Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

If I Dont Agree With My Fico Score What Should I Do

Your FICO® Score is provided to Wells Fargo by Experian® based on information within your credit report on the calculation date . If you feel this information is inaccurate, your next step should be to request a free credit report from annualcreditreport.com. If theres incorrect information within any of your credit reports, follow each bureaus instructions on how to dispute that information. If theres incorrect information about your Wells Fargo accounts, please call the Wells Fargo phone number in your credit report.

Don’t Miss: How To Dispute Repossession On Credit Report

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

How Can I Build My Credit Score

The two biggest factors in your credit score are paying on time and managing how much of your credit limits you’re using. Thats why they come first in this list of tips:Pay all your bills, not just credit cards, on time. Late payments and accounts charged off or sent to collections will hurt your score.Use no more than 30% of your credit limit on any card less, if possible. The best scores go to people using 10% or less of their credit limits.Keep accounts open and active when possible that gives you a longer payment history and can help your “credit utilization,” or how much of your limits you’re using.Avoid opening too many new accounts at once. New accounts lower your average account age and each application causes a small ding to your score. We recommend spacing credit applications about 6 months apart. Make sure you conduct thorough research on the best credit card for your needs before applying.Check your credit reports and dispute errors.

Also Check: Is 524 A Bad Credit Score

Include A Timeline To Complete Your Goal

Most goals need deadlines. That’s why you should implement a timeline when you set financial goals.

For example, if your goal is to save $1 million by retirement, you can break that goal up into smaller goals with deadlines. For example, you might aim to save $7,000 for retirement by the end of this year. Alternatively, you could break up your retirement goal by focusing on the shorter-term goal of saving three times your salary by age 40.

When it comes to paying down high-interest debt, assigning yourself deadlines for how much of your balance you’ll have paid down can help you stay on track and create a realistic plan.

If you’re shouldering $20,000 in credit card debt, for instance, you might want to make paying it down ASAP a top priority. To make a SMART debt payoff plan, you could assign a deadline for when you’ll be out of debt, such as within two or three years. With a smaller balance, you might aim to be debt free within one year.

I Opted In But It Says No Score Is Available Why

The most common reasons a score may not be available:

- The credit report may not have enough information to generate a FICO® Score

- The credit bureau wasnt able to completely match your identity to your Wells Fargo Online® information. To keep your information current, sign on to Wells Fargo Online®, visit the Profile and Settings menu, select My Profile and then Update Contact Information. Make sure your email addresses, phone numbers, and mailing addresses are current.

- If you’ve frozen your credit with the credit bureau, you may not immediately receive a credit score. A score should become available for you to view after the next monthly update. Contact Experian® with further questions.

Read Also: Does Marriage Affect Credit

Does A Fico Score Alone Determine Whether I Get Credit

No. Most lenders use a number of factors to make credit decisions, including a FICO® Score. Lenders may look at information such as the amount of debt you are able to handle reasonably given your income, your employment history, and your credit history. Based on their review of this information, as well as their specific underwriting policies, lenders may extend credit to you even with a low FICO® Score, or decline your request for credit even with a high FICO® Score.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Don’t Miss: Do Evictions Go On Credit Report

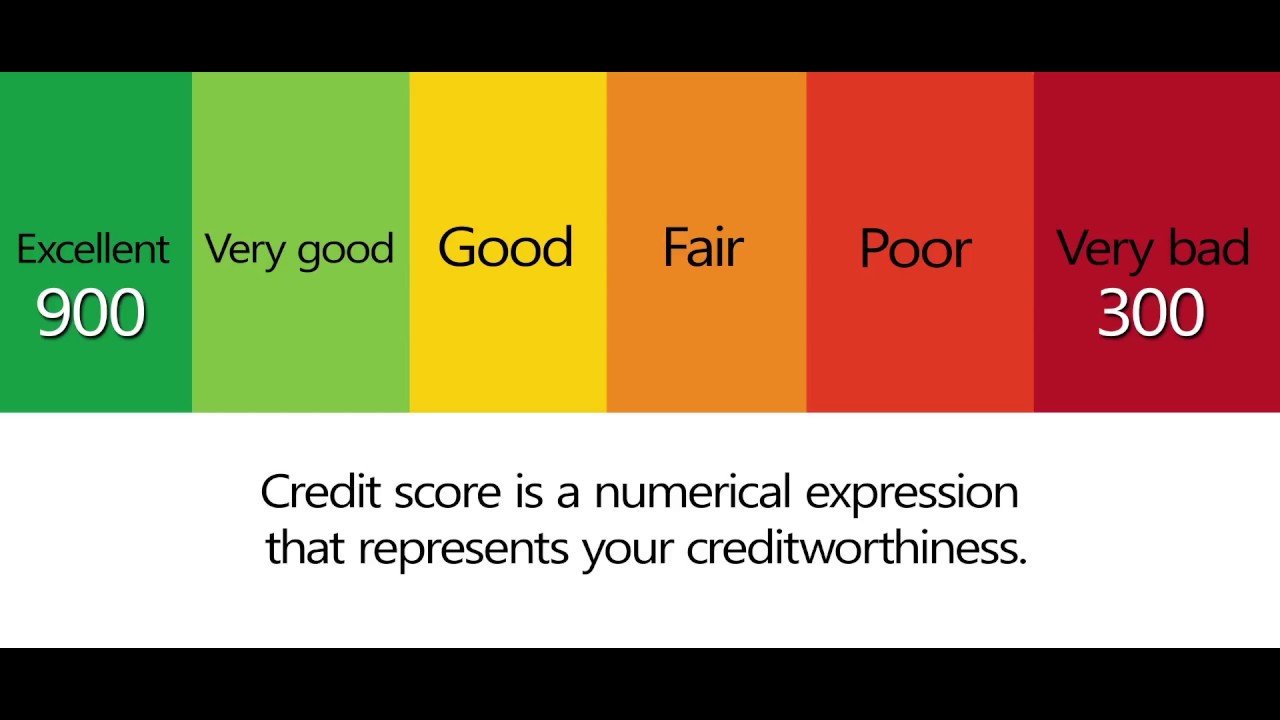

You Can Track Your Creditworthiness

Whenever you apply for a loan or a credit card, the lender or issuer will first check your credit score to study your creditworthiness. Once you will start checking your credit score, you will become aware of how your credit behaviour shapes your credit score. Youll see how, for instance, a late payment can pull your credit score down. In case your score is low, you can take steps to improve it to better your borrowing prospects. It takes time to build a good credit history and maintain it. If you foresee an upcoming need for a loan, it would be wise to check your score regularly and maintain it.

Why Is Wells Fargo Displaying Your Fico Score

Wells Fargo is displaying your FICO® Score for educational purposes and as a benefit to support your awareness and understanding of FICO® Credit Scores and how they may influence the credit thats available to you. Wells Fargo does not calculate your FICO® Score we are displaying a score that is provided to us by the credit bureau indicated on your score display. Your FICO® Score is provided through Wells Fargo Online® at no additional cost beyond your standard internet/mobile carrier fees.

Recommended Reading: Dispute Verizon On Credit Report

Free Credit Score Resources

Most credit card issuers provide free credit score access to their cardholders making it easier than ever to check and know your score.

Some issuers, such as Citi and Discover, provide free FICO Scores, while others, such as Chase and Capital One, provide free VantageScores.

You can check your credit score in less than five minutes by logging into your credit card issuer’s site or a free credit score service and navigating to the credit score section. There will typically be a dashboard listing your score and the factors that influence it.

FICO and VantageScore will pull your credit score from one of the three major credit bureaus, Experian, Equifax or TransUnion.

Here are some free credit score resources that you can access, whether you’re a cardholder or not:

What Is A Credit Score Or Credit Rating

A , also known as a , is a number calculated by a credit bureau to represent how trustworthy your reputation is as a borrower. Your credit score will typically be on a scale of 0-1,200 or 0-1,000 depending on the bureau you use. The higher your credit score, the better your position currently is.

Your credit score is one of the factors lenders may use to decide whether or not you are eligible for a credit product, and when deciding what interest rate to charge you.

- How often can you check your credit score? As often as you like typically, but there may be a limit on the number of free checks you can do.

- How long does it take? The response is usually instant after you have provided some identification information.

- What does it cost? Usually you can do a credit score check for free, but there may be an upper limit on the number of free checks you can do.

You May Like: Does Affirm Approve Bad Credit

Hows Your Experian Credit Score Calculated

The Experian Free Credit Score runs from 0-999. Itâs based on information in your Experian â like how often you apply for credit, how much you owe, and whether you make payments on time.

Youâll lose points for having information on your report that suggests to lenders youâre unlikely to manage credit responsibly, such as previous late payments and defaults. Youâll gain points for things that lenders usually view positively, such as a track record of always paying on time and being on the electoral roll.

Vantagescore 30 Credit Score Ranges

vary by scoring model, and lenders can view ranges in different ways. VantageScore 3.0 credit scores range from 300 to 850. Think of them in terms of four basic categorizations: Excellent, Good, Fair and Poor. Heres how they break down.

Excellent :You may qualify for the best financial products available, and youll likely have several options when it comes to choosing repayment periods or other terms. But excellent credit scores arent the only factor in a lending decision a lender could still deny your application for another reason.

Good :Youre less likely to have an application denied based solely on your credit scores, compared to having scores in the fair or poor range, and youre more likely to be offered a low interest rate and favorable terms.

Fair :You may have several options when it comes to getting approved for a financial product, but you might not qualify for the best terms.

Poor :You may find it difficult to get approved for many loans or unsecured credit cards. And if youre approved, you might not qualify for the best terms or lowest interest rate.

Read Also: Does Stoneberry Report To Credit Bureau

Will Closing A Credit Card Account Impact My Fico Score

It is possible that closing a credit account may have a negative impact depending on a few factors. FICO® Scores may consider your credit utilization rate, which looks at your total used credit in relation to your total available credit. Essentially, it measures how much of your available credit you are actually using. The more of your credit that you use, the higher your utilization rate and high credit utilization rates may negatively impact your FICO® Score. Before you close any credit card account, Wells Fargo recommends that you should first consider whether you really need to close the account or if your real intention is just to stop using that credit card. If you really just want to stop using that card, it may make sense if you stop using the card and put it somewhere for safe keeping in case of an emergency. Its also important to note that length of your credit history accounts for 15% of your FICO® Score calculation. Therefore, having credit card accounts that are open and in good standing for a long time may affect your FICO® Score.

Important Disclosures And Information

Bank of America credit cards are issued and administered by Bank of America, N.A. Better Money Habits, Merrill Lynch, U.S. Trust, Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation. All other company and product names and logos are the property of their respective owners.

Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

Also Check: Mrs Associates Verizon

Does Checking My Credit Scores Hurt My Credit

Checking your free credit scores on Credit Karma doesnt hurt your credit. These credit score checks are known as soft inquiries, which dont affect your credit at all.

Hard inquiries generally happen when a lender checks your credit while reviewing your application for a financial product. This kind of check can negatively affect your credit.

Read more about the difference between hard and soft credit inquiries.

How To Check Your Credit Score In Canada

With Borrowell, you can get your credit score in Canada for free! Signing up takes less than 3 minutes, and no credit card is required. Once you’ve signed up for Borrowell, you can download your Equifax credit report for free AND check your credit score at any time without hurting it. Plus, you’ll receive weekly updates on how your score has changed. Stay on top of your credit health with Borrowell.

Don’t Miss: Wipe Your Credit Clean

Are Fico Scores Unfair To Minorities

No. FICO® Scores do not consider your gender, race, nationality or marital status. In fact, the Equal Credit Opportunity Act prohibits lenders from considering this type of information when issuing credit. Independent research has shown that FICO® Scores are not unfair to minorities or people with little credit history. FICO® Scores have proven to be an accurate and consistent measure of repayment for all people who have some credit history. In other words, at a given FICO® Score, non-minority and minority applicants are equally likely to pay as agreed.

How Often Should You Check Your Free Credit Scores

Checking your free credit scores on Credit Karma isnt a one-time set-it-and-forget-it task. Your scores may be updated frequently as your changes, so checking them regularly can help you keep track of important changes in your credit profile.

Since you can check your free credit scores without hurting your credit, feel free to check as often as you like. If you see your credit scores steadily growing, it can help motivate you on your credit-building journey. And when youre ready to submit a credit application, getting a better idea of your overall credit health beforehand can give you a better sense of where you stand.

You May Like: Ccb Mprcc On Credit Report

What Is My Credit Score And Why Does It Matter

Your credit score is a number lenders and credit card issuers use to help them decide whether to approve your credit application. The higher your score, the better your chances. With a low score, you may still be able to get credit, but it may come with higher interest rates or require a co-signer or security deposit. You also may have to pay more for car insurance or put down deposits on utilities. Landlords might use your score to decide whether they want you as a tenant. But as you add points to your score, you’ll gain access to more credit products and pay less to use them. Borrowers with scores above 750 or so have many options, including the potential to qualify for 0% financing on cars and credit cards with 0% introductory interest rates.

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

You May Like: Paypal Credit Score Check