What Is The Difference Between Cibil Equifax Experian & High Mark

These are four credit information companies that function under the RBIs approval.They have various similarities and differences that are listed below.

1. CIBIL

-

It is the oldest and most popular in India today and also offers market insights and portfolio reviews for businesses apart CIBIL score and reports for individuals.

-

Its scoring system ranges from 300 to 900, with 900 being the highest and 300 being the minimum CIBIL score.

-

It offers businesses a Company Credit Report and a CIBIL Rank.

2. Equifax

-

It was granted its license in 2010.

-

Its scoring system is on a scale of 1 to 999, with 1 being the lowest and 999 being the highest score.

-

It also offers additional facilities like credit risk and fraud management, portfolio management and industry diagnostics.

3. Experian

-

It received its license for operation in India in 2010, but is an international company in existence since 2006.

-

The Experian score ranges from 300 to 900 with 300 being the lowest and 900 being the highest.

-

It offers several services for consumers and organisations like customer acquisition, collection and money recovery, customer management, data analytics, customer targeting and engagement.

4. High Mark

You can choose any one from these companies to calculate your credit score and so can lenders and other parties.

Only Spend What You Can Afford

Dont use a credit card to live beyond your means, or to roll over the costs of everyday expenses to the next month, Nitzsche recommends. This will only lead to spiraling debt that will be difficult to get out of.

People with an 800+ credit score dont apply for more credit than they can afford and dont spend more than they earn.

While using a credit card for everyday expenses is OK if you can pay the credit card bill off in full each month, while gaining awards points in the process, dont let the accumulation of points convince you to spend more, Nitzsche says. And if youre running to your credit card when your car, refrigerator or something else breaks down, start an emergency fund to pay for such repairs.

Bill Balderaz, president of Fathom Healthcare, has an excellent credit score and attributes it to his family living below their means. As our income rises, we keep our spending flat, Balderaz says.

They also pay off all credit card bills each month, pay off their vehicle loans early, and have paid off their mortgage early to help get them to an 800+ credit score.

Their excellent credit score has allowed them to get the most preferred loan rate. After three houses and eight vehicles, Balderaz estimates theyve saved tens of thousands of dollars on loans by getting the lowest loan rates.

Getting The Top Score

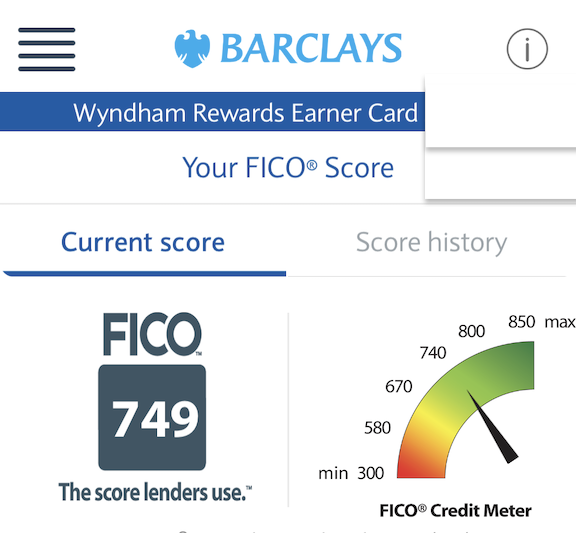

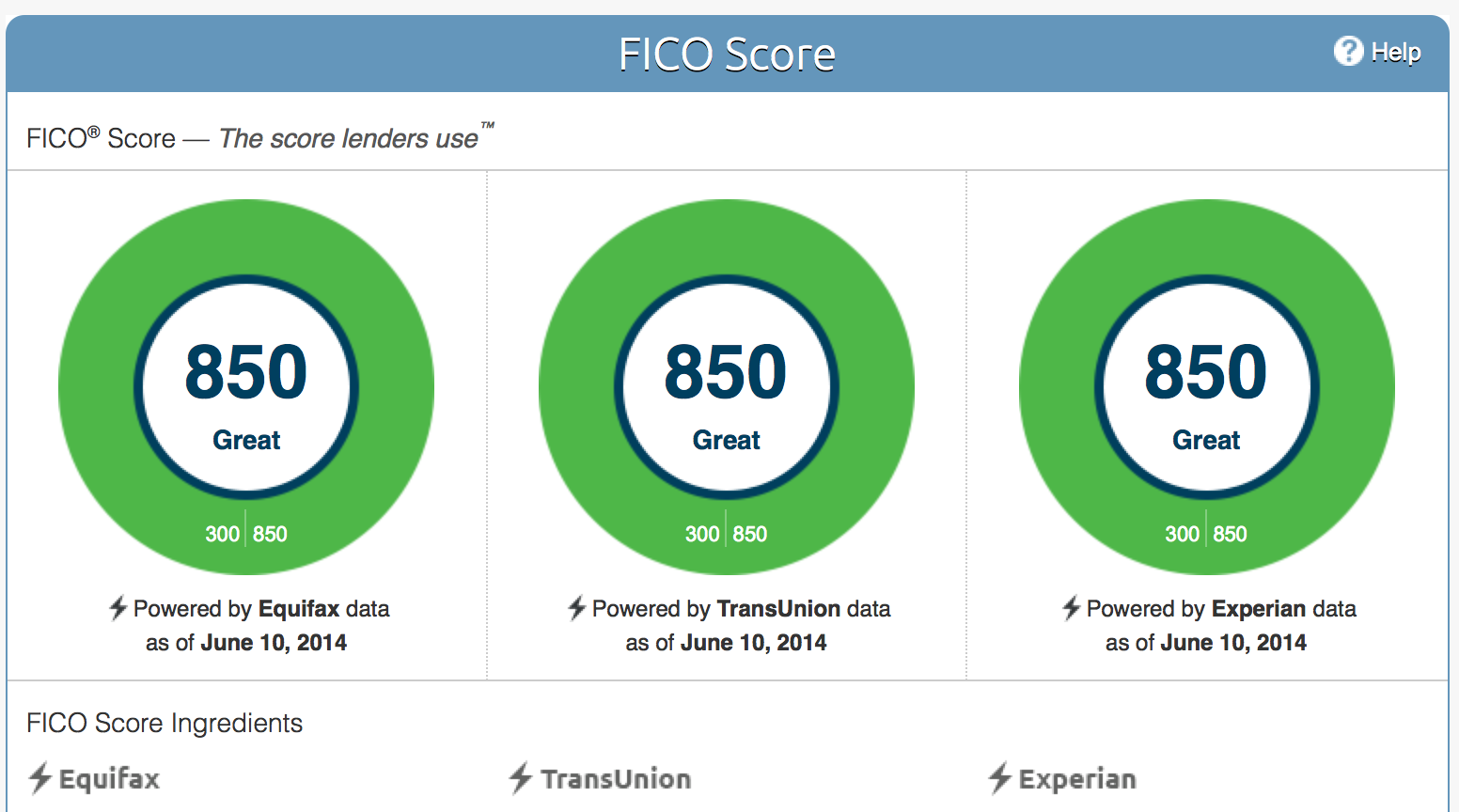

The highest score possible is 850 while the lowest is 300. In reality, achieving an 850 probably isnt going to happen. It would take a perfect combination of many factors to get there.

Whats the magic number that will get you the best interest rates, payment terms, and perks that come from being rated among the best of the best?

According to Anthony Sprauve, director of public relations at FICO, “If you have a FICO score above 760, you’re going to be getting the best rates and opportunities.”

How hard is it to get that number? Looking at the averages, its no easy task. The average credit score in America lies in the 670-739 range.

If those statistics seem a little depressing, dont worry. Even if you dont reach that coveted 760 number, its not like you’ll have to pay cash only for the rest of your life.

What Is A Good Credit Score?

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

What Factors Affect Your Credit Score

The two main credit scoring models, FICO and VantageScore, consider much the same factors but weight them somewhat differently. For both scoring models, the two things that matter most are:

-

Paying bills on time. A misstep here can be costly, and a late payment that’s 30 days or more past the due date stays on your credit history for years.

-

How much you owe. Credit utilization, or how much of your credit limits you are using, is weighted almost as heavily as paying on time. It’s good to use less than 30% of your credit limits lower is better. You can take several steps to lower your credit utilization. Scores respond fairly quickly to this factor.

Much less weight goes to these factors, but they’re still worth watching:

-

The longer you’ve had credit, and the higher the average age of your accounts, the better for your score.

-

How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score.

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

Read Also: What Credit Score Does Carmax Use

S To Improve Your 760 Credit Score

Improving your 760 credit score can take a lot of work, but following these steps can make all the difference. It will take time, but you can see your credit score go up within a year, which could save you countless amounts on interest rates. Dedicating the effort to improving your credit is worth the investment.

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Read Also: Does Paypal Credit Report To Credit Bureaus

The Basics What Is A Credit Score

Your credit score isnt just for getting a mortgage. It paints an overall financial picture. The term credit score most commonly refers to a FICO score, a number between 300 and 850 that represents a persons creditworthiness the likelihood that, if given a loan, she will be able to pay it off. A higher number corresponds to higher creditworthiness, so a person with a FICO score of 850 is almost guaranteed to pay her debts, whereas a person with a 300 is considered highly likely to miss payments.

The formula for calculating a FICO score was developed by Fair, Isaac and Company , and while the specifics remain a secret so that no one can game the system, FICO has made the components of the score public. The formula takes into account the following factors, in descending order of importance:

How To Improve Your Credit Score

If you have an average credit score or worse, its worth taking steps to improve your score over time. Heres are some moves you can make:

- Pay your bills on time every single month. Late and missed payments are the single biggest factor affecting your score.

- Lower your credit utilization. Credit utilization is measured by how much of your credit limit you use. For example, if you have a $10,000 limit and debt of $5,000, youre utilizing 50% of your available credit. If possible, aim for 30% or less overall and on individual credit cards.

- Check your credit report. You can check your credit reports from each of the three credit bureaus once a year for free through annualcreditreport.com . Reviewing your credit reports can help you spot any errors that may be having a negative impact on your score so you can take steps to correct them.

- Consider a secured card. If you have poor or bad credit, building a credit history with a secured card can be a good way to start. Choose a secured card that reports to all three credit bureaus for the best chance having your good payment behavior improve your credit standing.

Related: Should You Worry About No Credit Score?

Read Also: How To Get Credit Report Without Social Security Number

Check Your Credit Regularly

The first thing youll need to get started is your credit report to see your score and history.

This will help you identify what you can do to improve your score. We use and to check our scores and history.

More specifically, we use their phone app. We also recently saw that Chase Bank has an awesome tool for checking your credit history. Its called Chase Credit Journey, but you might need to have an account with them. Both are free.

We also check our credit reports annually at annualcreditreport.com.

They are the only company authorized by the government to issue your official credit reports. We recommend you request 1 report at a time since there are three major credit reporting bureaus. This means you can check a different one every 3-4 months to check for fraudulent activity.

You only get 1 free report per agency per year.

You should note that your credit report will NOT have your credit score in it. Thats why we love and .

If you have a low credit score and are looking to increase it quickly, you should learn more about Experian Boost. Its a free service you can use to add utility and other bills to your credit report to show more on-time payments. This can help improve your FICO 8 credit score, which is pretty awesome.

Check it out and !

How To Read Your Cibil Report Or Credit Report

The credit report is a detailed document that highlights your entire credit history and record. It includes details such as your personal information, contact information, employment history, credit limit on various credit cards, credit balances, and dates on when you opened various accounts. These credit reports are viewed by various parties or organisations. Some of the common parties who may be interested in viewing your credit report are as follows:

-

Lenders like banks and non-banking financial companies

-

Landlords

Given that your credit report is a comprehensive document with multiple sections, it is important for you to know how to read credit report. This will help you understand your report better, and even check to see if it does justice to your credit history.

Don’t Miss: Speedy Cash Collections

Figure Out Where You Can Improve

Finally, as you comb over the above list, also look for areas where you can improve. Even at 760, there are going to be things that are holding your score back from the Exceptional range.

Try to identify these and then look for good fundamental credit habits, like sticking to a budget or paying off your credit cards every month, that you can adopt to overcome them.

Diversify With A Personal Loan

Your go-to way to build credit might be paying back the money youve charged on your credit card each month. Lenders want to see that you have experience managing multiple types of credit and adding a small loan to your credit mix can help build up your score.

Your best bet is to choose a small personal loan if youve never taken out a loan before. Unlike other types of loans you can use a personal loan for just about anything. You can get a loan, treat yourself to some new furniture or a weekend away, pay it back and see your score rise.

Are you looking for an easy way to get a personal loan to boost your score? MoneyLion Plus members can get up to $500 in a low-interest personal loan with a few taps of a smartphone. Seventy percent of people who take out a credit builder loan with MoneyLion see their score rise. Get a MoneyLion membership if your credit profile needs a little more diversity.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Monitor Your Payment History

Your payment history makes up over 35% of your credit score. This makes it the single most important factor in building your credit score. The best way to increase your score is by making on-time payments on your loans and credit cards.

Make sure that youre always making your credit card and loan payments on time or ahead of schedule if you want to achieve perfect credit. Sit down with all of your credit cards and loan statements. Write down when each payment is due and the minimum amount you need to pay every month. Place this information somewhere youll see it often, like at your desk or in your day planner. This will help you avoid accidentally missing a payment.

You may also want to sign up for auto-pay if your creditor offers it. Auto-pay is a program that links your bank account and automatically deducts your minimum payments on your due date. Some credit card providers even allow you to choose when you want your withdrawal to go through.

Recommended Reading: What Credit Bureau Does Paypal Credit Use

You Dont Need A Credit Score Of 850 To Have An Excellent Credit Score

Experts agree that a credit score above 760 is considered an excellent credit score.

In fact, if you already have a score of 770 and are looking for a way to get your score to 800, you are wasting your time.

You are better off making sure you are contributing to your jobs 401k plan or learning how to invest your money.

Having a bullet proof budget wouldnt hurt either.

Heck, almost anything would be a better use of your time than trying to get your score up to 850.

How To Improve A 760 Credit Score

Work on removing all negative accounts such as collections, charge-offs, medical bills, bankruptcies, et al. Remove as many excess hard inquiries as you can. Get your revolving utilization as low as you can . Ensure you have a good credit mix of installment loans and revolving accounts. Last but not least, make sure you have at least two revolving accounts older than 2 years

We recommend taking a look at Credit Glory. Give them a call or setup a consultation with them.It’s generally much faster if you worked with Credit Glory, and they happen to have incredible customer service.

Also Check: Why Is There Aargon Agency On My Credit Report

Benefits Of Credit Tracking With Moneylion

Watching your credit score is crucial if youre on a journey to raise your numbers. Sign up with a credit monitoring service to help you keep track of how your score changes and to help you prevent fraud.

MoneyLion offers a credit monitoring service for members. You can check your credit score without damaging it, access advice, and get alerts when a new item appears on your credit report. Get access to all of these features and much more by signing up for , which is MoneyLions credit-building program that gives you access to a loan up to $1000. Youll also get weekly credit score updates in the MoneyLion app.