Is There Any Way To Avoid Hard Inquiries While Searching For The Best Loan Or Credit Card Offer

Finding the right lender can get you a more suitable deal, including benefits like flexible repayment plans or competitive interest rates. But this may mean submitting multiple applications, which can affect your credit score quite significantly. Instead, with some careful research, you can identify lenders who offer terms that are suitable for your circumstances without making multiple applications.

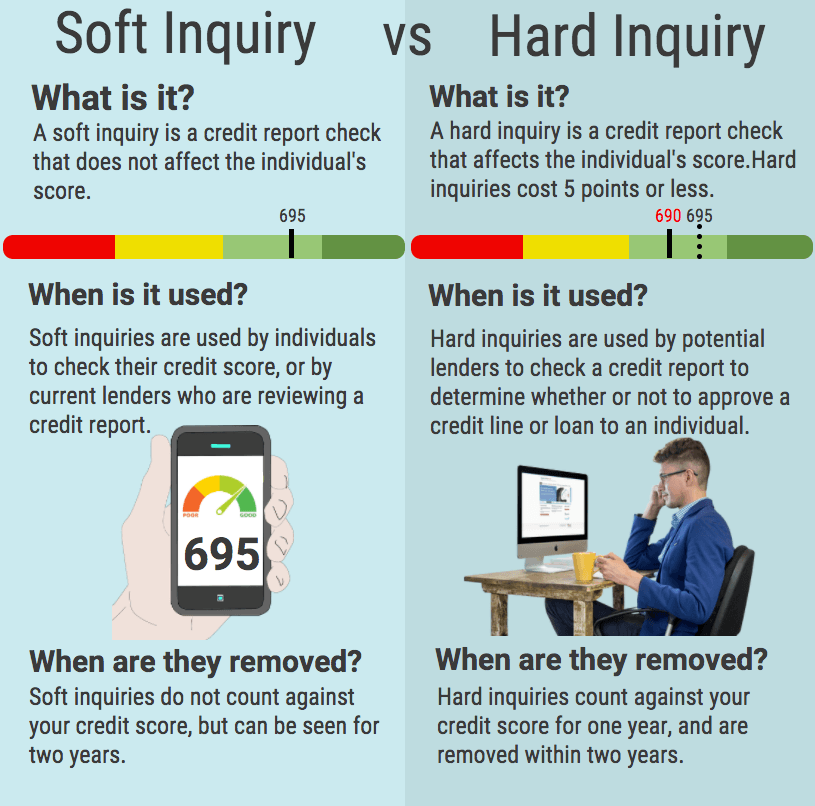

How Soft Inquiries Affect You

Not only do soft inquiries not affect your credit score, they’re not even visible to lenders when they check your report. They’re only visible to you when you pull your own credit report.

Keep in mind, though, that if you pull a copy of your credit report and provide it to a business to review, the soft inquiries will appear, since it is your version of your credit report.

How Do Hard Credit Inquiries Affect Your Credit

Lenders and credit scoring models consider how many hard inquiries you have on your credit reports because applications for new credit increase the risk a borrower poses. One or two hard inquiries accrued during the normal course of applying for loans or credit cards can have an almost negligible effect on your credit. Lots of recent hard inquiries on your credit report, however, could elevate the level of risk you pose as a borrower and have a more noticeable impact on credit scores.

Hard inquiries can stay on your credit report for two years, but the degree to which they affect your credit diminishes over time. While they could initially reduce your FICO credit score by several points, your scores will likely recover after a few months. The credit score sting caused by many hard inquiries in a short period of time will take longer to go away. At any rate, both types of inquiries are automatically removed from credit reports after two years.

Again, your overall credit health is what matters most. If you have a consistent track record of making on-time payments and keeping your revolving credit balances low, it isnt likely that a few hard inquiries will have enough of an impact on your credit scores that it affects your interest rates or credit approval.

You May Like: Credit Score Itin Number

How Does A Hard Inquiry Affect Your Credit Score

A single hard inquiry can shave up to 5 points off your FICO score. However, with the most-used FICO model, all inquiries within a 45-day period are considered as one inquiry when you are rate shopping, such as for mortgage, student and auto loans. Older FICO models and VantageScore, FICO’s competitor, also group inquiries for rate shopping, but into a 14-day period. A VantageScore spokesman said a hard inquiry can shave up to 10 points off a VantageScore.

Most lenders or card issuers will pull a credit report from just one of the three major credit bureaus Equifax, Experian or TransUnion. So the inquiry will show up on only one of your credit reports. The exception is for a mortgage, when all three credit bureaus are usually checked.

It is smart to limit hard inquiries. Before you apply for credit, check to be as certain as you can that you are likely to be approved so you don’t lose score points without getting the approval you seek. Avoid applying for credit on impulse. Consider whether a discount or bonus you are hoping to receive is worth the potential ding to your credit score. If you have excellent credit, a few points may not be a big deal. However, if you have borderline credit quality, think twice.

How Inquiries Affect Your Score

Inquiries on your credit report are one of the ways credit scoring companies gauge the risk that you’ll default on new credit obligations. Too many inquiries, especially in the past few months, might mean that youre taking on too much debt or that youre in some kind of financial trouble and are looking for credit to help you out. Several inquiries can lower your credit score.

Depending on how much information you have on your credit report, an additional inquiry might not affect your credit score at all. On the other hand, if you have a short credit history with only a few accounts, an additional inquiry could cause your score to drop by a few points.

Read Also: Www Bpvisa Syncb

When To Count Multiple Auto Loan Inquiries As One

Therefore, as long as the inquiries were all made within a certain period of time, usually 14 days but sometimes longer, they are counted as just one when calculating your score. The practice of counting multiple auto loan inquiries as just one enables you to shop for the best rates and terms without hurting your credit scores.

How Much Will Credit Inquiries Affect My Score

The impact from applying for credit will vary from person to person based on their unique credit histories. In general, credit inquiries have a small impact on your FICO Scores. For most people, one additional credit inquiry will take less than five points off their FICO Scores.

For perspective, the full range for FICO Scores is 300-850. Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports. While inquiries often can play a part in assessing risk, they play a minor part are only 10% of what makes up a FICO Score. Much more important factors for your scores are how timely you pay your bills and your overall debt burden as indicated on your credit report.

You May Like: How To Get Credit Report Without Ssn

Don’t Miss: Syncb/ppc Credit Inquiry

Does Applying To Refinance Trigger A Hard Inquiry

Applying to refinance your mortgage or vehicle will trigger a hard inquiry. Since you are applying for a new line of credit that will buy out your old line of credit, lenders need to see a full and detailed credit report. Condensing your refinancing shopping time to a window of two weeks will help minimize damage, this way multiple hard inquiries for auto loans will count as one hard inquiry.

Hard Inquiries Vs Soft Inquiries: What They Really Are How They Affect Your Credit

Your three-digit credit score will fall when a lender checks your credit reports or credit score, right? And if several lenders all check your credit during the same two-week period, the negative impact on your credit score will be even worse, right?

Not necessarily. Sometimes your score doesnt budge after lenders check your credit. And there are times when several lenders pull your credit during the same few days and the dip in your score is barely noticeable.

Why? Its all because of the difference between hard credit inquiries or pulls and soft credit pulls.

A credit pull or credit inquiry is when you or someone else checks your credit report and your credit score. But theres a difference between a soft pull and a hard pull. Heres what you need to know.

Read Also: What Score Is Needed For Care Credit

Why Do Credit Inquiries Matter

When you apply for a credit card, begin shopping for a loan or prepare to take on a new financial responsibility, like renting an apartment, the lenders and companies involved want to know whether you are likely to be a financial risk. By conducting an inquiry into your credit history, these companies are able to assess your level of financial responsibility and the likelihood that you might default on your loan, miss credit card payments or skip out on the rent.

There are two different types of credit inquiries: Hard inquiries, which can have a negative effect on your credit score, and soft inquiries, which dont affect your score at all.

When Can Businesses Request Your Credit

The Fair Credit Reporting Act requires businesses to have an acceptable reason for accessing your credit report. Acceptable reasons include:

- To grant credit. If youve applied for a credit card, loan, or other credit-based services, the business has permission to access your credit report to determine whether you qualify.

- To collect a debt. Debt collectors can use your credit report to obtain information, like your address or place of employment, that would help them collect a debt.

- To underwrite insurance. Some insurance providers use your credit score to gauge the likelihood that you will file a claim.

- For employment. Current and prospective employers may check your credit report before hiring you for certain positions, especially financial and upper-level management positions.

- To issue certain government licenses.

- For legitimate business transactions.

Companies that access your credit report under false pretenses or those who use it illegally are violating Federal law. You may be able to sue a company that violates your rights.

Recommended Reading: Does Closing A Credit Card Hurt Your Score

You May Like: Vantage Score Definition

Hard Credit Inquiry Vs Soft Credit Inquiry

Whats the difference between a hard credit inquiry and a soft credit inquiry? While a hard credit inquiry affects your credit score, a soft inquiry does not.

Hard and soft credit inquiries are two ways your credit reports are accessed. For instance, while an application for a mortgage leads to a hard credit inquiry, checking your credit score through Equifax or TransUnion will result in a soft credit check. One key difference between the two is that hard inquiries impact your credit score, while soft inquiries dont.

On This Page:

Learn More >

What Are Inquiries On Your Credit Report

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Inquiries are entries that appear on your credit report when your credit information is accessed by a legally authorized person or organization . Most commonly, inquiries are the result of an application for credit, goods or services an account review made by a company that you already do business with or a preapproved offer of credit that has been sent to you.

There are two types of credit inquiries: hard inquiries and soft inquiries. Account reviews and preapproved offers fall under the category of soft inquiries, which have no effect on your credit scores. Hard inquiries include applications for credit or certain services, and although their impact is minimal, they can temporarily affect your scores. It is good practice to get your credit report checked throughout the year to view hard and soft inquiries. Here’s what you need to know about inquiries on your credit report and the differences between hard and soft inquiries.

Recommended Reading: Creditwise Simulator

How Long Do Hard Inquiries Affect Your Credit Score

When you apply for small business loans, lines of credit, and other sources of funding, potential lenders might conduct a credit check. These financial institutions use credit scores to evaluate the level of risk of working with a business or individual.

In theory, the higher your credit score, the better your financial reputation and the more likely you are to pay back your debt.

However, not all credit inquiries carry the same weight. Use this guide to understand how long hard inquiries stay on your credit report and what this means for your business.

How Do You Minimize The Effect Of Hard Inquiries On Your Credit Score

The most important thing you can do when shopping around for a loan is to condense your search time. Credit bureaus give a two week period for inquiries to be made. If you apply for multiple loans in this period, the credit agency will consider them as one hard inquiry. This is the most important thing you can do to minimize damage from multiple hard inquiries.

In general, experts caution you to be aware of hard inquiries, but they stress that this part of your credit report is the least impactful. Missed payments and high credit balances are much more detrimental than new credit inquiries.

Recommended Reading: Does Paypal Credit Show On Credit Report

What Are Hard And Soft Credit Score Inquiries

There are two types of credit score inquiries lenders and others can make on your credit score: a “hard inquiry” and a “soft inquiry.” The difference between the two is that a soft inquiry won’t affect your score, but a hard inquiry can shave off some points.

Here’s what hard and soft inquiries are all about: why there’s a difference, and who makes them.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Long Can Eviction Stay On Your Credit

How Do Soft Inquiries Impact Credit Scores

Credit scoring models generate your by analyzing the information in your credit report. Soft inquiries don’t have any impact on your credit scores.

Hard inquiries may remain in your credit reports for about two years and they can impact your credit scores. But the impact is typically small, and credit scores tend to rebound within a few months if no new negative information gets added to your credit report. Scoring models usually only consider hard inquiries from the previous 12 months when calculating your scores.

Multiple recent hard inquiries can do more damage to your credit scores. However, credit scoring models often combine multiple inquiries from a 14- to 45-day perioddepending on the type of credit scoreto avoid punishing consumers who are rate shopping.

Benefits Of A Soft Credit Check

You can use soft inquiries to better understand how your credit score is reported with the various credit bureaus. One of the best ways to do this is by taking advantage of free credit reports and scores offered through your credit card company. Nearly every credit card company offers cardholders a free credit score assessment, and each assessment will differ by the reporting agency used. These inquiries are considered soft pulls and can provide you with information on your credit score and credit profile each month.

The Fair Credit Reporting Act regulates how credit bureaus or agencies collect and share your financial information. By law, you have the right to obtain a free copy of your credit report every 12 months from the credit bureaus. You can also get a copy of your report from the government-authorized website AnnualCreditReport.com.

As soft inquiries are listed on your credit report, they can provide useful information as to what companies are considering extending you credit. These inquiries will be found under a subheading such as soft inquiries or inquiries that do not affect your credit rating. This portion of your credit report will show the details of all soft inquiries, including the requesters name and the inquiry date.

Recommended Reading: Remove Syncb Ppc From Credit Report

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Read Also:

Checking Your Own Credit Score Wont Lower It But Other Credit Checks Might Have An Effect On Your Score

Ever wonder if checking your own credit scores will lower them? Great question! The short answer is noâchecking your credit scores yourself wonât hurt them. However, other types of credit checks could cause your scores to dropâthough the drop could just be temporary and only by a few points.

Read on to learn more about the two kinds of credit checksâsoft checks and hard checksâand how only hard checks can lower your scores.

Recommended Reading: Navy Federal Credit Score For Auto Loan