How To Check Your Cibil Score

Check your CIBIL score for free with Bajaj FinservIf you are wondering where to check your CIBIL score, you can do it easily by visiting the credit information companys website. Usually, you will need to pay a small fee to check your score. To get unlimited access to your credit score and report you can pay Rs.550 for 1 month or Rs.1,200 for a year at the CIBIL MyScore page. You can also check your CIBIL Score for free on a one-time basis here.

How Do I Get My Credit Score From 775 To 800

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have several different types of credit accounts that include a mix of installment and revolving credit.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

Read Also: How Do I Report A Tenant To The Credit Bureau

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

Know What Information You Need To Look At

You also need to know what information you should look at when looking at credit cards. When you are offered a credit card, you will be given a variety of information, such as the APR . Sometimes the credit card offer will offer a variety of rates, and you wont know what rate you will get until after you have been approved. You would be foolish to assume that you will get the lowest rate possible.

Another piece of information to look at is the credit limit. Your potential creditor will tell you that your card is limited up to a certain point, but again, you may not qualified for the maximum limit. When you do max out a credit card that has a low credit limit, it can harm your credit score.

Some credit card companies will also have a penalty APR. Always find out what the penalty rate is before applying for a card, what causes you to have the penalty, and how long the penalty will last.

Finally, look at any fees that come with the credit card. Examples of fees include late payment fees, cash advance fees, annual fees, and transfer fees. Again, dont apply for a credit card until after you have found out exactly what these rates are.

Read Also: Does Seventh Avenue Report To Credit Bureaus

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

How To Get A Loan Despite A Poor Credit Score

- Borrow from non-banks:While non-banking financial companies, like Bajaj Finserv, still need you to have a decent credit score, they tend to have relatively simpler eligibility criteria, which may help you raise funds fast and without too much effort.

- Apply with a guarantor or co-signer to your loan account:Adding a co-borrower to your loan application helps distribute the responsibility of repayment between you and the co-borrower. When your co-borrower has a good score, you will be able to borrow a larger loan amount and boost your chances of approval too.

- Try to find a secured loan:When a loan is unsecured, the lender is more stringent with the eligibility criteria by carefully filtering and selecting the most dependable or reliable borrowers. However, if you have collateral to offer, the significance of having a good credit score diminishes.

Additional Read: Get personal loan on bad CIBIL score

Read Also: How Long Does Repo Stay On Your Credit

What Factors Affect Your Credit Score

While every credit reporting agency is different, some of the most common factors that can affect your credit score are:

- Your repayment history

- The number of credit applications or enquiries you have made

- Negative information such as defaults , bankruptcies and court judgements against you

- Personal details like your age and how long youve been at your current job and residential address

- How far back your credit history goes generally it begins the first time you apply for credit

There can be a fair amount of confusion about what does and what doesnt affect your credit score. According to Experians 2019 Know Your Score survey, 90% of Australians surveyed believed having high-value assets would improve their credit score. This is actually incorrect.

However, if you miss just one credit card repayment, your credit score could drop by a pretty significant 22%, Experian says. This is the case even if youve never missed any credit card repayments before. The drop increases to 26% if you miss two repayments and as much as 42% if you miss three or more within three months.

Its worth noting that since Comprehensive Credit Reporting was introduced in 2018, lenders can now also see some of your positive financial behaviours on your credit report, such as when you make loan repayments on time. This is designed to give lenders a fuller picture of your credit history.

Open New Lines Of Credit

Because you are considered a lower risk for non-payment or default, a 755 credit score allows you to open various credit lines that establish a diverse credit history. Paying off combinations of car loans, mortgages, and credit card balances consistently enables you to open up additional options at lower rates and terms.

Don’t Miss: How To Remove An Eviction From Your Credit Report

Cash Back Vs Rewards Points Or Miles

Rewards come in three flavors: cash back, points, and miles.

When to use points or miles

Points and miles are typically associated with travel rewards. Once again, if youre a frequent traveler, this type of rewards package will be attractive. Understand that its typical with travel rewards that theyre primarily earned through travel purchases, and redeemed in the same category.

When to use cash back

If youre not a frequent traveler, cash back rewards are definitely the way to go. You can generally earn them through regular purchase activity, and redeem them for cash, or a statement credit .

Between the two, cashback is the more flexible reward type. If youre not sure which way to go, this is probably the one you should choose.

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Recommended Reading: Wells Fargo Authorized User Credit Report

How Long Does It Take To Improve A Very Good Credit Score

How long itll take to improve your score depends on a variety of factors. If you have accurate negative items one to two years from falling off your report, you might not reach the exceptional tier until those items are gone. On the other hand, maybe something as simple as reducing your credit utilization to under 10 percent could bump up your score.

If you can patiently maintain the responsible financial habits that got you to a score of 755, you can eventually get to 800. According to FICO, 22 percent of consumers have a credit score that qualifies them to be in the 800 Club. Typically, any improvement from 800 onwards isnt likely to get you better interest rates or loan termsyoull already be getting the best. So, set a goal to get to the exceptional tier, focus on the five credit factors and regularly monitor your credit reports.

How Your 755 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2Actually opening the account can further hurt your score and have even longer-lasting effects.

To maintain your good credit score, follow these tips:

Read Also: Syncb/ppc Closed Account

Credit Score Credit Card Options

With your score of 755, you should be approved for most credit cards. And since your credit score is relatively high, youll often get the cards with the best perks. This can include sign-up bonuses, no annual fees, travel programs, airport lounge or hotel perks and more.

Your score should secure you an average interest rate of 13.5 percent, while those with deep subprime credit scores will often have a rate above 20 percent.

How A Credit Score Is Calculated

In the United States, the three major credit reporting bureausExperian, Equifax, and TransUnionkeep track of your borrowing in regularly updated credit reports. Your credit score is essentially a snapshot of these reports, a way for lenders to quickly and consistently consider how well youve handled your loans in the past.

There are a number of factors that go into calculating a credit score. The major factors are your payment history, the amount that you owe compared to your credit limit, how long youve been using credit, how many new credit accounts you have, and your credit mix .

To find out your score, you can check with the credit bureaus or use a third-party provider like or Credit Sesame. Many banks and credit card companies will give you access to your credit score as well.

There are several different credit scoring systems, and even within the same system, scores can vary depending on which bureaus credit report is used. Fair Isaac Corp.s generic FICO scores are the most widely known, but auto lenders also use industry-specific FICO scores, as well as VantageScores.

Recommended Reading: Apple Card Experian

Why Do Lenders Check Your Cibil Score Before Approving Your Loan

Since CIBIL score measures your overall creditworthiness, a lender is certain to check your score when reviewing your loan application for a variety of reasons. They are:

- To check your credit history and past record

- To see whether you are capable of repaying debts

- To review your credit balance and understand the risk level of your profile

- To judge whether you qualify for the loan

- To decide on the loan amount to offer you and interest rate applicable

Credit Score Car Loan Options

When it comes to securing a car loan, your credit score likely wont matter much in the approval process. Thats because even people in the lowest credit score range of very poor can often get approved for an auto loan. Where your credit score comes into play is the interest rate youll get on the loan.

With a credit score of 755, youll receiveon averagean interest rate of 3.65 percent for a new vehicle and 4.29 percent for a used vehicle. This is very different from the rates you might get if you had a much lower credit score.

Additionally, having a score in the very good credit range will likely help you receive reasonable loan terms that include fewer potential penalties.

Recommended Reading: Zzounds Paypal

Mortgage Rates For Excellent Credit

Having excellent credit is one of the first steps to getting a great mortgage rate. But there are other factors at play here too, like the total cost of your home and your debt-to-income ratio.

Once youve got a sense of how much house you can afford and the type of mortgage you want, its time to shop around to understand the rates that might be available to you. Getting a mortgage preapproval can help you understand how much you can borrow and make your offer more competitive.

Compare current mortgage rates on Credit Karma to explore your options.

What Does A 755 Credit Score Mean

A credit score of 755 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that youre a low-risk borrower. FICO considers 755 to be very good, and VantageScore places it at the upper end of the good range. Its also above the national average.

Although a 755 credit score is much higher than the lowest credit score of 300, its still far from the highest credit score of 850.

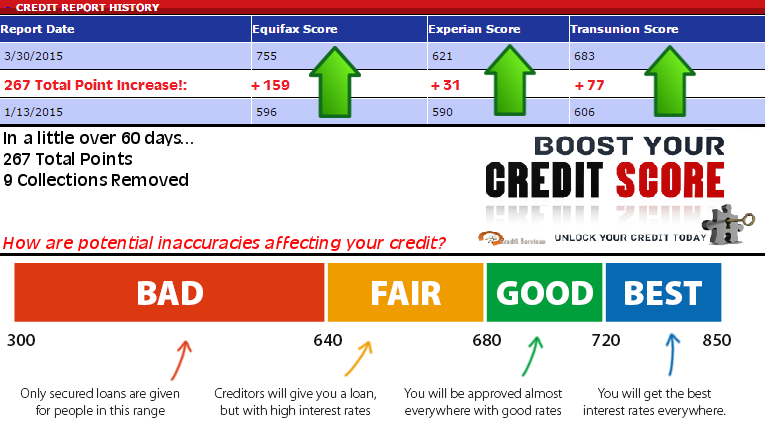

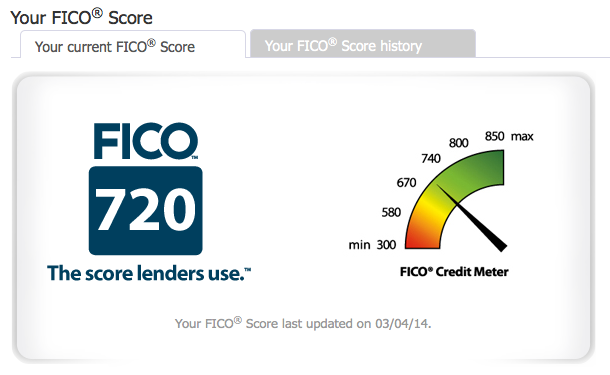

The image below shows how your 755 score compares with the average for different generations.

Read Also: Care Credit Credit Score Requirements

What Is A Good Credit Score In Canada

A good credit score in Canada is typically one that is 680 or higher. Of course, there are many different types of credit scores , and keep in mind that the credit scores a lender sees are usually different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores. The image below illustrates the different credit score ranges in Canada and can help you determine if your credit score is a good credit score.

What Does A 755 Credit Score Mean Pros And Cons Of Having This Credit Score

Those that have this credit score do not really have any cons, as this is one of the highest scores they can get. Though they are not at the very top of the ladder, they have a couple ways they can improve the score to get it to the top such as paying their payments on time, using the right amount of credit and never defaulting on their loans.

In terms of pros, a 755 credit score shows that you are a trustworthy, reliable borrower and that you would be ideal to loan money too for mortgage loans, vehicle loans, credit cards, lines of credit and a wealth of other money loaning services offered through various financial institutions.

Don’t Miss: Do Pre Approvals Hurt Your Credit Score