How Is Your Credit Score Calculated

According to FICO there are four basic elements used to calculate your credit score. These include:

Payment History = 35%: Your payment history accounts for approximately 35 percent of your entire credit score. While FICO tell us that a few late payments are not automatic “score-killers,” this is a large part of the calculation, which means that a history of late payments can negatively affect your score

Amount You Owe = 30%: The second largest factor making up your credit score is the amount of your outstanding debt. It is important to understand that owing a lot of money does not necessarily correlate to a negative credit score. However, if a high percentage of your available credit has been used, this is an indication that you may be overextended and more likely to make late or missed payments.

The length of your credit history, including how long you have been building your credit and the ages of your oldest and newest lines of credit, account for about a quarter of your credit score. For example, if you have recently opened up a number of new credit card accounts, your overall score may be negatively affected.

Type of Credit = 10%: The final part of your credit score equation involves the type of credit you have access to. A good credit score is one that includes a quality mix of installment loans, mortgages, retail accounts, credit card accounts and finance company accounts.

Why Are Used Cars Suddenly So Expensive

Now is a very bad time to buy a car, especially if your credit score is low. While Mays Consumer Price Index showed that prices were up 5% overall from a year earlier, about of that increase was due to the price of used cars. Used car prices rose 30% in the 12 months leading up to May.

According to Edmunds, the average used car price hit $26,500 in June, up 27% from a year ago, while the average new car transaction price is $41,000, up 5%, virtually the same as the average sticker price of $41,500.

What Do Auto Lenders Look For On Credit Reports

A credit score is used to determine how likely someone is to make their loan payments on time and pay off their entire debt. While all credit scoring models use the same factors to determine your score, they vary in ways that could either help or harm you when youre applying for a loan. Some key factors that determine your score include your payment history, credit utilization, the current debt you carry and your mix of credit types.

When people apply for a credit card or a loan, creditors obtain FICO® Scores from one of the major credit reporting agencies. Auto lenders use a special reporting system called FICO® Auto Score when determining the creditworthiness of a potential customer. The three credit reporting bureaus that contribute information to your FICO Auto Score are TransUnion®, Experian and Equifax®. A FICO® Auto Score may place more weight on whether youve made your monthly payments on past auto loans as opposed to accidentally missing a credit card or utility payment in the past, for example.

Because your credit score can have such a dramatic impact on what you pay for an auto loan, you should check your credit score annually and make sure that your report is accurate. You can do this by enrolling in a credit monitoring service or contacting the credit reporting bureaus directly and requesting a free copy of your credit report.

Ready to find the perfect fit?

You May Like: How To Dispute A Hospital Bill On Credit Report

Tips For Improving Credit

Here are some simple steps to get you started.

Use Navy Federals Mission: Credit Confidence Dashboard to see tips and resources to build, rebuild or manage credit. Use our tools to:

Can I Get A Car Loan With A Credit Score Of 600

With any type of car financing, better credit scores make the process easier and more affordable.

According to FICO, a credit score of 600 ranks as âfair.â VantageScore classifies a 600 credit score as âpoorâ . So a 600 credit score typically falls somewhere in between bad credit and good credit.

You can most likely qualify for a car loan with a credit score of 600 .

But you should expect to get higher interest rates. With a credit score of 600, most lenders will consider you to be a subprime borrower and will price your loan accordingly.

Maybe you are wondering what happens in the case of refinancing your vehicle after you are approved for a car loan. In this case, does refinancing a car hurt your credit score or affect your interest rate? And is there a way to best prepare your credit score before applying for an auto loan or refinancing your current vehicle?

Letâs take a look.

Also Check: What Is A Good Credit Score Rating

What Is A Good Credit Score

A FICO® credit score above 670 is generally considered “good.” FICO credit scores are the industry standard and are used by more than 90% of lenders when making decisions.

The FICO® Score is computed based on factors including the borrower’s payment history, amounts owed on loans and credit accounts, the length of their credit history, and more. It is expressed on a scale ranging from 300 to 850, with higher scores being better.

Whats The Ideal Credit Score For A Car Loan

Auto-loan lenders look for a borrower with a credit score in the mid-600s in Canada. A credit score between 630 and 650 is generally what lenders want to see.With this, there is some leeway around your credit score requirements when looking to obtain a car loan. Dependent on your lender or bank, sometimes they will be stricter and look for higher credit scores. At the same time, alternative lenders are often willing to accept lower credit scores. Some dealerships can also help borrowers find financing to meet their specific credit needs.

If your credit score is below 630, dont stress! You can still obtain a car loan. When youre shopping around, its important to keep your mind open to the idea your loan may cost a little more. It can take some time to find a lender that will work your low score. Find out more on obtaining a loan with bad credit here.

Read Also: How To Check Fico Credit Score

Checking Your Credit Score

For ongoing credit monitoring, free scores like those from Credit Karma, Credit Sesame, and WalletHub are useful for seeing where your credit stands.

Sometimes, your credit card issuer will also provide a free copy of your FICO score with your monthly billing statement. Make sure to check before purchasing a credit score.

If you’re preparing to apply for a loan in the next several months, it’s worth buying a FICO Score 1B Report, or the ongoing monitoring product. A one-time, three-bureau report is currently priced at $59.85 from myFICO. Purchasing directly from FICO gives you the option to look at the scores your auto lender is most likely to receive.

Doing research before you go car shopping can help you optimize your credit score before applying for an auto loan, and improve your overall understanding of the complex variables in the loan approval process. Above all, you should ensure that the information in your credit report is verifiable and accurate, and dispute any errors you find. If you’re diligent about building and maintaining your credit, your report will show that you have excellent standing, regardless of what scoring model an auto lender might choose.

How To Find Out What Car Loans You Can Get With Your Credit Score

While its impossible to predict exactly what car loans and interest rates youll qualify for with your credit score, you can get a good idea from looking at what loan terms other people with your credit score tend to get.

The tables below show the average interest rates, monthly payments, and loan amounts people got in 2021 for car loans depending on their scores.

The first table shows new car loans:

New Cars: Average Loan Terms by Credit Score Tier

The data in these tables was taken from the Experian 2021 State of the Auto Finance Market Report.

Bear in mind that these are average loan termstheyre not the only terms youll be able to qualify for. To find out the exact rates and loan amounts you can get, shop around with different auto lenders.

Don’t Miss: How Do You Get A 800 Credit Score

What To Consider When Buying A Car

Because applying for a loan generates a hard inquiry into your credit report, it isnt something you should frequently do. However, its a good idea to shop around for car loans before going to the dealership to make sure youre getting the best rate possible.

Luckily, if you apply for several car loans within a short time, theyll be grouped and count only once in your credit scores calculation because its clear youre buying only one car. Your FICO score, a type of credit score that creditors use to assess your creditworthiness, looks at a 30-day period, while the VantageScore uses a 14-day window. Some other scores dont include car loan inquiries at all, Experian explains.

MoneyUnder30 suggests knowing your credit score before looking for a car loan because consumers with better scores receive better loan rates. Then make sure you can afford the car you want to buy. When purchasing the car, compare loan interest rates, put money down, and keep the loan term as short as possible. Its also a good idea to pay cash for fees and extras like sales tax or registration fees rather than financing those additional charges.

So, in the short term, getting a car loan can hurt your credit score. But if you continue to repay the loan on time, your credit score will rebound and even increase. One oddity to note is that paying off your loan also causes a slight temporary drop in your credit score.

Be Prepared Before You Go To The Dealer

The best strategy is to get pre-approved for your loan before shopping for a car. Heres why.

Dealers want to sell cars and make a profit. But, they also make a profit on any financing they offer to customers because lenders share their loan profits with the dealers.

The reality is lenders don’t want to make a lot of loans to super-prime borrowers. There is a lot of competition for this class of buyers and profits are low for these types of loans. Lenders make more money with loans to buyers with less-than-stellar credit scores. As a result, dealers have an incentive to offer financing to buyers with lower credit scores because they make more money.

After you have reviewed your credit reports and know your credit scores, you will be in a better position to negotiate terms with the dealer. If you already have a car loan approved before going to a dealer, you won’t be in the position of being forced to take the loan terms and interest rates being offered by the dealer. Don’t forget that it’s in the interest of the dealer to persuade you to accept their loans with the highest interest rate possible because they will make more profits.

Preparation is the best way to take the emotions out of your car-buying fever and prevent you from getting locked into high monthly payments that may wreck your budget.

Read More: The Best Auto Loan Interest Rates for 2020

Read Also: How Is Credit Score Calculated

Shop Around For A Preapproval

Each lender can look at your credit history in slightly different ways and offer you a different loan APR. Thats why its best to shop around for any type of loan you want. Dont rely on a dealership to do this for you. As the middleman, car dealers can raise your APR up to two percentage points. Instead, look at the best auto loans for bad credit and especially consider applying at your local credit union.

| Lender | |

|---|---|

| $7,500 or more | Refinance loans |

It does not hurt your credit to apply to multiple lenders the major credit bureaus allow consumers a two-week window to rate-shop. If you do all loan applications within 14 days, your credit isnt harmed any more than it is when you apply for one loan.

Borrower Beware:

Can I Finance A Car With A Bad Credit Score

Yes, you can finance a car with a bad credit score. Below are the best bad-credit auto loans currently on the market.

You may have to take extra steps to reassure your lender that you have the ability to repay the car loan. The following things might make the application process go more smoothly:

- A larger down payment: By making a larger down payment, you wont need to borrow as much money to buy a car. This will make you seem less risky to lenders, improve your chances of loan approval, and benefit your finances by translating into lower monthly payments and maybe even a lower interest rate.

- Documents proving your financial stability: Lenders will see you as a lower-risk borrower if you can show them that youre financially stable despite your less-than-perfect credit score. Documents such as recent pay stubs and proof of residence are helpful.

- A cosigner: Getting someone with good credit to a cosign your auto loan application can greatly improve your chances of approval and get you better interest rates. However, since your cosigner will be responsible for paying off your loan if you stop making payments, they shouldnt make the decision lightly.

You May Like: Does Collections Affect Credit Score

How Car Financing And Car Loans Work

When you sign for a new car loan, you borrow a total amount of money and then repay it plus interest each month over a set period of time. The amount borrowed, the loans term, and the interest rate affect your monthly payment and the loans total cost, Bank of America explains.

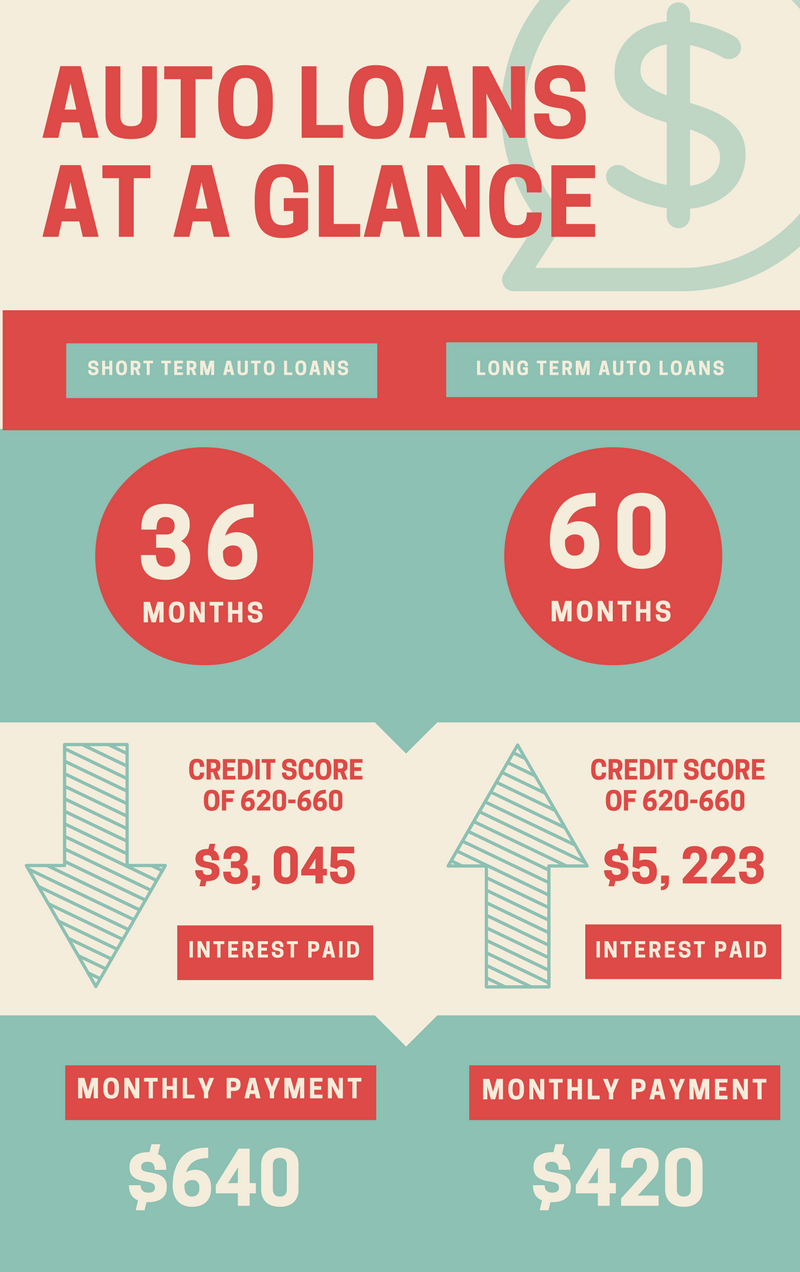

You can reduce the amount you borrow by making a down payment or offering your old car as a trade-in. The loan term, or how long the loan lasts, is usually 36 to 72 months. A longer loan term will lower your monthly payment but increase the total loan cost due to additional interest charges. The interest rate, or annual percentage rate , is the yearly interest on the loan. Its best to find the lowest rate possible so that you pay less in the end.

How To Get A Lower Interest Rate

As you can see from these examples, your credit score can have a huge impact on your monthly payments, the amount of interest that you pay and even your ability to afford to buy a car. In some cases, these higher monthly payments may not fit into your budget, and you may have to look for a cheaper car, just to get lower payments.

So, what are the steps you can take to improve your credit score? Follow these steps:

Request copies of your credit reports and credit scores. You are entitled to get a free credit report each year from the three credit reporting agencies Transunion, Experian and Equifax at AnnualCreditReport.com. You can get your credit scores for free at Credit Karma.

Look for errors and negative information. Make corrections for any incorrect addresses and employers. If you see any negative reports that you believe are in error, file a dispute with the credit reporting agency. They will have 30 days to respond verifying the claim or removing it from your report.

Bring past due accounts current. Bring any past-due payments up to date immediately. You want to take care of these past-due balances before they get sent to a collection agency, which will cause even more damage to your credit score. If the amount due is large, and you cant pay it off in one payment, contact the creditor and arrange a payment plan.

Keep existing accounts open and active. The longer that your accounts have been open adds to a positive credit history and improves your credit score.

Recommended Reading: Does Klarna Help Your Credit Score

They Want Your Business But Only On Their Terms

With the power dealers have right now, theyve been more selective than ever about which customers they work with. For example, there are some dealers who will turn you away unless you agree to use their financing and pay their rates when you make a car purchase.

For borrowers who are able to secure better rates from a bank or credit union, this practice is especially bad. Even an extra $15 a month could cost you more than $1000 over the course of the loan payments.