How To Get A Loan Despite A Poor Credit Score

- Borrow from non-banks:While non-banking financial companies, like Bajaj Finserv, still need you to have a decent credit score, they tend to have relatively simpler eligibility criteria, which may help you raise funds fast and without too much effort.

- Apply with a guarantor or co-signer to your loan account:Adding a co-borrower to your loan application helps distribute the responsibility of repayment between you and the co-borrower. When your co-borrower has a good score, you will be able to borrow a larger loan amount and boost your chances of approval too.

- Try to find a secured loan:When a loan is unsecured, the lender is more stringent with the eligibility criteria by carefully filtering and selecting the most dependable or reliable borrowers. However, if you have collateral to offer, the significance of having a good credit score diminishes.

Additional Read: Get personal loan on bad CIBIL score

How A Good Credit Score Can Help You

A credit score is a numeric representation, based on the information in your , of how risky you are as a borrower. In other words, it tells lenders how likely you are to pay back the amount you take on as debt.

In general, the higher your scores, the better your chances of getting approved for loans with more-favorable terms, including lower interest rates and fees. And this can mean significant savings over the life of the loan.

Having a good score doesnt necessarily mean youll be approved for credit or get the lowest interest rates though, as lenders consider other factors, too. But understanding your credit scores could help you decide which offers to apply for or how to work on your credit before applying.

Factors Affecting Credit Ratings And Credit Scores

For individuals, a high numerical credit score from the credit-reporting agencies indicates a stronger credit profile and will generally result in lower interest rates charged by lenders. A number of factors are taken into account for an individuals credit score, some of which have greater weight than others. Details on each credit factor can be found in a .

These five factors are included and weighted to calculate a persons FICO credit score:

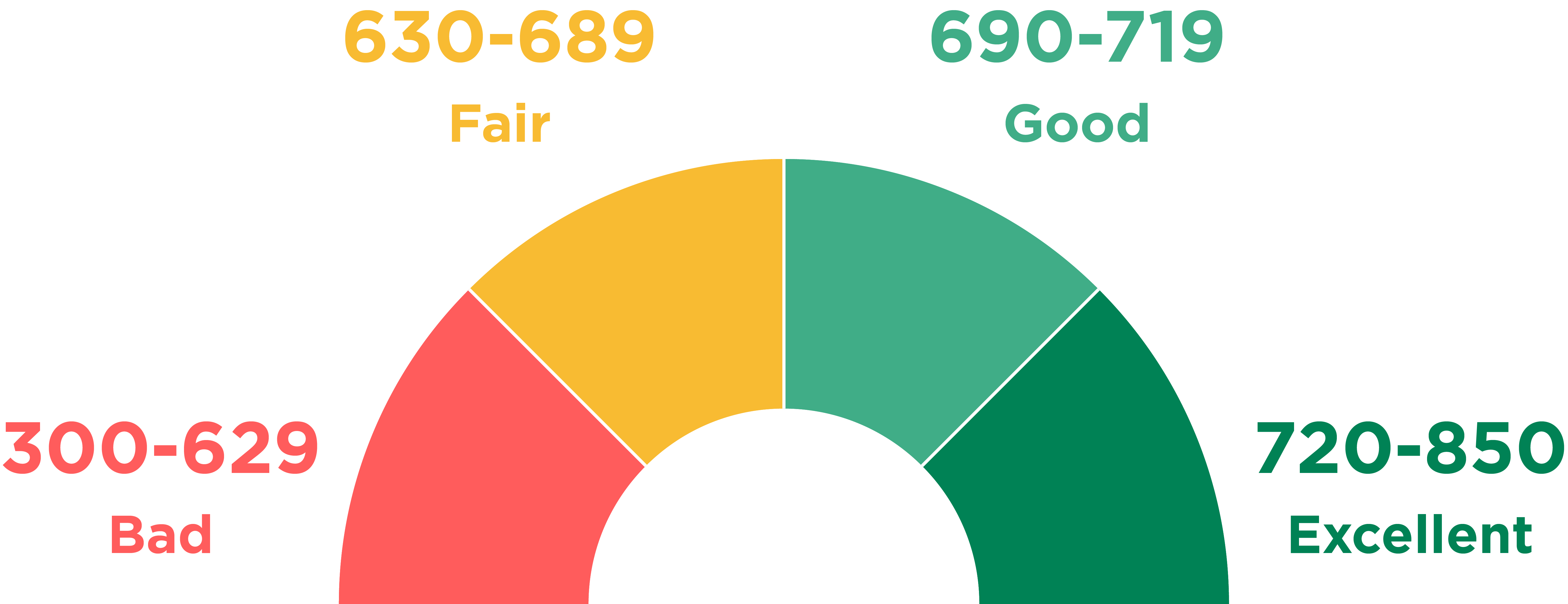

As noted above, FICO scores range from a low of 300 to a high of 850a perfect credit score that is achieved by only about 1% of the borrowing public. A very good credit score is generally one that is 740 or higher. This score will qualify a person for the best interest rates on a mortgage and the most favorable terms on other lines of credit.

With a credit score that falls between 580 and 740, financing for certain loans can often be secured but with interest rates rising as the credit score falls. People with credit scores below 580 may have trouble finding any type of legitimate credit.

FICO likes to see established accounts. Young people with several years’ worth of credit accounts and no new accounts that would lower the average account age can score higher than young people with too many accounts or those who have recently opened an account.

You May Like: Uplift Pulls Which Credit Bureau

Does Removing Hard Inquiries Improve Your Credit Score

Yes, having hard inquiries removed from your report will improve your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

What Is A Bad Credit Score Range

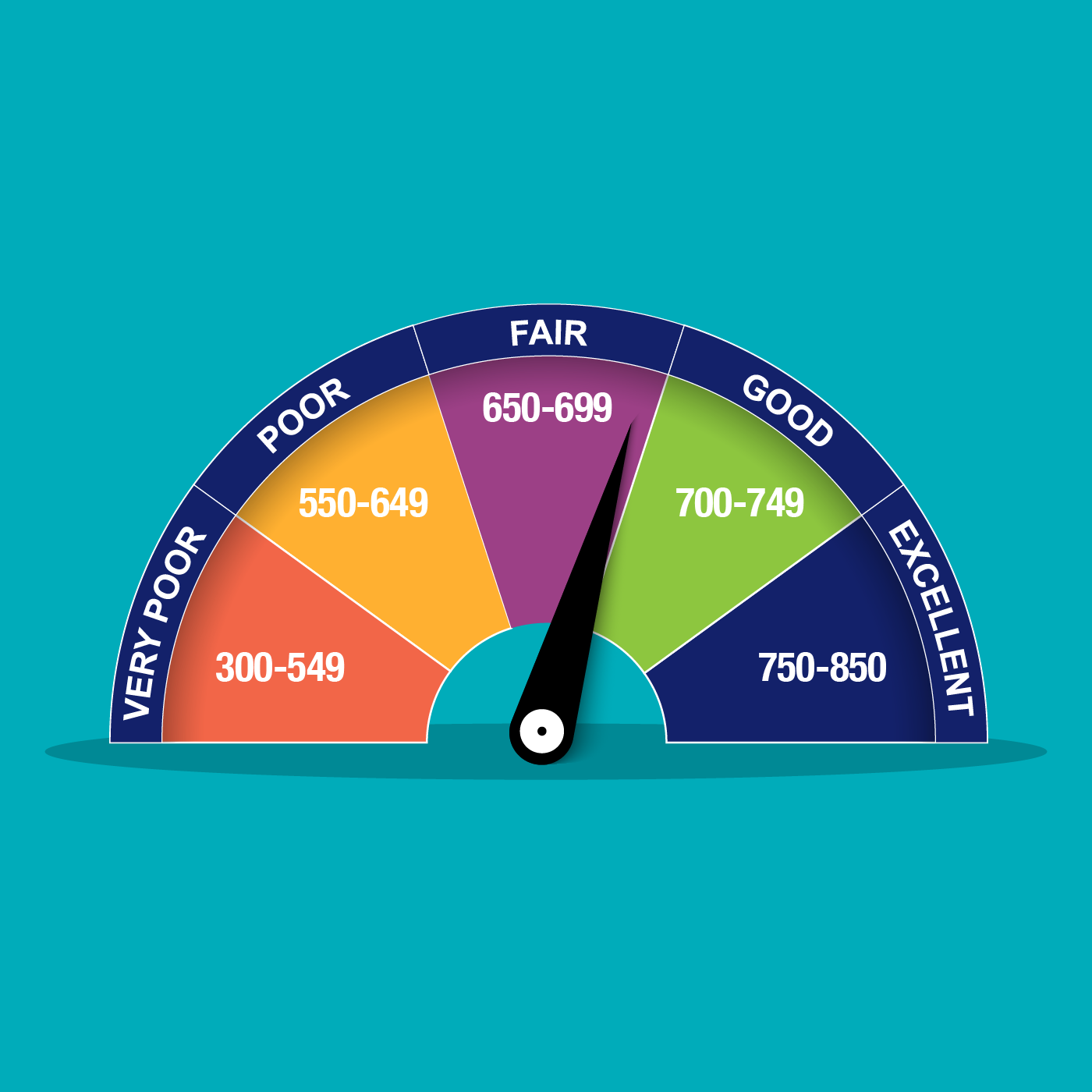

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Recommended Reading: Comenity Capital Mprc

Why Is It Important To Have A Good Credit Score

There are several reasons why itâs important to have a good credit score. If youâre hoping, for example, to take out a mortgage to buy your own home one day, your credit score will need to be in good shape to get accepted and to get the best rates. Having a good credit score also means youâre much more likely to get the best rates when you take out other credit products. For example, youâre much more likely to get better credit card offers , low-APR loans, and even 0% finance agreements if your credit score is good. If your credit score isnât good, though, it doesnât necessarily mean you wonât get accepted for credit. However, lenders will view you as more of a risk, and as a result your interest rates will probably be higher, and any purchase or balance transfer offers you get will probably be shorter. Before you apply for anything, itâs always a good idea to check your eligibility and see your chances of being accepted.

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Read Also: Does Student Loans Fall Off Your Credit

Personal Loan Growth Slowed From Last Year’s Record High

- 22% of U.S. adults have a personal loan.

- The average FICO® Score for someone with a personal loan in 2020 was 689.

- The percentage of consumers’ personal loan accounts 30 or more DPD decreased by 27% in 2020.

Despite growing by 12% in 2019, personal loan balances saw the least growth in 2020, at just 1%. Personal loan balances rank near the bottom compared with other debt types, with consumers owing an average of $16,458 in Q3 2020. Across the nation, nearly one-quarter of adults have a personal loan.

Personal loan accounts also saw a dramatic decrease in delinquencies, with the percentage of loans 30 or more DPD falling by 27% in 2020. Though personal loan delinquencies in 2019 also decreased from the prior year, this drop was 25 percentage points higher in 2020.

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Don’t Miss: 24 Hour Inquiry Removal

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| 6% | 2% |

Given time, you can improve your credit score. This can mean developing your credit profile if you dont have much of a credit history or recovering from negative marks that brought your score down. Even the most damaging items only stay on your credit report for 7 to 10 years. 4

Regardless of your circumstances, there are steps that you can take immediately to increase your credit score.

What Is A Good Credit Score To Avail Of A Home Loan

To avail a home loan, you need to ensure that you have a CIBIL score at least above 650. Since a home loan is a secured loan, lenders have the option of seizing your home if you are unable to repay the loan. This is why a slightly lower credit score is allowed. However, it is in your best interest to maintain a good credit score so you can get a larger loan amount at nominal interest

You can maintain a good CIBIL score by following these simple steps:

- Pay your EMIs on time to create a proper track record

- Avoid having a credit card that you dont use cancel dormant credit cards

- Manage your credit cards carefully by setting payment reminders or limit your use to one credit card

- Avoid re-applying for loans or credit cards that you did not get approved for in quick succession

- Dont make too many loan applications in a short span of time

- Choose lengthy loan tenors with care and try to make part-prepayments when you can

You May Like: Carmax Credit Requirements

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Why Do I Have Different Fico Scores

FICO, which stands for the Fair Isaac Corporation, regularly updates the formula it uses to calculate FICO® Scores.

Currently, most lenders use the FICO® Score 8 formula. But there is a newer version, for instance, called the FICO® Score 9, which isn’t yet widely adopted. The FICO® Score 9 reduces the impact of medical debt on your score and will add in rental payments to credit reports when landlords choose to report this information. That may help people without much credit history build a credit file.

Additionally, there are FICO® Scores geared toward different industries, such as auto lending, mortgage lending and credit card issuing. These measure and weight your financial information in slightly different ways.

Finally, you may see different FICO® Scores depending on the credit bureauExperian, TransUnion or Equifaxyour lender pulls your score from. The bureaus may receive information from your creditors at different times over the course of a month, which affects, for instance, the amount of credit they’ll report you’re using, and thus your credit score. A lender may request credit scores from multiple bureaus for that reason.

Read Also: How To Raise Your Credit Score 50 Points

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

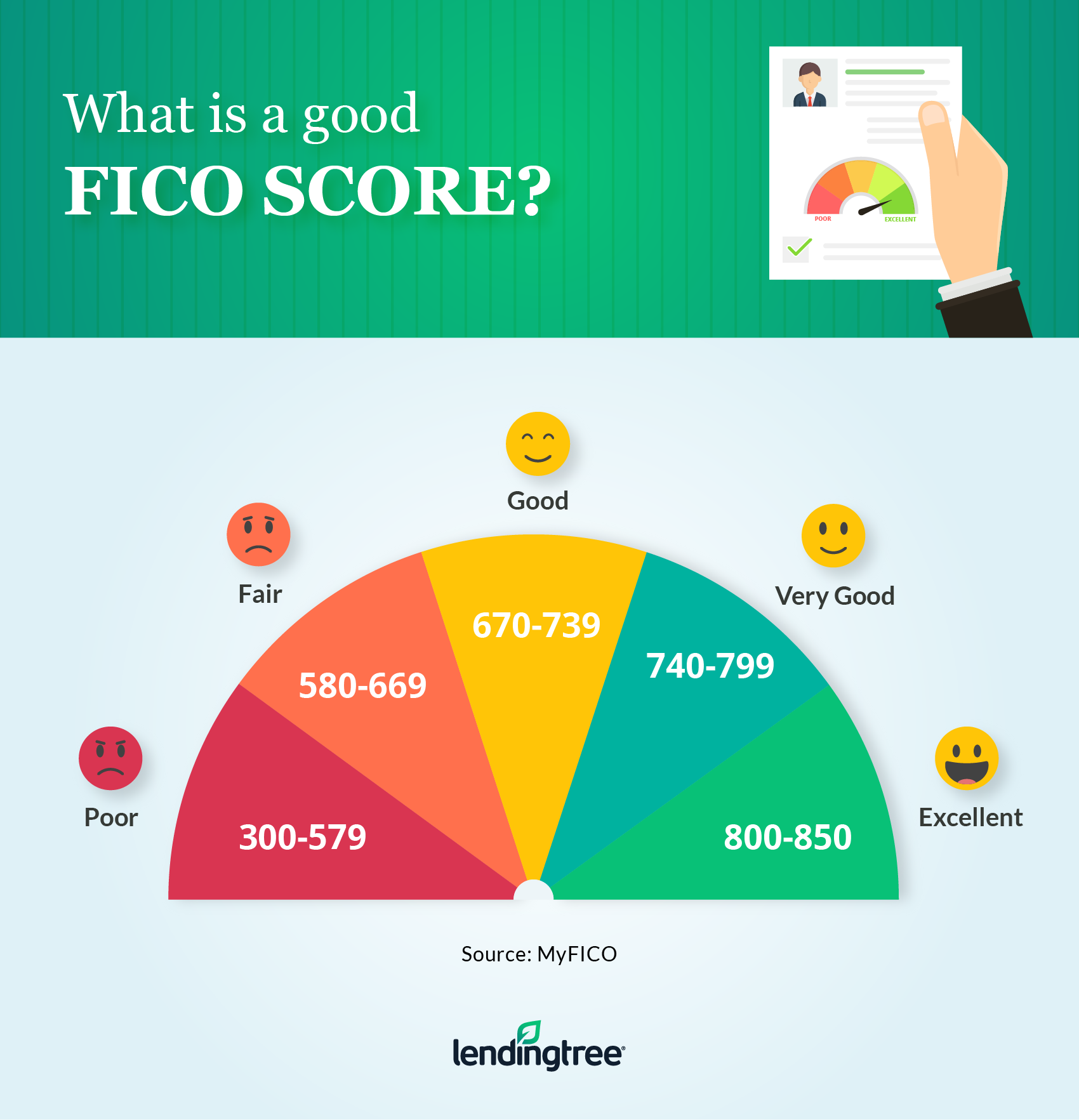

What Are The 5 Levels Of Credit Scores

What Do Your Credit Scores Mean?

- Exceptional: 800 to 850. FICO® Scores ranging from 800 to 850 are considered exceptional. …

- Very good: 740 to 799. FICO® Scores in the 740 to 799 range are deemed very good. …

- Good: 670 to 739. FICO® Scores in the range of 670 to 739 are rated good. …

- Fair: 580 to 669. …

- Poor: 300 to 579.

Read Also: How Long Does Repossession Stay On Your Credit

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Also Check: What Is Syncb Ppc On My Credit Report

Keep Old Accounts Open And Deal With Delinquencies

The age-of-credit portion of your credit score looks at how long youve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts that youre not using, dont close them. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time. That wont erase the late payments but can improve your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the creditor a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsand bankruptcies for 10 years.

How Can You Maintain A Good Credit Score

A good credit score comes with responsible credit behaviour. Here are some of the factors which will help you in maintaining a good credit score:

- Consistent Repayment: Credit score calculations lay nearly 35% weightage on your payment history. If you want to maintain a good credit score all the time, your repayment record should be 100% positive. For this, you must ensure to never miss a repayment.

You May Like: Credit Score Needed For Apple Card

What Does It Mean If Your Credit Score Is High

Lenders tend to look at your credit score when you apply for credit, such as a credit card. Theyâre looking for someone who will be able to meet the repayments – someone who is low risk.

A higher credit score means your credit report contains information that shows youâre low risk, so youâre more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, youâll be considered a reliable borrower.

If you have a high credit score, your application is more likely to be accepted. Youâre also more likely to be offered the best interest rates and higher credit limits.

Check your eligibility: See what offers you’re eligible for with your credit score.

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Don’t Miss: Does Zzounds Do A Credit Check

What Credit Score Do Lenders Use

For the majority of general lending decisions, such as personal loans and credit cards, lenders use your FICO Score. Your FICO Score is calculated by the data analytics company Fair Isaac Corporation, and it’s based on data from your credit reports. VantageScore, another scoring model, is a well-known alternative.

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what “good credit” means as they decide whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

You May Like: Credit Score 779