Will Not Paying Car Insurance Affect Credit

If you stop paying your car insurance premiums, your credit score won’t be affected. However, you could face late fees from your insurer and eventually lose your car insurance coverage altogether. When your policy is canceled and you experience a lapse in coverage, your rates will go up in the future.

While not paying your car insurance won’t affect your credit, your credit could influence how much you pay for car insurance. If you have a poor credit history, insurance companies view you as more likely to file a claim in the future. As a result, your rates will be more expensive than someone with better credit often by more on average than what you’d pay if you received a speeding ticket or were involved in an accident.

Unpaid car insurance doesn’t go on your credit and make your credit score worse, but forgetting to pay your credit card bill after using your card to pay your insurance premiums will. Paying your car insurance on your credit card could also mean extra fees and more expensive car insurance in the future.

Do Car Insurance Quotes Affect Credit Score

Each time you request an insurance quote, the company will ask you for personal information. Whether you use a comparison site or go direct to the insurer, you will need to provide certain details that allow it to calculate the premium. This is the same information that will be used by a bank or building society for credit checks and the insurance company will look at your credit file to confirm the information.

Does An Insurance Quote Affect Your Credit Score

Car insurance companies in most states use an applicant’s credit score and credit history when calculating their premium. As a result, many applicants might wonder, does an insurance quote affect credit score? The simple answer is no.

Car insurance companies in most states use an applicant’s credit score and credit history when calculating their premium. As a result, many applicants might wonder, does an insurance quote affect credit score? The simple answer is no.

Also Check: Does Eviction Notice Go On Credit Report

The Effect On Your Credit Score

Each time an insurance company looks at your credit record to make sure your personal information checks out, this will register as an inquiry. However, it will only show on your personal credit file in the same way as a check by an employer. That means you will see the check by the insurance company on your file if you ask to see it. However, it is what is known as a soft search and wont be visible to anyone else.

That means that any company that looks at your credit file in future will not see it. As a result, it wont damage your credit score. It will be ignored in future if you apply for a bank loan, credit card or any other finance agreement that is treated as credit, including a gas, electricity or mobile phone contract.

Why Do Car Insurers Care About My Credit

Research has shown that your credit-based insurance score is a good predictor of the likelihood youll file a claim. The lower a persons score, the larger the losses incurred by the insurance company for that person, on average.

Some consumer advocacy groups protest the use of credit-based insurance scores, saying that minorities are disproportionately affected and that most customers dont understand that their credit can affect their insurance premiums. If you live in California, Hawaii or Massachusetts, insurers are prohibited from checking your credit history.

Some insurers, like Nationwide, have an extraordinary life circumstances policy that allows you to request a reconsideration of your premium if your credit has suffered because of a divorce, military deployment, serious illness or other catastrophic event.

Read Also: Repossession Credit Repair

If Your Car Is Badly Damaged By Weather Vandalism Fire An Animal Or A Falling Object Such As A Tree

Your comprehensive coverage may pay the actual cash value, or ACV, of your vehicle minus the deductible on your policy. To determine your cars ACV essentially, its fair market value your insurance company will take into account factors such as your vehicles age, mileage and condition as well as the cost of similar cars in your market.

Some auto insurance companies also offerwhats called new-car replacement coverage. If your vehicle is totaled, thiscoverage may give you the money to purchase a brand new car of the same makeand model versus reimbursement for your cars current value.

How Much Does A Late Car Payment Affect Your Credit

According to Equifax, one of the three major credit bureaus, one 30-day delinquency could drop your FICO score as much as 90 to 110 points if you have good to excellent credit. On the flip side, if you have poor credit, one late payment isnt going to affect your FICO credit score as much roughly a drop of 25 points for a 30-day late payment. At the same time, multiple delinquencies greatly affect your FICO score, regardless of where your credit score stands.

Recommended Reading: Care Credit Credit Score Requirements

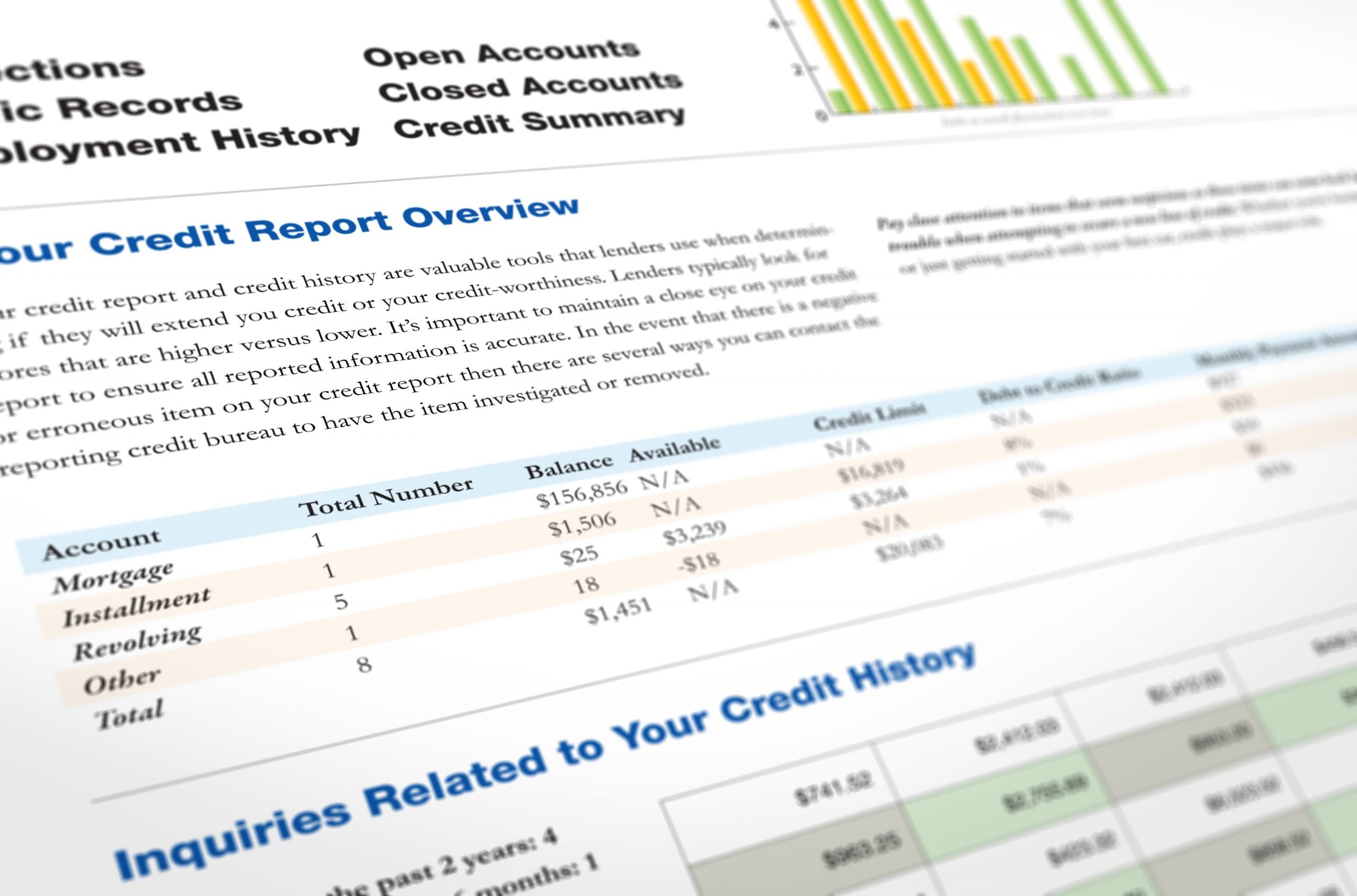

Get Familiar With Your Credit

While your credit-based insurance score is different from your typical consumer credit score, what’s found in your credit report will still play a role in how it’s calculated. Getting home insurance won’t have a negative impact on your credit, but if your credit is in bad shape, you may find it difficult to get approved for coverage, or you may be charged a higher insurance premium. If you’re planning to buy a home soon and haven’t checked your credit in a while, check your credit report for free through Experian to get a sense of where you stand. If it needs some help, you can spend some time working to improve your credit before you begin the homebuying process.

But Does It Affect Your Score

But the question still remains. If car insurers pull your credit report during the application process, does that actually affect your credit? After all, . But the credit report a car insurer pulls wont actually affect your score, generally.

Why? Its because insurance companies do whats called a soft pull on your credit. There are two types of credit inquires, called a soft pull and a hard pull:

- A soft pull, also known as an involuntary inquiry, occurs when creditors want to send you pre-approved offers. That credit card solicitation you received in the mail was probably the result of a soft pull on your credit. Potential employers may check your credit as do your existing credit card accounts. Both of these are soft pulls. And if you check your own credit score, thats considered a soft pull, too. The key is that a soft pull happens when you arent actively seeking out credit. So it has no effect on your credit score.

- A hard pull, also known as a voluntary inquiry, occurs anytime you actively seek credit and fill out an application. The lender will run your credit report and determine whether to approve your credit application and under what terms. A hard pull on your credit report indicates that youre shopping for credit. So that will affect your credit score.

Heres what other major insurers disclosure about pulling credit reports:

State Farm says:

Recommended Reading: Realpage Inc On My Credit Report

Is There Anything I Need To Do Concerning My Credit Before I Go Car Shopping

Check your credit report yourself. This is the most recommended piece of advice by both dealership representatives and consumer advocates. Eleazer says to pay attention to the accuracy of the report and challenge any mistakes with the credit reporting agency. Resolving these problems ahead of time could raise your credit score and give you access to a wider range of finance options.

“I tell consumers to take advantage of one free credit report each year,” says Shawn Petersen, regulatory, legislative and compliance counsel for NIADA. “Going into a car transaction armed with that information, and knowing what your credit report says, will show the dealer that you are knowledgeable.”

That knowledge could help you avoid mistakes and save a lot of money in the long run.

The Edmunds content team brings you industry-leading vehicle reviews, news and research tips that make it easier for you to find your perfect car.

Where Can I See My Credit Report

Under the Fair Credit Reporting Act , you are legally entitled to a free credit report each year. Obtaining your free copy allows you to check the report for any mistakes or inaccuracies that could harm your score. If you see incorrect information on your credit report, be sure to report it immediately to the appropriate credit bureau so your credit score does not suffer.

Don’t Miss: Does Ashley Furniture Repossession

Why Is The Salesman Eager To Get Me To Fill Out A Credit Application

The dealership uses the credit report both as a tool to increase sales and a way to protect itself from undesirable or even fraudulent shoppers, according to auto financing and car-selling experts.

Dealers know they have access to the best financing available, and they are eager to share these opportunities with their customers, says Marv Eleazer, finance director at Langdale Ford in Valdosta, Georgia. Almost 80 percent of his customers arrange financing through the dealership.

“The reasons are pretty clear,” Eleazer says. “We generally get rates lower than most customers can obtain elsewhere and the amount we can typically get financed is greater than most local banks or credit unions.” This is a huge benefit to customers who owe more on their trade-in than it is worth, he adds, because sometimes the dealer finance office can add this debt to the new loan.

Chris Cutright, a former car salesman, cites another reason dealers ask for a credit report. When people walk into a car dealership and request a test-drive, the dealer will want to know if they have the ability to pay for a car if they ultimately say they want to buy it. The fastest way to answer that question is to run their credit report.

Further, if a customer “looks kind of rough,” a manager will want to protect the dealership’s cars against theft or damage that might occur during a test-drive, Cutright says.

The Problem With Uninsured Drivers

You share the road with an estimated 30 million uninsured drivers, according to the Insurance Research Council. Although every state except New Hampshire mandates that drivers have insurance coverage, some slip through the net of state enforcement by buying coverage to register a car, then letting it lapse.

Its easy to demonize those consumers by assuming that they choose not to buy a product they can easily afford. There are individuals out there who like to live on the edge and drive without insurance, says an Allstate Web video.

But insurance credit scoring, which links customers premium prices to their creditworthiness, raises the cost of insurance for some low-income drivers and might make it unaffordable to them. In fact, research by the Consumer Federation of America found a strong correlation between state poverty rates and the percentage of uninsured drivers in a given state, which ranges from 4 percent in Massachusetts to 26 percent in Oklahoma.

Whats worse, our own data show that when the uninsured try to get back on track and buy coverage, insurers tack on an additional price penalty. Our single policyholders who had a 60-day lapse in their coverage got socked with a $207 higher premium on average nationally. The penalty varied by state and ranged from zero in California to $834 per year in Michigan.

Our single policyholders who had a 60-day lapse in their coverage got socked with a $207 higher premium on average nationally.

Highest: Michigan

Recommended Reading: Unlock Transunion Account

Why Does Credit Affect Car Insurance Rates

When you apply for car insurance, the company checks your credit rating, explains John Espenschied, owner of Insurance Brokers Group and an insurance expert with over 20 years in the industry. If your score is low or if there is an indication that you might be living beyond your means, it may affect whether you get coverage at all.

Like your driving record, your credit rating is a helpful tool for car insurance companies to use when assessing your risk as a driver. Yes, most car insurance companies use credit scores as one of many factors affecting car insurance premiums, affirms Adrian Mak, CEO of AdvisorSmith. Other factors considered include driving history, claims history, ZIP code, vehicle type and many other factors.

Analysis of car crash data shows that credit scores can accurately predict the risk that a policyholder will crash or file a claim against a policy, Mak adds. Drivers with higher credit scores tend to get into fewer crashes and file fewer claims than those with lower scores.

Therefore, the drivers who have higher credit scores are generally perceived as lower risk and are offered lower rates than drivers with lower credit scores.

Does Getting An Auto Insurance Quote Hurt Your Credit Score

Modified date: Jun. 10, 2021

Editor’s note –

Recently we wrote about how to compare auto insurance rates online. One question that has come up is whether getting an auto insurance quote will lower your credit score.

Car insurance companies today routinely pull your credit report and use your credit score and history as one factor in setting premiums. As weve discussed in the past, your credit history affects your finances in many ways. Car insurance premiums are a good example of this. The higher your score, the lower your premiums.

A quick note on credit scores, if you want to increase your score, sign up for Experian Boost. This is a fast and easy way to raise your FICO® Score. The way it works is by tracking your monthly payments including your utility bill and mobile phone bill. When you make these payments on time, this information is used to give your FICO Score a boost. Start now for free.

Experian Boost Disclaimer – Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost.

Learn More:Experian Boost Full Review

Heres how Progressive explains the use of credit scores in its underwriting process:

Also Check: Navy Federal Car Loan Interest Rates

If Im Late Paying My Car Insurance Will It Affect My Credit Score

On the bright side, while your insurance doesnt help your credit score, it also wont hurt your credit. But there are some major ramifications to missing car insurance payments:

In the worst case, if you dont pay, your car insurance may be canceled. If you drive without active insurance, you could get in trouble with the law if you get pulled over. Even if you are rear-ended by someone else, you could get a ticket for driving without insurance. In some states, you could incur a large fine, drivers license suspension, or even jail time for driving without insurance.

If you get a ticket for driving without insurance and dont pay your fine, it could be sent on to collections. In that case, driving without insurance would negatively affect your credit, since collections show up as a major bad mark on credit reports.

What Is The Difference Between A Hard Inquiry And Soft Inquiry

There are two types of inquiries that lenders may use when running your credit. A hard inquiry results in a permanent record on your credit score. A soft inquiry, on the other hand, does not affect your credit score. Applying for insurance policies counts as a soft inquiry your credit score is reviewed but is not impacted by the act of getting auto insurance quotes.

Also Check: What Does Your Credit Score Tell Lenders About You Brainly

If Your Car Is Totaled Following A Collision Such As Hitting Another Vehicle Or Object Or Being Involved In A Rollover

Your insurer may pay the actual cash value of the vehicle minus your policy deductible if you have collision coverage.

Notethat comprehensive and collision coverage are optional for drivers, but theymay be required if you finance or lease your vehicle. If you own your car anddont have either coverage, you may not be protected in certain situations ifyour vehicle is totaled.

Besides The Impact To My Fico Score Are There Other Risks To Having A Dealership Check My Credit History

It isn’t a good idea to divulge personal information unless it is necessary. There is always the chance someone could take your Social Security number and other personal information and use it to access your bank or credit card accounts. So, despite his explanation of why dealerships do what they do, Cutright advises consumers to decline early invitations to run your credit.

“Only allow them to run your credit when you are certain you are interested in buying a car,” he says.

Recommended Reading: What Bureau Does Care Credit Pull

Do Home Insurance Companies Check Your Credit

You’re probably familiar with your credit score, such as the ones calculated by FICO®, and the effect it can have on how a lender views your ability to borrow. What you might not realize, however, is that many insurers also use a version of your credit score to help assess your coverage risk and determine your rates.

Insurers, including home insurance companies, might look at a type of score called a when you apply for coverage. These scores differ from the scores lenders use in a few key ways, but are influenced by similar factors.

Here’s what you should know about how the shape of your credit can help determine your home insurance rates.