Building Credit Without Credit Cards

The need for good credit history is inevitable for most of us. When the time comes to buy a car or a home, rent an apartment, set up new utility accounts, obtain a cell phone, or handle other financial transactions, a healthy is crucial. For many, the first step in establishing a credit history is through the use of credit cards.

Luckily, only a small portion of your is based on having and using revolving credit products . However, consumers who can’tor don’t want toobtain a credit card can build a credit history in other ways.

When To Unfreeze Your Credit Report

Unfreezing your credit reportalso known as “thawing” in the credit industryis a temporary lift of the freeze for a specific period of time. This allows you to make your applications in the short window before your credit freezes again automatically. Permanently removing the credit freeze is known as lifting the credit freeze. Youll have to specifically request to add the credit freeze again if you want to protect your credit against unauthorized .

Here are a few instances where you should temporarily or permanently unfreeze your credit report.

Since you can’t predict which of your credit reports a business might check, you should unfreeze all three. Make sure you allow enough time to complete your application process before freezing your credit reports again.

Why Should I Check My Credit Report

Your credit report has information that can affect whether you’re approved for a loan or credit card and the amount you’ll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Also Check: Does Zzounds Report To Credit Bureau

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

Read Also: What Is Syncb Ntwk On Credit Report

Why Do Your Credit History And Score Matter

Banks stay in business by issuing credit to people who are responsible enough to pay it back. Without an intimate knowledge of how you spend your money, a credit score and credit history are the next best thing. They give the lender an idea of the risk they are taking when they lend to you. Then, they can approve or deny your application based on that risk.

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

You May Like: Does Paypal Report To Credit Bureaus

Why Would A Potential Employer Look At Your Credit

More than half of employers conduct background checks during the hiring process only, and the No. 1 reason is to protect their employees and customers, says the 2018 HR.com report.

For security purposes, the credit report can be used to verify someone’s identity, background and education, to prevent theft or embezzlement and to see the candidate’s previous employers . For employers, it is a big picture snapshot of how a potential candidate handles their responsibilities.

“Credit reports indicate whether or not you’re responsible,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select. “And, they also indicate if you’re in financial distress. These are attributes that are important to employers. For example, would you want to hire someone in your accounting department who can’t manage their own obligations?”

If an employer is running a credit check on you, it is most likely only after they already made a decision to hire you, and it is usually the last thing they check. Since pulling credit checks cost employers both time and money , credit checks aren’t necessarily used to weed out a big pool of potential applicants and not all applicants will have their credit checked.

Employers are more likely to run a credit check for candidates applying for financial roles within a company or any position that requires handling of money .

What Is A Credit Check

A credit check happens when you authorize a company to access your credit reports. Some companies might only pull one while others could pull one from all three credit bureaus. When companies pull your credit report, theyre checking to see how responsible you are with paying bills. If you have a history of missing payments, you might represent more risk to the company and they might be less likely to offer you service.

There are two ways a company can check your credit, they could do a soft pull or a hard pull. Here are the differences between each:

| Action |

| Could drop it a few points per inquiry |

Read Also: What Is Syncb Ntwk On Credit Report

Keep Paying Old Bills

That old student loan may feel like an albatross around the neck, but years of on-time payments and the age of the account will boost your score. An account in good standing factors into your score until 10 years after it’s paid off and closed, so dont miss payments or pay late.

Pay off collection accounts, too, since the newest version of the FICO score ignores paid collections .

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Read Also: What Is Syncb Ntwk On Credit Report

What Doesn’t Impact Your Credit Score

There are many common misconceptions about what does affect your credit score. “Consumers sometimes focus on things that simply don’t matter to their scores. The most common is information about your wealth,” says Ulzheimer.

“Income, balances in retirement accounts, equity in your home, net worth … anything that defines how much money you have or how much you’re worth are not considered by your credit scores.”

Other factors that don’t affect your credit score include race, religion, nationality, gender, marital status, age, political affiliation, education, occupation, job title, employer, employment history, where you live or your total assets.

Learn more: Can employers see your credit score? How to prepare for what they actually see when they run a credit check

What Is The Fair Credit Reporting Act Or Fcra

The Fair Credit Reporting Act is an important law that gives you the right to know the information that the credit bureaus keep on you and how that information informs your credit scores.

This law includes a number of consumer rights and protections. For example, under the FCRA you have the right to dispute incomplete or inaccurate information on your credit reports. In most cases, the credit bureau must investigate your case and correct or remove any inaccuracies within 30 days.

Also Check: What Company Is Syncb Ppc

Stay Up To Date On Credit Check Policies

When choosing a provider that requires a credit check, it is beneficial to find out whether it is a hard inquiry or soft inquiry. In basic terms, a hard inquiry will show up on your credit report and affect it for a certain amount of time, whereas a soft inquiry will not affect your credit. Hard inquiries can also cause a small drop in your credit score. As long as there are not multiple hard inquiries, the drop will be quite minimal and not affect your score very long.

As said above, there is no straight answer to whether you need a credit check or good credit for internet service, as it depends on the provider. Realistically, ISP credit check requirements are changing all the time and it can be hard to keep up with. When looking for a new provider, this is a question that you should ask right away, just in case their policy has changed recently. Over time, some ISPs may begin offering better options for those with low credit scores or those who do not want to give out their sensitive information.

You May Have No Credit Scores Even If You Have Open Accounts

If your open accounts are old and you havenât used them in the past two years, you could have no score. This is true for accounts that you have closed, or accounts that donât report to the credit agencies. One way to make sure your data is contributing to a score is to reopen old accounts or only do business with lenders that report to the three major credit bureaus.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.

Ready to help your credit go the distance? Log in or create an account to get started.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

You May Like: Does Klarna Report To Credit

Apply For A Store Charge Card

If you shop in-store, itâs common to be asked to sign up for a store card when you pay for your purchase. While these cards generally have higher interest rates and very low credit limits, they can be an ideal tool for building credit. Approval rates are generally higher, and these cards can sometimes come with extra perks, such as a percentage off your initial purchase or special in-store coupons.

How Are Credit Scores Calculated

FICO Score

VantageScore

Recommended Reading: Does Paypal Credit Affect Credit

How Does Borrowell Work

Free Weekly Credit Monitoring

Sign up in just 3 minutes for free access to your Equifax credit score and report, which we update every single week.

The first in Canada, our AI-powered Credit Coach helps you understand your credit score and gives personalized tips that may help you improve it.

Product Recommendations

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report. An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life

- disability insurance applications.

You May Like: What Credit Report Does Capital One Use

How To Get A Credit Report

The Fair Credit Reporting Act requires Experian, Equifax and TransUnion to provide you a free copy of your credit report once, every 12 months.

There is a charge for credit scores, but the credit report is free.

To get a free credit report, go online to www.annualcreditreport.com or call 1-877-322-8228 and request it. This is the only website authorized to fill orders for free credit reports. Once there, each agency must supply you one credit report every 12 months. You could receive all three reports at once, or spread them out over 12 months depending on the purpose you have.

If you want to examine the three together and compare all the information contained in each report to be sure its accurate , you should request all three at the same time.

Since the information on all three should essentially be the same, you may want to ask for one report every four months and verify each time that the information remains accurate.

If you already received a free report from each of the bureaus and want to check your credit report again, you can contact any of the three reporting agencies and order one for a small charge, usually under $10.

Is Everyone Eligible To Get Their Free Statutory Annual Credit File Disclosure

Yes. As of Dec. 1, 2005 all consumers are eligible to request their statutory annual credit file disclosure once every twelve months.

Monitor your Experian credit report for free

No credit card required.

- Access to your free Experian credit report and FICO® Score

- Get real-time alerts to help you detect possible identity fraud sooner

- Monitor your spending and know when your account balances change

Recommended Reading: Does Paypal Report To Credit Bureaus

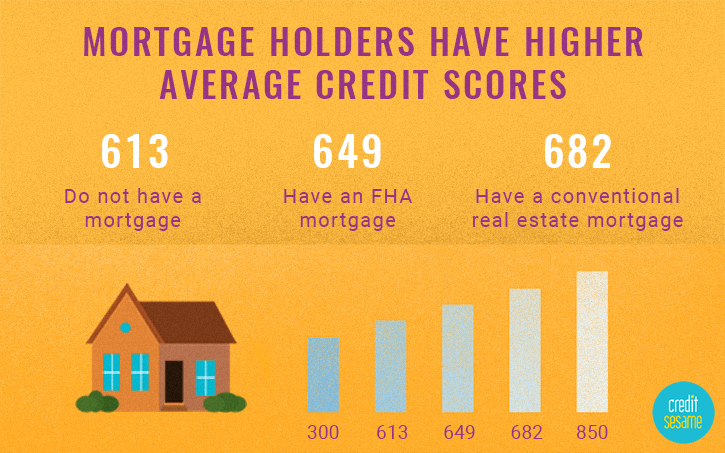

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

Debt-To-Income Ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

Down Payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think you are less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment, then, makes your loan less risky for lenders.

Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least two months of mortgage payments.

Employment History: Lenders vary, but they usually like to see that youve worked at the same job, or at least in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.