Why I Decided To Give Experian Boost A Try Essential Reads Delivered Weekly Subscribe To Get The Weeks Most Important News In Your Inbox Every Week Your Credit Cards Journey Is Officially Underway Keep An Eye On Your Inboxwell Be Sending Over Your First Message Soon

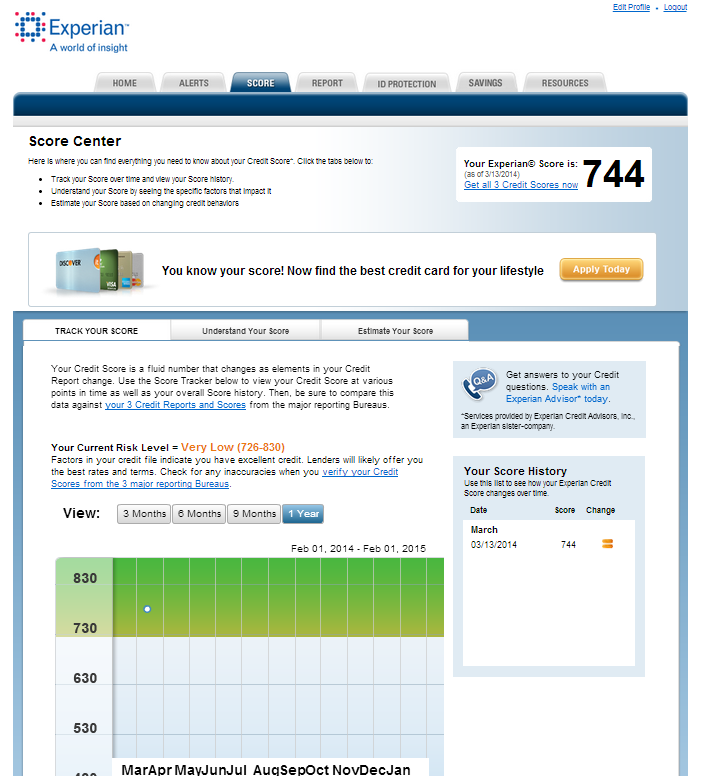

Now, I had heard a lot about Experian Boost but didnt see many reviews. Programs like Experian Boost and UltraFICO are designed to help consumers with their credit scores whether its simply to expand the customer base for lenders or genuinely help consumers remains to be seen.

The key difference between Experian Boost and UltraFICO, however, is Boost focuses on payment histories while UltraFICO looks at your bank account for lack of overdrafts and an average balance over the past three months.

Experian Boost seemed too good to be true. The option to raise my score a significant amount in real time was completely unheard of, hence my skepticism. Also, since both are fairly new programs, there isnt a lot of information yet about how effective they are.

Nevertheless, Experian Boost seems a helpful initiative as it takes into account phone and utility payment histories. Those who sign up for the service give Experian access to their bank accounts in order to look at these bills which arent normally used when calculating credit scores.

After a bit of research, I decided to give it a try. I figured it couldnt hurt. Here are the steps I took and what you can expect if you sign up.

Experian Boost seemed too good to be true. The option to raise my score a significant amount in real time was completely unheard of, hence my skepticism.

What Credit Score Do Lenders Use

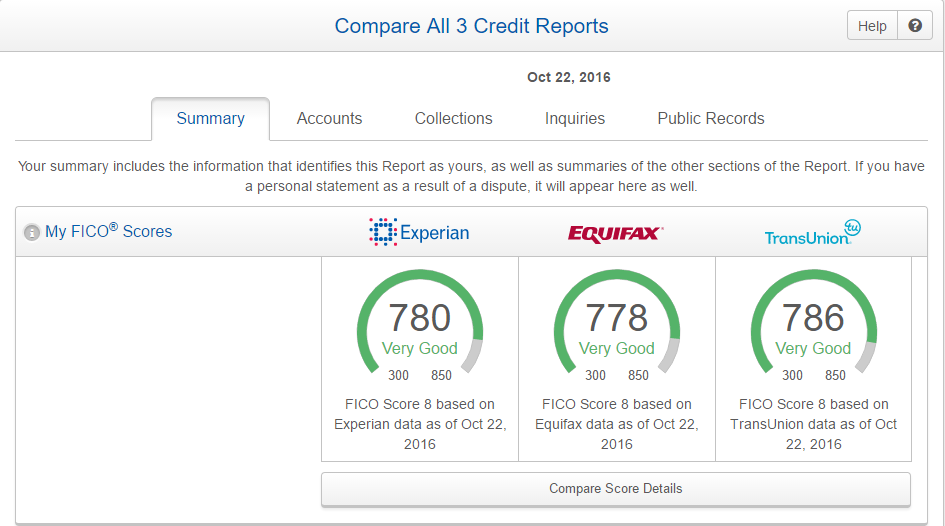

The two main companies that produce and maintain are FICO® and VantageScore. Lenders most commonly use the FICO® Score to make lending decisions, and in particular, the FICO® Score 8 is the most popular version for general use. If you’ve taken an interest in the health of your credit and how lenders will view it, checking your FICO® Score 8 is a smart place to start.

There are, however, many types of FICO® Scores. FICO® has released updates to its basic score over the years, and the FICO® Score 10 is the most recent. Mortgage lenders most often use older versions to assess applicants: the FICO® Score 2, 4 or 5.

There is also the FICO® Bankcard Score and the FICO® Auto Score . If you know you’re interested in a certain type of credit, it could be worthwhile to check beforehand the specific score type you know a lender will look at.

What Is The Difference Between Vantagescore & Fico

The VantageScore was developed by the major credit reporting agencies and uses a combined set of consumer credit files from the three agencies to come up with a single formula. The scores for the most recent iteration of this scoring model, the VantageScore 3.0, ranges from 300 to 850, with a higher score indicating lower risk.

FICO was developed by Fair Isaac Corporation and bases its credit scoring models on credit reports obtained separately from each of the three reporting agencies. FICO then builds scores based on each specific agencys data. While the score range is the same for FICO and VantageScore 3.0, there isnt just one FICO score.

Also Check: Does Speedy Cash Report To Credit Bureaus

Getting Your Credit Score Has Never Been Easier

Developed by Fair, Isaac, and Company in 1956, the FICO scoring system initially flopped. Credit bureaus didnt adopt FICO until 1991, and consumers didnt gain on-demand access to bona fide FICO scores until much later than that. Now, thanks to the internet, you can see your FICO score in minutes. Lets explore two ways to get your score right now.

Alternate Credit Scores Launched By Lexisnexis

On 9 February, LexisNexis Risk View Spectrum and Risk View Optics were unveiled by LexisNexis Risk Solutions. Risk View Spectrum and Risk View Optics are FCRA-compliant credit scores that offer a larger view on consumer credit worthiness. The new tools that are used can improve financial inclusion by finding out more credit-worthy consumers. Over 90% of individuals who do not have a regular credit score can get a score from Risk View Spectrum and Risk View Optics. Lenders can provide better offers to individuals whose credit scores are from Risk View Spectrum and Risk View Optics.

10 February 2021

You May Like: Aargon Collection Agency Address

Does Experian Boost Have Any Downsides

There have been some reports of consumer scores going down after using Experian Boost, yet these accounts dont seem to be associated with the tool itself. Everhart and Felice-Steele confirmed that Experian Boost only reports positive payments to credit reports, so the addition of new bills will ultimately improve ones credit score or be neutral.

Ulzheimer says that if someone uses Experian Boost and their credit score drops, its due to other credit factors. For example, they may have closed a credit card in the same timeframe, resulting in a sudden increase in their .

He points out that users also have the power to instantly add and remove bills through Experian Boost, so you can shut it off and have the tradelines removed any time you want.

However, Ulzheimer notes that theres an intermediary company involved with Experian Boost called Finicity. Finicity goes into your bank account and grabs all the information that is converted to a tradeline for Boost.

That is what goes on your credit report, Ulzheimer says. Ultimately, this means you have to be comfortable letting Finicity get into your bank accounts and see all your information.

Users should also know that, while incredibly useful in some cases, Experian Boost has some serious limitations.

Dont Forget Your Credit Reports

Your score is only as good as the information behind it. The scores are typically calculated using information in one of your three credit reports from the main credit bureaus Experian, Equifax and TransUnion. If that information is wrong, then this number wont accurately reflect your creditworthiness. For that reason, its important to also get your free annual credit reports to understand the finer details about your credit, as well as to make sure the reports dont contain mistakes. Youll want to review each of them, as not every place reports to each credit bureau, so the information on your reports may be slightly different. You can access your free credit reports every 12 months by visiting AnnualCreditReport.com.

This article has been updated. It was originally published April 30, 2014.

Don’t Miss: Opensky Payment Due Date

What Can Your Experian Credit Score Tell You

The credit score you need to get a mortgage varies, as thereâs no one credit score or universal âmagic numberâ. However, if you have a good credit score from one of the main such as Experian, you are likely to have a good credit score with your lender. Checking your Experian Credit Score before you apply for a mortgage can give you an idea of how lenders may see you, based on information in your Experian Credit Report. It can also help you work out if you need to improve your credit history before making your mortgage application.

Indias Cut In Credit Rating

Indias credit rating has moved one step closer to junk after Moodys Investors Service had downgraded the country to a low investment grade level and had also surprised the economists.

Moodys had reduced the long-term foreign-currency credit rating to Baa3 from Baa2, and this implies that it can get cut further. This action brings it in par with the BBB- assessment from Fitch Ratings Ltd and S& P Global Ratings. The economy is now facing a huge contraction in over four decades.

4 June 2020

Recommended Reading: Speedy Cash Collection Agency

Psbs Are Offering Personal Loans At Attractive Rates Shows Cibil Data

The overall personal loan business dropped by 42.2% on a year-on-year basis in August 2020 due to economic disruptions caused by the Covid-19 pandemic.

However, the approach taken by public sector banks kept them in a good stead during the pandemic as their business grew by 66.5%, according to a data by credit bureau CIBIL data.

PSBs are offering personal loans to customers at attractive rates compared to their peers. This is attracting consumers to avail loans from PSBs despite facing financial hardship.

29 December 2020

What Is The Vantagescore Model

The VantageScore Model was originally developed in 2006 and the VantageScore Model 3.0 debuted back in 2013. There is currently a 4.0 model as well but it has not been as widely adopted as it has only been out since 2017. VantageScore Model 3.0 is used for other credit services like , Chase Journey, etc.

The VantageScore Model Credit Karma uses is pretty similar to the FICO model but it has some key differences. It uses the same FICO range of 300 to 850 for the score and stresses many of the same factors as FICO it just gives them different weight and has some slightly different criteria for calculating them.

Here are the 3.0 factors according to :

- Payment history

You May Like: Can You Remove Hard Inquiries Off Your Credit Report

How To Contact Us About Your Experian Membership

Have questions about your Experian membership? Call us at 1-866-617-1894 Monday-Friday 6am to 8pm PT Saturday-Sunday 8am to 5pm PT. International callers who experience difficulties calling these numbers should contact their telephone service providers for assistance. How would you like to dispute? Dispute online.

What Affects Your Credit Scores

![[credit]Is my Experian report accurate? : UKPersonalFinance](https://www.knowyourcreditscore.net/wp-content/uploads/creditis-my-experian-report-accurate-ukpersonalfinance.png)

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

Don’t Miss: How To Get Credit Report Without Social Security Number

Experian Vs Credit Karma: What Is The Difference

- Banks Editorial Team

Experian and Credit Karma are both well-known financial services companies that offer digital tools to help you track your credit history and improve your credit scores. Heres an overview of their offerings, how they differ, and how you might use them to improve your financial health.

Understand Your Credit Scores

- Good, fair, poorall credit scores need a closer look. Knowledge is power, and most consumers feel more empowered after they learn about credit scores. Without further ado, lets review what goes into a

- What is a credit score?

- What affects my credit score?

- How do I get my free score/check my credit scores?

- Why do I have more than one credit score?

- Will checking my credit score hurt my score?

Recommended Reading: Is 779 A Good Credit Score

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

You May Like: How Long Does A Repossession Stay On Your Credit Report

Csc Partners With Transunion To Provide Cibil Score

The Common Service Centre has partnered with TransUnion CIBIL Ltd. to provide the CIBIL score. The new partnership will provide access to individuals in rural areas, where over 2.5 lakh CSCs are present. CSCs allow individuals to avail bank loans quickly for their personal and entrepreneurial needs. Lenders access the CIBIL score to check the individuals financial health and credit worthiness. Lenders use this data before loans are provided. Individuals will have to go through the authentication process in order to get the CIBIL score via CSCs. The report can also be downloaded. According to the Chief Executive Officer of the CSC, Dinesh Tyagi, individuals in rural areas lack awareness about the CIBIL score. Customers who have a good credit score can negotiate for better interest rates.

14 July 2020

Experian Vs Transunion: Whats The Difference

- Banks Editorial Team

When youre checking your credit report or credit score, you may hear about different credit bureaus, including TransUnion and Experian. What are the similarities and differences between these credit reporting agencies, and does it matter which one you use to check your information?

Recommended Reading: Carmax For Bad Credit

Comparing Scores From Experian And Credit Karma

If you decide to enroll in both services, keep in mind that the FICO Score based on Experian data is calculated differently than the VantageScores based on TransUnion and Equifax data youll get from Credit Karma. Your FICO Score may differ from your VantageScores because of those different calculation methods.

When working on building your credit, its helpful to bear in mind that, while the FICO Score and VantageScore may weigh them differently, both scoring systems look into similar good credit habits, and focusing on those behaviors will tend to increase all your credit scores. These best practices include:

Experian and Credit Karmas free services both have much to offer if youd like to track your credit scores, work toward improving them over time, and help you shop for credit offers youll likely qualify for based on your credit scores. Experian and Credit Karma make money if you apply for those offers, but youre under no obligation to do so, and you can learn an awful lot for free from both services.

Why Having A Good Credit Score Is Important

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you’ll have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That’s extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having a good score could save you $26,071 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

Read Also: Speedy Cash Repayment Plan

Experian Vs Credit Karma: The Differences

While they offer similar services, Experian and Credit Karma have some distinct differences that make them useful for individuals in different circumstances. Lets check the differences:

Is The Fico Score On Wells Fargo Accurate

Wells FargoaccuracyaccurateFICO scorescore

Free FICO Credit Scores

| Issuer | |

|---|---|

| Login here | FICO Score 9 |

One may also ask, what is the difference between credit score and FICO score? What is the difference between the Equifax and the FICO®Score? The Equifax uses a numerical range of 280 to 850, where higher scores indicate lower risk. The FICO Score uses a numerical range of 300 to 850, where higher scores also indicate lower risk.

Besides, does viewing FICO score on Wells Fargo hurt credit?

On a smartphone, select View your FICO® at the bottom of your Account Summary. When applying for a new account at Wells Fargo, a unique scoring model is used which considers more than to evaluate applications. Remember: Accessing your FICO Score is free and will not impact your .

What credit score is needed for Wells Fargo propel card?

700+

Recommended Reading: Syncb/ppc Closed