Re: When Will Open Sky Show Up On My Credit Reports

Some cards take several billing cycles to report. I wouldnt worry just yet. However, I would highly recommend checking prequals for Discover or Amex. Those cards would be so much better than Open Sky.

wrote:

I opened an Open Sky solely for the purpose of participating in the AZEO method. However it still has not shown up on my credit reports and its been almost two months. I need the point increase that a new card on your credit report provides. Has anyone else had a credit card take that long to show up? I was recently approved for a Capitol One Quicksilver and it posted to my credit report within a few days of approval.

My OpenSky showed up within the first month. Their CS reps are pretty friendly, in my experience, you can always give them a call and see if anyone is willing to push it to report? It will probably show up in a cycle or two on its own. I had one card take 3 months to show up, sometimes it just takes more time.

F8 EQ:EX:TU:Accounts: Reporting:

wrote:

I opened an Open Sky solely for the purpose of participating in the AZEO method. However it still has not shown up on my credit reports and its been almost two months. I need the point increase that a new card on your credit report provides. Has anyone else had a credit card take that long to show up? I was recently approved for a Capitol One Quicksilver and it posted to my credit report within a few days of approval.

Rebuild Cards

Are There An Application Fee With Acima

You will not pay an application fee when applying for Acima credit. But your total lease payments do include the Acima cash price for a particular merchandise, and the cost of the lease service.

Depending on where you live, youre also required to pay sales tax on each rental payment.

Always make your rental payments on time.

Late payments might result in additional fees.

Bogdan Roberts Credit Cards Moderator

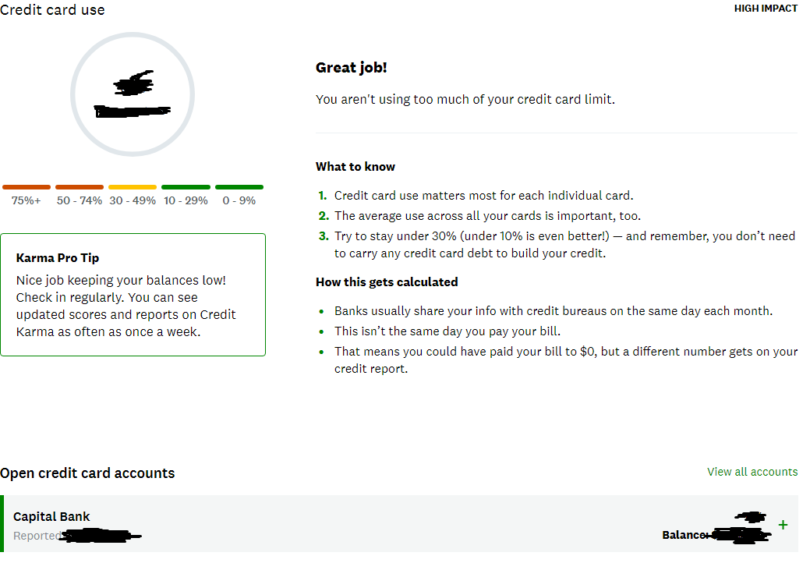

Citibank reports to the credit bureaus once a month, typically 30 days from the statement closing date. So, if your billing cycle ends on the 15th of every month, Citibank will report information on your credit card balance on or around that date.

But when the information Citibank reports to credit bureaus actually appears on your credit report is a different story. Credit bureaus, in theory, report the balance on your Citibank credit card as soon as it’s received. Realistically, it can take up to a week, or sometimes up to two months, or billing cycles, for a new account.

It’s important to know when Citibank and other banks report to the credit bureaus. If you’re trying to boost your credit score in order to make a major purchase such as a mortgage, you’ll want to make sure any positive information is reported. Also, if there’s a dispute on your Citi credit card account that’s been resolved, you’ll want to confirm that information is removed.

The problem is, not all issuers report your activity, positive or negative, to credit bureaus. Those that do, may not report to all three of the major credit bureaus. Citibank reports to all three of the major bureaus: Equifax, Experian, and TransUnion.

Also, consider paying your Citi credit card bill well before your statement closing date. That way, the snapshot of your balance will be lower when it’s reported. A low balance helps your , which in turn, boosts your credit score.

You May Like: Is It Possible To Remove Hard Inquiries From Credit Report

Who Is This Credit Card For

I think the OpenSky credit card is good for people that are:

- looking to build credit

- Have no credit history/bad credit history

- Are looking to get a bigger loan in the future

- Dont need a high credit limit

- Are just interested in having a safe, reliable way to build credit.

This credit card is NOT for:

- People looking for cash rewards/big rewards from a credit card.

- People looking for a high credit limit/unsecured card.

- Not for people looking to make big purchases/pay stuff over 12 months.

- Not for people that are looking for a great travel card.

Simply put, this card is what its all about. Building credit.

Youre not going to get expensive trips to the Bahamas from this card. Youre not going to get cash back either. And even then, the credit limit is fairly low and its a secured card.

This isnt for the person looking to blow thousands of dollars at a party or something, this is for the people that are trying to get a good credit score and build it.

As I said, this credit card is good for a reliable, safe way to build credit.

Theres nothing special or fancy about this card, and this card isnt going to be much use if youre trying to make big extended purchases.

This is a barebones, build your credit up, move onto the next card kinda thing.

But regardless, that doesnt make it a bad card. Its a very solid credit card.

Does Opensky Report To Credit Bureaus Instant Credit Boost

Im sure youve heard the term previously. Its that 3 digit number that follows you & your financial life every where you go. You require it to get authorized for loans, credit cards, apartment or condos, home loans & more! And since you never really see it, its generally out of sight, out of mind but this number is something that needs to be taken severe.

Though none of us like it, the fact that a credit score is so crucial to almost everything we do financially is precisely why we said it has to be taken serious. It can take years to build up a good score and just a day or 2 to bring the whole thing crashing down.

Luckily, theres things you can do to safeguard and educate yourself on the topic. From techniques to provide you a near-instant boost to your score to comprehending what a credit score even is from a basic level, were going to walk you through this step by step. Prepare yourself to take control of your financial flexibility once and for all!

Read Also: What Department Stores Use Comenity Bank

How Does Opensky Secured Visa Work

The OpenSky Credit Card is a great option for someone who needs to establish credit or repair bad or damaged credit and desires a low APR and a higher initial credit limit than usual. If youre concerned that youll need to regularly rotate a balance on your secured card, having the lowest APR feasible is a smart choice.

Youll also get a bigger initial credit limit than with numerous other secured cards , and no credit check is necessary.

Because of its cheap cost and simplicity of acceptance, as well as its substantial maximum credit limit, the OpenSky Secured Visa should be a good option whether you want to build or rebuild your credit. While there are probably less expensive secured card choices, the OpenSky Secured Visa should provide ample opportunity to establish your trustworthiness while keeping prices low.

Obtaining New Credit To Re

A bankruptcy discharge eliminates all prior debts and enables consumers to have a fresh financial start in life. Consumer credit scores can be as low as in the 400s after bankruptcy discharge. We will show you how to get your credit scores over 700 FICO one year after the bankruptcy discharged date. Gustan Cho Associates offers home mortgages with no waiting period after bankruptcy and/or foreclosure. Government and conventional loans require a mandatory waiting period after bankruptcy and/or foreclosure. Just meeting the waiting period after bankruptcy and/or foreclosure does not guarantee you a home mortgage approval. Lenders want to see re-established and timely payments after bankruptcy and/or foreclosure.

One late payment after bankruptcy is the kiss of death. Lenders and other creditors do not want to see any late payments after bankruptcy. Consumers with late payments after bankruptcy are called second offenders. Lenders and creditors will classify late payers after bankruptcy as habitual financially irresponsible consumers and want nothing to do with them At Gustan Cho Associates, one or two late payments are not always deal killers. Borrowers with late payments will be scrutinized and mortgage underwriters want to know why they were late on their monthly debt obligations. Obtaining new credit after bankruptcy is the best way of re-establishing credit. How can creditors give a recently bankrupt consumer new credit?

Possibly two.

You May Like: Ccb On Credit Report

No Bank Account Required

Most cards require you to have a bank account, putting them out of reach for the unbanked. The OpenSky® Secured Visa® Credit Card doesn’t. You can pay the security deposit with a money order or a Western Union payment. Credit card bills can also be paid by money order. However, if you already use these services, you know that they cost money, which adds up over time.

Who Is This Credit Card Best For

- Prioritizes sticking to their budget while buying what they want and need See more cardsSavvy Saver

- Takes improving their finances seriously and wants recognition for using credit responsibly See more cardsCredit Builder

This credit card is best for someone whos looking to build credit with a card that doesnt require a credit check or even a bank account at all to get started. Secured cards in general dont require good credit to be approved, but theyll usually still check your credit. The OpenSky Secured card stands apart in that it doesnt run any credit check at all.

Not having any credit and not having a bank account often run hand-in-hand, and if thats you, this might be another good reason to consider this card. Itll be easiest to make your security deposit with your bank account debit card. But if you dont have one, you can use a Western Union transfer or get a check made, too, although a fee may apply.

-

No path to move up to a better product

You May Like: Speedy Cash Change Due Date

How To Get Approved For A No Credit Check Visa Credit Card

OpenSky believes in giving an opportunity to everyone. You provide a deposit to establish a credit line from $200 up to $3,000. The fully refundable deposit is held in an FDIC savings account but it does not earn interest. A deposit is required for two reasons:

- The cash deposit is collateral and serves as your actual credit limit.

- That deposit provides the credit card issuer with a safety net, should you default.

The refundable deposit you provide becomes your credit line limit on your Visa card. Choose it yourself, from as low as $200 up to $3,000. Not only is no credit check required, a checking account is not required either. It doesn’t get much easier than this to qualify for a real Visa credit card that is accepted worldwide, wherever you see the Visa logo.

Opensky Secured Visa Credit Card Basics

The OpenSky® Secured Visa® Credit Card allows you to make your security deposit from as low as $200 and up to $3,000, so you have some flexibility when it comes to determine how much credit you will have with the Card.

The OpenSky® Secured Visa® Credit Card reports to all three major credit bureaus, so your account history will factor into your credit score. Not all secured cards report to all three bureaus. This is an important detail to ask about, since documenting how you are handling your account and building a credit history depends on the card issuer reporting your account details to all three major credit bureaus.

The Annual Percentage Rate is currently 17.39% variable. This APR will vary with the market based on the prime rate. This card does not charge a fee to apply but it does come with a $35 annual fee.

OpenSky® Secured Visa® Credit Card does not offer unsecured credit card accounts, so youll have to keep an eye on your credit and consider applying for a traditional card from another issuer after six to twelve months after you have demonstrated consistent responsible management of all your credit obligations.

You May Like: Jefferson Capital Systems Verizon Phone Number

How To Apply For The Opensky Secured Visa Credit Card

You can sign up for the OpenSky® Secured Visa® Credit Card right from their website. All you need is some personal information so OpenSky can verify your identity:

- Name.

Then, youll provide some information about your finances:

- Total annual income.

- Housing payment type .

- Social security number.

- Date of birth.

This is very private information, but they need this data from you so they can make sure you are who you say you are verifying identity for financial accounts is a law under the USA Patriot Act.

Next, OpenSky will share some disclosures with you. These are the terms of your financial agreement and youll see some details about the OpenSky® Secured Visa® Credit Card, such as the annual percentage rate , which is 17.39% for both purchases and cash advances.

How Much Does Opensky Secured Visa Cost

Lets take a look at the cost! Its a secured type card that will charge annual fees of about $35. Besides this, the valid social security number and security minimum deposit is $200 minimum to $300 maximum.

Secured cards allow you to get a rewards program and refundable security deposit feature with its own credit limit. The credit building and balance transfers include free credit scores with higher credit history and assurance.

Heres something about the interest rate! It has a variable APR of 17.39%. There is a foreign transaction fee of 3% on the whole. Moreover, it comes with a cash advance fee of 5% or a minimum fee of $6. The card features payment information with major credit bureaus to build an effective credit line for assurance.

Recommended Reading: Coaf Credit Inquiry

What To Look Out For With The Opensky Secured Visa Credit Card

-

Annual fee

The OpenSky® Secured Visa® Credit Card charges a $35 annual fee. If youd prefer a secured card with no annual fee , check out the Discover it® Secured Credit Card.

-

Can’t graduate to an unsecured card

With some secured cards, theres a chance to transition to an unsecured card with the same issuer and get your deposit back after demonstrating responsible credit card usage. With the OpenSky® Secured Visa® Credit Card, theres no such option. To get your deposit refunded, you must pay the card off in full and close the account. However, once your credit score dramatically improves with the card, you should be able to apply for an unsecured card with a different issuer.

-

Foreign transaction fee

If you happen to be traveling outside the United States, be aware that this credit card charges 3% of each Transaction in U.S. dollars.

Bankrates Takeis The Opensky Secured Card Worth It

The OpenSky Credit Card works well for a cardholder who needs to build up credit or fix bad or damaged credit and wants a reasonable APR or an above-average initial credit limit. If youre worried youll need to revolve a balance occasionally on your secured card, getting the lowest APR possible is a good idea. Plus, youll get a higher initial credit limit than several other secured cards, and theres no credit check required.

Otherwise, this card isnt the best choice on the market since youll owe a $35 annual fee and you cant offset it by earning rewards or boosting your credit limit beyond the $3,000 secured max.

Don’t Miss: Centurylink Collections Agency

Re: Question On Charged Off Account With Acima

COs hurt you in several ways first off its the worst of the derogatory status that isnt a collection, judgment, or BK and puts you into a dirty scorecard. If its reporting CO every month, its further suppressing your scores. AND if thats not enough, as firemedic points out, the past due balance is counting against your credit utilization .

If its reporting monthly and it appears that it is once you settle, it will stop reporting and the $0 balance will no longer be hurting your Util scores. These are great things for your scores.

In my experience with COs unless its very old, not reporting monthly, and/or about to fall off your credit report at the 7 year mark, you should settle or pay it.

You May Like: Minimum Credit Score For Carmax

Whats The Credit Limit On An Opensky Card

So credit cards generally have a credit limit, but when you have low/bad credit, you can have a very hard time getting a good credit limit for the card.

Thankfully, OpenSky lets you pick whatever credit limit you want as long as you match the security deposit with it.

So say you want a credit limit of $500- thats fine, you just need to give them $500.

Remember, you get this security deposit back when you close the card! So youre not paying them money for it, its just how a secured card works. They hold onto the money until the card is closed in case you dont pay off the card.

You May Like: Notification Of Death To Credit Bureaus

How A Bad Credit Score Isbad

As discussed previously, a bad credit score is anything listed below 670. If you want to get more particular, a score varying in between 580-669 is thought about fair, while anything between 300 and 579 is thought about bad. This is going off the FICO scoring thats most typically used.

Not sure what your credit score is? . Its free!

Having a bad score can stop you from doing a lot of things. This includes getting approved for better charge card, mortgages, homes, individual loans, company loans, and more.

Plus, any loans or credit cards you do get approved for will be much more costly . This is due to the fact that loan providers charge much higher interest rates to those they deem high danger in order to balance out the additional danger they feel theyre taking by loaning you cash.

How do they get more expensive? By charging greater interest rates. For example, if you take out a $10,000, 48 month loan on a automobile with a 3.4% rates of interest, youll pay about $704 in interest throughout the loan. If you got that exact same loan with a 6.5% rate due to bad credit, you d pay about $1,376 in interest. Thats nearly double!