afterpay is that shoppers can settle their purchases across four installment payments. Customers just have to download the Afterpay app and set up an account. Simultaneously, retailers, both online and offline, can integrate with Afterpay to offer their customers this payment option.

Purchases as small as $35 can be broken down into four payments. These are interest-free. You just need to pay a 25% deposit. Then the items are yours straight away- just as they would be with a regular purchase!

In a world where payment flexibility is an asset, Afterpay sounds like a fab idea for putting more power into the hands of the consumer. Lots of us would welcome the option of paying for things via a manageable payment plan, rather than losing a bulk of our money in one go. Services like Afterpay empower shoppers to access retailers that otherwise have been too expensive for them.

Afterpay acts as an intermediary between retailers and customers. Afterpay lends money to the retailer, and the customer pays them back. The product markets itself as a budgeting tool rather than a loan or credit card. The concept is similar to the old-fashioned layaway in stores, where shoppers had a product put aside for them, and they paid for it in increments until they were square. Only with Afterpay, you get the product immediately.

Can You Build Credit With Affirm Or Afterpay

When you borrow with Affirm, your positive payment history and credit use may be reported to the . This can help you build credit with the credit bureaus as long as you make all of your payments on time and do not max out your credit.

Afterpay will not help you build your credit history because it does not report its loans to the credit bureaus. While this is helpful to get approved, its lack of reporting of your positive payment history will not help your credit either.

Don’t Miss: Does Zzounds Report To Credit Bureau