How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Which Credit Report Errors Aren’t Worth Disputing

Small errors that dont affect your score like a misspelled former employer name or an outdated phone number dont hurt anyones assessment of your creditworthiness and aren’t worth disputing.

And sometimes a negative mark might surprise you but is not an error. If its accurate, don’t use the dispute process. Instead, try to resolve the problem directly with the creditor. For example, if you accidentally missed a payment, contact the creditor, arrange to pay up and ask if it will rescind the delinquency so it no longer appears on your reports.

The credit agencies are not obligated to investigate “frivolous” claims.

Submit A Credit Dispute Letter

Youll want to write a detailed dispute letter that outlines all the inaccuracies you have found.

You will send this letter to the credit bureaus asking them to correct the inaccuracies or remove the negative information altogether.

The federal Fair Credit Reporting Act requires credit bureaus to report only accurate information on your credit report.

Many times the credit bureaus cant verify each detail about the negative entry, so it has to be removed.

You will have to send the same dispute letter to all three major credit bureaus Experian, Equifax, and TransUnion if the negative information appears on all three of your credit reports.

If this sounds overwhelming, you might want to reach out to a credit expert. It costs some money but is far less expensive than you might think considering you are getting your own lawyer to fight on your behalf.

You May Like: Navy Auto Loans

Hire A Credit Repair Service

Disputing errors can be a time-consuming process, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, bear in mind that there are consumer protection laws regulating how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they has been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Before signing up with one of these companies, its important to understand what they can and cannot do. For example, any company that promises to remove accurate negative items or create a new credit identity for you is most likely engaging in illegal practices or a scam.

Ways To Remove Old Debt From Your Credit Report

Having an accurate and up-to-date credit history without old collections or delinquent accounts is important when youre applying for loans or other new credit.

If youve noticed old debts on your credit report, its best to act as soon as possible to remove these items. Here are a few steps you should take.

Also Check: How Long Does A Car Repo Stay On Your Credit

How To Monitor Your Credit To Detect Inaccuracies

Along with inaccurate information about you, that debt collectors may report to Experian, Equifax, and TransUnion, you should also lookout for signs of identity theft on your credit reports.

Identity theft happens more and more now as data breaches and scams keep exposing our sensitive financial data.

Heres how to monitor your credit to make sure its in good standing with all three reporting bureaus:

Hire A Credit Repair Company

If youre looking for the easiest way to fix your credit report, the following three credit repair services earn our top marks based on BBB ratings, industry reputation, and our own reviews.

These services challenge each of three major credit bureaus to verify, correct, or remove negative items on your credit reports.

| $79 | 9.5/10 |

The Fair Credit Reporting Act entitles you to dispute inaccurate items on your credit reports. You can do so through the mail or online at the three credit reporting company websites.

While you can attempt to fix your credit yourself, the process requires effort, patience, organization, and expertise. For what many consumers consider to be a reasonable price, you can hire a credit repair organization to do the work for you.

Some disputes are easy to resolve, such as the removal of outdated information. Other disputes require more work, including submitting evidence to contest items and forcing the bureaus to validate questionable data. The ideal outcome is to remove enough negative items to give your score a boost.

Most credit repair services offer a free consultation to review your credit reports and identify fruitful areas worth challenging. The credit specialist will review with you the different plans the company offers, what services come with each plan, and how much each plan will cost you.

Don’t Miss: What Is Leasingdesk

Is Voluntary Repossession Better For Your Credit

Repossession has the same impact on your credit score even if you opt for a voluntary repossession. Either way, the lender had to reclaim the car and try to recoup its losses from your loan.

But voluntary repossession has a couple other benefits. You can preserve some dignity by taking control of the process, for example.

And, you could avoid a few additional late or missed payments from making their way onto your credit report.

If you see theres no way to avoid repossession, you may as well surrender the car voluntarily. Usually, though, you can avoid a repo by communicating with the lender.

Dispute Inaccurate Items Yourself

You can embark on DIY credit repair by ordering your three credit reports from AnnualCreditReport.com, a source of free credit reports authorized by the federal government. You need all three reports because creditors may report transactions to only one or two credit bureaus.

After receiving the reports, review the four sections for errors:

- Identification: Information identifying yourself, including your address, date of birth, and Social Security number. Incorrect information may be a tip-off that the report covers accounts that dont belong to you.

- Tradelines: This contains your account data, which includes your use of credit and your borrowing activity. The data includes account balances, payment history, and a collection account or charge-off.

- Public records: Court information regarding adverse legal judgments, bankruptcies, liens, foreclosures, vehicle repos, and money owed for child support.

- Inquiries: Hard inquiries are those you authorize a credit provider to make when you apply for a credit card or loan. These can lower your credit score. Unauthorized soft inquiries have no impact on your score.

The hardest part of DIY credit repair is combing through your report data for accounts or account activity you dont recognize, incorrectly reported negative credit file items , and liens and judgments you have already paid. You also should check for hard inquiries you didnt authorize.

Don’t Miss: Who Is Coaf On My Credit Report

How Do You Get Rid Of Credit Reports That Are Closed And Charged Off On Your Credit Reports

Closed accounts cannot be removed, but after some time, theyll disappear. Accounts charged off may get paid for and will be reflected as being paid. Many people believe that an account charged off means you are no longer owed the amount and are excused. That isnt the situation. Rather it indicates that they have given up and arent actively seeking to get the money back. However, this does not mean that they cant reopen accounts or transfer them to a collection firm that will attempt to recover the debt. Its not identical to an account that is part of the bankruptcy discharge.

Can You Remove Negative Information From Your Credit Reports

Reading time: 2 minutes

Your credit reports are like a financial report card an extremely useful record that helps lenders evaluate the risk involved in loaning money to you.

They contain information about your credit history including some bill repayment activity and the status of your credit accounts. This information includes how often you make your credit card or loan payments on time, how much total available credit you have, how much of that credit you’re currently using and whether you have outstanding debt.

If you’re delinquent on your loan payments, your debt may be transferred or sold to a collection agency. At that point, a new lender will be added to your credit reports, meaning your debt will appear twice: once with the original lender and again with the collection agency. You will have a set period of time to pay off the debt with the collection agency. The debt will stay on your credit report for as long as it remains unpaid and can only be removed approximately seven years from when you were first found delinquent.

Read Also: How Long Before Eviction Shows On Credit Report

Student Loan Delinquency Or Default

Late student loan payments can start to hurt your credit after 30 days for private student loans and 90 days for federal student loans, and those delinquencies stay on your credit report for seven years.

Federal student loans go into default if you dont make a payment for 270 days. And the government has strong debt-collection powers: It can garnish your wages, Social Security benefits or tax refunds. With private student loans, your lender can term you in default as soon as youre late, but it has to take you to court before it can force repayment.

What to do: If youve paid late but havent defaulted, consider switching to an income-driven repayment plan, putting your loan in deferment or forbearance, or asking your lender for a modified payment plan.

If youve defaulted on your federal student loans, the government offers three options: Repayment, rehabilitation and consolidation.

How To Remove A Repossession From Your Credit Report

When you stop making payments on an auto loan, the lender will take the vehicle back. In lending terms, this is called repossession.

A repossession could happen in two ways:

Either kind of repossession hurts your credit score. The negative item could crush your credit score if you have good credit otherwise.

Whats worse: You could still owe money on the car loan, even after the repossession, if the bank cant pay off your balance by selling the car. This will make your bad credit even worse.

Don’t Miss: Does Affirm Accept Itin Number

No Your Credit Scores Wont Be On These Reports

The most important thing to keep in mind, though, is that you want your credit report to be completely accurate so your credit scores are accurate, too. A credit score is a rating of your creditworthiness, which is how lenders determine what type of loan terms you may qualify for.

While reviewing your credit reports, you might be flipping the pages wondering, Where is my credit score?

The answer is a bit counterintuitive: Your credit scores arent recorded on your credit report.

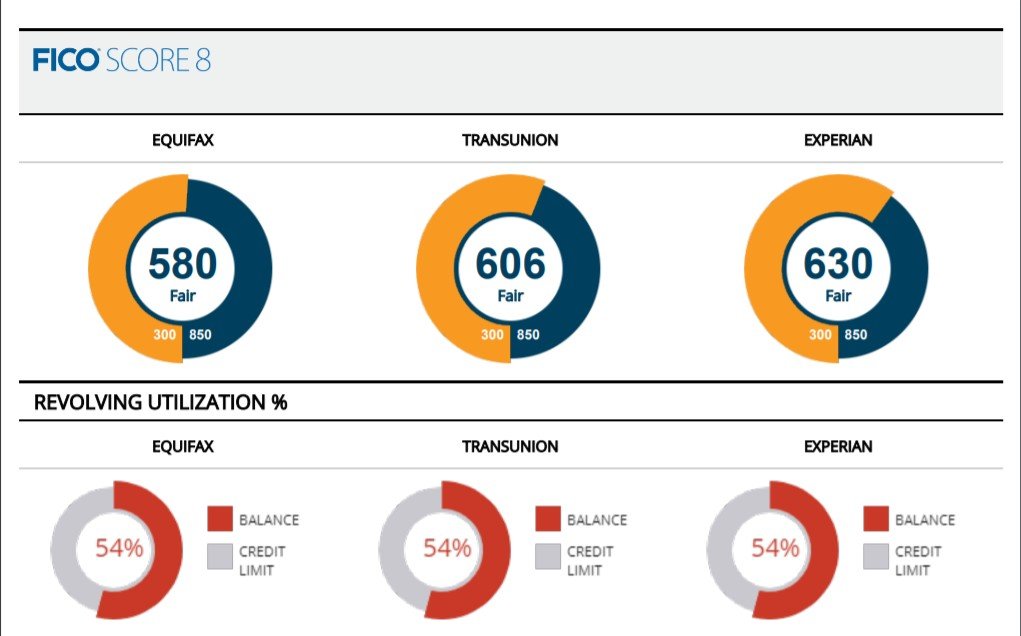

Equifax, Experian and TransUnion are private companies that collect and maintain information about consumer credit. This information is then used by credit score modeling companies, such as VantageScore and FICO, to determine your credit scores. You can have multiple credit scores, and each company has their own way of calculating scores, so not all of your credit scores will be the same .

Lenders may also have their own credit scoring models.

Review The Results Of The Investigation

The credit bureau involved must provide you with results of the investigation in writing and also a free copy of your credit report if the dispute results in a change to that report. The credit bureau must also provide you with the name, address and phone number of the furnisher that reported the incorrect information.

If a furnisher continues to report a disputed item, it is required to notify the credit bureau involved about your dispute. If the disputed information is found to be inaccurate, the furnisher must tell the credit bureau to update or delete the item. The furnisher must also notify all the credit bureaus to which it sent the incorrect information so that the bureaus can correct their records.

Even if the furnisher insists that the disputed information is accurate, you can still request that the credit bureau include a statement in your credit file explaining the dispute.

Read Also: Carmax Auto Finance Defer Payment

How Do You Get Something Removed From Your Credit Report After 7 Years

In theory, debts should be automatically removed from your credit report once they reach their legal expiration . If you see debts on your credit report that are older than that, youll want to contact both the creditor and the credit bureau by mail requesting a return receipt. In your letter, include all documentation about the debt, including any inaccuracies.

Impact Of Identity Theft On Your Credit Report

Identity theft when someone steals your personal information and uses it to open new financial accounts can wreak havoc on your credit. These new accounts show up on your credit record and hurt your score, especially if theyre delinquent or if the identity thief applied for several in a short amount of time.

Cleaning up your credit after identity theft can take anywhere from several months to years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. This is why keeping a close eye on your report and learning how to protect yourself from identity theft will help you to keep your information safe.

How to remove negative items related to identity theft

If you believe youve been a victim of identity fraud, file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

To prevent further damage to your credit history, these are the steps you should take:

- Notify the incident to Transunion, Experian and Equifax through phone or mail

- Place a security freeze and fraud alert on your credit report

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service

Don’t Miss: Which Credit Bureau Does Capital One Pull

Dispute The Information With The Credit Reporting Company

If you identify an error on your credit report, you should start by disputing that information with the . You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. You can also use our instructions

If you mail a dispute, your dispute letter should include:

You may choose to send your letter of dispute to credit reporting companies by certified mail and ask for a return receipt, so that you will have a record that your letter was received.

You can contact the nationwide credit reporting companies online, by mail, or by phone:

Improve Your Credit Habits

In general, the best way to improve your credit is to work on your financial habits. There arent many reliable fixes for credit mistakes, so its best not to make them at all. Even if the outlook isnt bright, you can take control by making a list of your negative items, and then deciding on the best course of action, one item at a time. It may not be the fastest method, but its effective.

Kristin Wong writes and makes videos about all things money. You can find her writing at Lifehacker, NBCNews.com, and on her own personal finance blog, Brokepedia.

Also Check: Afni Subrogation Department Bloomington Il

Get A Copy Of Your Credit Report

The first step is to get a copy of your credit report from all the three bureaus. You can request a free copy of your credit report from Annualcreditreport.com. Alternatively, you can get credit reports through third-party services as well.

The next step is to mark accounts that have a dispute remark or comment associated with it. Youll need this list when contacting the bureaus.

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

Read Also: Does Amex Pay Over Time Affect Credit