Collection Accounts And Your Credit Scores

Reading time: 3 minutes

Highlights:

- If you fall behind on payments, your credit account may be sent to a collection agency or sold to a debt buyer

- You are still legally obligated to pay debts that are in collections

- Collections accounts can have a negative impact on credit scores

Past-due accounts that have been sent to a collection agency can be a source of confusion when it comes to your credit reports and credit scores. What does that mean? And if you pay off the accounts, can they be removed from your credit reports? Weve broken down what you need to know.

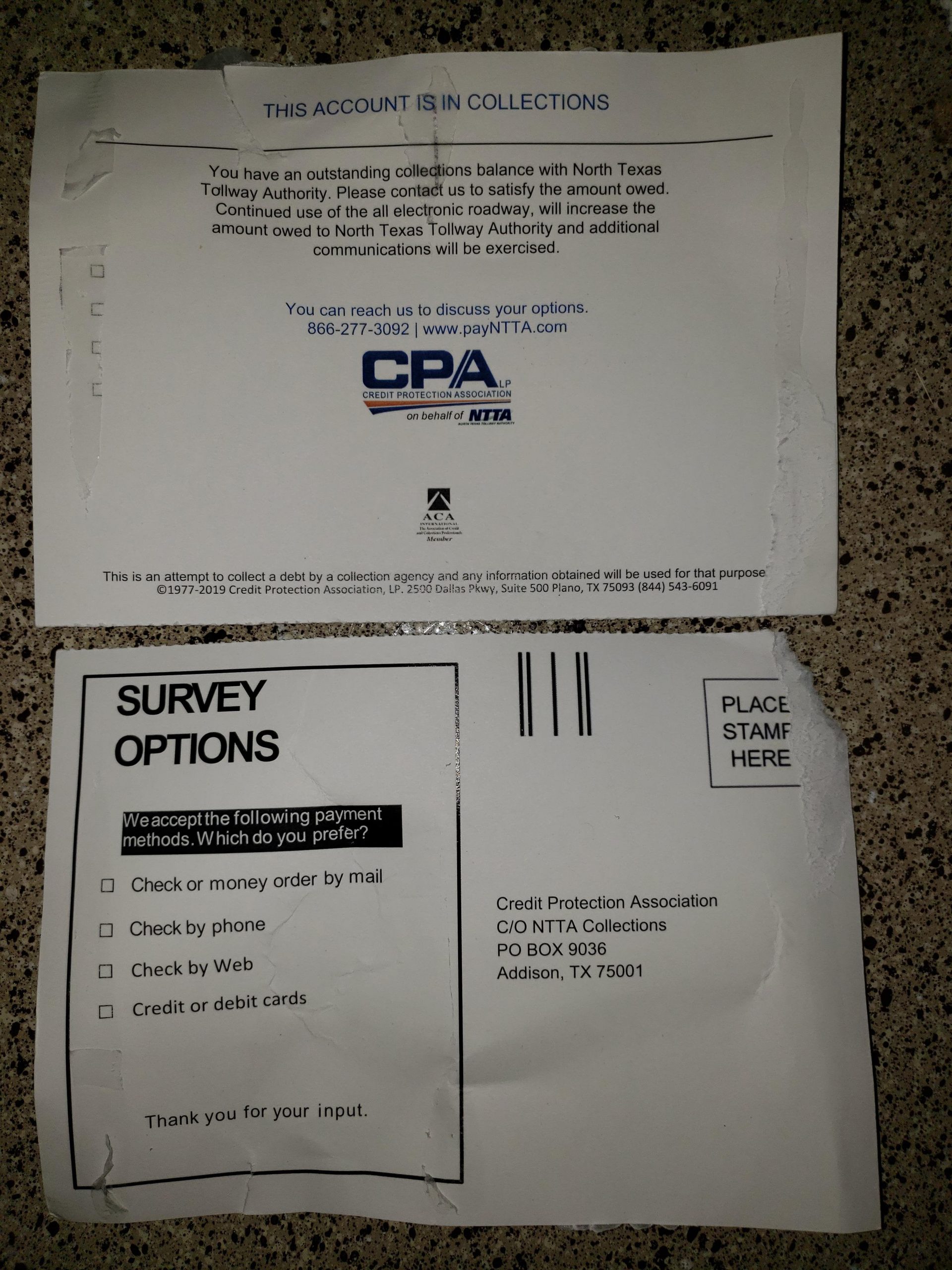

What is a collection account? If you fall behind on payments, the lender or creditor may transfer your account to a collection agency or sell it to a debt buyer. This generally occurs a few months after you become delinquent, or the date you begin missing payments or not paying the full minimum payment.

Typically, lenders and creditors will send you letters or call you regarding the debt before it is sent to a collection agency. You may not be notified if your account is being sold to a debt buyer, however. The collection agency or debt buyer will then attempt to collect the debt from you.

If your debt is sold to a debt buyer or placed for collection with a collection agency, you are still legally obligated to pay it. You may end up making payments directly to the collection agency or debt buyer instead of the original lender.

Know Your Rights When Dealing With Collectors

One important thing to keep in mind before you start calling debt collectors, or before you answer their phone calls, know your rights as a consumer. The Fair Debt Collection Practices Act protects you from abusive debt collection practices. However that doesn’t mean that all collectors actually follow the rules.

With that in mind, here’s what debt collectors are not allowed to do:

- Talk about your debts to anyone except you or your attorney. They are, however, allowed to call friends or family members for the purposes of finding out how to get in touch with you.

- Harass you. They can’t keep making debt collection calls repeatedly and can’t use foul language when speaking with you.

- Keep calling if you request they stop. You can submit a request in writing to ask them to stop making collection calls. If you do that, they can only contact you to say that they’ll be stopping collection efforts or taking legal action against you. This is my preference, as it’s easier to deal with collectors in writing — plus having written records helps protect you.

- Make any claims that they can’t legally follow through on. They can’t threaten to have you arrested for not paying, or foreclose on your house.

- Lie about who they are or the purpose for their contact. Before the FDCPA, it was common practice for a collector to call pretending to be an old friend just to get you on the phone. A legitimate debt collector will not do this today.

What Happens When An Account Goes Into Collections

Step by step, here’s what happens when you have an account go into collection:

Virtually any type of unpaid debt can be sent to collection, including:

Recommended Reading: How To Get Credit History Report

Why Do Credit Accounts Get Closed

- You closed the account yourself: If you decide that you dont want to keep an account open , you can tell your creditor you want them to close it. Before they do so, theyll expect you to pay off your remaining outstanding balance on the account, so accounts closed for this reason usually have no debt associated with them.

- You finished paying off a loan: When you pay off an installment loan, such as a student loan, auto loan, or mortgage, the account will close automatically. As youd expect, an account like this will also have a zero balance when its closed.

- The account was inactive: If you go for a long time without using one of your credit cards , your card issuer may close it automatically. For an account to go unused for that long, it generally also has to have a zero balance.

- Your creditor closed a delinquent account: If you consistently fail to pay off an account on time or otherwise violate the terms of your agreement with your creditor , they may punitively close the account. In this case, youll continue to owe whatever balance remained on the account when they closed it.

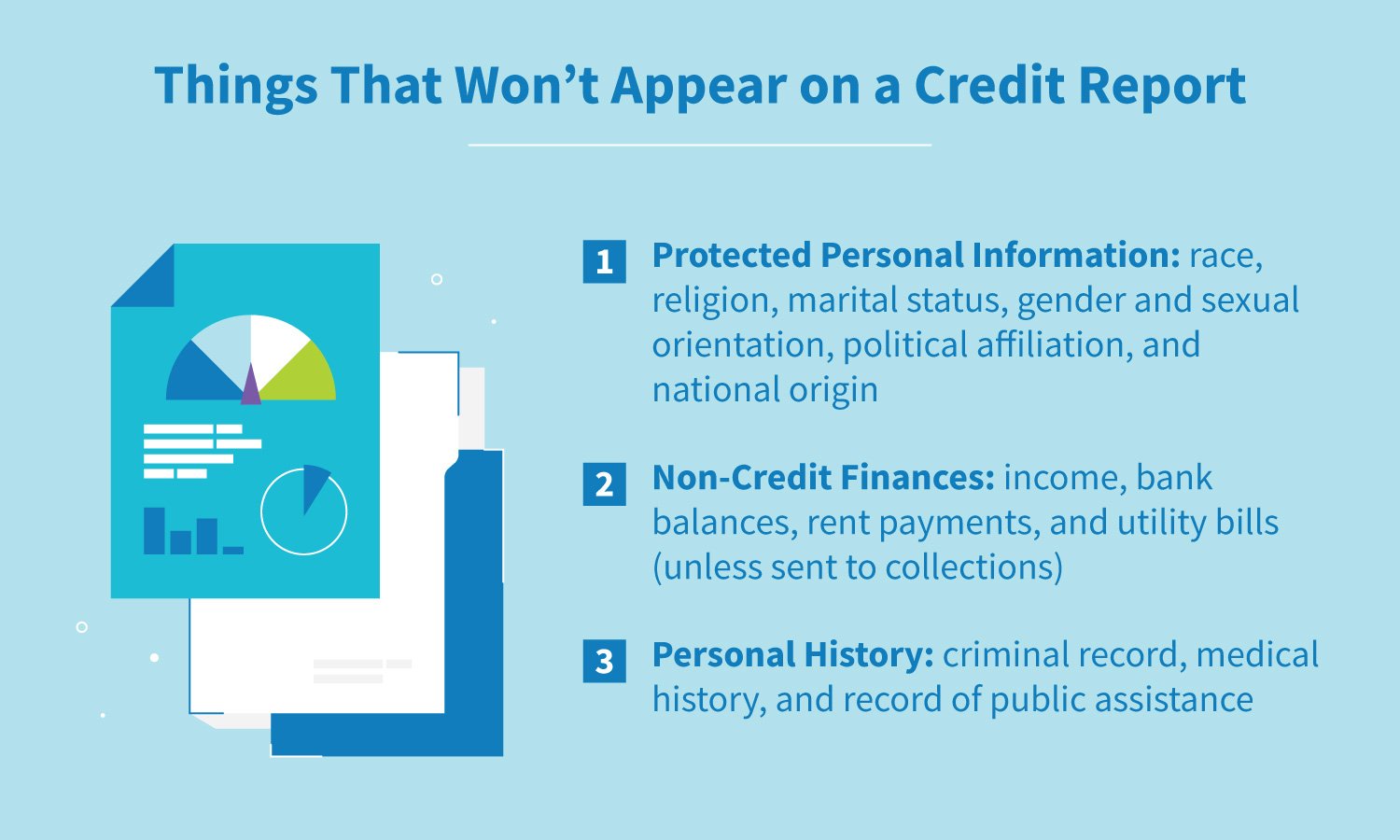

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

Read Also: How To Add Rent To Your Credit Report

How Closed Accounts Affect Your Credit

Your FICO credit score is determined by a wide range of factors including your payment history , how much debt you owe , the average length of your credit history , new credit and your credit mix . compile this information on your credit reports, which they use to determine where your score falls.

The two main areas where closed accounts can affect your credit score are the length of your credit history and the amounts you owe. Heres how:

- Certain closed accounts can increase your credit utilization rate. When you close a credit card account specifically, you are reducing the amount of open credit available to you. This can cause your credit utilization rate to increase, which could have a negative impact on your credit score. Note, however, that installment loans like personal loans do not affect your credit utilization. For this reason, a closed personal loan account would not affect your credit utilization rate.

- Closing an account can decrease the average length of your credit history. The length of your credit history is partially determined by the average age of all your credit accounts combined. As a result, closing an account can reduce the average length of your credit history, and thus impact your credit score in a negative way.

Will Account Closed By Creditor Hurt Your Credit Score

The remark “account closed by creditor” or a comment that a creditor closed your account doesnt hurt your credit score. Fortunately, this type of comment isn’t picked up by the credit scoring calculation. However, the act of having a , whether by you or , can hurt your credit score by raising your credit utilization. For example, your credit score could be impacted by a closed credit card if you have a balance on the credit card or if you have high balances on all your other credit cards and this was the only card with significant available credit.

You can minimize the impact to your credit score by paying off the balance on the closed credit card, even if you have to pay it off over a period of time.

If the credit card issuer closed your account because of late payment or serious delinquency, those delinquencies will impact your credit score. These late payments will remain on your credit report for seven years, but they will hurt your credit score less as time passes and as you add positive information to your credit report.

Accounts closed in good standing will remain on your credit report for ten years or whatever timing the credit bureau has set for reporting positive, closed accounts.

Recommended Reading: What Credit Score Do You Need For Paypal Credit

Why Do Closed Accounts Stay On Your Credit Report

A credit report is a detailed document listing information about how you’ve handled borrowed money. You have a credit report from each of the three major credit bureaus Equifax, Experian and TransUnion which get data about your accounts from lenders and compile it. That data is then used to calculate your credit scores.

Your reports list both positive and negative information about how you manage credit. For instance, if you always pay your car loan on time, it will be listed as in good standing. On the other hand, if youve paid late, that will be noted.

Including both open and closed accounts gives more data about your use of credit, which helps credit scores more accurately portray what type of customer you are.

Its a common misconception that your credit report includes only information about your active accounts. Unless you have a very limited credit history, your credit report is probably full of data about closed accounts, like loans and credit cards you paid off years ago.

Can A Collection Agency Report An Old Debt As New

You may have heard of another date pertaining to collection accounts: the date of last activity .

You might have heard it said that you should never make payments on a collection because that action would change the DLA on the account. If the DLA changes, so the advice goes, this resets the clock on the seven-year period after which the collection will fall off your credit.

In reality, debt collectors cannot change the DLAonly the can do that. Furthermore, the DLA does not affect the timeline of your collection account.

The seven-year period begins at the DOFD, not the DLA, and not the open date of the collection. The collection agencies are not legally allowed to change the DOFD, so there should be no legitimate way for them to restart the seven-year timeline. Yet there are many cases in which consumers report that their collection accounts are suddenly being updated as new accounts, even if they are several years old. What is going on in these situations?

This shady practice is the collection agency re-aging the debt.

Its illegal to re-age a collection account by incorrectly changing the DOFD.

When a debt collector acquires an account, they sometimes improperly update the DOFD to be the same as the date that the new collection account was opened. If you make a payment on the collection, they may replace the DOFD with the DLA, which is the date that you made the payment. This explains why the seven-year clock seems to restart in these situations.

You May Like: Does Getting Pre Approved For A Mortgage Affect Credit Score

How To Remove A Charge

Removing charge-offs or other negative information from your credit reports can be tricky. Technically, negative credit information that’s accurate can legally remain on your credit reports for seven years, and some types of negative information can stay even longer.

That being said, there are some remedies for dealing with charge-offs. The first is disputing a charged-off account if you believe it’s being reported in error. Federal law allows you to initiate a dispute with the that’s reporting information you believe to be inaccurate. The credit bureau then has to investigate your claim and if there is an error, correct it or remove it.

Determine The Accounts Legitimacy

Is the collection account legitimate a past-due debt that you actually owe? If it is, youre going to have a tough time getting it removed from your credit reports. However, if the account is actually incorrect, or should have been removed from your reports by now, then you may be able to get it removed through the dispute process.

Also Check: What Does A Judgement Mean On Your Credit Report

Rebuilding Your Credit Rating

Since the charged-off account will still show up on your credit report, it will continue to impair your credit score. But the good news is that as charge-offs and other negative information ages, its overall impact can lessen.

In the meantime, you can work on rebuilding a positive credit history by doing things like paying your bills on time, keeping your low, and limiting how often you apply for new credit.

Will The Collection Agency Remove A Paid Collection From Your Credit Reports

In case youre wondering whether you can ask a collection agency to delete a collection account early from your credit reports as part of a settlement agreement, youll probably be disappointed again. Collection agencies typically wont agree to this type of settlement, which is known as pay for delete.

Why not, especially if doing so might entice more people to pay off old debts? The reason collection agencies generally wont agree to delete paid or settled accounts is because the major credit bureaus have asked them not to.

Collection agencies sign agreements with the credit bureaus to obtain the right to report the collection information they want included on consumer credit reports. After all, adding negative collections to credit reports is a big way that collection agencies put pressure on people to pay their old debts.

For example, someone might not care about an old medical bill that a collection agency is calling and writing them about. But if that old bill turns into a collection account that lowers her credit scores and gets her denied for a loan, suddenly things change.

So, as mentioned, collection agencies sign agreements with the credit bureaus to get those delinquent accounts added to consumer credit reports. In those agreements, collection agencies generally promise not to request the deletion of accurate information simply because the applicable accounts are paid.

MoneyFactWeight in Credit Scores

You May Like: What Is The Free Annual Credit Report Website

Will Paying Off A Closed Account Help My Credit Score

Paying off a closed account usually wont directly benefit your credit score. However, as you know, unpaid closed accounts often lead to charge-offs and collection accounts, and those do hurt your score.

This means that paying off a closed account before its charged off can protect your score from damage in the future.

Whats more, future lenders will look at your full credit history in addition to your numerical credit score. Having a debt thats labeled paid in full is better than having one thats marked as unpaid or settled. The latter might be a dealbreaker when you apply for credit in the future, but the former is less likely to be.

Wait Until It Falls Off

When the debt in question is legitimate and you cant convince the debt collector to delete it from your report, your only remaining option is to wait. After seven years from the date the account first became delinquent, the collection should fall off of your credit report.

Although this means the collection will continue to impact your credit score its impact will lessen as time passes.

Recommended Reading: What Does A Closed Account Mean On Your Credit Report

Choose Your Plan Of Action

There are a few ways to handle a collection account on your credit reports:

- If the collection account is inaccurate, dispute it with each credit bureau thats reporting it. The consumer credit bureaus let you file disputes online for convenience. You can also dispute inaccuracies with debt collectors and creditors themselves, though these disputes will typically have to be by phone or mail. In this case, consider sending a 609 dispute letter via certified mail.

- If the account is legitimate but has been paid, contact the collection agency to request a goodwill deletion. This literally involves asking for the account to be removed because you paid it. Its probably not going to work, but its worth a shot. A goodwill adjustment may be more viable if you havent made any other credit blunders in the past.

- Just wait. A collection can usually remain on your reports for about seven years after the account was declared delinquent, even if its unpaid, and its impact on your scores will dissipate over time.

Multiple Collection Agencies Same Debt

If your credit report looks as Experian describes, with the old collection accounts accurately reporting as closed, there may not be much you can do besides wait seven years for the collections to fall off your credit report.

However, if the original creditor and/or multiple collection agencies report the same debt as if they are all separate open collection accounts, that may be an error that you need to dispute with the credit bureaus.

Recommended Reading: How To Read A Credit Report