Let Donotpay Write Your Credit Dispute Letters

DoNotPay understands that it can be intimidating and time-consuming to attempt to write credit dispute letters, and it can be especially frustrating if you don’t know where to start or have been unsuccessful at cleaning up your credit report. If you are seeking assistance with writing credit dispute letters, DoNotPay has a simple solution to help you clean your credit report.

How to clean up your credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in three easy steps:

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more.

What To Do If Your Credit Dispute Letters Are Unsuccessful

If your credit dispute letters are unsuccessful, you still have options. You can double-check the information on your credit report, and if anything is incorrect, you may file a dispute with the credit bureaus. Credit agencies are required to verify and correct information. If they cannot, you could likely get it removed from your credit report.

Other options to consider are a credit repair agency, a financial advisor, or a lawyer. It is important that you research these options carefully. They may be able to help you, but they may be time-consuming and costly as well.

If you are looking for an easier way to write an effective credit dispute letter to a collection agency, DoNotPay can help.

Dispute The Errors On Your Credit Report

The company that gives information about you to the credit bureau and the credit reporting bureau must accept any disputes as per the Fair Credit Reporting Act. These disputes are given by consumers and rectify any incomplete or inaccurate information. You have to ensure to send a credit dispute letter to the company that has given you with inaccurate information and the credit reporting bureau.

You May Like: Does Removing Hard Inquiries Increase Credit Score

What Can I Dispute On My Credit Report

The same credit repair firms that sell 609 letters may also suggest you can “fix” your credit by having negative items removed. While you can file a dispute for items you feel are incorrect or if you feel you’ve been the victim of identity theft, it’s not likely that accurate information will be removed from your credit report, no matter what format your letter is in. Most negative information, such as late payments, will remain on your credit report for up to seven years.

Here are a few examples of issues you might address using a dispute letter:

- An account was opened in your name as a result of identity theft and it does not belong to you.

- An address associated with your file lists the wrong house number.

- Your credit card company has reported a late payment, but you have documentation to show the payment was made on time.

- Your credit report shows a bankruptcy, but you have never filed for bankruptcy.

- An address associated with your file lists the wrong house number.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

You May Like: Does Care Credit Report To Credit Bureaus

Ii Statement Of Dispute

Introduction. The name of the Credit Bureau Contact Person that you wish this letter be directed to should be furnished to the blank line after the word Dear. It is suggested to make every effort to address this letter to a specific Party with the concerned Credit Bureau, however, if this is not possible, this letter may be addressed to a specific Department within the Credit Bureau as well.

Name Of Debtor. The statement made will require that the name of the Party who believes an error has been made with his or her credit be provided to the first space. Thus, as the Party who believes an error in your credit account has occurred, present your entire name in the first blank line displayed in the letters body.

How To Write A Credit Dispute Letter To Fix Credit Report Errors

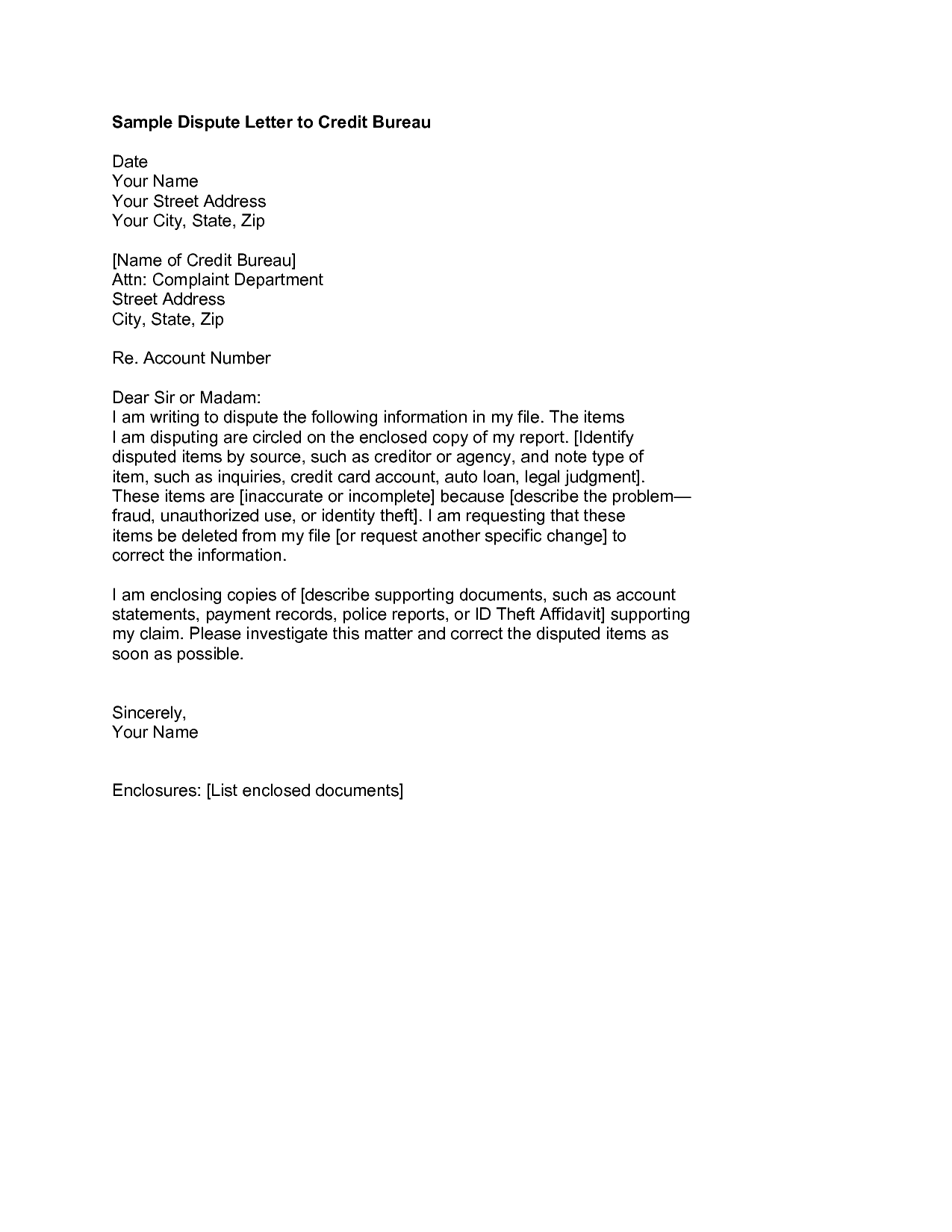

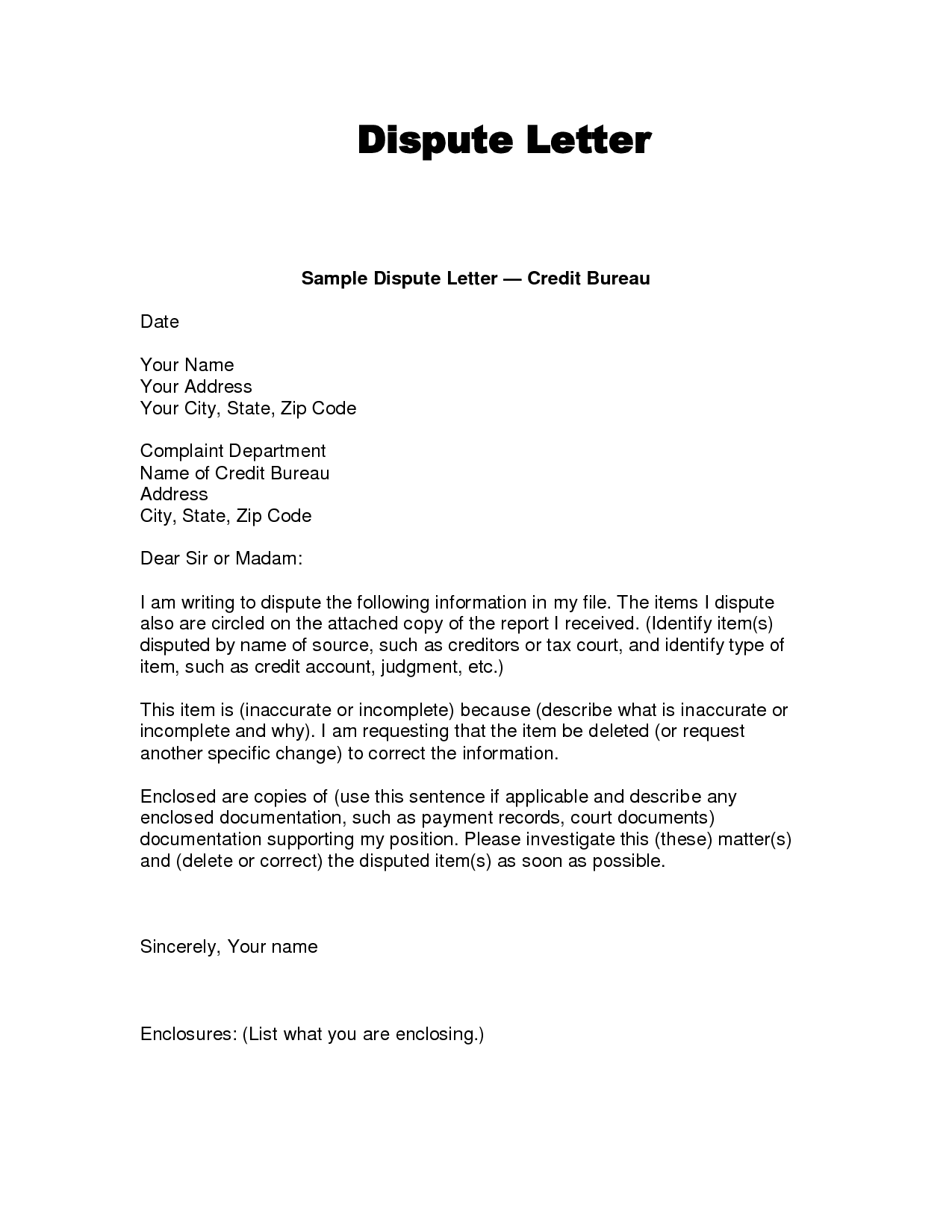

There are a few ways to dispute an issue on your credit report, including mailing a letter to the credit bureaus. Your credit dispute letter should detail the error you found on your credit report. Your letter should also include copies of important documents to help the bureaus conduct an investigation.

- Who owns your credit score? You might be surprised to find it’s not youIt can determine the interest rates they pay and whether they get credit at all. So, who owns your credit score and all the granular, personal data that goes into it? You might be surprised to find it …08/14/2022 – 2:48 pm | View Link

- How to Write a Credit Dispute Letter to Fix Credit Report ErrorsMany or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this …08/12/2022 – 5:54 am | View Link

- What Equifaxs credit score errors mean for consumersEquifax, one of the three major credit bureaus, announced that a computer coding error resulted in the miscalculation of credit scores for consumers in a three-week period between March 17 and April 6 …

You May Like: How To Boost Credit Score Fast

Do 609 611 And 623 Dispute Letters Work

Although some people have success invoking specific sections of the FCRA, these letters may not help any more than a well-written general-purpose credit report dispute letter.

It is even possible that credit reporting agencies may flag 609 and 611 credit report letters as potentially frivolous. Thats because some credit repair companies advise people to send dispute letters that point to certain sections of the FCRA to question everything on their credit report.

Connect with an accredited credit repair service that will help you clean up your credit report correctly.

How Do I Correct Or Dispute Inaccuracies On My Credit Reports By Mail

If you see information on your credit reports you believe is incomplete or inaccurate, a good first step is to contact the lender or creditor directly. This is especially helpful if the information involves your name or address. Updating your personal information with lenders and creditors can help ensure the information reported to the three nationwide credit bureaus Equifax, Experian and TransUnion is correct.To file a dispute by mail, you may need to provide copies of documentation. Please to review documents that may be required. You can send your request and copies of documents to the three nationwide credit bureaus at the following addresses:Equifax Information Services, LLC

Don’t Miss: What Credit Score Is Needed To Buy A Mahindra Tractor

Can I Dispute My Credit Report On The Phone

Yes, you can but it isn’t recommended. Here are the phone numbers for the major credit reporting agencies:

- Experian: 397-3742

- Equifax: 864-2978

- TransUnion: 916-8800

Phone calls are not the best way to go about disputing your credit report, though. Phone conversations are difficult to document. You may also give up some of your rights if you decide to call.

An old-school letter in the mailbox is your best bet. It is the slowest but the most effective of creating a record of your attempt to resolve the issue. When you use certified mail, you have proof of when the bureau received your letter. The bureau you dispute with has 30 days to investigate the dispute and make the necessary corrections. If you can prove when they received your letter, you can track the progress.

Dispute Letter How To Write

There are many instances where you may need to write a dispute letter. A collection dispute, credit dispute, debt collection dispute and many more will require you to write a dispute letter to the concerned parties. Whatever your reasons, there is a specific format that you should follow when writing a dispute letter.

Formal language should be used, and you should also ensure that you include the correct details.

Read Also: Is 830 A Good Credit Score

If One Letter Doesnt Do It Our Attorneys Can Help You Fix The Errors In Your Credit Report

Often, a well-written letter is all it takes to fix the mistake on your credit report. If this is not the case for you, however, contact The Consumer Law Group. We can help you with the next steps to clear up the mistakes and get your credit score back where it should be. Dont hesitatecall as soon as you realize you are not going to be able to fix the problem yourself.

|

Related Links: |

How To Write A Credit Report Dispute Letter

Keep the Credit Report Dispute Letter to one page in length, keep it concise and focus on providing the information the credit bureau needs to identify you and the issue you are raising. Stick to the facts and keep it professional. Letting your emotions get the better of you in this kind of letter will not help your case. Follow the process outlined on their websites for disputes. Keep notes of who you might have talked to, what was said, the date and time to reference at a future time if needed.

Read Also: How To Maintain A Good Credit Rating

Why Should You Use Donotpay To Write Credit Dispute Letters

DoNotPay has a history of being fast, easy and successful. We know your time is valuable, so we make sure you don’t have to waste time or stress over writing effective dispute letters. You only have to provide DoNotPay with the important information, and we handle everything by making the best case on your behalf.

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Don’t Miss: How Does Closing A Credit Card Affect Credit Score

The Responsibilities Of The Credit Bureau:

Seeing that only verifiable and accurate information gets included in credit reports is one of the main responsibilities of the credit bureau. The main tool used in repairing credit is the letter. To gather credit details from consumers that can come from different sources is part of the credit bureaus job.

This collected information is then resold to businesses that require it for the assessment of credit applications of consumers. The Fair Credit Reporting Act is followed by all credit bureaus. This Act informs that when they report consumer information, what information furnishers and credit reporting agencies should and shouldnt do.

This is the best reason that to fix your credit issues why using the credit report dispute letter can be your best option.

Fix Errors On Your Credit Report: 8 Tips For Writing An Effective Complaint Letter To The Credit Reporting Agency

You were surprised to be turned down for a loan because you have an excellent credit history. When you checked your free credit report, however, you saw the problemthere were several past due credit card accounts that did not belong to you. You quickly learn that the first step to take is to notify the credit reporting agency and the credit card companies that they have made a mistake, but what should that letter say? Here are several valuable tips for writing an effective letter to credit reporting agencies:

Read Also: Does Car Insurance Show On Your Credit Report

How To Write A Debt Validation Letter

The following are the steps to write a debt validation letter:

Undoubtedly, the DIY process to draft and send a debt validation letter is long and tedious. DoNotPay can deal with this process. Contact the debt collectors with a demand letter on your behalf through our new debt collection product. If you choose to report the collection agency to the CFPB instead, we’ll file the complaint on your behalf.

How To Dispute Credit Report Errors In Writing

If your credit report has errors, it is important that you dispute them right away. Credit report errors can be very costly, in the form of higher interest rates, higher insurance premiums, loan denial, promotion or job loss, or housing denial. Under the Fair Credit Reporting Act, credit reporting agencies must make sure that all information that they report is accurate. Unfortunately, credit report errors are very common.

You have the right to dispute credit report errors and sue credit reporting agencies for damages.

Most credit reporting agencies have a disputes area on their websites, or they will send you a form with your credit report. If you do not have a credit correction form, or cannot locate a dispute submission area online, you can dispute credit report errors in writing.

Read Also: What Is The Government Credit Report Website

What Should You Include In A Credit Dispute Letter

Experian provides an easy process for filing a dispute by mail. You may dispute information on your credit report by submitting a dispute form, or write your own letter that details your issues. Your dispute letter should include the following information:

- Your full name

- Your date of birth

- Your Social Security number

- Your current address and any other addresses at which you have lived during the past two years

- A copy of a government-issued identification card such as a driver’s license or state ID

- A copy of a utility bill, bank statement or insurance statement

You may print out and complete a dispute form and enclose it with your letter. Or simply list out each item on your credit report that you believe is inaccurate along with the account number and the reason you believe the information is incorrect. Be as specific and factual as possible. If you have documents to support your claim, such as a police report documenting your experience with identity theft, enclose copies of these documents as well.

Mail your dispute letter along with completed forms and supporting documentation to:

Experian

Tips For Writing Successful Credit Report Dispute Letters

- Pay attention to the evidence that you include and provide records to back up your claims.

- Try not to use form letters from the internet or credit bureaus. We include templates for guidance. But please adjust them and make them your own document.

- Dispute errors that are real. Dont try to get the credit bureaus to take off valid and legitimate negative items. Most likely, they wont, and your legitimate disputes could get rejected in the process.

- Always ask for the error to get deleted or updated.

- Try to dispute one error at a time, or at least just a few at once. If you have a large number of errors, you may want to group them and space out the disputes.

- Send your letter by certified mail, return receipt requested.

- Keep records of all correspondence.

- If you feel you were a victim of Identity theft, you need to report that immediately, in addition to making the dispute with the credit bureau.

Get professional help to clean up errors in your credit report.

Also Check: What Is An Excellent Credit Rating