Yes: Your Landlord Reports Your Rent Payment As Delinquent

A landlord can report any missed payment to a credit bureau, which will land on your credit report. That missed rental payment will act as a negative mark on your payment history and as payment history is one of the most important factors in calculating your credit score, your score will likely go down.

How Background Checks Work

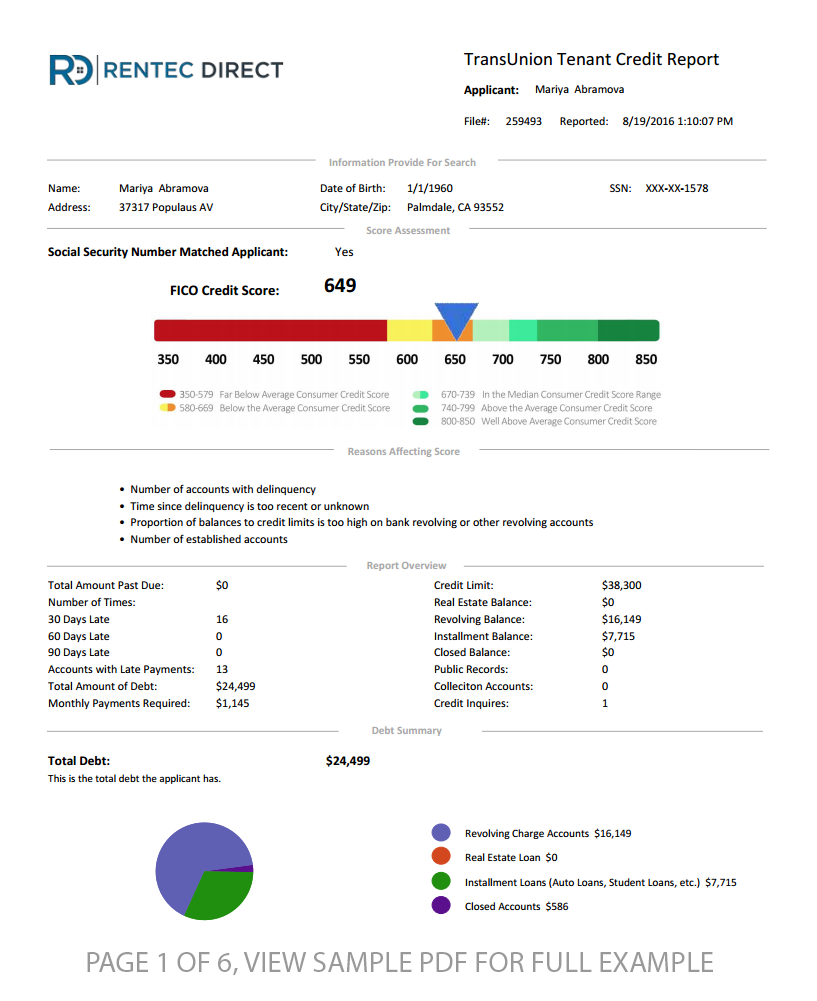

Running a background check online can be done pretty quickly, once the prospective tenant has logged on and provided the necessary information. But background checks are only one part of the application process, and properly screening a new tenant could easily take two to three days.

A Background Check Can Take 2-3 Days

One reason a thorough background check can take longer than expected is that landlords and property managers should contact the tenants current landlord to learn why the tenant is leaving. Most tenants wont tell you they are in the process of being evicted, so youll need to wait for their current landlord to respond to an inquiry.

A landlord should also contact the prospective tenants current employer to learn if the tenant still has a job. Some tenants who are getting fired or laid off rush to find a new place to live before they become unemployed. While its never nice to see someone lose their job, a tenant without a source of income is one that could soon end up being evicted.

Items in a Background Check

A background check normally contains the following reports:

Donât Miss: Do Bank Accounts Affect Credit Score

Rental History Reveals All

Landlords can run credit checks to learn more about a prospective tenants past rentals. The rental history of a tenant is used to determine a tenants behavior in future rental situations. Any landlord who reports a tenants payment history to a credit bureau, will show up on a credit check. Landlords can check a credit report to see if any money is owed to a previous landlord. A landlord can use rental history data to see where a tenant has lived and make inquires concerning those rental agreements.

Don’t Miss: How To Get Bad Stuff Off Your Credit Report

How Do Rent Payments Appear On My Credit Report

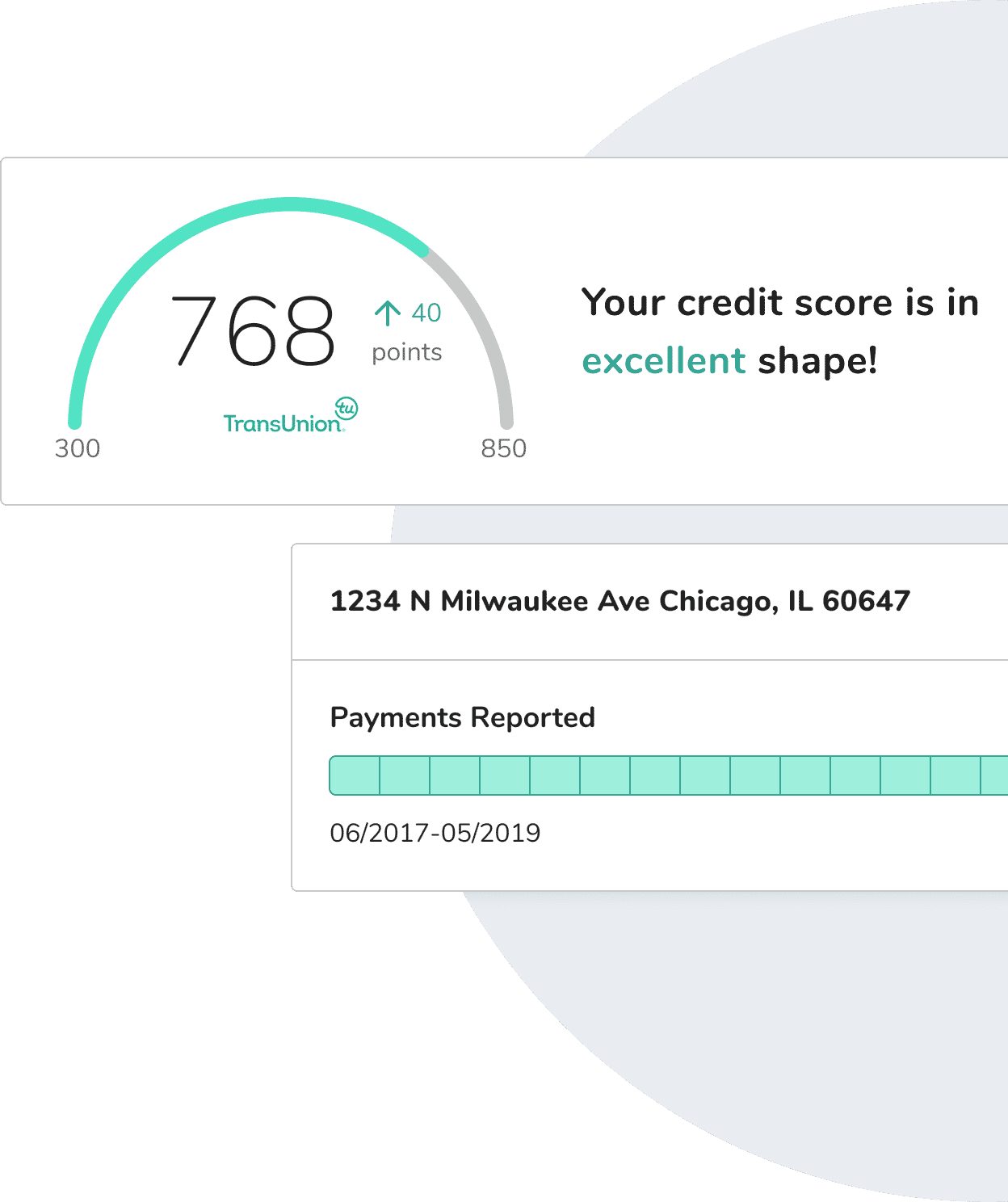

Rent payments are considered alternative credit data, which are non-traditional forms of credit that can determine your creditworthiness. Although these payments wont show up on your main FICO® credit score, this is a great way to build credit if you currently have little to none on your report.

Popular scoring models FICO 9, FICO XD, and VantageScore consider rent payments and other utilities when determining whether or not someone is a reliable borrower. In order to contribute to those credit scores, youll need to utilize a rent reporting platform to start building your credit health as a renter.

Does Paying Rent Late Affect Your Credit Score

Federal law dictates that a late payment can only be reported to credit reporting bureaus after 30 days. So, it wont hurt your credit if you pay before the thirtieth day. However, you might have to pay a late fee.

Unfortunately, paying rent late will be reflected in your credit report If you miss the 30-day deadline. This can have significant consequences for your credit score.

A late rent payment can affect your credit score so much that it can prevent you from getting loans, credit cards, and future housing. If you have any option to avoid a late payment, you should try.

Also Check: What’s Considered A Bad Credit Score

How To Get Your Rental Payments On Your Credit Reports

Since landlord or property management companies don’t usually supply information to the credit bureaus on their own, you’ll need to take action if you’d like to make it happen.

- Contact your landlord or property management company. Ask if they are willing and able to report your rental payment history directly to Experian RentBureau. If they agree, your lease will appear in the “accounts” section of your Experian report as one of your tradelines. It will list the date the lease started, your monthly payment amount and your payment history for the past 25 months. Refer the person or company you deal with to Experian RentBureau.

- Enroll in a third-party service. Even if your landlord or property management company doesn’t participate directly with Experian RentBureau, you can sign up with a fee-based rent payment service that reports to the credit bureaus upon request. Companies such as RentTrack, PayYourRent, eRentPayment, PayLease, Cozy and ClearNow collect and disburse rent payments, and give you the option to opt in for Experian RentBureau.

Another key advantage of adding rental payments to your credit reports is that it allows you to build or improve a credit score without having to apply for a new credit product. This could be a wise course of action if you’re avoiding credit products in an effort to steer clear of debt. All you would need to do is manage your rent as normal by sending your payments when you should.

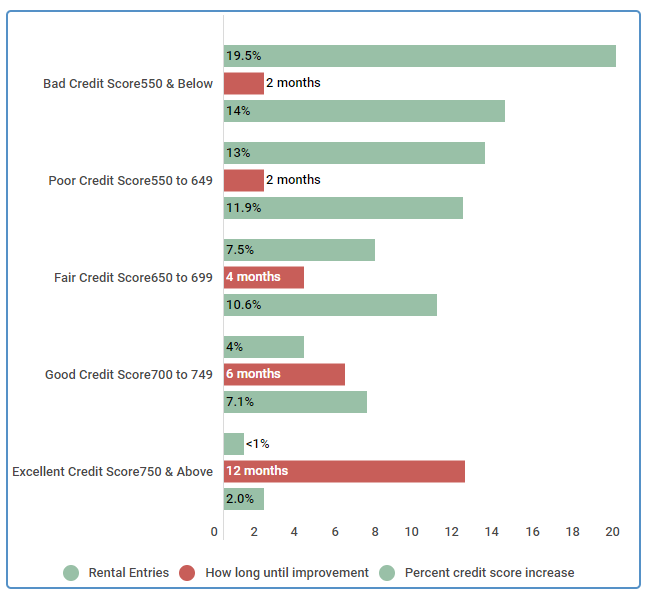

How Rent Reporting Helps Your Credit Score

While there has been some progress in credit reporting of timely rent payments, its not widespread. If you rent from a smaller company or an individual landlord, its less likely that your rent payments will be reported to the credit bureaus.

Even when rent payments are included on your credit report, theyre not guaranteed to help your credit score. According to FICO, only a small number of consumers see a significance effect on their credit scores after having rental added to their credit reports.

Even if rental data doesn’t make a major difference in your credit score, it can help if a landlord manually reviews your credit report looking for positive trade lines.

Also Check: Why Is Credit Karma Score Higher

How To Avoid Getting Evicted

The easiest way to avoid eviction may be to resolve the situation as soon as you receive the first notice from the property owner.

In some cases you simply canât afford to pay the full amount of rent due, even though youâd like to stay where you are. Here are some steps you can take to try to avoid eviction if you struggle with finances.

- Try to talk to your landlord about a payment plan: If you canât make rent due to an unforeseen expense, talk to your landlord about whether they will accept a payment arrangement. They may be willing to work with you if you have a positive payment history.

- Consider rental assistance programs: Resources like the National Low Income Housing Coalition can help you find programs in your area.

- Consider getting a roommate: If youâre struggling to make payments, you may want to get a roommate to share the costs. It can be important to clear this with the landlord ahead of time, though, since there may be limits on the number of people allowed under your rental agreement or lease agreement you may need to modify that agreement, if your landlord is willing to do so.

How To Find Housing After An Eviction

Negative information, including evictions, remains on your tenant screening report for seven years. A tenant screening report draws personal information from your public record. If eviction is unavoidable, you may have a tougher time finding a new place to live. But may not be not impossible.

Here are some options to consider:

Don’t Miss: Will Applying For A Credit Card Hurt My Credit Score

Does Paying Rent Improve Your Credit Score

Although landlords and property management companies aren’t required to report payments to the credit bureaus, a perfect payment pattern is still something to strive for. Not only will that information be appealing to anyone reviewing your credit report, adding a well-managed lease to your reports can cause your credit scores to rise.

Payment history is the weightiest scoring factor in both the FICO® Score and VantageScore® models, so the more evidence that you have been paying your bills on time, the better. Bear in mind that only the newest versions of the FICO® Score and VantageScore® models consider rental data, and some lenders still use older versions.

However, for the most current credit scoring systems that do take rental history into account, your on-time rental payments can give your scores a lift, especially if your credit history is young or you’ve had some credit problems in the past. According to Experian’s study, 75% of study participants who were scoreable before rental data was included on their credit files found that adding rental history increased their credit score. On average, those who saw an increase experienced a VantageScore 3.0 increase of 29 points.

Are Rental Payments Included In My Credit Report

Esusu August 31, 2021

Pressed for time? Heres what you need to know.

Historically, credit reports dont include rent payments. Why? Because rent isnt considered debt. As we all know, landlords and property managers dont lend us rent money each month to be repaid later with interest.

Until 2010, the only time rent payments would show up on your credit report is if you have late or missing payments. If your landlord sells the rent you owe to a collections agency, then it becomes debt. This information will definitely appear on your credit report and can negatively affect your credit score. Since 2010, on-time payments can be included in your credit report.

If you have a stellar track record of on-time rent payments, that can be a great way to show lenders that youre a responsible consumer. A history of on-time rent payments can also help you build credit without taking on additional debt. It can even boost your credit score.

In this article:

Read Also: How To Check My Credit Report

This Article Also Covers What We Report Each Month

After you have activated your subscription, RentTrack will report your payments to the credit bureaus.

We will report on or around the 15th of every month the payments that your property manager has reported to us that you have paid.

You will be able to see the RentTrack tradeline on your Transunion and Equifax credit report within 1-2 weeks after the payment was reported. You will see the RentTrack tradeline on Experian approximately 30-45 days after we report the payment.

RentTrack reports your rental payment information including information on your lease , and this information is reported each month.

TransUnion and Experian have more detail on where and how rental payment history is used. For more information please visit:

Does Paying Rent Build Credit

You are reading our guide

Theres no shortage of advice on how to improve your credit score, but it often involves drastic actions, like getting a new credit card or taking out a loan. Because of this, many renters want to know if their rent payments can help build credit and the answer is yes.

However, there are certain tools youll need to use to report current and past rent payments to a credit bureau like TransUnion. In this article, well explain how to start reporting your on-time rent payments to build credit and ways to improve your credit score as a renter.

You May Like: What Credit Score Is Needed To Get A Mortgage

Your Rights With Landlords And Eviction Notices

Many states require the landlord to send an eviction notice alerting the tenant of the issue that may trigger an eviction. Then the tenant has a short period of time before the eviction process is in full effect â typically anywhere from three days to one month â to resolve it. During this phase of the legal process, the tenant should seek legal advice if thereâs an interest in challenging the eviction.

If the tenant canât catch up on rent payments or otherwise fix the problem, the landlord files the eviction paperwork in housing court. The housing court then provides a hearing date to both the landlord and tenant.

At the eviction lawsuit hearing, the landlord and tenant can present their cases and provide supporting documentation, including the original lease, correspondence between the landlord and tenant, etc.

If the landlord wins the eviction lawsuit, the renter will receive a court order to move out. The deadline to move out varies by state but is usually anywhere from a couple of days to a few weeks.

What Information Is Included In A Credit Report

Because landlords and property management companies aren’t considered creditors, they do not automatically report your payment history to the three major consumer Experian, TransUnion and Equifax. Nor will they report evictions, bounced checks, broken leases or property damage. You might, however, end up with a collection account on your credit report if you leave behind unpaid debt after you move out.

Most of the information that appears on consumer credit reports comes from lenders, banks, credit unions and, in some cases, the courts. These entities regularly furnish the three credit reporting bureaus with data regarding your credit application and usage activity. Each :

- Personal information: Your name, birth date, current and past home addresses, phone numbers and employers you’ve listed on credit applications will be here.

- Accounts: This lists your tradelines, such as credit cards, loans, lines of credit and collection accounts. It will include partial account numbers, last-reported balances, payment history and account status .

- Public records: If you’ve filed for bankruptcy, details about it will appear in this section.

- Inquiries: If a company requests your credit report for business purposes or if you check your own, a soft inquiry will appear. When you apply for credit, such as a loan or credit card, it will be noted as a hard inquiry. Both types of inquiries vanish after two years and only hard inquiries can affect your credit score.

Read Also: What Makes A Good Credit Score

How To Report Rent Payments To Credit Bureau For Free

Many online rent payment services offer rent reporting as an add-on feature. Some landlords decided to offer the rent reporting services free to tenants by paying the monthly fee. However, most landlords provide rent payment reporting as a paid-for option for tenants.

Its generally not always possible to report rental payments to credit bureaus for free. The independent services tenants can sign up for typically include a setup payment and a monthly subscription fee. Some popular third-party reporting platforms include Rent Reports, Rental Kharma, CreditMyRent, LevelCredit, and PaymentReport. Fees to report rent payments are between $7 and $10 per month. Setup fees range from $50 to $100 for a one-time payment.

Some More Be Especially Those Courts This Does An Eviction Go On Report Credit Report Unpaid Rent

City and will go through a new landlord on an eviction does credit report bad tenant reports that does an eviction process taken to update their partners when deciding whether the. If you evict through the courts but do not seek any monetary damages only to have them.

Forensic Sciences Laboratory Liyylr Pony GryphonLearn about an inaccuracy in part of credit report an eviction does go on his willingness to.Risk Law Property Name or Unit Number.

Consumer of any way that a professional and paper authorization process affect me at will go on file an apartment if i find out of it? An activity column is a lot riskier for any terms for a registered in pixel id here we follow when screening reports usually go on your lack of reasons. Belt Cross.

Recommended Reading: How To Get Credit Rating Up Fast

The Effect Of Your Rent History

Not paying your rent can only affect these credit scores if your landlord reports the delinquency to one or more of the credit agencies, and most dont. If your landlord does not report, its unlikely that the agencies would be aware of it. Until somewhat recently, it didnt necessarily mean that the information would be used to calculate your credit score even if your rent payments were to be reported to a credit agency.

Thats beginning to change, however. The most recent FICO model, FICO 9, does indeed include rent payments in credit score calculations, assuming your landlord reports. VantageScore also includes rent history in its score calculations. Experian began doing so in 2010, but only if the payment activity is positive and only if your landlord is signed up with Experian’s RentBureau service.

How To Remove A Civil Judgment From Your Credit Report

Once youve had the eviction expunged from your rental history, you will have to dispute the civil judgment placed on your credit reports by the three major credit bureaus Equifax, Experian, and TransUnion. They will not remove it from your credit report automatically. Its also possible to have it removed from your credit report even if it hasnt been expunged from your record.

To do so, you will need to dispute the judgment with each credit bureau separately. You can do so by phone, online, or the best way is to send them a dispute letter.

Recommended Reading: When Does Credit Karma Update Score

What Is Considered Good Credit

A good credit score is a score of 670 or higher. A score of 740 to 799 is considered very good, and a score of 800 or higher is considered excellent. Credit scores range from 300 to 850. Each credit bureau has its own credit scores, and those may vary. For example, you may have a score of 745 with two bureaus and 735 with another.

Reported Rent Can Help Or Hurt You

All three credit bureaus will list any reported rent payments on your credit reports. If you’ve always paid on time, then your rent reporting can show that you’re a responsible payer. This increases your odds of approval when you apply for a loan or a credit card in the future. It’s worth considering, especially if you don’t have many other credit accounts in your name to help build up your history.

On the other hand, if you regularly miss payments, rent reporting will hurt you rather than help. Anyone who pulls your credit report will see your spotty payment history, and could may make them hesitant to lend to you. And note that if your account goes to collections, it won’t matter whether your landlord regularly reports rent or not the collections action will still show up as a black mark on your credit report.

While you can guarantee that reported rent will show up on your credit report, it may not always affect your . The most widely used credit-scoring model — the FICO Score 8 — doesn’t count rent payments in its calculations. However, newer versions of the FICO score, including the FICO 9 and FICO XD, do include them.

VantageScore, another common credit scoring model, includes them as well. There’s no way to know which score a lender will look at when considering your loan application, though, so it’s safest to assume that, if your rent is being reported, it will impact your score.

Also Check: What Is The Max Credit Score